A Financial Practitioner's Market Reflections: In This Storm of Reshaping Rules, Where Are the Opportunities?

Introduction: That Phone Call Six Months Ago

I still remember six months ago, when the news of Trump's high tariffs hit the market like a bomb, the office phones and messaging apps wouldn't stop ringing. Panic is contagious, and my clients were all asking the same question: "Is the market about to crash? Should I sell everything?"At the time, my answer was simple: "Don't make a move just yet. Let's take some time to observe. The real impact never fully reveals itself on the first day."

Half a year has passed. The market has gone through dramatic ups and downs and seems to have found a fragile equilibrium. Now, it's time to deliver my observation report. The gains and losses on stock market accounts are just the surface; beneath the water, three deeper, more magnificent changes are taking place. Understanding these three points is far more important than guessing tomorrow's market movements.

Change #1: The Central Bank's "Handcuffs" — The Ghost of Inflation and the Policy Dilemma

Over the past six months, the market's biggest struggle has been trying to guess the Federal Reserve's intentions. But the truth is, I believe the Fed itself is caught in a dilemma, like a giant in handcuffs.These handcuffs are precisely the "inflation" ignited by the tariffs.

Tariffs directly push up import costs, and this pressure inevitably passes through to final consumption. The core CPI data we've seen is more stubborn than anyone expected. This has completely disrupted the market's previous linear thinking of "economic slowdown → Fed rate cuts."

The current script is: the economy is indeed showing signs of slowing down due to trade disputes, but inflation remains high. This has plunged the Fed into the nightmare of 1970s stagflation: raising rates could burst asset bubbles and accelerate an economic recession; cutting rates could unleash the tiger of inflation, leading to a complete loss of control.

Therefore, the current market volatility is largely a direct result of the central bank's hands being tied, leading to a significant decrease in policy predictability. For a long time to come, we must get used to trading in this monetary policy environment of "dancing in handcuffs."

Change #2: The "Cracks" in Globalization — Supply Chain Restructuring and a Major Industry Reshuffle

If the central bank's predicament is a short-term contradiction, then the changes in the global supply chain are a slow but profound "silent revolution." Trump's tariffs are like a giant stone thrown into a calm lake; although the ripples will eventually subside, the ecosystem at the bottom of the lake has been permanently altered.Over the past six months, I have spent a great deal of time reading corporate financial reports and transcripts of earnings calls, and one phrase has been mentioned repeatedly: "supply chain diversification." This is not just empty talk. From the tech industry to traditional manufacturing, companies are using real money to move production capacity out of single markets and build more resilient, multi-regional supply networks.

This transformation has created clear winners and losers:

- Losers: Companies that previously relied heavily on the "single-market manufacturing, global sales" model. Their profit margins and valuations have taken a double hit.

- Winners: Companies with localized supply chains, or whose production bases happen to be in countries benefiting from the "order diversion effect" (such as Vietnam, Mexico, India), are getting a chance to be re-evaluated.

This "great reshuffle" has only just begun. As investors, it is now more important than ever to examine the supply chain risks in your portfolio.

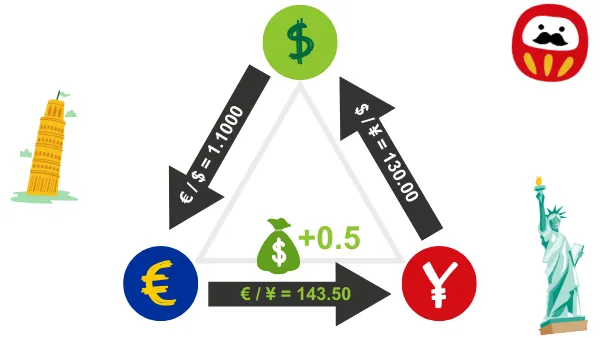

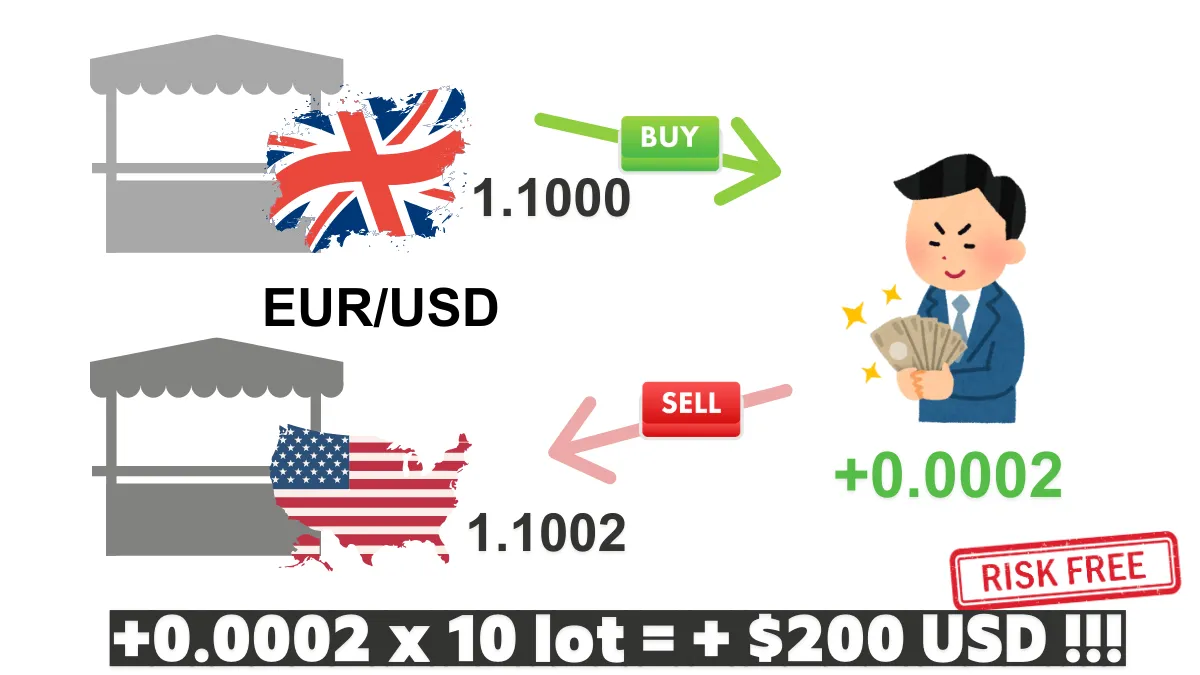

Change #3: The "Repositioning" of the US Dollar — The Power Game in the Foreign Exchange Market

Beneath the clamor of the stock market, a more profound power game is playing out in the foreign exchange market, with the US dollar as the protagonist.In the past, during times of market turmoil, the US dollar was typically the undisputed "king of safe havens." But this tariff incident has made the dollar's role extremely complex. On the one hand, global uncertainty will still cause funds to flow into the dollar in the short term; but on the other hand, the tariff policy itself is fundamentally shaking the dollar's long-term status.

Why is that? Because high tariffs weaken US trade competitiveness, and the resulting concerns about inflation and economic recession limit the Fed's ability to raise rates. The long-term strength of a nation's currency ultimately depends on its economic strength and fiscal health. From this perspective, the tariff policy is undoubtedly overdrafting the dollar's future.

Over the past six months, we have observed that whenever risk aversion sentiment rises, a significant portion of funds, in addition to flowing to the dollar, has also conspicuously flowed to traditional safe-haven currencies like the Japanese Yen (JPY) and the Swiss Franc (CHF). At the same time, central banks around the world are accelerating the diversification of their foreign exchange reserves.

This tells us that the US dollar's positioning is quietly shifting from "the one and only king" to "the strongest of the feudal lords." For foreign exchange traders, this means a new era of greater volatility but also more diverse trading opportunities.

My Coping Strategy: How to Survive and Profit in the Reshaped Rules?

Under these new rules, my investment and trading strategies have also been adjusted accordingly. The core idea is no longer to predict the market, but to manage risk and maintain flexibility.- Reduce Risk Exposure, Increase Cash Position: In an environment of uncertain central bank policies and high geopolitical risks, reducing overall leverage and risk exposure is the top priority. "Cash in hand, peace of mind" is fundamental to maintaining rationality and initiative in a chaotic situation.

- From "Stock Picking" to "Supply Chain Picking": I now pay more attention to a company's "position in the industrial chain." Is it on the receiving end of supply chain restructuring benefits? Does it have the pricing power to pass on inflation costs? The importance of these macroeconomic factors now even surpasses that of a company's individual financial report.

- Look for "Asymmetric" Trading Opportunities: I will spend more time waiting for those opportunities where the "potential return far outweighs the potential loss." Such moments, where price severely deviates from value, often occur when market sentiment is extremely pessimistic or optimistic. The rest of the time, I choose to wait patiently, because when the direction is unclear, the best strategy is "no trade."

Conclusion: A Turning Point of an Era

This is not just a tariff event; it is likely a turning point of an era—a shift from the triumphant march of globalization over the past thirty years to a new phase filled with friction and competition.As traders, our job is not to predict the future, but to understand the current changes and adjust our sails accordingly. This storm is a crisis for those who stick to the old rules; but for those who can understand the new rules and remain flexible, it is a huge opportunity for a reshuffle.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.