World's Strictest Regulation! Why 99% of Traders Should NOT Open a US Account?

Preface: The "Supreme Hall" and "Narrowest Gate" of Forex Regulation

In the hierarchy of global forex regulation, the United States holds absolute dominance. The regulatory bodies here are not just strict, they are "ruthless".To legally operate a forex business in the US, brokers must post capital of up to $20 million (compared to just about €730,000 for the UK's FCA). This means most small and medium-sized platforms simply cannot enter the US market, leaving only capital-rich giants.

However, for the average trader, US regulation (NFA / CFTC) is a double-edged sword. It offers the world's strongest fund security but also imposes the harshest trading restrictions.

This article will tell you:

1. The relationship between NFA and CFTC.2. How to use the NFA BASIC system to spot "fake registration" scams.

3. Why you probably shouldn't pursue a US regulated account.

The Dual Defense of CFTC and NFA

The US financial regulatory system is unique, operated jointly by two organizations:1. Commodity Futures Trading Commission (CFTC):

A US federal agency. It is the "Legislator", responsible for making the rules.

2. National Futures Association (NFA):

An independent self-regulatory organization. It is the "Enforcer", responsible for daily supervision of broker compliance.

Mr.Forex Viewpoint

A legitimate US forex broker must hold both of the following identities:- Registered with the CFTC.

- Is a full NFA Member.

Many scam platforms exploit this information gap, claiming "We have an NFA ID". But this only means they "left a record" in the database, not that they are a "compliant member". This is the most common word game.

3 Steps to Check NFA License (Using FOREX.com as an Example)

To verify if a platform is truly regulated in the US, you just need to use the BASIC (Background Affiliation Status Information Center) system provided by the NFA.We will use FOREX.com (Gain Capital), an old-school broker whose parent company is listed on NASDAQ and has a high market share in the US, as an example:

Step 1: Get the NFA ID

Go to the bottom of the broker's official website to find the NFA ID. This is usually a 6 or 7-digit number.Example: The NFA ID shown on the FOREX.com website is 0339826.

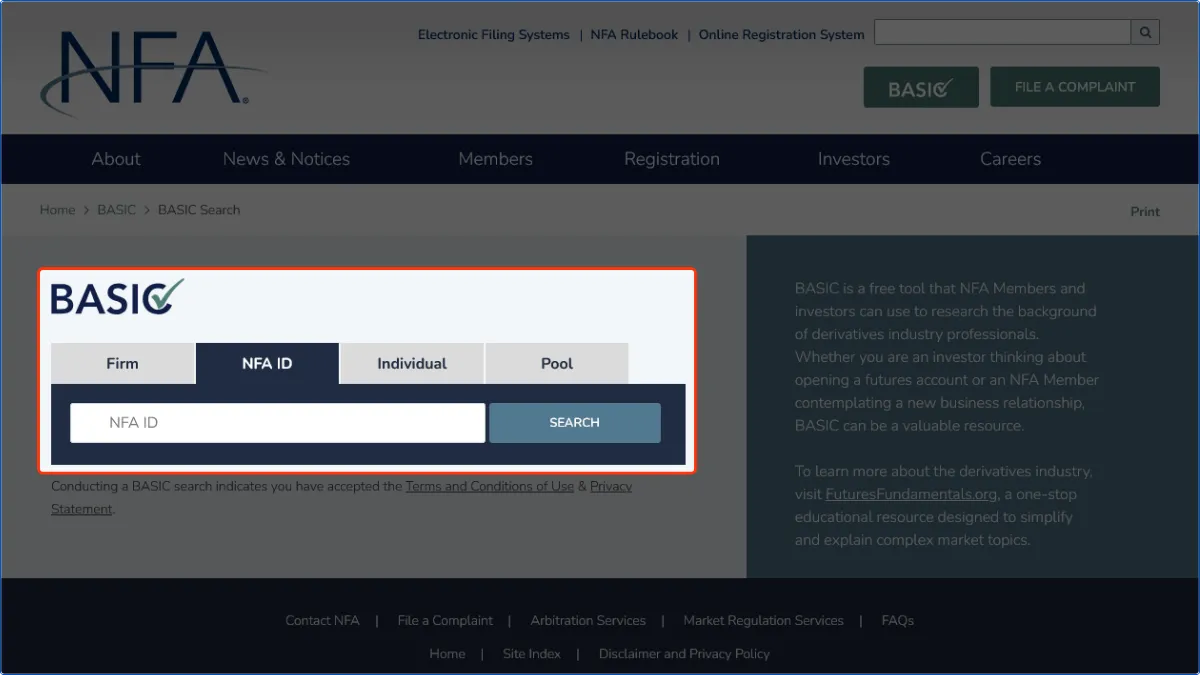

Step 2: Enter the NFA BASIC System

Official URL: [NFA BASIC Search]

- Select the "NFA ID" tab and enter in the search box: 0339826.

- Click "SEARCH".

Step 3: Verify "Member Status" and "Firm Name"

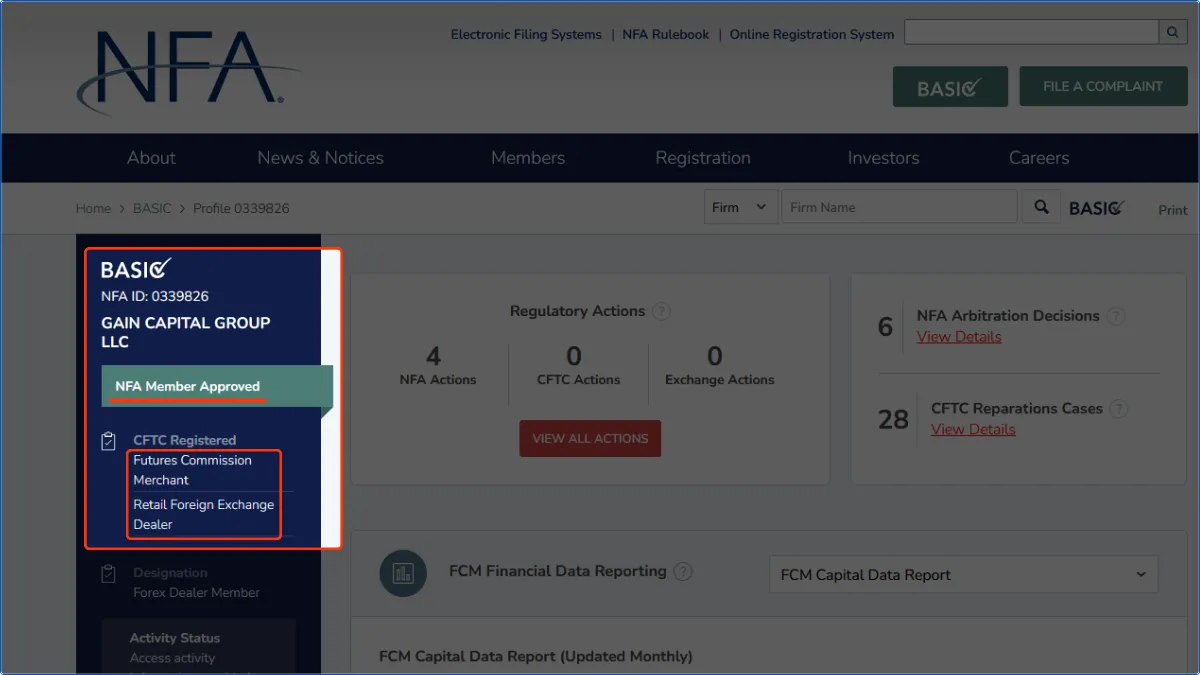

After entering the details page, there is a detail that confuses beginners the most, please look carefully:Verify Status (Status):

It must display "NFA Member Approved". This is the basic baseline for safety. Also, the detailed list below must include "Retail Foreign Exchange Dealer" or "Futures Commission Merchant".

Caption: Search result page. Status must show "NFA Member Approved". Note that large companies often register under their parent company name (e.g., GAIN Capital), so check against website terms.

Verify Legal Name (Name):

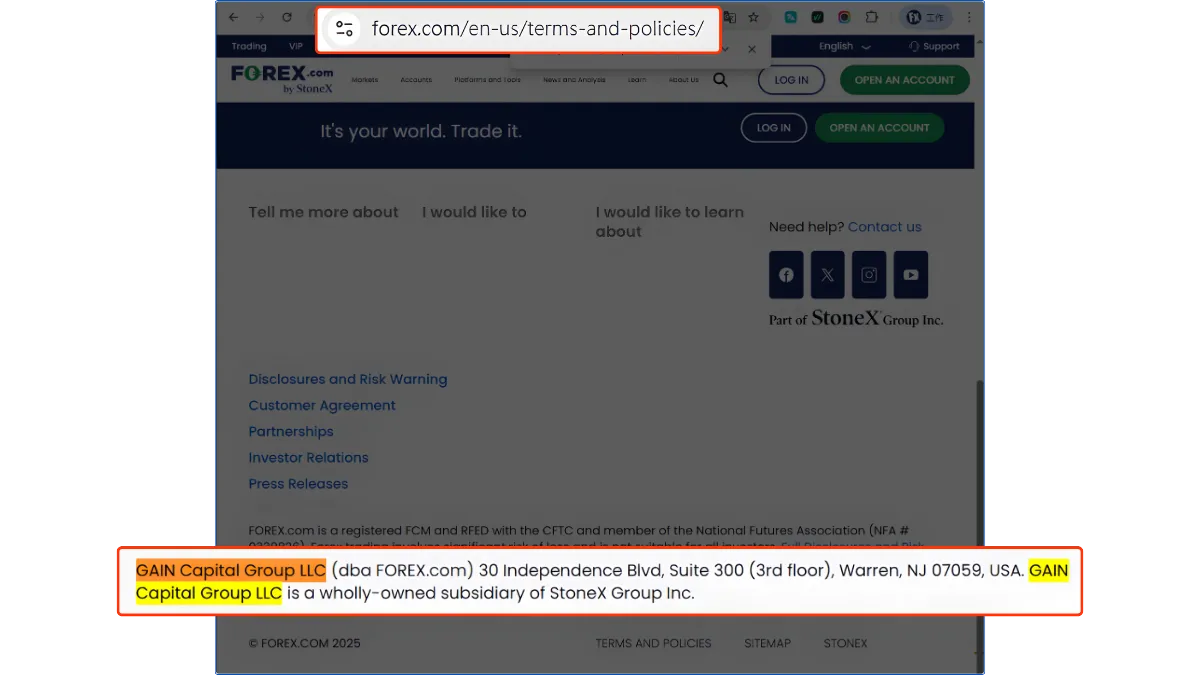

You will find the company name in the search result is "GAIN CAPITAL GROUP LLC", not "FOREX.com". Is this normal? Yes.

Because "FOREX.com" is just a brand name, while "GAIN CAPITAL" is its registered legal entity (parent company). You must go back to the "Legal Terms" page of the broker's website to confirm if it states that it is operated by GAIN Capital.

Caption: Verification of the broker's website legal disclaimer. Be sure to check the bottom of the website to confirm the stated operating parent company matches the NFA search result (as marked "GAIN Capital Group LLC" in the image).

Teaching Point:

This is why you can't just look at the Logo; you must verify the legal entity name. Fake websites usually cannot provide correct parent company information.Why I Don't Recommend Opening a US Account?

If your capital is very large and you want ultimate safety, US regulation sounds great. But for 99% of international traders, US accounts are very difficult to use.Because the CFTC has set the strictest restrictions in the world:

- Extremely Low Leverage:

Capped at 1:50 for major pairs and just 1:20 for minor pairs. This means you need to prepare more principal. - No Hedging:

You cannot hold both long and short positions simultaneously. - FIFO Rule (First In, First Out):

If you have multiple orders for the same instrument, you must close them in the "order they were placed", you cannot freely choose which one to close first. This is extremely inconvenient for short-term traders. - Rejecting Foreigners:

The vast majority of US compliant brokers (like FOREX.com US) only accept US residents. If you live in Asia or Europe, you generally cannot open a US account; they will redirect you to other jurisdictions (like UK FCA or Australian ASIC).

Conclusion: The True Use of an NFA License

In 2026, for non-US residents, the meaning of an NFA license lies in "identifying strength" rather than "actual account opening".- If you are a US resident:

You have no choice but to use NFA / CFTC regulated brokers. - If you are an international investor:

Seeing a broker hold an NFA license is a huge trust bonus. Because companies that can pass the US government audit have world-class financial strength and compliance. You can safely use other regulatory accounts under the same group (such as UK FCA or Australian ASIC) to enjoy a more flexible trading environment while having the reputation guarantee of a large group.

👉 Further Reading:

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.