Despite having the perfect "Trust Preservation," why do international investors typically not use Japanese accounts?

Foreword: The "Galapagos Islands" of Regulation

On the world map of Forex regulation, Japan is an extremely unique existence. It is referred to as the "Galapagos Islands" — meaning that in a closed environment, it has evolved a unique system completely different from the rest of the world.The regulatory standards of the Japan Financial Services Agency (JFSA) are known for being "abnormally strict."

- Pros: It is the safest place for funds in the world, bar none.

- Cons: It has many trading restrictions, and control over leverage is extremely conservative.

For international investors, the significance of understanding Japanese regulation lies not in "opening an account in Japan" (because that is very difficult), but in "establishing a cognitive benchmark for the highest standard of fund safety".

This article will teach you:

- Why Japan's unique "Trust Preservation" mechanism is safer than the UK's FCA.

- How to check the official JFSA register (using Rakuten Securities as an example).

- The fatal flaw of Japanese regulation: Why you might "owe money" when trading in Japan.

Core Analysis: 100% Trust Preservation — The Ultimate Defense for Fund Safety

If the UK FCA's compensation scheme is "insurance after the fact," then Japan JFSA's "Trust Preservation" is "segregation beforehand."Most countries' regulations (such as Australia, Cyprus) only require "fund segregation," which means keeping client funds in a different bank account. However, this money may still legally be considered part of the broker's assets.

Japan's "Trust Preservation" is completely different:

Japanese law mandates that brokers must settle all client assets (margin + unrealized profits) daily and "entrust" them to a third-party trust bank (such as Sumitomo Mitsui Trust Bank).

This means:

Even if the broker suddenly goes bankrupt today, your money is not with the broker at all, but with the trust bank. The trust bank will return the funds directly to the clients, without needing to go through lengthy court liquidation procedures. This is currently the highest level of fund protection mechanism on Earth.

JFSA License Lookup (Using Rakuten Securities as an Example)

Checking Japanese regulation is troublesome because the JFSA does not provide a convenient "ID Search Box" like the NFA or ASIC. Japan uses the most traditional "Official Register (Excel / PDF list)" mode.We will use the Japanese giant Rakuten Securities as an example:

Step 1: Get the "Registration Number"

Go to the bottom of the broker's official website and find the information for "Financial Instruments Business Operators (金融商品取引業者)."Example: The registration number shown on the Rakuten Securities website is "Kanto Local Finance Bureau (Kin-sho) No. 195 (関東財務局長(金商)第195号)".

Note: Japanese brokers usually register with their local Finance Bureau (such as Kanto, Kinki).

Step 2: Enter the JFSA Official Register Download Page

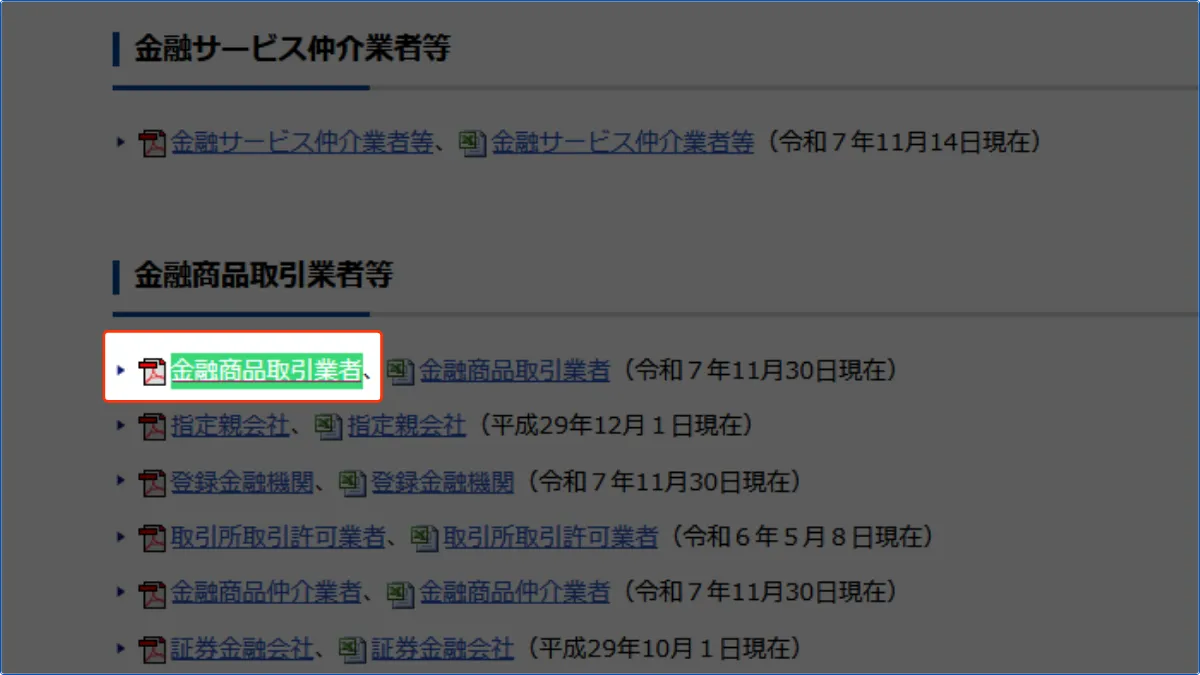

Official URL: [JFSA Financial Instruments Business Operators List] (This link is usually a PDF or Excel list page)After entering the official website, please confirm that the page title is "List of Operators who have received License, Permission, Registration, etc. (免許・許可・登録等を受けている事業者一覧)".

Figure 1: JFSA Japan Financial Services Agency regulation query homepage. Confirm the page title is correct.

Next, scroll down to find the "Financial Instruments Business Operators, etc. (金融商品取引業者等)" section, and click the first link "Financial Instruments Business Operators (金融商品取引業者)" to download the Excel or PDF file.

Figure 2: Register download location. Under the category "Financial Instruments Business Operators, etc. (金融商品取引業者等)," click the first link to download the latest register.

Step 3: Search for the Company Name in the Register

Open the downloaded file (this is usually a dense spreadsheet), and you will see a list of all compliant companies.

Figure 3: Official regulation register (PDF) opening screen. The table contains detailed information such as registration number, trade name, and location.

Use the search function (Ctrl + F) to find:

- Enter Keyword:

楽天 (Kanji for Rakuten) or 195 (Registration number digits). - Verify Information:

- Trade Name (商号):

Must display楽天証券株式会社. - Registration Number (登録番号):

Must correspond to関東財務局長(金商)第195号. - Main Business (主要業務):

Must include第一種金融商品取引業(This means authorized to conduct Forex and securities business).

- Trade Name (商号):

Figure 4: Search result verification. Confirm that the "Trade Name" is 楽天証券株式会社 and the "Registration Number" is 関東財務局長(金商)第195号.

Risk Warning: The Two Major Costs of Japanese Regulation

Although funds are very safe, there are two reasons that "deter" traders regarding Japanese regulation:1. Maximum Leverage Limit 1:25

To protect investors, Japanese law stipulates that the leverage cap for personal Forex margin trading is 1:25.This means you need to prepare a very large amount of capital to trade. This forms a huge contrast with the 1:500 commonly found in international markets.

2. No "Negative Balance Protection"

This is the most terrifying point. In Europe and Australia, regulators mandate that "client losses cannot exceed the principal" (the account will not go negative). But in Japan, the law prohibits brokers from "covering client losses."This means that if a Black Swan event (instant market crash) occurs, your account will not only go to zero but may also turn negative. You are legally responsible for repaying this debt (known in Japanese as "Oishou (追証)").

Conclusion: The Reference Value of the Japanese License

In 2026, the Japan JFSA license is a "reputation indicator" rather than a "practical option" for international investors.If you live in Japan:

You must use a JFSA-regulated broker (such as Rakuten, GMO, DMM) to enjoy Trust Preservation, but be careful to control leverage to avoid debt risks.If you live overseas:

You do not need to open a Japanese account (leverage is too low and opening an account is difficult). However, if an international broker (such as an overseas subsidiary of Rakuten) has a Japanese parent company, this is an extremely strong safety signal. Because this represents that the group possesses the financial strength and compliance capability to pass Japan's "abnormally strict" audit.👉 Further Reading:

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.