An FCA License Doesn't Guarantee Compensation! Understanding Your Last Line of Defense: FOS & FSCS

Intro: Don't Let "FCA Regulation" Be Your Placebo

In our previous article, we taught you how to verify the authenticity of an FCA license. But did you know? Even if your broker genuinely holds an FCA license, your funds may not necessarily be protected by the UK government.This sounds absurd, but it is the most common phenomenon in the international forex market.

The UK has two of the world's most powerful protective umbrellas: the Financial Ombudsman Service (FOS) and the Financial Services Compensation Scheme (FSCS). However, they are like top-tier medical insurance—the terms are full of "exclusions."

This article will reveal the "client routing rules" that brokers don't want to tell you about, and teach you how to activate this rescue mechanism if you encounter slippage, withdrawal refusals, or even broker bankruptcy.

What is the difference between FOS and FSCS?

Many investors are confused about these two institutions. Simply put:Financial Ombudsman Service (FOS)

- When to use:

The broker is still active, but you have a dispute (e.g., malicious slippage, withdrawal refusal, unreasonable liquidation). - Function:

Independent third-party arbitration. - Power:

FOS decisions are legally binding, and they can order a broker to pay compensation up to £415,000.

Financial Services Compensation Scheme (FSCS)

- When to use:

The broker has gone bankrupt/collapsed/absconded and cannot repay your money. - Function:

Government subrogated compensation. - Power:

Compensation cap is £85,000 (approx. $110,000).

Does your account really have "Insurance"?

This is the cruelest truth. Most Asian/International investors, even if using a major international group "holding an FCA license," do not actually enjoy FSCS protection.Why? Because brokers play a game called "Regulatory Arbitrage."

To put it bluntly, this is "hanging a British signboard while doing offshore business." Brokers use the prestigious FCA brand to win your trust, but when opening an account, to avoid the UK's strict leverage limits (max 1:30), they will legally "route" your account to a subsidiary in an island nation with loose regulations.

This leads to two completely different fates for clients of the same company:

Scenario A: UK Residents

- Entity: UK Headquarters (UK Ltd)

- Cost: Leverage locked at 1:30, low capital efficiency.

- Benefit: ✅ FSCS Protected (If the company collapses, the UK government compensates you up to £85,000).

Scenario B: International Clients

- Entity: Offshore Branch (Offshore)

- Incentive: Offers 1:500 or higher leverage, making trading more flexible.

- Risk: ❌ No FSCS Protection (If the offshore subsidiary collapses, the UK government will not compensate).

Mr.Forex Conclusion:

This is a fair trade: You give up "UK government insurance" in exchange for "the freedom of high leverage."As long as you confirm that the group's parent company holds an FCA license, the safety is still far higher than that of a black-market platform. However, you must clearly understand: your fund safety is built on "Group Reputation," not on "UK Law."

What if something goes wrong? How to save yourself (Operation Guide)

If you are lucky enough to have a genuine FCA UK account (e.g., you are a UK resident, or insisted on opening under low-leverage UK regulation), please be sure to bookmark this "Rescue SOP."We won't talk theory; we will teach you directly "where to click" to start a complaint.

Path A: The broker is still alive, but you have a dispute → Complaint to FOS

Step 1: Internal Formal Complaint

The FCA requires that you give the broker a chance to resolve the issue first. You must write to the broker's compliance department and give them 8 weeks to process it.💡 Mr.Forex Exclusive: English Complaint Letter Template

(Please copy the content below, fill in your information, and send it)Subject: Formal Complaint - Account Number: [Your Account Number] To the Compliance Department, My name is [Your Name]. I am writing to formally log a complaint regarding my trading account [Your Account Number]. The Issue: On [Date of Incident], I requested a withdrawal of [Amount] / experienced an unusual slippage on [Symbol/Product]. However, [Describe the situation: e.g., funds not received/order execution error]. My Request: I request that you investigate this matter and provide a resolution within 8 weeks, as per FCA regulations. If I am not satisfied with your final response, or if I do not receive a response within 8 weeks, I will escalate this matter to the Financial Ombudsman Service (FOS). Sincerely, [Your Name] [Date]

Step 2: Obtain a "Final Response Letter"

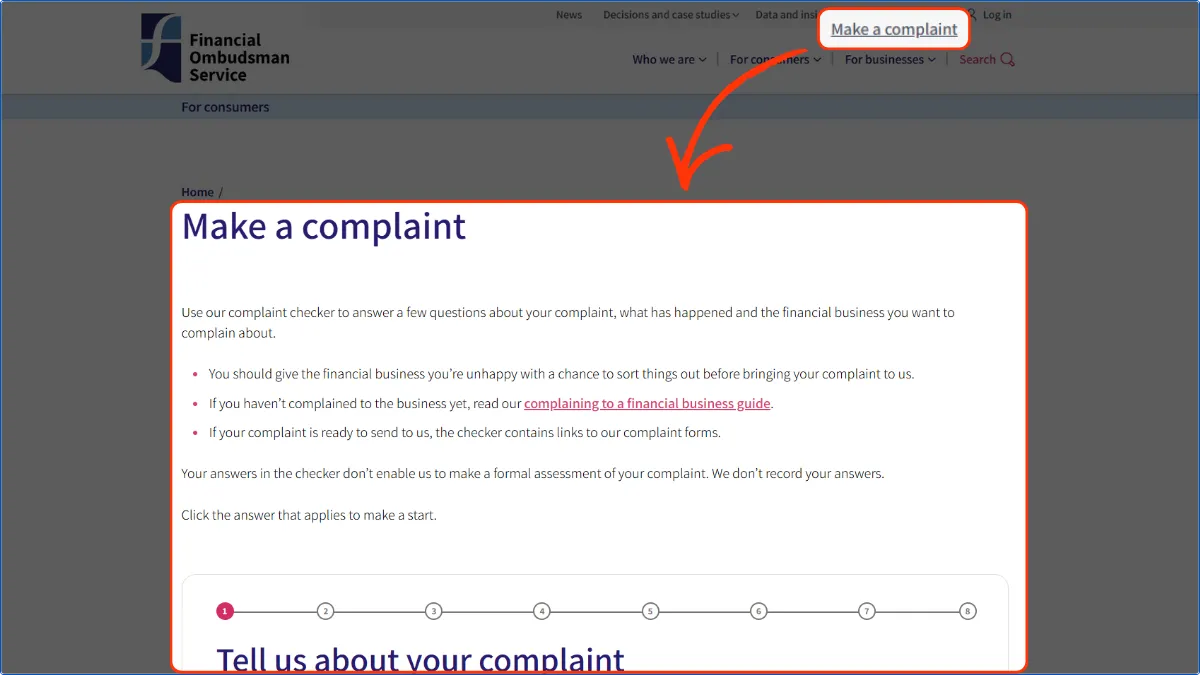

Brokers usually compromise when they see the keyword "FOS." If they refuse compensation, they must give you a "Final Response Letter." This letter is your key to opening the door to the FOS.Step 3: Online Appeal on FOS Website (Illustrated Guide)

After receiving the letter (or if there is no response after 8 weeks), please go to the FOS Complaint Page.Many readers report they cannot find the complaint entry point. Please follow the instructions in the image below:

- Go to the homepage.

- Find the "Make a complaint" button at the top of the homepage.

- After clicking, the system will guide you through a simple eligibility check, and then you can fill out the online form.

Path B: The broker has gone bankrupt/run away → Claim from FSCS

Step 1: Confirm "Default Status"

FSCS will only accept claims after officially declaring the broker "in default."Step 2: Prepare the "Three Pillars of Evidence"

Before the FSCS opens the Claims Portal, you must prepare the following documents. Remember, make a habit of backing these up!- Proof of Identity:

Passport or Driver's License (must match the account holder's identity). - Proof of Funds:

Bank wire transfer statement or credit card statement from when you deposited. - Proof of Balance:

The last transaction statement (Daily / Monthly Statement) before the collapse.

Warning: Many investors cannot get this statement because they cannot log into the MT4 backend. It is recommended to download and save this every month.

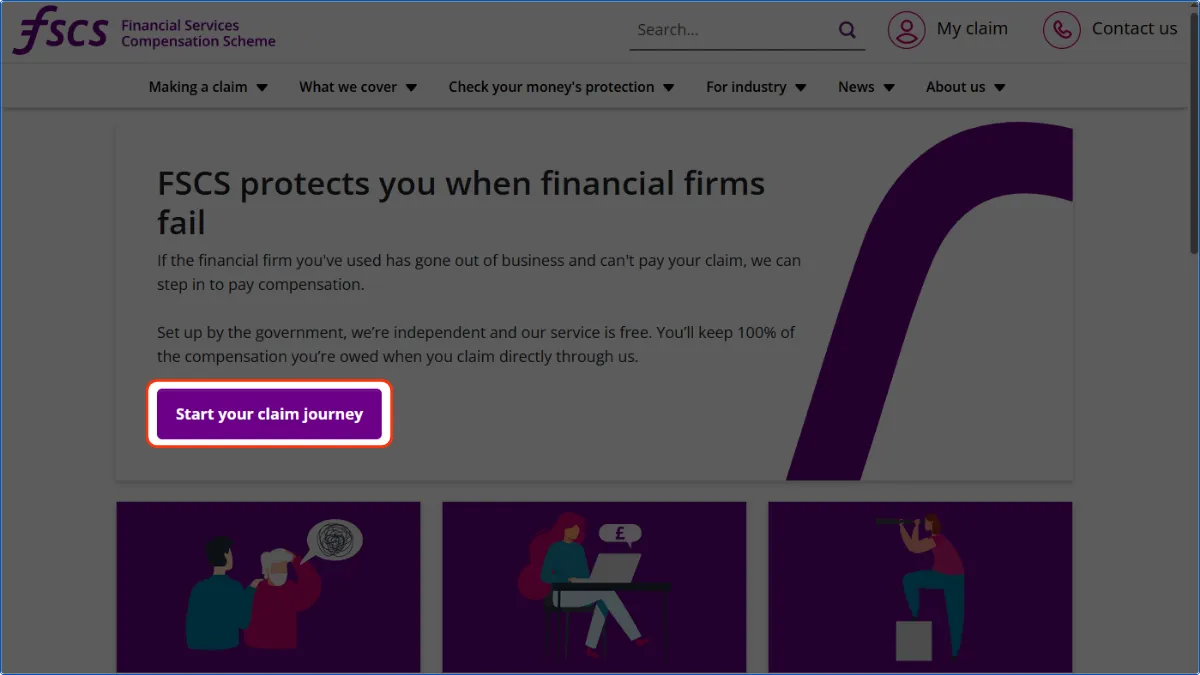

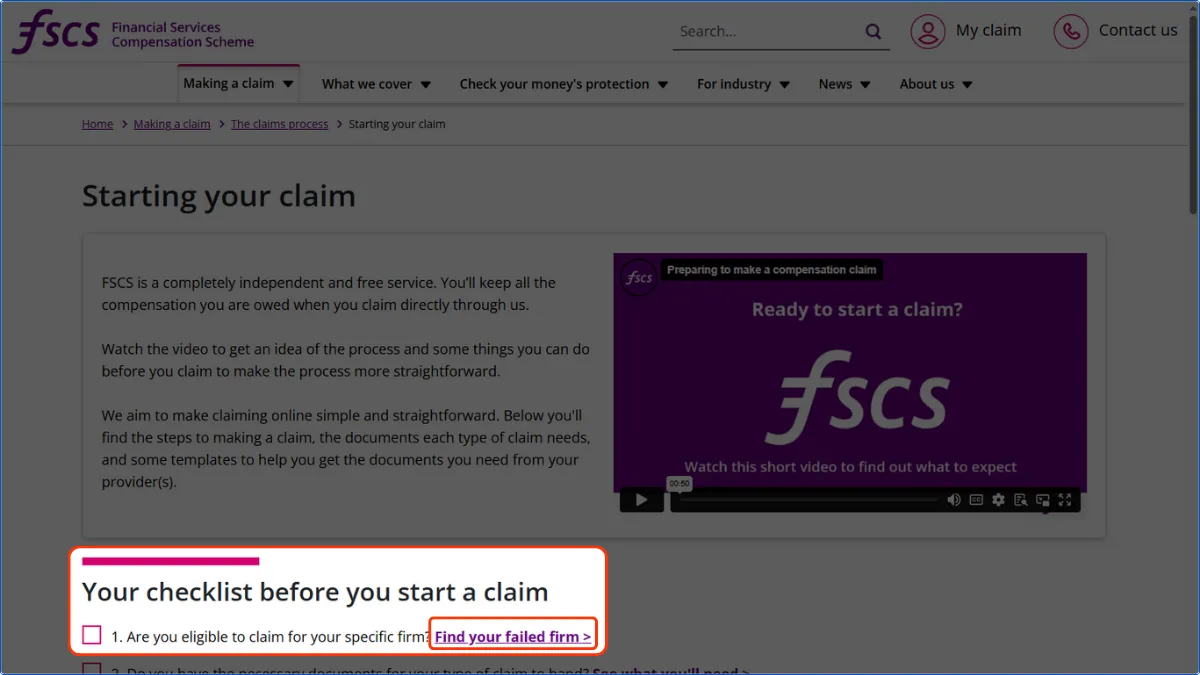

Step 3: Apply for Compensation on FSCS Website (Illustrated Guide)

Go to the FSCS Website. Please follow the "Two-Stage" steps below to find the portal.3-1. Start the Claim Process

On the homepage, click the button "Start your claim journey" in the center of the screen.

3-2. Search for the Failed Firm

After clicking, you will enter the "Starting your claim" page. There is a checklist here. Please find point 1 "1. Are you eligible to claim for your specific firm?", and click the link "Find your failed firm" behind that text.

After clicking, a search box will pop up, allowing you to enter the broker's name (e.g., Alpari). Only after confirming that the company has been declared in default will the claim permission be officially opened.

Conclusion: Buying Insurance or Buying Freedom?

After understanding how FCA, FOS, and FSCS work, you will find that forex trading is actually a multiple-choice question:- Ultimate Safety → Insist on opening under FCA (UK).

Cost: Leverage is limited to 1:30, capital efficiency is low, and account opening review is strict. - Efficiency First → Choose offshore regulation under a major group.

Cost: Give up FSCS compensation and rely on group reputation.

There is no standard answer, only the choice that suits you best. But no matter which one you choose, "confirming that the parent company holds an FCA license" is always your baseline for screening platforms.

👉 Further Reading:

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.