Revealing the Truth: ASIC's "Closed Market" Policy & Client Diversion

Foreword: The "High Leverage Paradise" is History

If you have been trading for more than 5 years, you surely remember when ASIC was a top choice in the forex market. Back then, ASIC regulation meant the perfect combination: top-tier fund safety plus high leverage of 1:500.But all that ended between 2019 and 2021.

With ASIC implementing strict Product Intervention Orders, the Australian market has become as "closed" as the US (NFA) market.

Many investors still don't understand the current situation. They see the "ASIC Regulated" logo on a broker's site and feel safe depositing funds. Mr.Forex must tell you a harsh truth: that logo you see might not apply to your account at all.

This article will teach you two things:

- How to correctly check the validity of an ASIC license.

- How to determine if your account is actually under "Australian regulation" or if you have been "auto-redirected" to an offshore regulator.

You See ASIC, But You May Not Be Protected By It

This is the biggest misconception in the forex market today.When you visit the international website of a well-known broker (e.g., Pepperstone, IC Markets, GO Markets), you will indeed see the ASIC license number in the footer. This proves the group "holds" this license and shows the company has compliant financial strength.

However, this does not mean your funds are directly protected by ASIC.

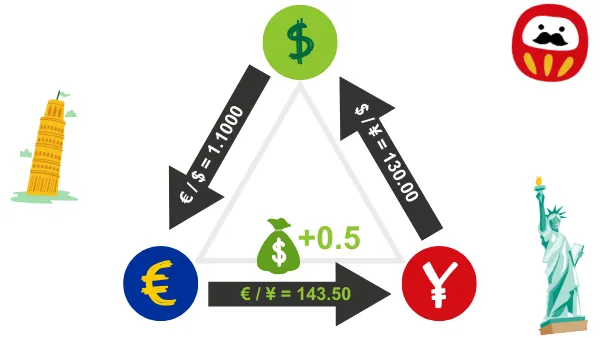

Since ASIC now strictly prohibits marketing to overseas clients (especially in Asia and international regions), brokers usually adopt the following strategy:

For Australian Residents:

Account opened with the Australian entity (ASIC), leverage limited to 1:30.

For International Clients:

The system automatically assigns you to the group's offshore regulatory subsidiary (such as SCB in the Bahamas or FSA in Seychelles) based on your IP address and residence, to provide 1:500 leverage.

Conclusion:

For most international investors, the main function of the ASIC license is to "prove the parent company's credibility," not to directly regulate your specific trading account.

3 Steps to Check an ASIC License (Using Pepperstone as an Example)

Despite this, verifying whether a broker truly holds an ASIC license remains extremely important. If a company claims to be a major broker but fakes its ASIC license, it is definitely an unsafe platform.We will use the well-known Australian broker Pepperstone as an example. Please follow these steps to verify:

Step 1: Get the AFSL License Number

Go to the bottom of the broker's official website and find the AFSL (Australian Financial Services Licence) number. It is usually a 6-digit number.Example: The AFSL number shown on the Pepperstone website is 414530.

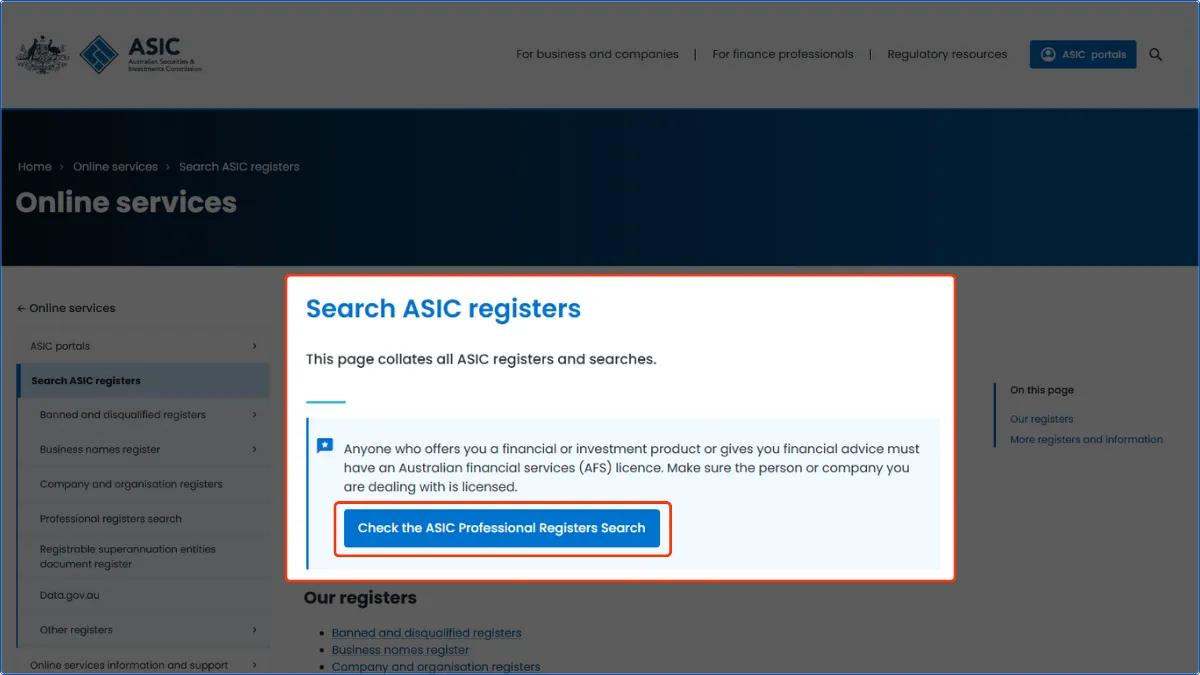

Step 2: Enter the ASIC Official Database

Official URL: Search ASIC registersClick the button "Check the ASIC Professional Registers Search" on the page to open the search interface.

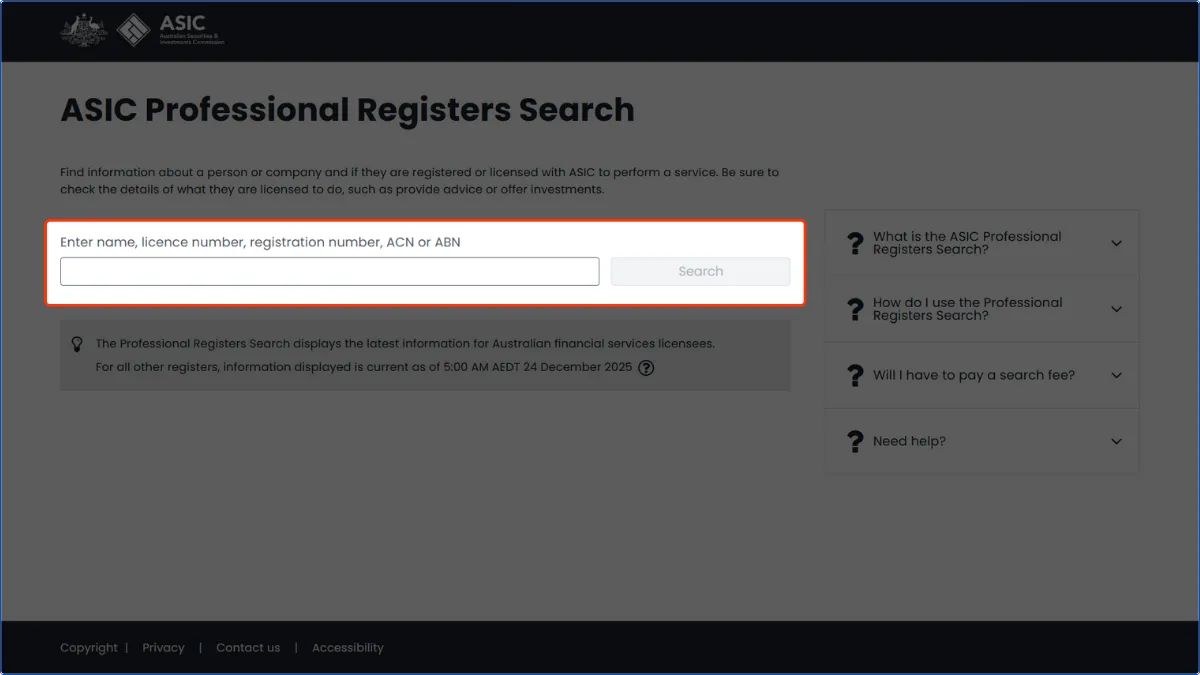

1. In the search box labeled "Enter name, licence number..." in the center of the screen, directly enter: 414530.

2. Click the "Search" button.

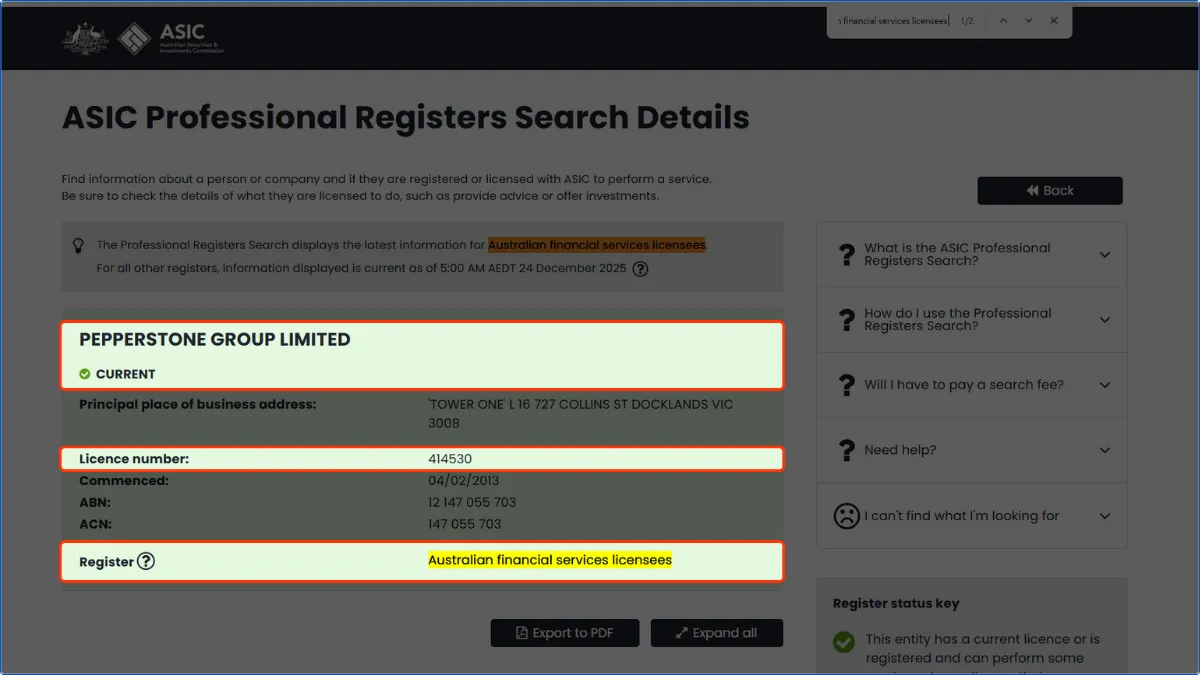

Step 3: Identify Search Results and Verify Details

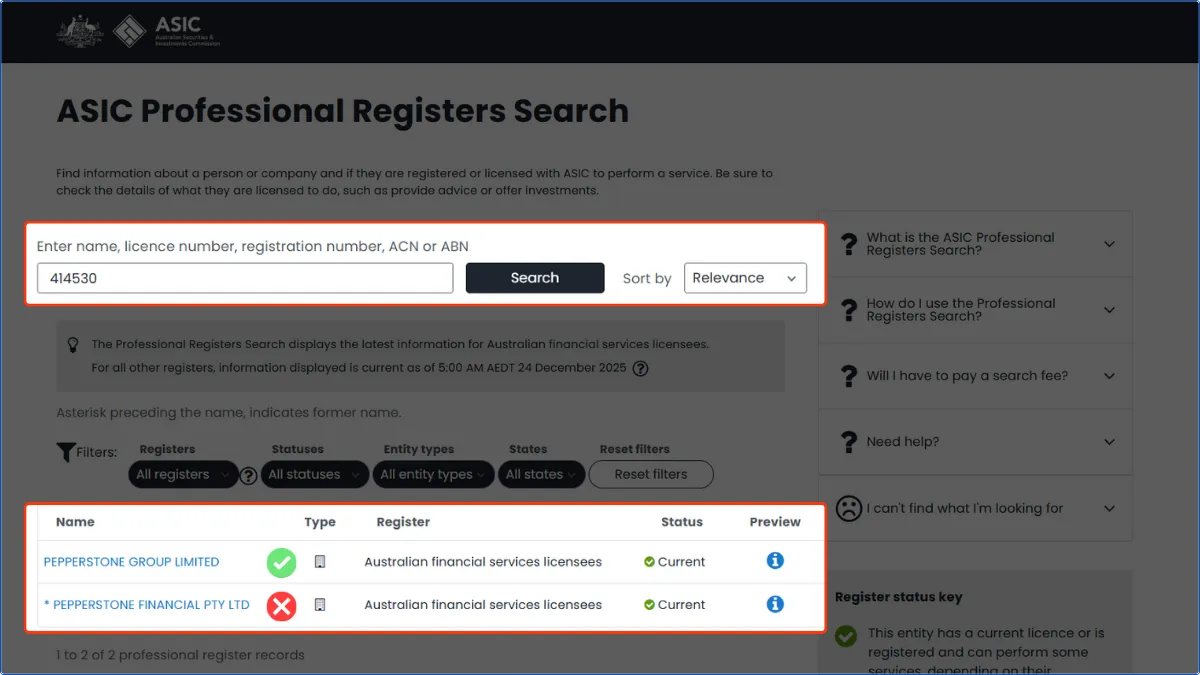

After searching, a list of results will appear (as shown in the image). Do not rush to a conclusion, as you may see multiple similar company names.1. Exclude "Former Names"

ASIC search results list all historical records under that license number. Please pay attention to the small print above the list: names with an asterisk (*) in front represent the company's old names.

For example, * PEPPERSTONE FINANCIAL PTY LTD appearing in the results is an old name, please do not click it.

2. Click on the Correct Company Entity

Please click the option "without an asterisk (*)" and where the name matches the legal terms on the website (in this case, "PEPPERSTONE GROUP LIMITED") to enter the details page.

3. Verify in the Details Page

After entering the details page, please confirm if the following information matches:

Status:

Must show a green checkmark with "Current".

Licence number:

Confirm the number is 414530.

Register:

Should display as "Australian financial services licensees".

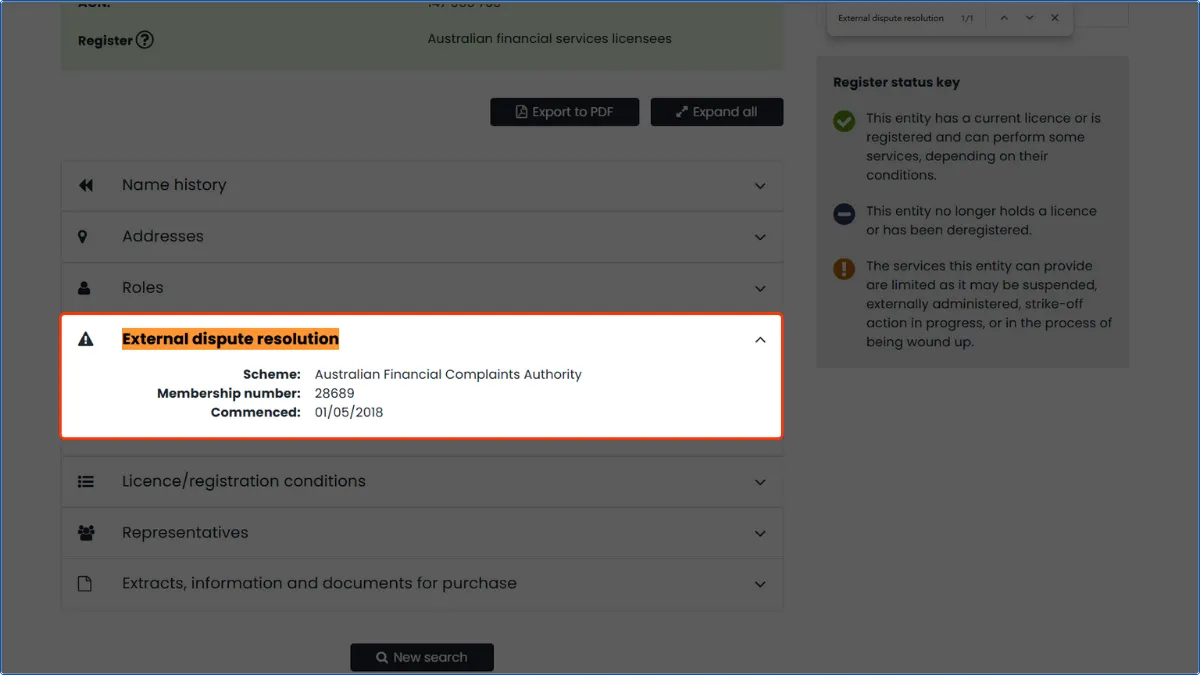

External Dispute Resolution:

This is the most important protection mechanism. Please find the "External dispute resolution" menu at the bottom of the page and click to expand it. Confirm its Scheme shows "Australian Financial Complaints Authority (AFCA)". This means if an unresolved dispute occurs, you can apply for third-party arbitration with AFCA.

Differences in Compensation Mechanisms: ASIC vs. FCA

Many people mistakenly believe that Australian regulation is the same as UK regulation, where the government provides compensation if the platform goes bankrupt. This is a common misconception.UK (FCA):

Has the FSCS scheme. If a broker goes bankrupt, the government guarantees compensation of up to £85,000.

Australia (ASIC):

Currently, for forex derivatives, there is no government-level "compensation scheme of last resort". ASIC's protection mechanism is: Mandating brokers to purchase PI Insurance (Professional Indemnity Insurance) and join AFCA. If a trading dispute occurs (such as inability to withdraw funds or slippage), AFCA can rule that the broker must compensate. However, if the broker goes directly bankrupt, the recovery of client funds usually requires a liquidation process, and there is no unconditional government payout.

Mr.Forex Viewpoint: regarding "fund protection after bankruptcy," the UK's FCA remains the highest global standard. Although ASIC regulation is strict, the compensation mechanism is slightly different.

Conclusion: Should I Insist on Opening an ASIC Account?

In 2026, the answer to this question is simple:1. If you are an Australian resident:

You must choose an ASIC-regulated account. This is a legal requirement and offers you the safest protection. However, you must accept the low leverage limit of 1:30.

2. If you are an international investor (Asia/Global):

Please do not obsess over getting an "Australian regulated account".

Legitimate large brokers usually will not allow international clients to open ASIC accounts because it violates compliance requirements. If a broker tells you: "We let you open an Australian account and still offer 1:500 leverage," there are only two possibilities:

- They are lying (they are actually transferring you to offshore regulation).

- They are a non-compliant platform, and the risk is extremely high.

Best Strategy:

Confirm that the group holds an ASIC license (proving the strength of its parent company), and then safely trade using its regulated offshore subsidiary (such as Seychelles or Bahamas). This is the best way to strike a balance between "safety" and "high leverage".

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.