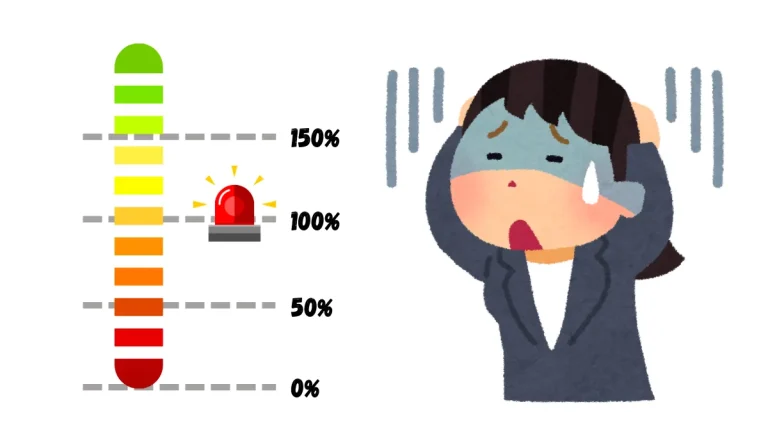

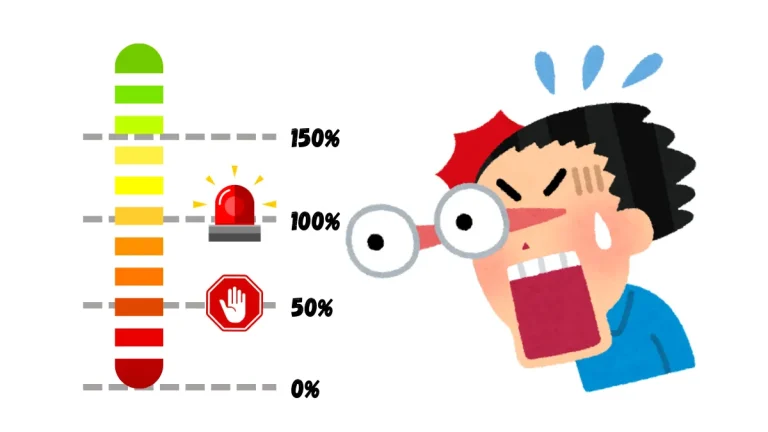

7 Practical Ways to Avoid Margin Calls in Forex Trading

"Learn how to effectively avoid margin call notifications in Forex trading and protect your capital with 7 practical tips through reasonable leverage, stop-loss settings, and risk diversification!"