Myfxbook Tutorial: Boost Forex Profits with Expectancy & Risk-Reward

Stop closing trades too early! Discover how to use Myfxbook data—Expectancy & Risk-Reward—to diagnose psychological weaknesses and optimize your Forex strategy for maximum profit.

Stop closing trades too early! Discover how to use Myfxbook data—Expectancy & Risk-Reward—to diagnose psychological weaknesses and optimize your Forex strategy for maximum profit.

Looking for a Myfxbook tutorial? This beginner's guide provides step-by-step instructions on how to connect MT4/MT5, set up an Investor Password, and successfully verify your account to start objectively tracking your forex trading performance.

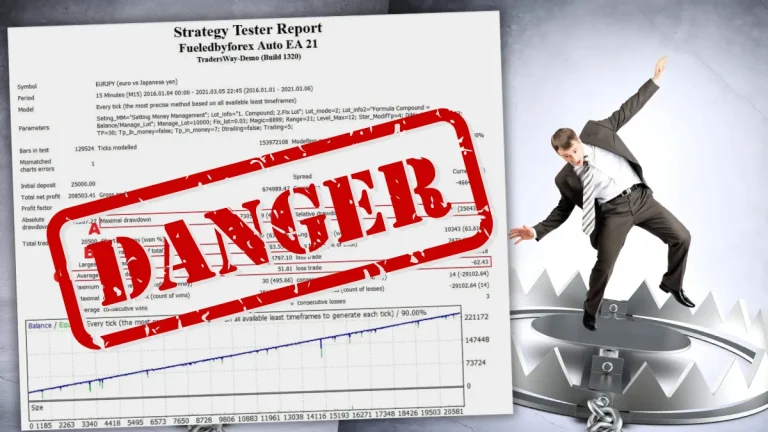

In the world of automated trading, it is estimated that over 80% of EAs (Expert Advisors) carry more or less the shadow of the Martingale strategy. It is like a ghost lurking behind various seemingly perfect performance reports. Therefore, learning how to identify it is not an advanced option but a necessary survival skill. The purpose of this article is to provide you with all the tools you need to have a pair of "X-ray eyes" that can see through the high-risk temptations of the market.

The tragic downfall of a million-dollar team reveals the true cost of the Martingale strategy. This article combines exclusive cases and practical self-protection guides to teach you how to identify high-risk EAs, choose reliable brokers, and fundamentally avoid traps.

A friend's lucky investment success reveals the dangerous "survivorship bias" psychological trap. This article analyzes a real case study and provides a risk management guide to help you build a truly strong investing mindset.

"Understand what the Sharpe Ratio is, how to calculate risk-adjusted returns, and how to apply this key indicator in Forex trading to optimize investment strategies and enhance performance!"

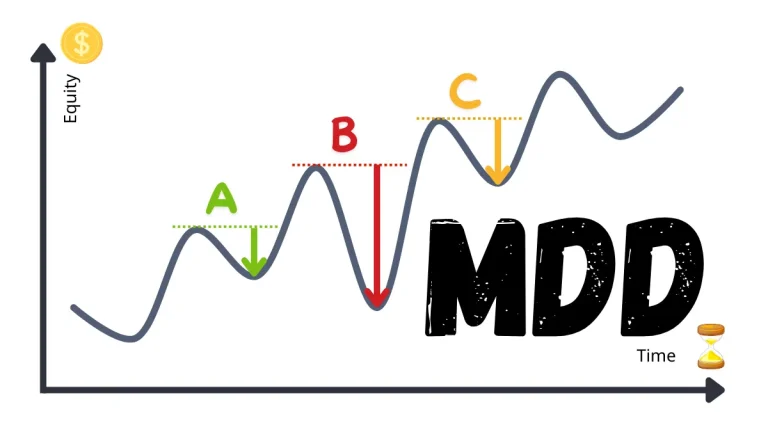

"Deeply analyze the key risk indicators in Forex trading, understand what max drawdown (Max Drawdown) is and its importance for capital management, and master practical strategies to reduce drawdown, helping you build a robust trading plan!"

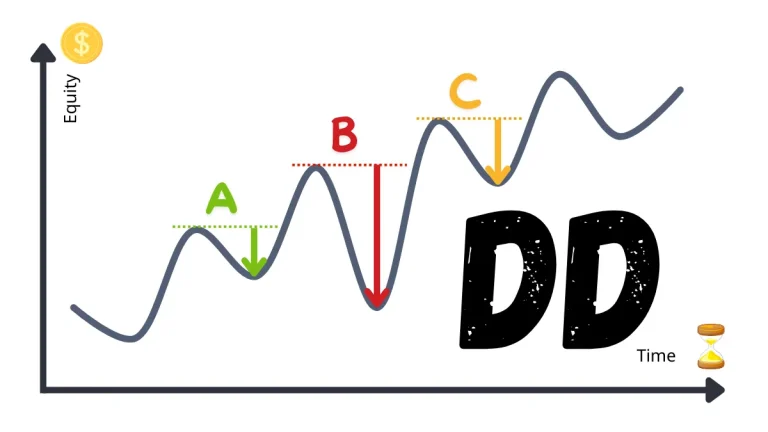

"How to effectively manage drawdown in Forex trading? From strategy selection to psychological adjustment, this article teaches you techniques to cope with drawdown, reduce risk, enhance profit stability, and help you move steadily in a volatile market!"

"Understand what excessive leverage is and its risks, master effective Forex trading strategies, avoid margin call traps, and make your investments more stable!"

The Kelly formula is a mathematical capital management strategy that calculates the optimal capital allocation ratio, helping Forex traders maximize long-term returns while controlling risk. It is applicable to trend trading and risk management, and it requires dynamic adjustments to respond to market volatility and data instability.

©2026 Mr.Forex

Shine Wealth Co., Ltd.

+886 2 8751 5503

2 F., No. 12, Zhouzi St., Neihu Dist., Taipei City 114064, Taiwan (R.O.C.)

All Rights Reserved.

Disclaimer: The information on this website is not intended for distribution to, or use by, residents of the United States, Taiwan, or any other jurisdiction where such distribution or use would be contrary to local law or regulation. By registering or using the services, the user confirms that their actions are entirely voluntary and at their own initiative, and not in response to any solicitation by this website. Users are responsible for ensuring their access and use comply with local laws.

Disclosure: Trading Forex and Contracts for Difference (CFDs) involves high risk and may result in losses exceeding your initial capital. Past backtesting data and strategy performance do not indicate future results. This website provides technical analysis and software tools only and does not offer any investment advice.

Notice: The content of this website is assisted by Artificial Intelligence (AI) translation and is for reference only. In case of any discrepancy, the English version shall prevail. If you find any translation errors, corrections are welcome.[email protected]