How to Choose and Evaluate an Expert Advisor (EA) ?

There are many Expert Advisors (EAs) in the market, which can be overwhelming and confusing for beginners. Don’t worry, here are some simple methods and suggestions to help you find an EA that might suit you and avoid some pitfalls.Where to Find EAs?

You can find EAs from the following places:- Official MetaTrader Market (MQL5): In the "Market" feature of the MT4 or MT5 platform, you can find many EAs shared or sold by developers.

- Independent Developer Websites: Some developers sell EAs on their own websites.

- Forex Forums and Communities: Some trading forums also share free or recommended EAs.

What to Look for When Evaluating an EA?

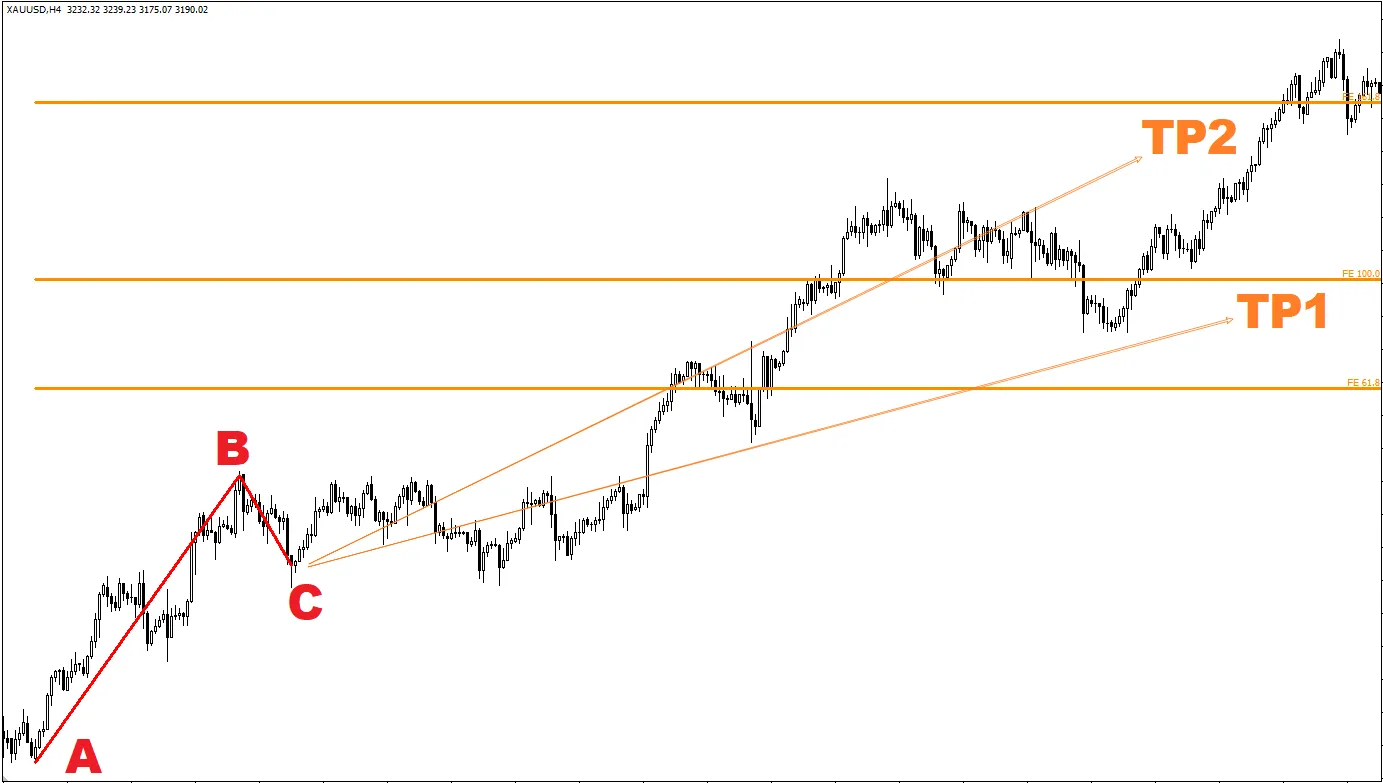

When choosing an EA, pay attention to the following points:- Understand Its Strategy: Avoid using black-box EAs that cannot explain their strategy logic. Choose products that can explain their operational logic (e.g., trend strategy, range trading).

- Check Past Performance: Is there verified live trading history? Pay attention to max drawdown data (Maximum Drawdown) to understand historical risk.

- Analyze Backtest Data: Check if the backtest period is long enough and if the simulation environment is reasonable. Over-optimized results often look too perfect, so stay cautious.

- Refer to Other Users’ Reviews: Look for real user experiences on forums, trading communities, and other independent platforms.

- Consider Price and Charging Model: Don’t assume expensive means better; free EAs can also be effective. Check if there is a trial or refund policy.

- Developer Reputation and Customer Support: Is there customer support? Are there regular updates and educational materials?

- Is a Trial Available: Prefer EAs that can be tested first on a Demo Account to understand actual performance before purchasing.

Special Attention: Beware of Unrealistic Promises and Scams!

- "Guaranteed Profit" Is the Biggest Red Flag: There is no tool that guarantees profit in the forex market. Stay away from EAs claiming "sure-win" or "no loss."

- Beware of Exaggerated Promotions: Fake trading screenshots, fake reviews, and "limited-time offers" are common scam tactics.

- Lack of Transparency: Be cautious if you cannot find detailed strategies, verified records, or if it’s difficult to contact the developer.

- Excessively High Prices: If the price is outrageously high without supporting evidence, it could also be a scam.

Simple Checklist for Beginners to Evaluate an EA

- Is the strategy clear?

Can I roughly understand how this EA trades?

If the strategy is completely undisclosed and it’s like a black box, be cautious. - Is there real trading history?

Is there verifiable long-term live account history?

If there are only screenshots or claims of never losing, remain skeptical. - Is the backtest reliable?

Is the backtest period long enough? Is the simulation scenario reasonable?

If the results look too perfect, it might be over-optimized. - What do others say?

Are there real user reviews on forums or other communities?

If only the official website has positive reviews, be alert. - Is there someone to ask?

Does the developer provide customer support? Are there instruction documents?

If customer support is unreachable or there are no user guides, it’s a big red flag. - Is a trial available?

Is there a free trial period or can it be tested on a Demo Account?

If you must pay upfront before trying, proceed with caution. - Are the promises exaggerated?

Is the price reasonable? Does it claim guaranteed profits or quick wealth?

If the price is high and paired with unrealistic promises, avoid it.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.