Drawdown Calculator Instructions

Input

- Opening Balance:Enter your initial account balance. For example, $1,000.

- Consecutive Losses Times:Simulate of N consecutive losses. Example, 6 consecutive loss.

- Loss % per trade:This is a key parameter of the Drawdown Calculator! According to experience, the risk of each trade for professional traders does not exceed 2% of the net value of the account. Take a 2% loss per trade as an example.

Result

- End-of-period Balance:Display the account balance after facing consecutive loss trades.

- Total Loss:Display the total loss percentage after facing consecutive loss trades.

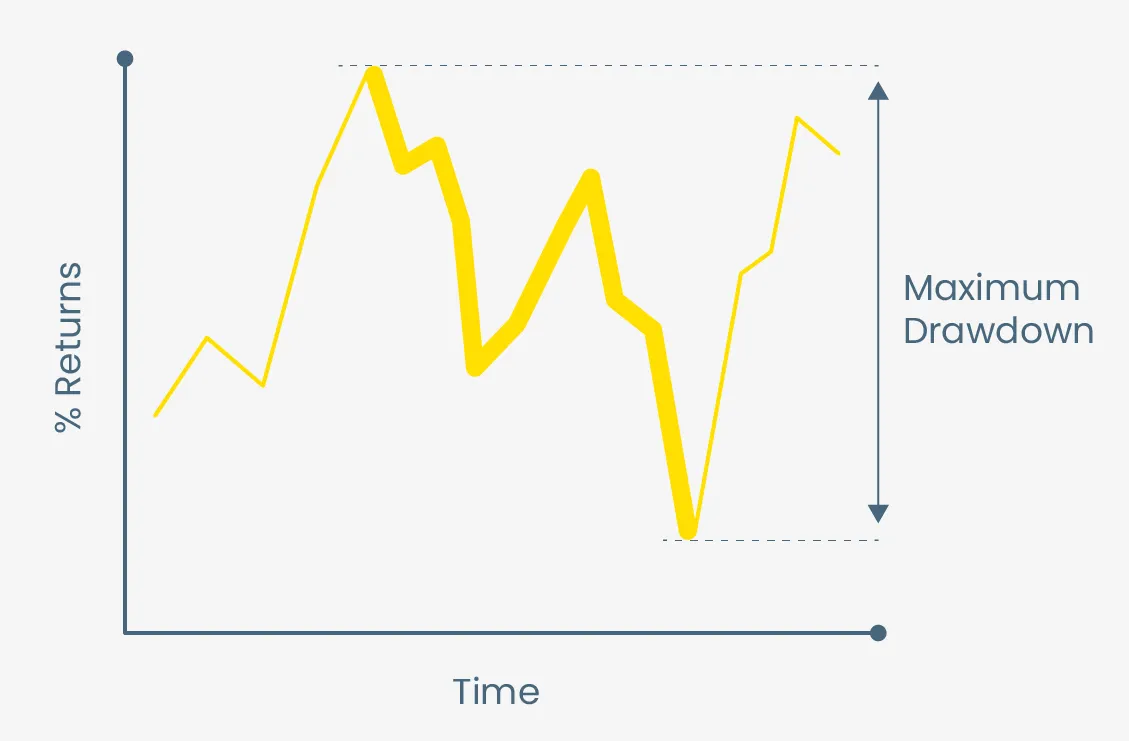

What is Max Drawdown (MDD)?

Max Drawdown (MDD) refers to the maximum loss suffered due to trading activities since the establishment of the trading record. Drawdown is calculated based on the difference in net value, so the Drawdown Calculator includes both settled and unsettled orders. If the maximum Drawdown (MDD) is large, it indicates that the risk of capital loss is also large.(MDD)If it is large, it indicates that the risk of capital loss is also large.

How is Drawdown Calculated?

Drawdown measures the single continuous loss from a high point to a low point. Simply put, drawdown refers to the continuation from a high point to a low point, until a new high point appears.

Drawdown calculator is considered one of the most important risk calculators in the trader’s toolbox. One of the features of our drawdown calculator is that it allows traders to accurately simulate the ideal net value and risk percentage of each trade.

Using this calculator can also help traders avoid reaching an uncomfortable drawdown percentage, which could ultimately risk a total loss of account net value. For example, even ifeach transaction uses 7%of the capital ratio, if there are 10 consecutive losses,it may also deplete more than 50% of the initial capital.。

We recommend that traders always use this drawdown calculator before opening a trading position, and integrate it with any sound capital management system or account net value risk management plan.