In the Forex and CFD markets, security is always the primary criterion for our reviews. EBC Financial Group has emerged rapidly in recent years, winning the "Most Trusted Broker" award from "World Finance" for three consecutive years.

As the Mr.Forex review team, we focus not on the halo of these awards, but on the hard power behind them: Full FCA regulation in the UK, top-tier fund custody with Barclays Bank, and its brand strength as the Official Partner of FC Barcelona.

However, what truly sets EBC apart is its emphasis on the "trading ecosystem"—from a transparent IB system that eliminates multi-level exploitation to a massive program that supports traders in becoming fund managers. Below is our full in-depth report.

However, EBC is connected to over 25 top-tier bank and non-bank liquidity providers (Tier-1 LPs), and this deep aggregated pricing brings excellent slippage optimization.

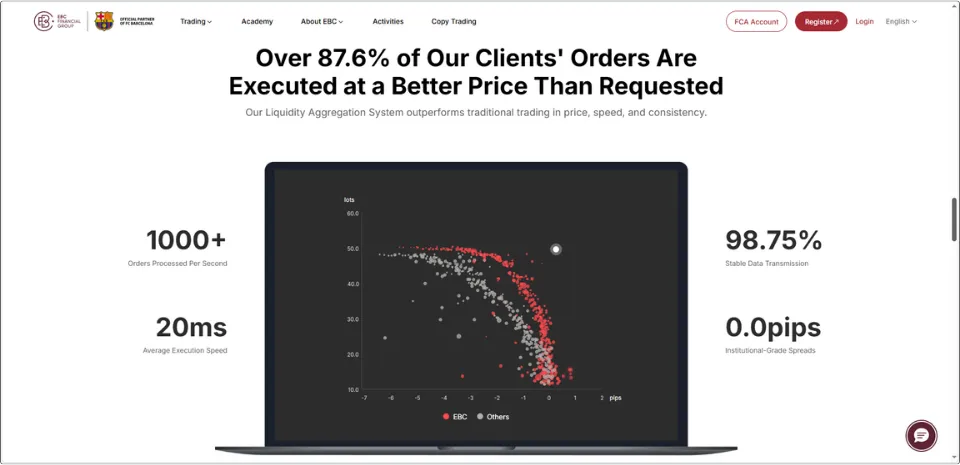

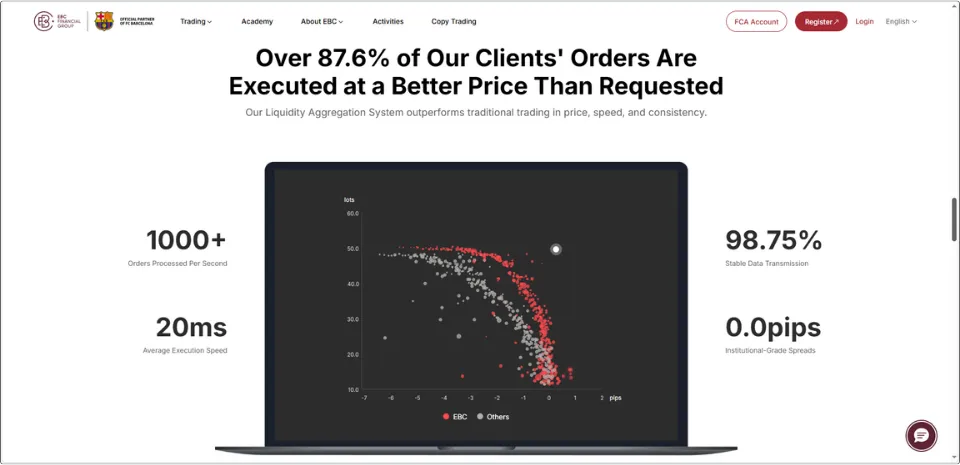

Real-time liquidity data published by EBC official. This chart supports its "anti-spread widening" and "positive slippage" advantages, with up to 87.6% of orders executed at prices better than expected, thanks to its powerful top-tier liquidity aggregation system.

This provides an important layer of protection for traders, reducing the risk of severe slippage due to liquidity exhaustion.

Testing shows that from EUR/USD, which regularly maintains 0.0 pips, and extremely narrow spreads on Gold and US indices, to the newly launched BTC/USD, EBC demonstrates institutional-grade pricing stability and cost advantages across its entire product line.

Summary: EBC builds a low-cost and highly resilient trading environment for traders through the dual mechanisms of "low-latency hardware" and "aggregated liquidity."

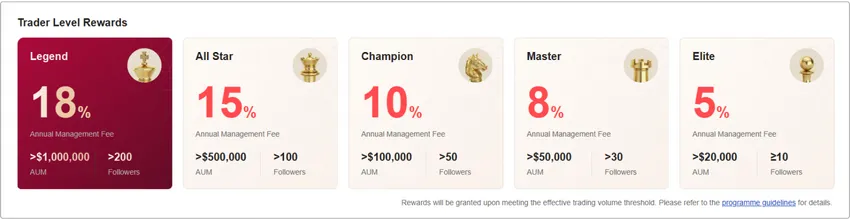

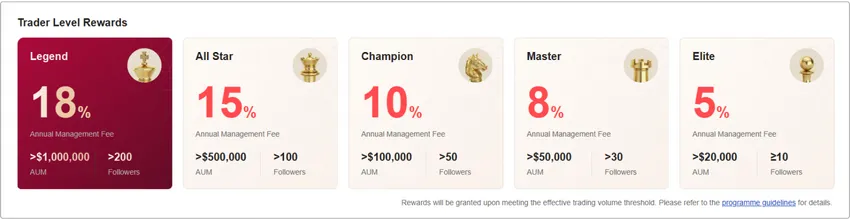

If you have a stable trading strategy, you can apply to become an EBC signal provider. But please note, this is a program that rewards "active trading"; to receive high management fees, you must meet both "capital size" and "trading activity" metrics.

The progression mechanism announced by EBC. As AUM and the number of followers increase, traders can gradually unlock higher annual management fee rates (from 5% to 18%).

This means the program is more beneficial for high-frequency, intraday, or short-term swing traders; for extremely low-frequency long-term holding strategies, there may be a risk of not being able to receive management fees due to insufficient trading volume.

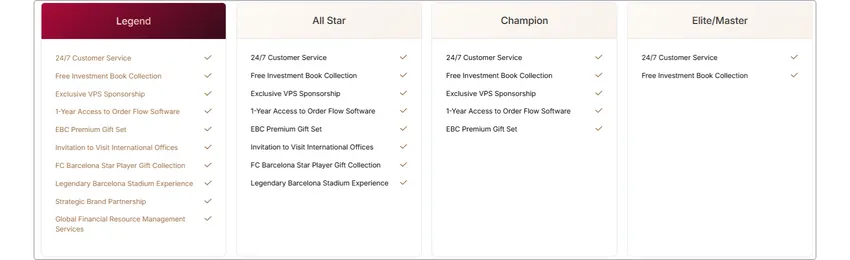

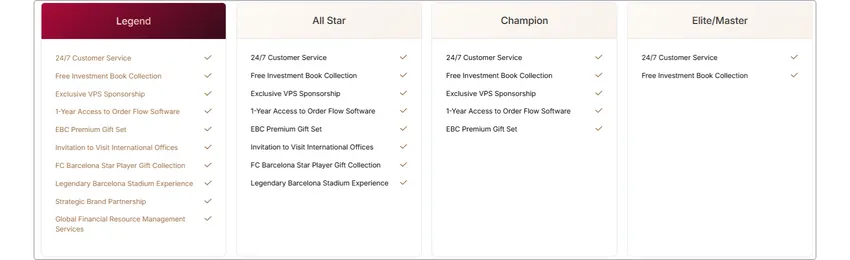

In addition to cash rewards, EBC provides differentiated resource support for traders at different stages. From basic educational books to professional trading environment upgrades (VPS, Order Flow), and even top-tier FC Barcelona exclusive experiences, it builds a complete growth ecosystem.

Mr.Forex Observation:

EBC has adopted a "steady progress" strategy in its cryptocurrency layout. They did not blindly list a large number of illiquid small coins, but started with BTC, the most liquid one, ensuring that even cryptocurrency assets can enjoy institutional-grade stable quotes and execution speeds. This reflects EBC's consistent and rigorous attitude toward risk control.

As the Mr.Forex review team, we focus not on the halo of these awards, but on the hard power behind them: Full FCA regulation in the UK, top-tier fund custody with Barclays Bank, and its brand strength as the Official Partner of FC Barcelona.

However, what truly sets EBC apart is its emphasis on the "trading ecosystem"—from a transparent IB system that eliminates multi-level exploitation to a massive program that supports traders in becoming fund managers. Below is our full in-depth report.

1. Regulation and Fund Safety: The Value of a Full FCA License

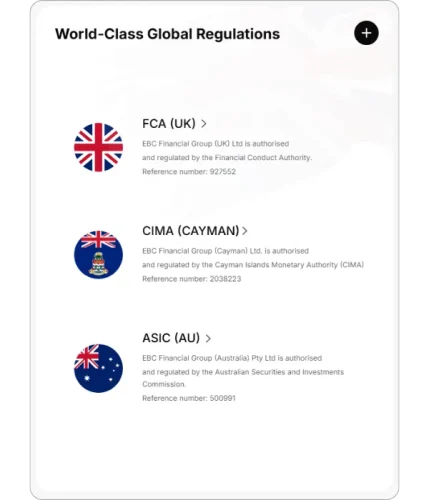

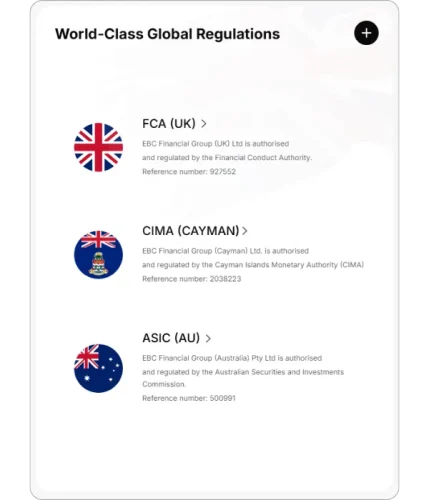

For international investors, regulatory licenses are not decorations, but the last line of defense for fund safety. EBC currently holds one of the world's strictest regulatory combinations:- UK FCA (EBC Financial Group (UK) Ltd):

Holds a full license (Reference No: 927552). This is one of the most difficult licenses to obtain and the most stringently regulated in the world, representing the highest standards of capital adequacy and compliance. - Australia ASIC (EBC Financial Group (Australia) Pty Ltd):

Regulated by the Australian Securities and Investments Commission (Reference No: 500991), protecting the interests of clients in the Asia-Pacific region. - Global Offshore Regulation (SVG/CIMA):

To serve international traders seeking high capital efficiency, EBC provides services through St. Vincent (SVG) and Cayman (CIMA) entities (Reference No: 2038223). This allows the group to provide more competitive leverage (up to 1:500) and flexible copy-trading services within a compliant framework.

Fund Safety Mechanism: Tiered Protection and Insurance Net

EBC implements strict fund management policies globally, but protection mechanisms differ depending on the regulatory entity:- For UK Regulated Accounts (FCA):

Strictly complies with the UK Client Assets Sourcebook (CASS) regulations, with client funds held entirely in independent trust accounts at a top-tier investment bank—Barclays Bank, and protected by the FSCS compensation scheme. - For Global Accounts (SVG/CIMA):

Governed by the SIBA of the Cayman Islands (CIMA), client funds are also independently held at Barclays Bank, ensuring client funds are completely segregated from the company's operating capital to eliminate misappropriation risks. - Additional Insurance Net: EBC Group has professional indemnity insurance (PII) with coverage exceeding $10 million. This means that regardless of your regulatory jurisdiction, you have an additional layer of protection beyond basic regulations.

2. Execution Quality and Trading Costs: Competitiveness from Hardware Advantages

For professional traders, "spreads" are only part of the cost; "execution stability" is the key to profit. EBC demonstrates institutional-level standards in both areas.1. 20ms Ultra-Fast Execution

EBC deploys servers in top financial data centers such as London LD4, connected directly via dedicated fiber optic lines. An average order execution speed of approximately 20ms is an ideal hardware environment for EA algorithmic trading or high-frequency strategies that rely on speed.2. Mechanism to Prevent Spread Widening Based on Deep Liquidity

On ECN accounts, spread widening during major news events like NFP or interest rate decisions is a physical reality of the market.However, EBC is connected to over 25 top-tier bank and non-bank liquidity providers (Tier-1 LPs), and this deep aggregated pricing brings excellent slippage optimization.

Real-time liquidity data published by EBC official. This chart supports its "anti-spread widening" and "positive slippage" advantages, with up to 87.6% of orders executed at prices better than expected, thanks to its powerful top-tier liquidity aggregation system.

- Positive Slippage Advantage:

According to execution statistics released by EBC, approximately 87.6% of orders are executed at a "better price." This means that in fast markets, traders not only encounter less malicious slippage but even have the opportunity to get a better entry price than at the moment of clicking. - Fast Mean Reversion:

Compared to brokers with a single price source, EBC can rely on multi-party price competition to narrow spreads back to normal levels more quickly after a momentary spike caused by news.

This provides an important layer of protection for traders, reducing the risk of severe slippage due to liquidity exhaustion.

3. Actual Spread Performance (Pro Account)

After confirming the underlying architecture, let's look at the actual holding costs. EBC's Pro account offers highly competitive spreads on major instruments:

Testing shows that from EUR/USD, which regularly maintains 0.0 pips, and extremely narrow spreads on Gold and US indices, to the newly launched BTC/USD, EBC demonstrates institutional-grade pricing stability and cost advantages across its entire product line.

Summary: EBC builds a low-cost and highly resilient trading environment for traders through the dual mechanisms of "low-latency hardware" and "aggregated liquidity."

3. Flagship Feature: Trader's Career Ladder (Fund Manager Growth Program)

EBC provides not just a place to trade, but also "capital" and "traffic." Its original "Fund Manager Growth Program" is one of the most generous incentive schemes for signal providers in the industry today.If you have a stable trading strategy, you can apply to become an EBC signal provider. But please note, this is a program that rewards "active trading"; to receive high management fees, you must meet both "capital size" and "trading activity" metrics.

Tiers and Fee Structure (Determining Your Profit Ceiling)

Your tier is determined by "Assets Under Management (AUM)" and the "Number of Followers." The higher the tier, the higher the annual management fee rate and exclusive benefits you can unlock:

The progression mechanism announced by EBC. As AUM and the number of followers increase, traders can gradually unlock higher annual management fee rates (from 5% to 18%).

Key Assessment: Hard Conditions for Bonus Payout (Mr.Forex Reminder)

Reaching the above tiers does not mean you automatically get paid for doing nothing. EBC has an activity assessment; your effective trading volume for the month must reach the target to trigger the bonus payout.- Payout Condition:

Effective Trading Volume (Lots) ≥ Average Daily Balance × 0.2% - Interpretation:

If your account has an average daily balance of $1,000, you need to complete at least 2 lots of effective trading volume that month.

This means the program is more beneficial for high-frequency, intraday, or short-term swing traders; for extremely low-frequency long-term holding strategies, there may be a risk of not being able to receive management fees due to insufficient trading volume.

Hardware/Software Support and Exclusive Benefits

Beyond bonuses, EBC indeed invests significant resources in supporting high-level traders:

In addition to cash rewards, EBC provides differentiated resource support for traders at different stages. From basic educational books to professional trading environment upgrades (VPS, Order Flow), and even top-tier FC Barcelona exclusive experiences, it builds a complete growth ecosystem.

4. Product Range and Deposits/Withdrawals

- Diverse Assets: Covers Forex, Precious Metals, Crude Oil, Global Indices, and US Stock CFDs.

- Cryptocurrency: EBC has officially launched cryptocurrency trading functions (such as BTC/USD) in 2025, with plans to gradually add more mainstream coins.

- Deposit/Withdrawal Channels: Supports global wire transfers, credit cards, cryptocurrency, and local payment gateways in various countries.

Mr.Forex Observation:

EBC has adopted a "steady progress" strategy in its cryptocurrency layout. They did not blindly list a large number of illiquid small coins, but started with BTC, the most liquid one, ensuring that even cryptocurrency assets can enjoy institutional-grade stable quotes and execution speeds. This reflects EBC's consistent and rigorous attitude toward risk control.

5. Vision and Social Responsibility: Reputation Endorsement of a Top Broker

When evaluating whether a broker is worth entrusting in the long term, besides looking at regulation, we also observe its "Partner Level." Top-tier partners often mean the broker has passed strict due diligence, which is a powerful implicit endorsement.Global Top-Tier Partners

EBC's brand layout demonstrates its strong capital strength:- FC Barcelona (Official Partner):

This is not just marketing; it represents EBC passing the financial audit of one of the world's top sports clubs. - United Nations Foundation:

Partnering to promote the "United to Beat Malaria" campaign, demonstrating corporate ESG commitment. - University of Oxford:

Co-hosting economics seminars, showing its professional pursuit in academic and macroeconomic fields.

Video Caption: EBC's global anti-malaria public welfare documentary in partnership with the United Nations Foundation.

These initiatives, while not directly affecting spreads, send a clear signal to investors: EBC is a legitimate financial institution with a global vision and a focus on long-term development, rather than a platform merely concerned with short-term profits.

A: Absolutely not. EBC is multi-regulated by the FCA, ASIC, and CIMA, and funds are held in segregated custody. However, please note: Recently, scam groups have impersonated EBC to commit fraud via Line or fake apps. Please ensure you are on the official EBC website. Currently, EBC has NOT launched any self-developed mobile apps other than official channels.

Q: Does EBC provide educational resources?

A: Yes. In addition to regular market analysis, you can learn by observing the strategies of high-level traders.

Recommended for: EA algorithmic traders pursuing ultimate execution quality, professional fund managers hoping to earn high management fees through copy trading, and rigorous investors who value fund safety and transparency.

Not Recommended for: Traders seeking high-leverage cryptocurrency trading. Although EBC has started offering mainstream cryptocurrencies like BTC, its coin variety is still not as rich as specialized cryptocurrency exchanges.

If you are looking for a trading environment with strict regulation, no exploitation, and rewards for true experts, EBC is undoubtedly a top-tier broker worth allocating to in 2025.

[ Register EBC Demo Account Now ]

6. Frequently Asked Questions (FAQ)

Q: Is EBC Financial Group a scam?A: Absolutely not. EBC is multi-regulated by the FCA, ASIC, and CIMA, and funds are held in segregated custody. However, please note: Recently, scam groups have impersonated EBC to commit fraud via Line or fake apps. Please ensure you are on the official EBC website. Currently, EBC has NOT launched any self-developed mobile apps other than official channels.

Q: Does EBC provide educational resources?

A: Yes. In addition to regular market analysis, you can learn by observing the strategies of high-level traders.

7. Conclusion: Who is EBC Suitable For?

EBC Financial Group demonstrates the ambition to cross over from a "Retail Broker" to an "Institutional Service Provider."Recommended for: EA algorithmic traders pursuing ultimate execution quality, professional fund managers hoping to earn high management fees through copy trading, and rigorous investors who value fund safety and transparency.

Not Recommended for: Traders seeking high-leverage cryptocurrency trading. Although EBC has started offering mainstream cryptocurrencies like BTC, its coin variety is still not as rich as specialized cryptocurrency exchanges.

If you are looking for a trading environment with strict regulation, no exploitation, and rewards for true experts, EBC is undoubtedly a top-tier broker worth allocating to in 2025.

[ Register EBC Demo Account Now ]

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.