Understanding Forex Quotes: The Difference and Application of Bid and Ask Prices

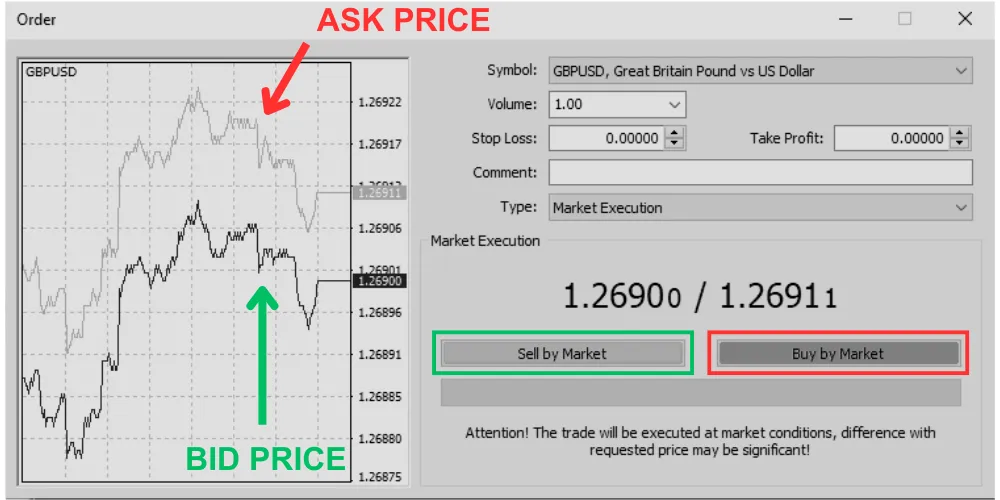

When you open a forex trading platform and prepare to start trading, the first thing you see is the constantly changing prices.You will notice that for each currency pair, usually two prices are displayed instead of just one.

These two prices are the "Ask Price" and the "Bid Price".

Understanding what these two prices represent and which price to look at when you want to buy or sell is the most basic prerequisite for forex trading.

If you get it wrong, it may lead to order costs that are not as expected.

Don’t worry, this article will explain clearly and simply the difference and usage of these two prices.

1. Forex Quotes: A Pair of Prices

We know that forex trading involves buying and selling "currency pairs".A currency pair quote shows the value of the "base currency" (the currency on the left side of the slash) measured in the "quote currency" (the currency on the right side of the slash).

The market always provides two slightly different numbers for this value, forming a pair of quotes.

2. "Ask Price": The Price You Pay When Buying

The "Ask Price" is sometimes also called the "Offer Price".The key points you need to remember are:

- This is the price at which the market (or your broker) is willing to "sell" the base currency to you.

- In other words, when you want to "buy" (Buy / Long) the currency pair, the price you pay is this "Ask Price".

- It is usually the higher price in the quote. Think of it this way: when you want to buy something from someone, the seller’s asking price (Ask Price) is usually higher.

3. "Bid Price": The Price You Receive When Selling

The "Bid Price" is sometimes also called the "Buyer’s Price".The key points you need to remember are:

- This is the price at which the market (or your broker) is willing to "buy" the base currency from you.

- In other words, when you want to "sell" (Sell / Short) the currency pair, the price you receive is this "Bid Price".

- It is usually the lower price in the quote. Think of it this way: when you want to sell something to someone, the buyer’s bid price (Bid Price) is usually lower.

4. The Difference Between the Two: Understanding the "Spread"

Now you understand that at any time, the market has a bid price and an ask price, and the ask price is always higher than the bid price.So, what is the difference between these two prices?

This difference is what we have discussed in detail in previous articles as the "spread".

Spread = Ask Price - Bid Price

The spread is one of the main costs of trading, representing the fee you pay to complete a trade.

5. Practical Application: Which Price to Look at When Placing Orders?

Understanding the bid and ask prices is crucial for your actual order placement:- When you expect a currency pair to rise and decide to click the "Buy" button on the platform or set a buy order, your trade will be executed at the current "Ask Price".

- When you expect a currency pair to fall and decide to click the "Sell" button on the platform or set a sell order, your trade will be executed at the current "Bid Price".

Please remember:

- Buying is executed at the higher Ask price.

- Selling is executed at the lower Bid price.

This also explains why your trade initially shows a slight loss—because the market price needs to move beyond the spread distance before you break even.

6. A Clear Example

Suppose you see the GBP/USD quote on the trading platform as follows:GBP/USD 1.2690 / 1.2691

Here:

- The number on the left side of the slash, 1.2690, is the Bid Price.

- The number on the right side of the slash, 1.2691, is the Ask Price.

Now:

- If you think GBP will rise and decide to buy GBP/USD, your execution price will be 1.2691.

- If you think GBP will fall and decide to sell GBP/USD, your execution price will be 1.2690.

Conclusion

Understanding the bid and ask prices in forex quotes is fundamental to trading.In summary:

- Bid (Sell Price): The price you receive when selling (lower price).

- Ask (Buy Price): The price you pay when buying (higher price).

Next time you prepare to place an order, make sure you are looking at the correct price.

Buy at Ask, Sell at Bid.

This seemingly simple detail is the first step to ensuring your trade execution meets your expectations.

It is recommended to observe the movement of these two prices and the changes in the spread on a demo platform.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

2 Responses

你都讲错了好吗,别祸害人

“您好,非常感谢您的留言与指教。您提出的这一点,确实是外汇交易中一个非常关键、也普遍存在疑问的地方。很高兴有机会能借此再和大家深入探讨一次。

首先,我想向您和所有读者再次澄清,文章中关于‘买入价 (Ask)’和‘卖出价 (Bid)’的解释是完全正确的,并且符合全球金融市场的标准定义和所有正规交易平台的实际操作。

之所以会对此产生疑问,通常是因为混淆了‘交易者’和‘市场提供者(例如券商)’这两者的视角。让我们用一个生活中的例子来彻底厘清:

想象您要去一家银行兑换外币:

当您要用本国货币‘买’外币时: 您要看的是银行的‘外币卖出价’ (Ask Price)。这个价格是银行‘要价(Ask)’多少才肯把外币卖给您。这个价格总是比较贵。

当您要把外币‘卖’回给银行时: 您要看的是银行的‘外币买入价’ (Bid Price)。这个价格是银行‘出价(Bid)’多少来向您收购外币。这个价格总是比较便宜。

外汇交易完全是同一个道理。您是客户(交易者),券商的角色如同那家银行:

您要买入 (Buy) GBP/USD: 您付出的价格是券商的‘卖出价’,也就是报价中较高的 Ask Price。

您要卖出 (Sell) GBP/USD: 您得到的价格是券商的‘买入价’,也就是报价中较低的 Bid Price。

这也解释了为何文章中的范例和附图都清晰地指出,点击‘Buy’会以较高价成交,点击‘Sell’会以较低价成交。这两者间的差距,就是交易成本‘点差 (Spread)’。

再次感谢您提出这个问题,这促使我们能更深入地探讨这个核心概念。最直接的验证方法,就是在任何券商的模拟账户中实际操作一次,便能立即印证这个市场运作的机制。

希望这个解释能帮助到您和有同样疑问的读者!祝您交易顺利!”