The "Helmsmen" of the Forex Market: Understanding Major Central Banks and Their Influence (Fed, ECB, BOJ, BOE)

You may often hear reports in financial news such as "Fed raises interest rates" or "ECB keeps rates unchanged," and notice that these announcements immediately cause significant volatility in the forex market.The key players behind these movements are the "central banks" of various countries.

They act like the "brain" and "heart" of a country's or region's monetary policy, responsible for managing the money supply, adjusting interest rates, and maintaining financial stability.

It can be said that central banks are the most influential participants in the forex market. Every decision they make, even every word they say, can change market expectations, triggering large fluctuations in exchange rates or even long-term trend shifts.

Therefore, understanding the roles of major central banks, the tools they use (especially interest rates), and why closely monitoring their actions is crucial for comprehending the forex market.

This article will briefly introduce the basic responsibilities of central banks and focus on the four major central banks with the greatest impact on the global forex market.

1. What Are the Main Responsibilities of Central Banks?

Although the specific responsibilities of central banks may vary slightly by country, their core objectives generally include:- Maintaining Price Stability: This is the primary task for most central banks. They need to control "inflation" (the rate at which prices rise), striving to keep it at a low and stable level (many developed countries set a target inflation rate around 2% annually).

- Promoting Full Employment: Especially for the U.S. Federal Reserve, which also aims to maximize employment, supporting economic growth and creating more job opportunities.

- Maintaining Financial Stability: Ensuring the healthy operation of the banking system and preventing systemic financial risks.

To achieve these goals, the primary tool central banks use is "Monetary Policy."

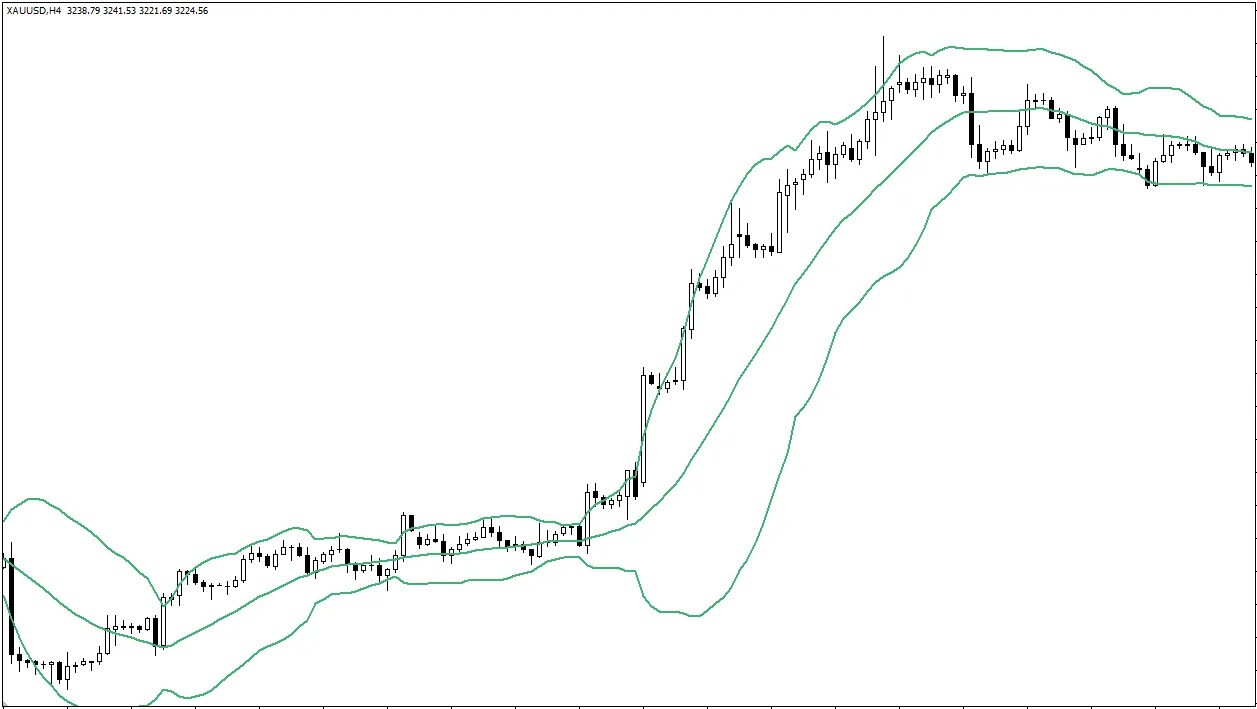

2. The Most Important Tool: Interest Rates

Central banks have many tools to implement monetary policy, but the most core and widely impactful is adjusting the "benchmark interest rate."What is the benchmark interest rate?

Simply put, it is a base interest rate set by the central bank that affects the cost for commercial banks to borrow from the central bank or the interest rates banks charge each other.

Changes in this benchmark rate ripple through the economy like waves, ultimately influencing various interest rates such as your savings rate and loan rates.

How do interest rates affect the economy and exchange rates?

- Raising Interest Rates (Hiking):

On the economy: Higher borrowing costs may suppress corporate investment and personal consumption, helping to cool an overheating economy and curb high inflation.

On exchange rates: Generally, higher interest rates attract international capital seeking better returns (e.g., higher interest on deposits), increasing demand for that country's currency and potentially causing it to appreciate (strengthen). - Lowering Interest Rates (Cutting):

On the economy: Lower borrowing costs may stimulate corporate investment and personal consumption, helping to boost a sluggish economy.

On exchange rates: Generally, lower interest rates reduce the currency's attractiveness to international investors, potentially leading to capital outflows and depreciation (weakening).

Other Tools (Conceptual Understanding):

Besides interest rates, central banks sometimes use "Quantitative Easing" (QE) —printing money to buy assets like government bonds to inject liquidity into the market—or the reverse operation "Quantitative Tightening" (QT) to withdraw liquidity, especially when interest rates are already very low.

3. Understanding the Four Major Central Banks and Their Currencies

For forex traders, the following four central banks must be closely monitored because their currencies (USD, EUR, JPY, GBP) constitute the main trading pairs in the forex market:- Federal Reserve System (Fed) - US Dollar (USD):

The central bank of the United States. Due to the dollar's core role in global trade and finance, the Fed's policy moves have the greatest impact on global markets. The body responsible for setting interest rates is the Federal Open Market Committee (FOMC). - European Central Bank (ECB) - Euro (EUR):

Responsible for monetary policy in the Eurozone (countries using the euro). Its decisions affect the entire Eurozone economy and the euro exchange rate. - Bank of Japan (BOJ) - Japanese Yen (JPY):

Japan's central bank, known for long-term implementation of ultra-low or even negative interest rate policies and large-scale asset purchase programs. The yen is often considered a safe-haven currency. - Bank of England (BOE) - British Pound (GBP):

The central bank of the United Kingdom. Its policies mainly influence the UK economy and the pound exchange rate.

4. Why Should You Closely Monitor Central Banks?

Traders pay close attention to central banks because their actions and statements often signal future interest rate directions, thereby affecting exchange rates:- Interest Rate Decision Announcements: Central banks hold regular monetary policy meetings and announce whether they adjust benchmark interest rates. This is the focal point of the market.

- Monetary Policy Statements: Accompanying interest rate decisions, these statements explain the reasons behind the decisions and reveal the central bank's views on the current economy and future inflation.

- Press Conferences and Official Speeches: The central bank governor's press conferences after meetings, as well as speeches by other officials on various occasions, are carefully analyzed by the market to find clues about future policy directions. These hints about future policy intentions are called "Forward Guidance."

- Expectation Management is Key: Often, market reactions to central bank decisions depend not only on the decisions themselves but also on whether they meet prior market expectations. If decisions align with expectations, market reactions may be muted; but unexpected moves (such as surprise rate hikes or cuts, or a shift in the tone of policy statements) often trigger sharp market volatility. The central bank's forward guidance often carries more weight than current actions.

5. How Should Beginners Handle Central Bank Events?

- Mark the Economic Calendar: Always know the dates of major central bank meetings (especially Fed, ECB, BOJ, BOE), the timing of policy statement releases, and governor press conferences.

- Understand Market Consensus: Before major central bank events, learn from financial news what analysts generally expect the central bank to decide or signal.

- Be Highly Cautious of Volatility Risks: The periods before and after central bank decisions are when market volatility is highest, spreads are widest, and slippage risk is greatest. If you are a beginner, it is strongly recommended to avoid trading during these times and not to try to "bet" on the direction.

- Focus on "Surprises" and "Tone Changes": After events, pay close attention to differences between actual results and expectations, as well as changes in the tone of central bank statements or governor speeches (whether more "hawkish" favoring future rate hikes or more "dovish" favoring future cuts). These are often key drivers of subsequent market reactions.

- Use for Judging Macro Background: Understanding the current monetary policy stance of major central banks (whether in a tightening or easing cycle) and possible future paths can help you form a fundamental bias toward related currencies, providing directional reference for your medium- to long-term trades.

Conclusion

Central banks are heavyweight players in the forex market. They influence the economy through monetary policy (especially interest rate adjustments), which in turn has profound effects on exchange rates.For forex traders, understanding the responsibilities of major central banks (such as the Fed, ECB, BOJ, BOE), paying attention to their interest rate decisions, monetary policy statements, and forward guidance is essential.

Although central bank events may present trading opportunities, the extremely high volatility and uncertainty involved pose significant risks for beginners.

It is recommended that beginners use central bank developments to understand the macro market background and grasp fundamental directions, utilize the Economic Calendar to avoid risky periods, rather than treating these events as direct short-term trading signals.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.