Forex Long-Term Trading (Position Trading) Analysis: Focusing on Long-Term Trends, Testing Patience and Vision

After introducing ultra-short-term scalping, intraday trading, and swing trading that holds positions for several days, we now arrive at the other end of the trading style time spectrum: "Long-Term Trading" or also known as "Position Trading".Traders with this style have a very long-term perspective, holding a trading position for weeks, months, or even years.

Long-term trading is conceptually closer to traditional "investment" rather than short-term "trading".

It does not care about daily or even weekly market noise fluctuations but focuses on capturing long-term major trends driven by changes in macroeconomic and political landscapes.

This requires extraordinary patience and deep insight.

This article will introduce you to the characteristics, methods, advantages and disadvantages of long-term trading, and whether it is suitable for beginners entering the forex market.

1. What is Long-Term Trading / Position Trading?

Long-term trading (position trading) is a trading style aimed at profiting from major market trends lasting several weeks, months, or even years.Long-term traders try to identify and capture very long-term price directions driven by deep economic fundamentals or structural changes.

Core concept: Ignore all short-term market fluctuations (considered "noise") and focus on judging and following macro, long-term trends.

Analogy: It is somewhat like value investors buying a company's stock because they believe in the company's fundamental outlook over the next few years and then holding it long-term without caring about daily price fluctuations.

Long-term forex traders also hold currencies based on their judgment of a country's long-term economic prospects.

2. Typical Practices of Long-Term Traders

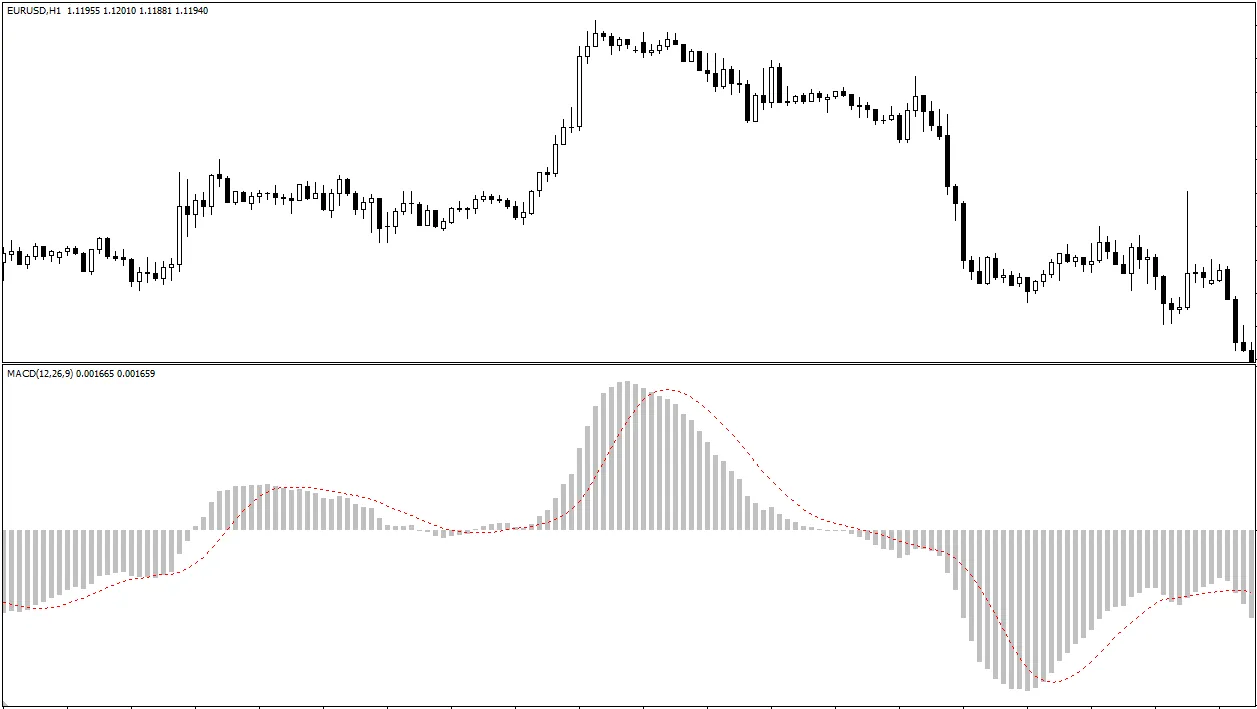

The operation methods of long-term traders are completely different from short-term traders:- Main timeframes analyzed: They almost exclusively focus on very long timeframe charts, mainly weekly charts (W1) and monthly charts (MN), used to identify and confirm major long-term trend directions and key historical support/resistance zones. Daily charts may occasionally be used for auxiliary observation.

- Main analysis methods:

- Fundamental analysis is the core: This is the absolute cornerstone of long-term trading. Traders need to deeply understand macroeconomic principles, central banks' monetary policy paths, long-term interest rate trends, international trade relations, political landscape evolution, national fiscal conditions, and other factors, and based on these analyses form a firm view on the long-term trend of a currency (bullish or bearish).

- Technical analysis for strategic timing: Technical analysis (mainly applied on weekly or monthly charts) is usually used to assist in finding more favorable, strategic entry and exit points within the context of a long-term trend. For example, in a fundamentally bullish long-term trend, waiting for price to pull back to important long-term support levels or key moving averages before buying.

- Position management:

- Very wide stop loss: Stop loss points (measured in pips) for long-term trading are usually set very far away to avoid being easily stopped out by medium- and short-term violent market fluctuations.

- Very small position size: To cope with very wide stop loss distances while ensuring the risk per trade remains within a controllable range (e.g., 1%-2% of total account capital), long-term traders usually use very small trading lots.

- Swap/overnight interest is an important consideration: Due to extremely long holding periods, the cumulative effect of swap/overnight interest becomes very significant. Traders must carefully calculate and consider whether the swap is positive (income) or negative (cost), as this directly affects the final total return of the trade.

3. Advantages of Long-Term Trading

- Lower daily stress: No need to monitor the market every day or react quickly to short-term fluctuations, resulting in relatively lower daily psychological pressure.

- Potential to capture major trends: If successfully capturing a major long-term trend, the potential profit per trade (measured in pips) can be very large.

- Less daily time commitment: Once a position is established and risk controls are set, the daily time needed for analysis and management is much less than short-term trading. Deep evaluations may only be needed weekly or even monthly.

- Minimal impact of trading costs: Trading frequency is very low, so spread and commissions have almost negligible impact on overall results. Swap becomes the main ongoing cost (or income) factor.

4. Challenges and Risks of Long-Term Trading

- Requires extreme patience and discipline: This is the biggest challenge. Being able to hold positions for months or even years, ignoring large drawdowns (unrealized losses) and various market noise along the way, requires extraordinary psychological quality and firm belief in one’s analysis.

- Requires strong macro analysis ability: Success largely depends on the ability to accurately judge complex global macroeconomic and political factors, which requires long-term learning and accumulation.

- May require higher initial capital: Although the risk per trade can be controlled very low, very wide stop loss points mean the account needs sufficient capital to withstand large potential price fluctuations to avoid margin calls. Meanwhile, capital will be tied up for a long time.

- Misses all medium- and short-term opportunities: This style completely ignores trading opportunities that may exist in the medium and short term.

- Long-term impact of swap: If the swap on the trade direction is negative, the long-term accumulation can be a very considerable cost, potentially eroding most of the profits.

5. Is Long-Term Trading Suitable for Beginners?

Main obstacles: For the vast majority of forex beginners, the challenges of long-term trading are huge: lack of in-depth fundamental analysis knowledge, difficulty in possessing the required extreme patience and psychological endurance, and possible capital thresholds.Long learning cycle: Because the trading cycle is very long, beginners find it hard to get frequent market feedback to quickly learn and adjust. A single trade may take months to conclude.

Recommendation: Generally, long-term trading is not recommended as the main trading style for forex beginners. Beginners usually need to familiarize themselves with the market, practice skills, build confidence, and receive timely learning feedback through shorter trading cycles (but not as extreme as scalping).

Medium-term styles like swing trading may be a more suitable starting point.

Of course, learning long-term fundamental analysis knowledge benefits all traders, but making it the core trading method usually requires more experience and accumulation.

Conclusion

Long-term trading (position trading) is a trading style focused on the next several months or even years, aiming to capture major market trends driven by macro fundamental factors.Its main characteristics are extremely long holding periods, reliance on in-depth fundamental analysis, and requiring great patience and strict risk (position) control.

Although long-term trading may bring lower daily stress and the potential to capture major trends, it demands very high analytical ability, psychological quality, and capital management, with a long learning feedback cycle.

Therefore, for beginners just entering the forex market, it is usually not the ideal entry method.

It is recommended that beginners start exploring with more manageable and learnable medium- to short-term trading styles.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.