What forex trading software, hardware, and other tools will you use?

Successful forex trading requires not only effective strategies and discipline but also suitable software, hardware, and auxiliary tools to assist you in market analysis, order placement, and risk management. Using the right tools can enhance your trading efficiency and help you better manage risks to achieve stable profit targets. So, what forex trading tools are essential? In this article, we will explore some common and effective forex trading software and hardware to help you choose the most suitable equipment.1. Trading Software

Choosing the right trading software is the first step for forex traders. Trading software is the core tool for market analysis, order placement, and fund management, so selecting a stable, feature-rich, and user-friendly trading platform is crucial.a. MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

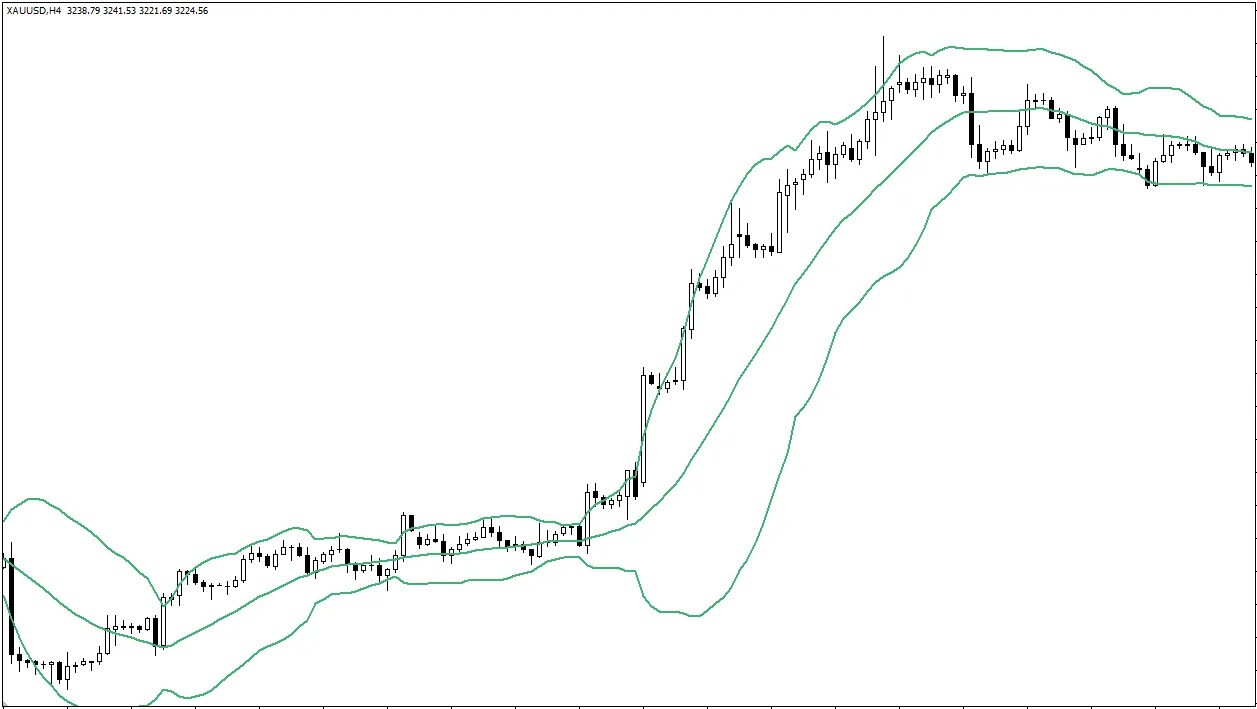

MetaTrader 4 and MetaTrader 5 are the most popular forex trading platforms worldwide. MT4 and MT5 offer a wealth of technical indicators, charting tools, and automated trading features, allowing traders to flexibly formulate strategies. MT5 provides more timeframes and technical analysis tools compared to MT4, making it an ideal choice for professional traders.Advantages:

- Rich technical indicators and charting tools

- Supports automated trading (EA programs)

- Offers demo accounts for practice

b. TradingView

TradingView is a cloud-based chart analysis tool with a large number of technical indicators and community features. It is suitable for users who wish to conduct detailed chart analysis and interact with other traders. TradingView can connect with multiple brokers' trading platforms for convenient operation.Advantages:

- Sleek interface, easy to use

- Provides community analysis and trader interaction

- Multi-platform data synchronization, suitable for cross-platform operations

c. cTrader

cTrader is another professional forex trading platform that offers more transparent order execution and finer trading tools compared to MT4 and MT5. It is particularly attractive to traders who value market depth and price transparency.Advantages:

- Transparent market depth

- Precise order execution

- Supports multiple order types

2. Hardware Equipment

Having stable and efficient hardware is crucial for forex trading. Your hardware should be able to process data quickly and support multitasking to avoid missing trading opportunities due to equipment issues.a. Powerful Computer or Laptop

Choosing a well-performing computer or laptop is the foundation of trading. Your equipment should have a fast processor, large memory, and stable internet connection. Here are some hardware recommendations:- Processor: At least a quad-core processor (such as Intel i5 or above) to ensure smooth operation of trading software and multitasking.

- Memory (RAM): At least 8GB of memory, with 16GB recommended for smooth performance during chart analysis and automated trading.

- Solid State Drive (SSD): An SSD can significantly improve system read speeds and reduce operational delays.

b. Multi-Monitor Setup

Using multiple monitors can help you view multiple market charts, news information, and trading platforms simultaneously. This is very helpful for technical analysis and market observation.- Main Monitor: Used for viewing primary market charts and technical analysis.

- Secondary Monitor: Used for checking economic news, real-time information, and trading platforms.

c. Stable Internet Connection

Forex trading requires a stable and fast internet connection. Ensure that your internet service provider can provide a stable connection to avoid delays or interruptions when placing orders or executing trades.- Backup Internet: Consider preparing a mobile network hotspot as a backup to avoid missing trading opportunities due to network failures.

- Fiber Optic Internet: Using fiber optic internet can provide faster and more stable connections, making it the preferred choice for forex traders.

3. Auxiliary Analysis Tools

a. Economic Calendar

The Economic Calendar is an essential tool for traders to understand important economic events and data release times. For example, websites like Investing.com and Forex Factory provide detailed Economic Calendars to help you prepare for risk management and strategy adjustments in advance.b. Trading Journal

Recording the details and insights of each trade helps you reflect on the trading process and find ways to optimize strategies. You can use spreadsheet tools like Excel or specialized trading journal software like Edgewonk to manage your trading records.Conclusion

The success of forex trading depends not only on strategies but also on the right tools and equipment. Choosing stable trading software, powerful hardware configurations, and auxiliary tools can greatly enhance your trading efficiency and performance. Based on your needs and trading style, find the tools that suit you and progress steadily in the market.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.