Introduction to Forex Trend Following Strategy: Dance with the Market Mainstream and Make the Trend Your Friend?

In forex trading, you may often hear the saying: “The trend is your friend.”This phrase precisely highlights the core idea of the "Trend Following Strategy".

Unlike trying to predict market turning points or catching breakout moments, trend followers believe that once the market forms a clear direction (trend), trading along this direction has a higher probability of success.

This strategy aims to join an already established trend and hold positions, expecting the trend to continue and thus profit.

It is a very classic and widely applied trading method.

So, how to identify a trend? When should you enter during a trend? What are the advantages and disadvantages of trend following? Is it suitable for beginners?

This article will analyze these questions one by one.

1. What is Trend Following Strategy?

Trend following strategy is a trading method that aims to profit by identifying an already established market trend (uptrend or downtrend) and building trading positions in the direction of that trend.Core Belief: Market price movements are usually not random but tend to form trends.

Once a trend (whether upward or downward) is confirmed, it is more likely to continue moving in the original direction than to immediately reverse.

Goal: Trend followers do not attempt to predict market tops or bottoms.

Their goal is to capture the main part of the trend (usually the most obvious middle section of the move), entering after the trend is confirmed and exiting when clear signs of trend termination appear.

2. How to Identify a Trend?

Before applying a trend following strategy, you must first determine whether a trend currently exists in the market and what its direction is.Common methods include:

- Observing Price Structure (Basic Definition):

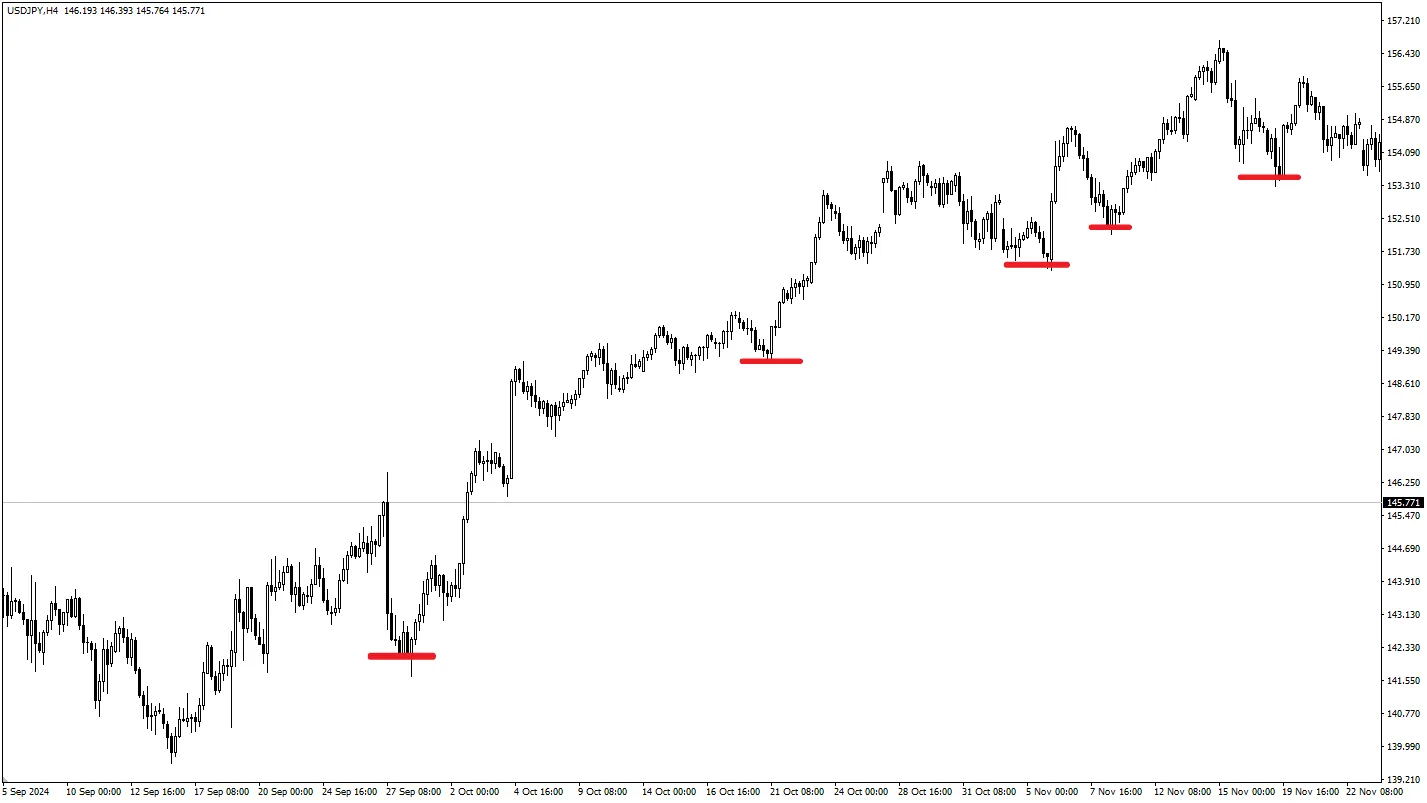

- Uptrend: A series of higher highs (HH) and higher lows (HL) appear on the chart. Overall price movement slopes from the lower left to the upper right.

- Downtrend: A series of lower highs (LH) and lower lows (LL) appear on the chart. Overall price movement slopes from the upper left to the lower right.

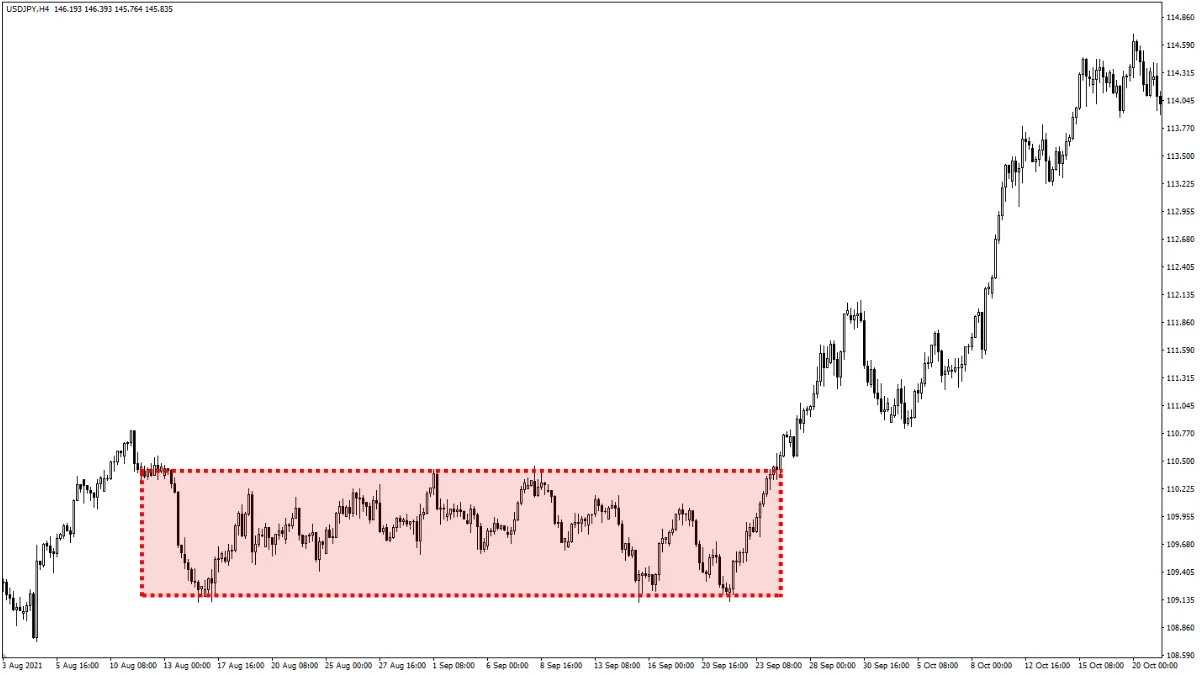

- Sideways / Range: Price fluctuates back and forth within a relatively fixed horizontal range, without forming sustained new highs or new lows.

- Using Auxiliary Tools (Technical Analysis):

- Trend Lines: Connect important lows in an uptrend or important highs in a downtrend to draw trend lines. If price continues to run above the trend line (uptrend) or below the trend line (downtrend), the trend is considered to continue.

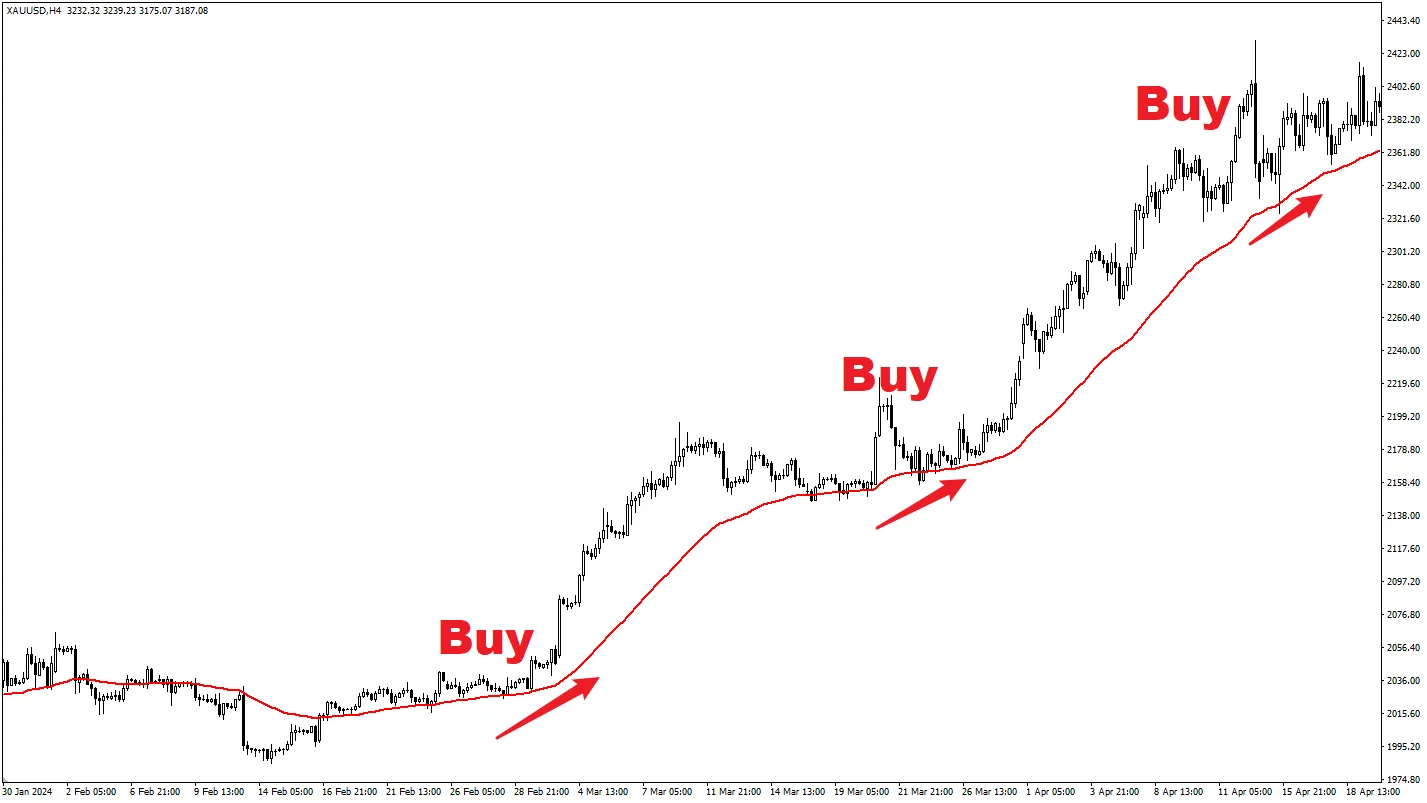

- Moving Averages (MA): Observe the relative position of price to moving averages. For example, if price continuously runs above an upward sloping moving average, it is usually considered a signal of an uptrend.

3. Entry Timing for Trend Followers: Looking for "Pullbacks"

This is a key point of the trend following strategy.Experienced trend followers usually do not chase buys when price makes new highs or chase sells when price makes new lows, because this easily results in buying at (temporary) tops or selling at (temporary) bottoms, which carries higher risk.

They prefer to wait for a short-term counter-trend adjustment within the main trend—called a "Pullback" or "Retracement" —and then enter when the pullback seems to end and price is ready to resume the main trend.

- In an Uptrend: Wait for price to temporarily pull back from a high to a support level, the uptrend line, or an important moving average. When signs of stabilization and readiness to move up again appear, buy the dip.

- In a Downtrend: Wait for price to temporarily rebound from a low to a resistance level, the downtrend line, or an important moving average. When signs of resistance and readiness to move down again appear, sell the rally.

The purpose of this approach is to enter at a relatively more favorable price and to set stop-loss points closer (compared to chasing highs or selling lows), thereby improving the risk-reward ratio.

4. Advantages of Trend Following

- Aligns with the Market’s Main Force: Trading along the trend direction is equivalent to standing on the market’s most probable direction, statistically increasing the chance of success.

- Potential to Capture Big Moves: If you can successfully catch a strong and lasting trend, profits can be substantial.

- Relatively Clear Trading Logic: The core logic of "Identify Trend - Wait for Pullback - Enter with the Trend" is relatively easy to understand and master.

5. Challenges and Risks of Trend Following

- Difficult to Determine When a Trend Ends: This is the biggest challenge of trend following. Every trend eventually ends. Distinguishing between a normal pullback and the start of a true trend reversal is very difficult. This may cause traders to exit too early and miss subsequent profits or exit too late and suffer large profit retracements or losses.

- Performs Poorly in Sideways or Choppy Markets: When the market lacks a clear direction and fluctuates back and forth (called sideways or choppy market), trend following strategies often generate false signals, resulting in consecutive small losses (being "whipsawed"). Long periods of choppy markets are very challenging for trend followers.

- Requires Patience to Wait for Entry Signals: Waiting for ideal pullback opportunities requires patience and discipline; the market will not always provide perfect entry points.

- Psychological Challenges: Holding positions through price pullbacks (unrealized losses) requires strong confidence. Seeing the trend reverse shortly after entry can also be frustrating.

6. Is Trend Following Strategy Suitable for Beginners?

Potential Advantages: The core logic is relatively intuitive, and the idea of "following the crowd" is easier to accept.Compared to trying to predict market turning points, following confirmed trends may feel "safer."

Especially on longer timeframes (such as daily charts), trends tend to be clearer.

Challenges for Beginners: Accurately identifying the start and end of trends, judging the validity of pullbacks, maintaining confidence during pullbacks, and distinguishing trending markets from choppy markets all require a lot of practice and experience.

Recommendations:

- Trend following strategy is a very classic method and is often recommended as a starting point for beginners learning technical analysis.

- Beginners are advised to first learn how to identify clear trends on longer timeframes (such as Daily Chart D1 or 4-Hour Chart H4).

- Practice identifying pullback opportunities within trends on a Demo Account (e.g., pullbacks to key support/resistance levels or moving averages).

- Most importantly, strict risk management must be combined! No matter how strong the trend looks, set reasonable stop-loss orders for each trade (e.g., slightly beyond the pullback low/high) and control the maximum risk per trade through position sizing (lot size).

- Also recognize the limitations of this strategy and learn to identify signs that the market may enter a sideways consolidation.

Conclusion

The core of the Trend Following Strategy is to identify the main market direction (trend) and follow it, looking for entry opportunities during short-term pullbacks, aiming to capture the main part of the trend.Its philosophy is "The trend is your friend."

The advantage of this strategy is aligning with the market’s most probable direction, offering the chance for substantial profits; the disadvantage is the difficulty in perfectly timing the start and end of trends and poor performance in sideways markets.

For beginners, trend following is a good learning starting point, but the prerequisite is to learn to clearly identify trends, patiently wait for pullbacks, and always implement strict risk management.

Understanding its applicable conditions and limitations is key to successfully applying the trend following strategy.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.