Introduction: Why do 99% of Brokers claim to be "Regulated"?

Open the official website of any unregulated trading platform, scroll to the bottom, and you will inevitably see the phrase: "Regulated by...".However, in today's market, the real value of the word "Regulated" varies immensely.

Some regulations mean your funds are stored in a bank vault with government guarantees; others mean the company simply paid a few thousand dollars for a registration certificate, and your money could vanish at any moment.

This article serves as the master guide for the "Mr.Forex Regulation Series." We have categorized dozens of global regulatory bodies into three tiers to help you establish a correct screening logic, ensuring your funds enter a "Safe" rather than a "Black Box."

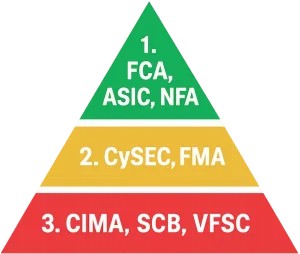

The Forex Regulation Pyramid: An Overview of the Three-Tier System

In the Forex margin trading industry, we use a pyramid structure to distinguish the safety and value of licenses:

Tier 1: Top-Tier Regulation

This is the highest standard of global financial safety.- Representative Bodies: UK (FCA), USA (NFA/CFTC), Australia (ASIC), Japan (FSA).

- Features: Mandatory segregation of funds, typically offers investor compensation schemes, extremely strict leverage limits (usually 1:30), and very high compliance costs.

- Target Audience: Large-capital investors who prioritize "Principal Safety" over "High Returns."

Tier 2: Mainstream Regulation

This is a pass for entering specific regional markets (such as Continental Europe).- Representative Bodies: Cyprus (CySEC), New Zealand (FMA).

- Features: Offers a degree of fund protection and compliance requirements, but compensation caps or enforcement strength may be slightly lower than Tier 1.

Tier 3: Offshore Regulation

This is the hub for high-leverage traders.- Representative Bodies: Bahamas (SCB), Cayman Islands (CIMA), Bermuda (BMA), Vanuatu (VFSC).

- Features: Loose regulatory environment. Allows extremely high leverage (1:500 or higher) and fast account opening, but typically lacks government-level compensation mechanisms.

Tier 1 Analysis: The Big Four Global Regulators

If you have substantial capital, or if you are approaching this with an "Asset Allocation" mindset, you must look for these four "Golden Licenses." Although their specific rules vary, they all represent the highest standard of fund safety.1. United Kingdom (FCA) — The King of Retail Forex

Status: The most respected regulator globally, featuring the most powerful FSCS compensation scheme (£85,000).Who is it for? The vast majority of international investors seeking safety.

2. Australia (ASIC) — The Fortress of Asia-Pacific

Status: Formerly a high-leverage paradise, now transformed into an extremely strict, protection-focused regulator.Who is it for? Primarily protects Australian residents. International clients are usually redirected to its offshore subsidiaries.

3. USA (NFA / CFTC) — The Toughest Gate in the World

Status: Highest capital threshold ($20 million regulatory capital), extremely low leverage (1:50).Who is it for: Strictly for US citizens or Green Card holders; foreigners can almost never open accounts.

4. Japan (JFSA) — The Closed Eastern Giant

Status: Extremely protective of domestic Japanese investors, with perfected fund segregation and trust preservation mechanisms.Who is it for: Services Japanese residents only.

Should You Refuse Being Assigned to an "Offshore Region"?

This is the most common confusion encountered by international investors: "I opened an account with a renowned international broker, but the contract shows the regulation is in an offshore region (e.g., Bahamas, Cayman, or Seychelles). Have I been scammed?"The Mr.Forex Truth:

This is not necessarily a scam; it is an industry "Norm."

Since Tier 1 regulators (like FCA, ASIC) mandate a leverage cap of 1:30, a trader's buying power is significantly reduced for the same amount of capital. To meet retail clients' demand for High Leverage (1:400, 1:500), brokers typically guide global international clients to their "Offshore Regulated" subsidiaries.

How Should You Choose?

Look primarily at the strongest license held by the "Parent Company." If the group's parent company holds a full FCA or ASIC license, the safety of its offshore subsidiary is generally acceptable.

But to be honest, for traders seeking extreme leverage (1:500+), the protective power of regulation is often overshadowed by "Trading Risk." Under high leverage models, the probability of hitting a Stop Out due to market volatility is far higher than the probability of the platform going bankrupt. Therefore, for such traders, choosing offshore regulation is essentially a risk exchange: "Trading Fund Safety for Trading Flexibility."

However, if your capital is substantial, please insist on opening an account under Tier 1 regulation. Even if the leverage is lower, do not gamble with your principal.

The Golden Rule of Offshore Regulation: "Single Holding" vs. "Group Strategy"

This is the core watershed for distinguishing "High-Risk Platforms" from "Legitimate Major Brokers."When you see a broker showing regulation in Tier 3 or offshore regions (e.g., Bahamas, St. Vincent, Vanuatu, Seychelles), be sure to check against the following scenarios:

Scenario A: Single Offshore License (High Risk Warning) 🚩

If the broker "only" holds this one offshore license and has no registration records in major global financial hubs (UK, Australia, USA).- Verdict: This is a typical "Orphan Platform."

- Risk: Due to the lack of audit pressure from top-tier regulators, you have no recourse if they abscond or if disputes arise.

- Action: Stay away immediately. No matter how polished their website looks, fund safety cannot be guaranteed.

- Typical Case: Many scam platforms love to use "St. Vincent (SVG FSA)" as their sole shield, but in reality, that body does not regulate Forex trading.

Scenario B: Group Multi-Regulation (Acceptable Strategy) ✅

If the broker is an international financial group where the parent company holds a Tier 1 license (like FCA or ASIC), but uses its offshore subsidiary to sign with you to service international clients/provide high leverage.- Verdict: This is a common industry "Group Strategy."

- Risk: Although your contract is with the offshore subsidiary, to maintain the group's global reputation and share price (if listed), the parent company usually enforces the same internal risk control standards across subsidiaries.

- Action: This is a considerable option. Suitable for mature traders seeking high leverage and flexibility.

Conclusion: Compliance Costs Make the Strong Stronger

Compared to a few years ago, the global regulatory environment has become incredibly strict. The operational compliance costs for brokers are suffocatingly high. This is actually a good thing, as small platforms with insufficient strength are naturally weeded out.As for scams, the methods haven't become smarter; only the packaging has changed. As long as you possess the correct "Regulatory Tier Concept" and master the "Website Verification Method" we teach, scammers won't stand a chance.

Summary Advice:

- Large Capital Users: Choose Tier 1 (FCA / ASIC) directly.

- High Leverage Users: You may choose an offshore subsidiary under a "Group Strategy" (Parent company holds a top-tier license).

- "Single" Offshore License: Close the webpage immediately. The risk is too high.

Now that you have mastered the regulatory map, if you want to dive deeper into how the strictest FCA regulation protects your funds, please click the link below.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.