Let AI Work for You, Start Your Passive Income

Mr.Forex automatic copy trading lets you avoid painstakingly studying candlestick charts and constantly monitoring the market. Simply replicate expert strategies and easily participate in the global market.- Capital security and transparency (Funds are in your personal account)

- Top Trading Team (Years of Practical Trading Experience)

- Diverse Investment Portfolio (Covering Multiple Risk Profiles)

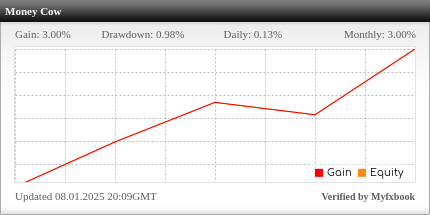

Money Cow

Want to test the waters first? Use the minimum capital to experience the joy of AI automatically generating profits for you!

min. deposit $1,000 USD | Risk Profile: Aggressive (suitable for small capital trials)

min. deposit $1,000 USD | Risk Profile: Aggressive (suitable for small capital trials)

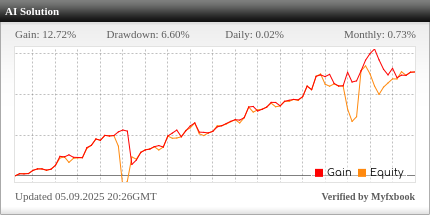

AI Solution

The core choice for most people! Achieve the perfect balance between risk and reward, allowing your assets to grow steadily.

min. deposit $2,000 USD | Risk Profile: Balanced (Main asset allocation)

min. deposit $2,000 USD | Risk Profile: Balanced (Main asset allocation)

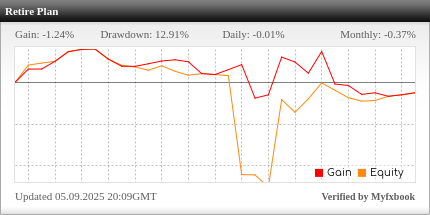

Retire Plan

Pursue ultimate peace of mind! Aim for minimal volatility and let time compound to build a stable future for you.

min. deposit 10,000 USD | Risk Profile: Conservative (Top choice for large capital)

min. deposit 10,000 USD | Risk Profile: Conservative (Top choice for large capital)

Don't know how to start?

For the first time, it is recommended to choose 【Money Cow】 to experience profit with the least amount of funds. After becoming familiar with it, use 【AI Solution】 to balance and increase your investment. Finally, let 【Retire Plan】 do long-term and steady planning for you.Want to know how much your assets will grow in 10 years?

Investment Growth Calculator

Estimate the growth of your assets under the effect of compound interest, based on an initial investment plus regular monthly additions.

| Year | Total Principal (USD) | Cumulative Profit (USD) | End-of-Year Value (USD) |

|---|

How to Start Copy Trading?

- Confirm the Supported Platforms for Signals: Check which platforms the signals you want to copy can be executed on.

- Register and Open a Trading Account: Go to the official website of the corresponding platform, register as a member, and complete identity verification and account opening.

- Search for Strategy Name: Follow the instructional guide to go to the copy trading community on the platform and search for "Strategy Name."

- Start Copy Trading: Click on the signal, select the copy amount and risk ratio, and you can activate automatic trading.

Friendly Reminder: The names of each signal, platforms, and copy trading methods may vary slightly, please refer to the detailed instructional explanations on each signal page.

Choose Your Copy Trading Platform

Frequently Asked Questions (FAQ)

1. What is Copy Trading?

Answer: Copy Trading is an investment method where your account automatically replicates our trading decisions without manual operation.2. How much capital do I need to start copy trading?

Answer: Each Mr.Forex trading signal has a different recommended minimum capital. Please refer to the "min. deposit" indicated on each signal page. You can also adjust according to your own financial situation.Reminder: Having too little capital may result in a higher risk ratio during copy trading compared to the original signal source, increasing trading risk.

3. Can I stop copy trading at any time?

Answer: Yes, you can adjust or stop copy trading anytime on the copy trading platform, and your funds are fully under your control.4. Will my funds be managed by Mr.Forex?

Answer: No. Your funds are 100% under your own control. Our role is to "send trading signals," and your account automatically copies these signals through the copy trading system. Your money always remains in your personal broker account under your name. Mr.Forex has no right or ability to access or use your principal. You can pause or stop copying at any time, retaining full ultimate control over your funds.How to Choose the Trading Signal That Suits You?

We offer a variety of trading signals with different risk profiles, ranging from conservative, balanced to aggressive strategies, helping you select according to your personal risk preference.Copy Trading Allocation Recommendations

We recommend allocating your main capital to conservative or balanced strategies to pursue stable growth; at the same time, consider allocating a small portion to aggressive strategies to seek potentially higher returns. Flexible allocation is key to achieving an ideal balance between risk and reward.We believe there is no universal formula for trading. Choosing a strategy that fits your risk tolerance is the key to stable market participation.

Risk Management: How to Set Up a "Safety Airbag" to Protect Your Capital?

You can flexibly set an appropriate stop-loss percentage according to your investment style and risk tolerance.Think of it as a car's "safety airbag" that protects your principal in the worst-case scenario.

Conservative Strategy: Recommended Stop-Loss Setting > 30%

The "drawdown" of this strategy, which is the temporary decline of the account, is usually between 15%-20%.Allowing more than 30% space is to avoid triggering your "safety airbag" due to normal market fluctuations, preventing you from missing subsequent opportunities.

Moderate Strategy: Recommended Stop-Loss Setting > 50%

The "drawdown" of this strategy is approximately between 25%-35%.A larger stop-loss buffer is to provide the strategy with enough "cushion" to cope with intense market volatility.

Aggressive Strategy: Stop-Loss Not Recommended

High-Risk Transparency:

This type of strategy has higher volatility and may experience drawdowns of 50% or more. Setting a stop-loss may interfere with its trading logic.In the worst case, the capital you invest in this strategy may be completely lost.

- Please treat this as a "high-risk speculative" position rather than an "investment" position, and regularly withdraw profits.

- If you cannot accept this risk, please do not choose this strategy.

Contact Us (Online Customer Service)

We understand that taking the first step always requires the most courage. Whether you encounter difficulties opening an account, feel confused about strategy selection, or just want someone to talk to, you are always welcome to contact our online customer service. The Mr.Forex team not only provides signals but also hopes to become your reliable partner on your investment journey.- If you are interested in a business collaboration, please contact our customer service email. We will provide comprehensive information and further discuss the details of the cooperation with you.