Fundamental Impact of Historical Price Data on Backtesting Simulation

In the practice of algorithmic trading, performing backtesting is an indispensable step.Among all backtesting elements, the quality of historical price records plays a decisive role. This is because any Automated Trading System (EA) or trading strategy’s buy and sell decisions are entirely triggered based on historical price information.

If inaccurate price data is used during the backtesting process, regardless of whether the simulation results show profit or loss, the conclusions may lack real reference value, thus rendering the entire backtesting exercise meaningless.

Therefore, before starting backtesting, the primary task is to prepare "high-quality historical price data." Only then can we truly rely on backtesting results to evaluate the effectiveness of a strategy.

How to Obtain Built-in Historical Data in the MT4 Platform

MetaTrader 4’s backtesting function supports three different price data precision modes for running simulations, which are:- Open price only

- Using control points

- Based on every real-time price tick

In the early stages of strategy development, to quickly overview the strategy’s performance, the faster "control points" mode can be selected.

However, after finalizing strategy parameters, the most accurate "every tick" mode should be used for a detailed backtest to confirm all trading details.

As for the "open price" option, due to its overly coarse data and very low accuracy, it is almost worthless as a reference and is rarely used.

Regardless of which mode is chosen for backtesting, corresponding historical data records must be available first. In the MT4 backtesting process, to obtain broker-provided internal historical price data, you need to download it from the platform’s toolbar.

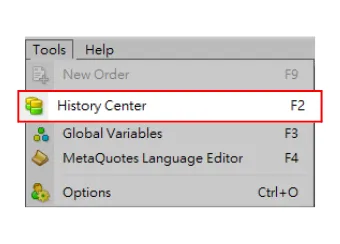

Operation path: Tools > History Center

Detailed Download Steps

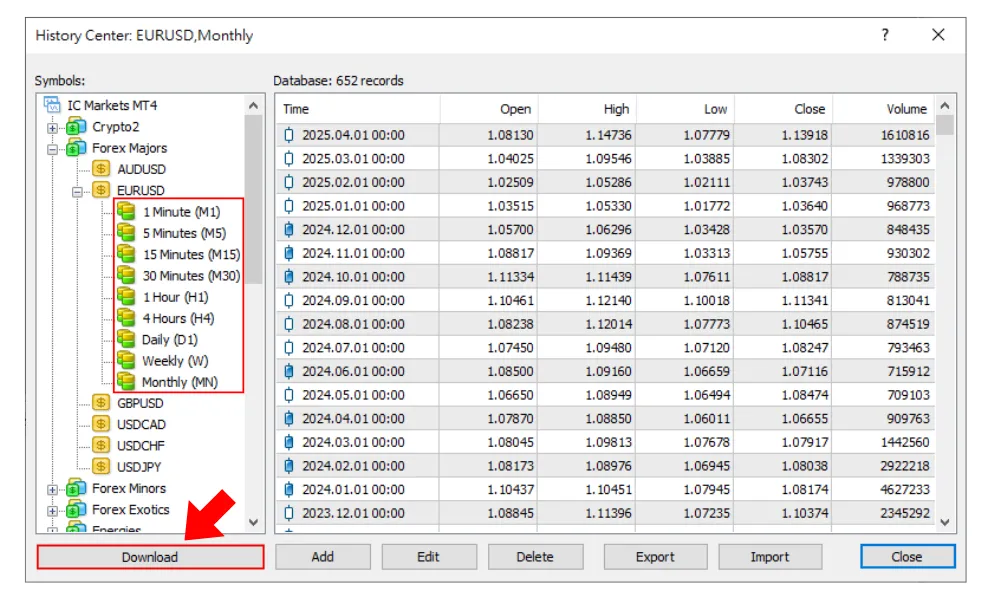

After entering the "History Center," you will see a list of all trading instruments provided by the broker.

In the History Center window, find the instrument you intend to backtest, double-click the instrument name, and the system will expand to show all available timeframes (such as M1, M5, H1, D1, etc.).

Next, you need to double-click each desired timeframe one by one, then click the "Download" button at the bottom of the interface, and patiently wait for the download progress bar to complete.

Confirmation and Recommendations After Data Download

When the data for a certain timeframe is successfully imported, its corresponding icon will turn "green."It is recommended to download data for every timeframe to ensure a more complete overall historical price record.

After downloading the required historical price data for all target backtest instruments, you can start the backtesting operation.

However, it should be noted that directly using broker-provided historical data may carry the "risk of incompleteness." Some brokers’ data records may be relatively complete, but others may be quite sparse or of poor quality.

The reason is that brokers’ main responsibility is to provide trade execution services, not to specialize in storing and maintaining historical data.

Therefore, to significantly improve backtesting accuracy, many traders choose to use data provided by specialized "third-party companies" that offer historical data services.

Ways to Obtain High-Quality 99.9% Tick Precision Historical Data for MT4

In the market, the commonly used professional software for obtaining high-precision forex historical price data mainly includes:- Tickstory

- Tick Data Suite

Compared to Tick Data Suite, Tickstory has some inconveniences in use. For example, it usually requires downloading historical data as separate CSV files first, then manually importing them one by one into the corresponding MT4 instruments.

Additionally, a single instrument’s historical data file can be very large, and handling multiple instruments’ data will occupy a large amount of local hard disk space.

In view of this, if you are an active MT4 algorithmic trading user, the author tends to recommend using Tick Data Suite.

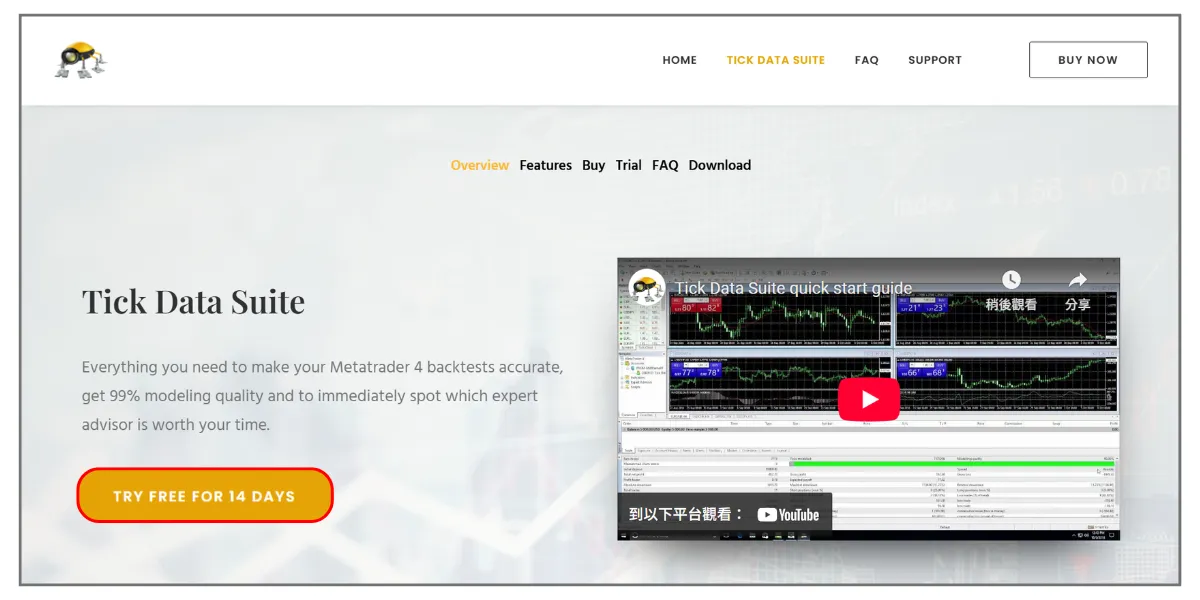

Introduction to Tick Data Suite (TDS)

Tick Data Suite (abbreviated as TDS) is not a free tool, but if you plan to deeply develop MT4 EA algorithmic trading, the author highly recommends investing in purchasing and using it.You can start by trying the trial version of Tick Data Suite, which usually has a "14-day" trial period.

Go to the official website of Tick Data Suite (https://eareview.net/tick-data-suite), click the "TRY FREE FOR 14 DAYS" link, fill in your email address, and they will send you a trial license code.

Then, click the "Download" page to download the latest version of the TDS software.

After downloading, follow the standard installation process, clicking "Next" until the installation is complete.

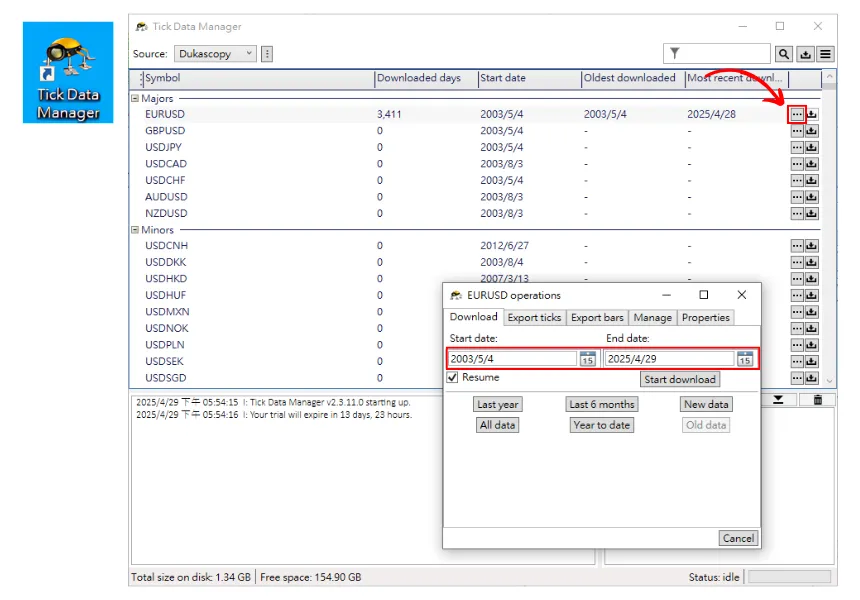

Tick Data Manager After Installation

After installation, an application icon named "Tick Data Manager" (with a logo of a small bug) will appear on your desktop.After launching the program, you need to download the historical price data for the target instrument. The operation interface is roughly as shown in the picture.

For the first download, it is recommended to click the settings button behind (the three dots circled in red in the picture) to set the "start and end date range" for the data you want to download.

TDS Download Settings and Technical Advantages

Pre-setting the date range here is a good habit; you can choose to start from 2008 or 2010.If you do not make a selection and directly click the download button (the arrow icon behind), the system will default to downloading from 2003.

However, market data that is too old has relatively low reference value for current backtesting and usually does not need to be downloaded that far back.

TDS reportedly uses some kind of mirroring technology during data download (the author has not deeply researched the specific technical details). The significant benefit to users is that it does not excessively occupy your computer’s hard disk space when downloading and using data, eliminating the need to download and save huge raw data files.

Moreover, TDS updated its download technology in 2022, making the current download speed extremely fast, with a huge efficiency improvement compared to versions from several years ago.

Integration of TDS with MT4 Backtesting Interface

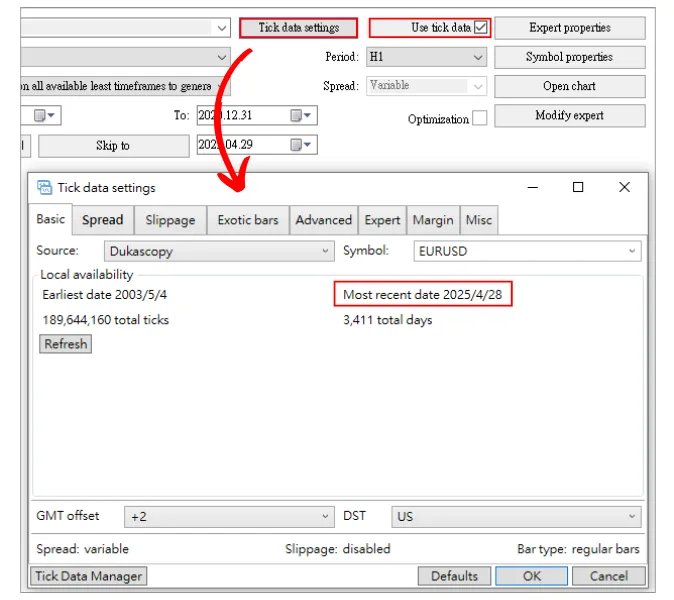

After data is downloaded through Tick Data Manager, return to the MT4 Strategy Tester interface, where you will notice two new option boxes in the upper right corner:One is "Use tick data," which must be checked to ensure your backtest calls the high-quality historical data provided by TDS;

The other is "Tick data settings," which opens an advanced settings window mainly used to confirm that TDS has successfully read your latest downloaded price data.

Advanced Backtesting Settings of TDS

Inside the "Tick data settings" window, you can also perform more detailed configurations, such as setting the server’s GMT timezone, simulating floating spread, and slippage.These rich features partially compensate for MT4’s native backtesting limitation of only using fixed spread.

The author personally usually does not specifically set floating spread and slippage when backtesting long-term strategies because long-term strategies are less sensitive to these two factors.

However, if you trade short-term strategies, the impact of floating spread and slippage will be very significant. Enabling these two features in TDS for backtesting will yield simulation results closer to real trading environments.

Achieving High-Quality Backtesting Using TDS

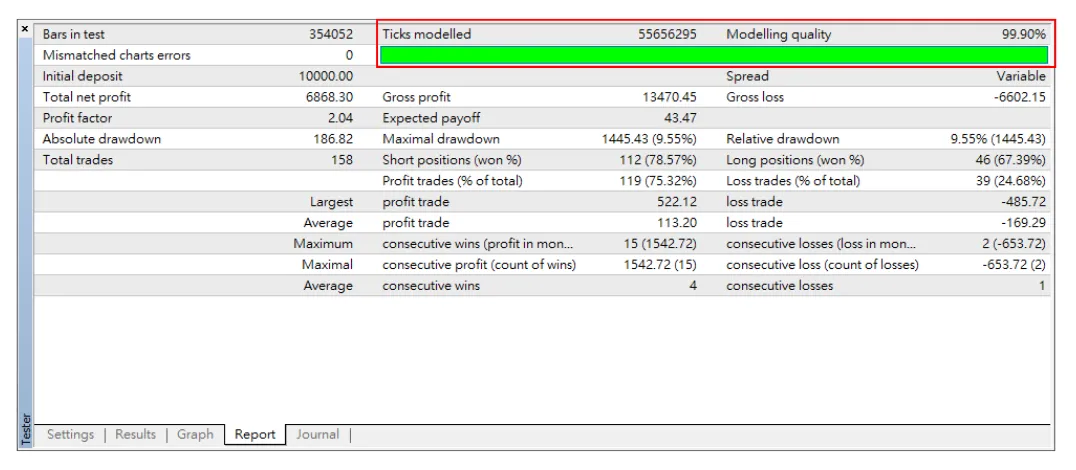

After enabling TDS, MT4 can easily perform backtests with model quality up to 99.9% tick precision.Only backtest reports generated based on such high-quality data have high reference value and can more realistically reflect the historical performance of strategies.

Tick Data Suite Payment Plans

Tick Data Suite offers three payment plans to choose from:- Annual subscription

- Monthly subscription

- Lifetime license

Later, when you confirm long-term continuous use of EA trading, you can consider switching to the lifetime plan.

Notes on Using TDS License Codes

After successful purchase, Tick Data Suite will also send the license code (key) to you via email.One important point to note: a license code can only be activated and used on one computer at the same time.

Although you can change the computer used, after each change, the license code will be locked to the current computer for 14 days.

In other words, if you enter and activate the license code on one computer, and then want to switch to another computer, you need to wait at least 14 days.

Summary of MT4 Historical Price Data Preparation

In summary, if you are a beginner just starting with EA and only want to preliminarily understand and experience backtesting, then directly downloading and using the free historical price data provided internally by brokers can meet basic needs.However, if your goal is to actually use EA for trading, obtaining a set of historical price data that can produce backtesting results with reliable reference value becomes crucial.

Although TDS requires a paid purchase, the author believes the benefits it brings far outweigh its cost:

- Saves computer space

- Convenient and fast downloads

- Direct compatibility with MT4 interface

- No need for manual import, etc.

It can be said that for an algorithmic trader using the MT4 platform, TDS is an essential tool.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

2 Responses

Great article, exactly what I was looking for.

Thx