How to Backtest in MT4?

You might want to try an Expert Advisor (EA) but worry about losing real money? There is a good solution to this concern: Backtesting.What is MT4 Backtesting?

Simply put, backtesting uses historical market data to simulate running your EA strategy to see whether it would have made a profit or loss if used at that time. It’s like giving your EA strategy a "historical simulation test," helping you understand the potential effectiveness and risks of the strategy before investing real money. MetaTrader 4 (MT4) platform has a built-in tool called the "Strategy Tester" that can help you perform backtesting.How to Perform Backtesting in MT4?

-

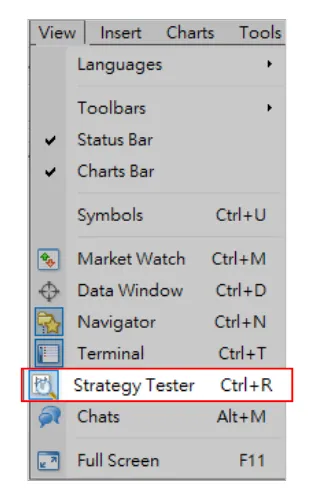

Open the Expert Advisor Testing:

- In the MT4 platform menu bar, click "View".

- Select "Strategy Tester".

- Or press the keyboard shortcut

Ctrl + R. - This will open the testing panel at the bottom of the window.

-

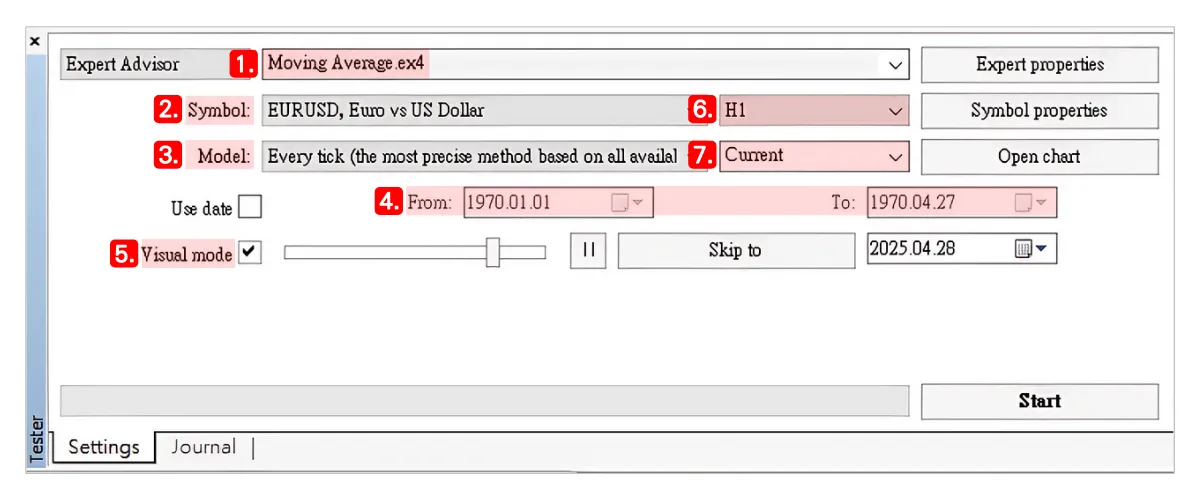

Basic Settings (under the "Settings" tab):

- Select EA: Choose the EA name you want to test from the dropdown menu.

- Select Symbol: For example, EURUSD.

- Select Model:

- Every tick: Highest accuracy but most time-consuming.

- Control points: Faster testing with moderate accuracy.

- Open prices only: Fastest speed but lower accuracy.

- Set Testing Period: Check "Use Date" and select the historical data range.

- Visual Mode: Check this if you want to observe trading actions on the chart, but testing will be slower.

- Timeframe: Choose like H1 (1-hour chart), etc.

- Spread Setting: Choose "Current" or manually input a fixed spread.

-

Set EA Parameters:

- Click the "Expert Properties" button to open the parameter settings window.

- Testing Tab: Set the initial capital amount and currency, e.g.,

10000 USD. - Trade Direction: Choose to trade long only, short only, or both.

- Input Parameters: Adjust strategy-related parameters such as lot size, stop loss, etc.

- Optimization Feature: Can be skipped; suitable for advanced users.

-

Start Testing:

- After confirming all settings are correct, click "Start".

- MT4 will start the strategy test based on your settings; the time required depends on the historical period and model.

-

View Results:

- Results: Displays detailed information of all simulated trades.

- Equity Curve: Shows the capital change curve for intuitive observation of strategy performance.

- Report: Statistics on total return, drawdown, profit/loss ratio, etc., which can be saved as a report file.

Backtesting Tips for Beginners:

- Results are for reference only: Backtesting reflects past conditions; future market trends are unpredictable.

- Data quality is important: Using high-quality historical data improves testing accuracy.

- Avoid over-optimization: Deliberately adjusting parameters to fit past data may cause distorted live performance.

- Demo Account Testing: After backtesting, be sure to run the strategy on a Demo Account to verify its performance in real-time markets.

Backtesting is a very useful tool for evaluating EA strategies, especially for beginners who fear losing money at the start. Through MT4’s Expert Advisor testing, you can gain more confidence in understanding an EA’s potential performance and risks.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.