Is Your Trading Strategy Profitable? 3 Key Steps to Optimize Trading via Myfxbook

In the previous article "Myfxbook Beginner's Guide," we completed account verification, and you may have already accumulated some trading data. Looking at the numbers jumping on the dashboard, you might ask: "So what? Can these numbers help me make more money?"The answer is yes.

Many traders stare at charts and draw lines every day, but rarely "look back" at their own data. However, the real trading edge is often hidden in your past trading records.

Myfxbook is not just a ledger; it is a powerful "Strategy X-ray Machine." This article will take you past those fancy charts to interpret the most core data directly. Through a real case study, we will teach you how to use data to catch "discipline loopholes" that even you haven't noticed.

💡 Pro Tip: Analyzing with the English Interface

To ensure the precision of data terminology (and avoid machine translation errors within the Myfxbook website itself), the screenshots in this tutorial will strictly use the Myfxbook English interface. We recommend that you also switch your language setting to "English" to learn the internationally common trading terms.Level 1 Analysis: Dashboard Quick Scan, Judging Account Health in 30 Seconds

Before digging deep into the data, let's take a glance at the Info / Stats field in the upper left corner of the dashboard. There are two numbers here that allow you to quickly judge whether this account (or an account shown to you by others) is honest.1. Gain vs. Abs. Gain

You will often see these two numbers are different. Why?Gain: Affected by your "Deposits." If you are losing money in trading but expand your principal by constantly depositing funds, this number might be beautified.

Abs. Gain (Absolute Gain): This is the true profitability. It excludes the impact of deposits and purely calculates "how much money was made using the original money."

Expert Judgment: If you see an account with a very high Gain but a very low (or even negative) Abs. Gain, be careful. This is usually an illusion created by "constant deposits."

2. Drawdown

This shows the "maximum drawdown that has occurred in history" for that account.- If this number exceeds 30%, it represents that the strategy carries high risk.

- If it exceeds 50%, it means the strategy has historically lost half its value, and there is a possibility of blowing up the account in the future.

Don't just look at the green Gain! Abs. Gain reflects true profitability, while Drawdown reveals hidden risks.

Don't just look at the green Gain! Abs. Gain reflects true profitability, while Drawdown reveals hidden risks.

Level 2 Analysis: Why "Expectancy" is the Holy Grail of Trading?

Novices look at "Win Rate," while veterans look at "Expectancy." You may have heard this saying, but do you really understand its mathematical meaning? Let's break this concept down into a mathematical formula, and you will find that "Win Rate" often lies.The Myth of Win Rate

We often hear people showing off: "My strategy has a win rate of 90%!" This sounds amazing, but what if he only makes $1 every time he wins, but loses $20 when he loses?This is the trap of "Win Rate." To judge whether a strategy is profitable, we must introduce a core formula.

What is "Expectancy"?

Expectancy tells you: "In the long run, how much money do you earn (or lose) on average for every trade you place?"Its formula is very simple:

Expectancy = ( Win Rate x Average Win ) - ( Loss Rate x Average Loss )

Let's calculate this using two extreme examples:

Case A: The High Win Rate Novice (90% Win Rate)

- Win Rate: 90% (0.9)

- Average Win: $10

- Average Loss: $100 (Loss Rate 10%)

- Calculation: (0.9 x 10) - (0.1 x 100) = 9 - 10 = -1

Conclusion: Although he wins 9 out of 10 times, his expectancy is Negative (-1). This means the more he trades, the faster he goes bankrupt.

Case B: The Low Win Rate Veteran (40% Win Rate)

- Win Rate: 40% (0.4)

- Average Win: $30

- Average Loss: $10 (Loss Rate 60%)

- Calculation: (0.4 x 30) - (0.6 x 10) = 12 - 6 = +6

Conclusion: Although he loses more times than he wins, his expectancy is Positive (+6). In the long run, he earns $6 on average for every trade placed. This is a profitable strategy.

Summary: Stop obsessing over increasing your win rate from 50% to 80%. As long as your Reward to Risk Ratio is controlled properly, you can still make big money with a low win rate.

Diagnosing Your Account: The 3 Most Important Health Check Metrics on Myfxbook

After understanding the formula, let's move our gaze to the Advanced Statistics area below the main chart, and ensure you stay on the default Trades tab.Here, you can find three key indicators closely related to expectancy:

1. Profit Factor

- Definition: Total Gross Profit ÷ Total Gross Loss.

- Interpretation: This is the quickest indicator to judge if a strategy is making money.

- Greater than 1.0: Passing. It represents that you are profitable (positive expectancy).

- Greater than 1.5: Excellent. It represents that your strategy is quite robust.

- Less than 1.0: Warning. It represents that your income does not cover your expenses. You need to stop trading immediately and review your strategy.

2. Win Rate (Profitability)

- Pro Tip: On the Myfxbook interface, Profitability refers to "Win Rate."

- Interpretation: This is an important variable when calculating your expectancy.

3. Average Win vs. Average Loss

- Definition: How much money you make on average per winning trade—i.e., Average Win, and how much money you lose on average per losing trade—i.e., Average Loss.

- Interpretation: This directly reflects your "Actual Reward to Risk Ratio."

Special Note: Although an extremely high win rate (e.g., above 80%) can offset a poorer reward-to-risk ratio, swing trading is usually difficult to maintain at an ultra-high win rate (normally around 40%-60%). If you position yourself as a swing trader but find that the absolute value of Average Loss is larger than Average Win, this usually means you are "closing positions too early" or "holding onto losses," causing expectancy to turn negative. There is a major problem with your execution.

In the "Advanced Statistics" area below the main chart, you can find these key health check data points. Please note that "Profitability" on the interface represents the Win Rate.

In the "Advanced Statistics" area below the main chart, you can find these key health check data points. Please note that "Profitability" on the interface represents the Win Rate.

Real Case Diagnosis: How Data Catch Your "Discipline Loopholes"?

Data doesn't lie; it can even reveal your psychological state. Let's look at a real diagnostic case, which might be a problem you are currently facing.Case Background

A trader planned a "Swing Trading" strategy.- Expected Plan: Catching big trends.

- Expected Data: Win rate might be lower (around 40%), but the reward-to-risk ratio needs to be high (around 1:3). That is, stop loss at 100 pips loss, but take profit only at 300 pips gain.

Data Diagnosis

After a period of time, we opened his Myfxbook to review:- Win Rate (Profitability): Unexpectedly high at 60% (higher than expected).

- Average Reward/Risk (Avg Win / Avg Loss): Only 1:1 or even lower.

- Result: Although the account was barely profitable, the Profit Factor was very low, and accumulation was difficult.

Root Cause Analysis: "Loss Aversion" in Human Nature

This is a very typical psychological trap that even experienced traders are not immune to. The data revealed a cruel truth: our execution is often distorted by fear.When the market trend is correct and the order starts to make money, traders often generate anxiety of "fear of giving back profits." This fear of "losing" is far greater than the desire to "gain more."

The Result is "Closing Positions Too Early":

The order that was originally planned to be closed after earning 300 pips was hurriedly pocketed after earning 80 pips because of the fear of a pullback. This led to a dangerous deformation: The win rate increased (because of the rush to realize profits), but the reward-to-risk ratio collapsed (the original high odds advantage vanished).Although the account was ultimately profitable, the data honestly pointed out this hidden danger: if this psychological hurdle is not overcome, in the long run, you will lose the mathematical advantage originally designed in the strategy.

Expert Solution

Myfxbook's data is loudly warning you: Your execution does not match your strategy.Although it is profitable currently, this state of "high win rate, low reward-to-risk ratio" is fragile. Once continuous choppy markets occur, your meager profits will not be enough to cover the losses.

Optimization Suggestion: This does not require changing the strategy, but rather changing the mindset. Please try to strictly execute your Take Profit (TP), or adopt a Trailing Stop, letting the profits run and allowing the data to return to the "high reward-to-risk ratio" model you originally planned.

Advanced Techniques: Using Data to Find Your Best Battlefield

Besides psychological quality, we can also perform physical optimization through Myfxbook's advanced statistical functions.1. Eliminate Losing Currency Pairs: Summary Analysis

Click on the Summary tab in the Advanced Statistics area.This page will list all the currency pairs (symbols) you have traded and detail the profit and loss status of each symbol. Often you will be surprised to find: "Oh my god, I thought I was good at trading EUR/USD, but the data shows that 80% of my losses come from it!"

Optimization Action: Simple and crude—directly stop trading that currency pair that loses you money.

Click on the "Summary" tab to see at a glance which currency pairs are making money and which are losing money.

Click on the "Summary" tab to see at a glance which currency pairs are making money and which are losing money.

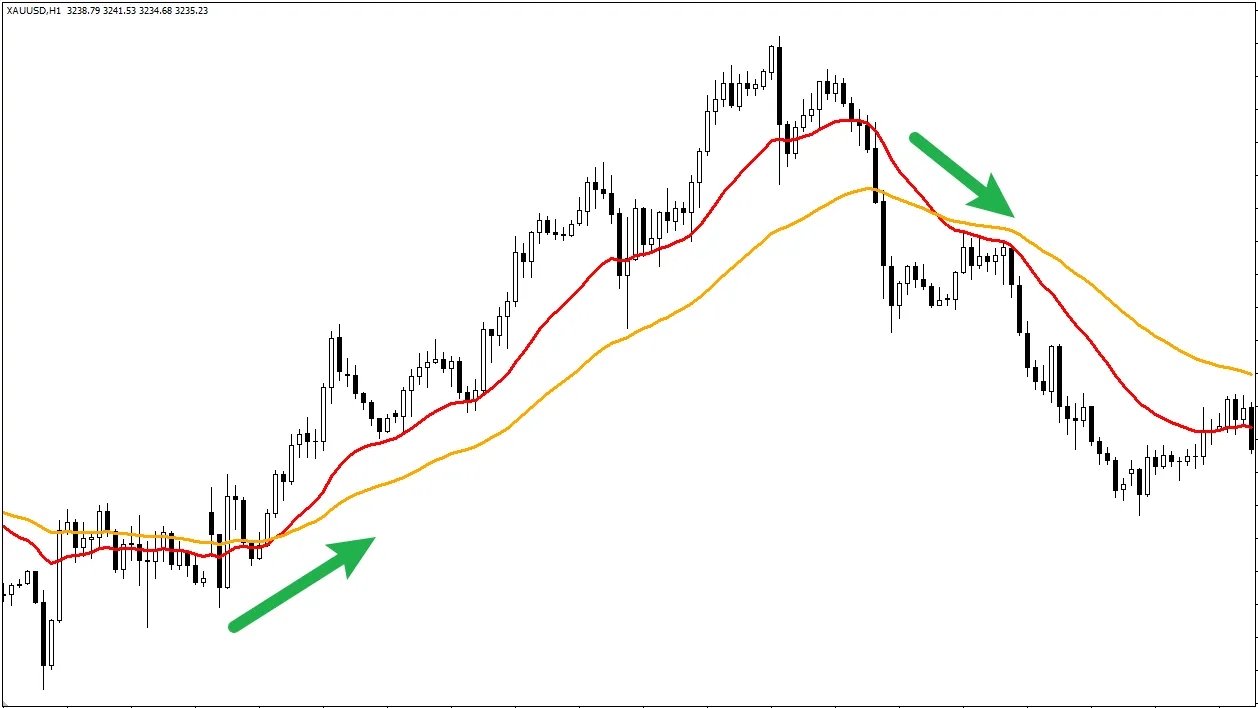

2. Adjust Trading Hours: Hourly Analysis

Some people are suitable for trading the US market open with high volatility, while others are suitable for the Asian session with lower volatility.Click on the Hourly tab (Note: This usually refers to the hour of the day). This page will typically use a chart to display your profit and loss situation at different times of the day.

Observe where your losses are mainly concentrated. If you find that you always lose money during GMT 00:00 - 08:00 (Asian session), it might mean that your strategy is not suitable for low volatility environments.

Optimization Action: Go to sleep during that time; do not place orders.

Click on the "Hourly" tab to analyze your trading performance at different times of the day and find the "Golden Trading Time" that suits you best.

Click on the "Hourly" tab to analyze your trading performance at different times of the day and find the "Golden Trading Time" that suits you best.

Conclusion: From "Feeling-Based" to "Data-Driven" Trader

The hardest part of trading is not technical analysis, but "being honest with yourself."Our brains use "selective memory" to beautify performance, making us mistakenly believe we are doing well. But Myfxbook's data is cold and objective.

Through this tutorial, you learned to calculate Expectancy, and you also learned how to diagnose the hidden psychological weakness of "closing positions too early" through Average Win / Loss.

Starting today, stop just looking at the increase or decrease in account balance. Regularly open Myfxbook, have a conversation with your data, and find room for optimization. This is the key watershed moment for evolving from "gambling on luck" to "professional trading."

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.