The Potential Risks Behind an Investment Profit

Today, I had a conversation with a long-time friend. He was very excited to share his recent success story in the stock market. He invested a considerable amount of his personal savings into a single stock he was very optimistic about. However, the market did not perform as expected, and the stock's price fell by 50%, causing its paper value to be cut in half.While most investors might have panicked and sold, he chose to hold on and continued to increase his investment at the low points. Fortunately, the market eventually rallied, and his stock's price recovered, even surpassing his original purchase price, turning his loss into a profit.

He concluded that he believes his success was mainly due to his own firm investment conviction, and that the element of luck was relatively small.

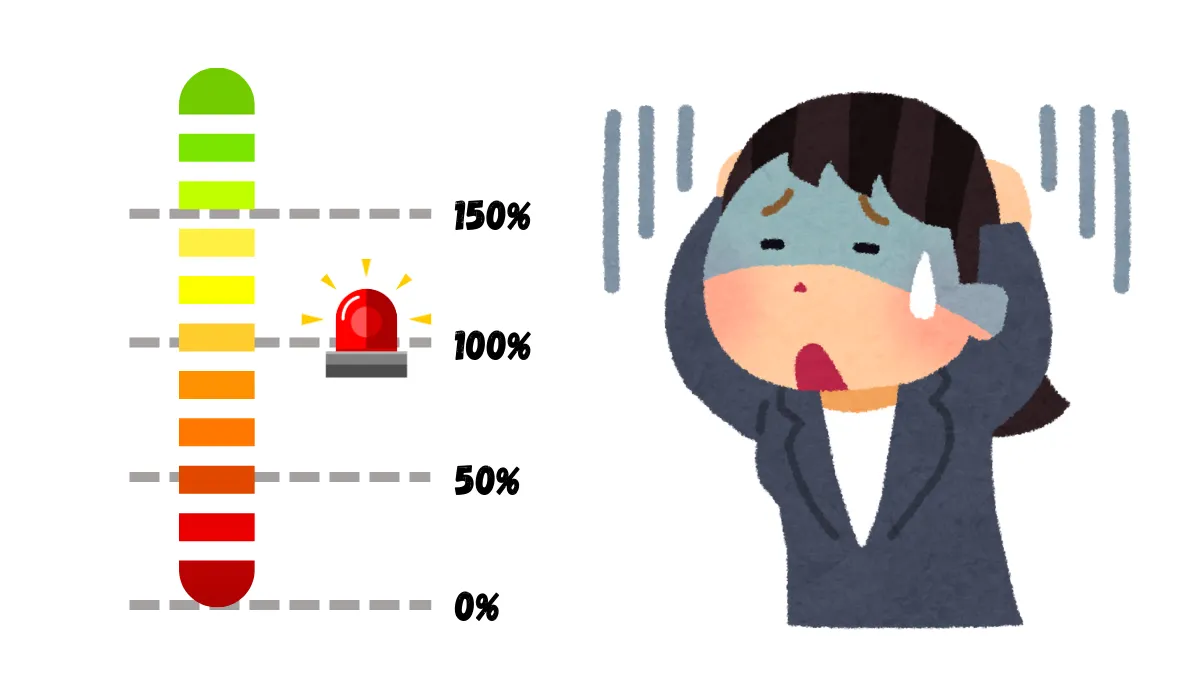

I was genuinely happy for his profit, but as a "financial practitioner," I was also deeply concerned about the process he took. From a professional risk assessment perspective, his method of operation violated multiple key principles that could lead to catastrophic losses.

Analyzing the Three Major Risks Behind This "Success Story"

On the surface, this is a success story of buying when others are fearful, but when analyzed from a risk management perspective, the process is fraught with serious potential dangers.- Extreme Concentration Risk: Investing almost all funds into a single asset is a high-risk behavior. No matter how confident an investor is in that asset, it is impossible to fully predict macroeconomic changes, industry policy adjustments, or internal company events. There are numerous real cases in the market of asset prices falling and never recovering. Once this happens, the investor will lose all their principal.

- The Risk of Averaging Down into a Downtrend: The strategy of "buying more as the price drops" to lower the average cost is essentially based on the assumption that "the asset price will eventually bounce back." For this strategy to succeed, two conditions must be met: the investor must have sufficient funds to withstand a continuous decline, and the asset's price must indeed recover in the end. If either of these conditions is not met, the result could be catastrophic.

- Incorrect Attribution of Cause: This is the most dangerous point. Because this high-risk behavior happened to have a positive outcome, my friend attributed the success to his "strong conviction" and "accurate judgment," while ignoring the significant element of luck involved. This cognitive bias has a specific name in psychology, known as "Survivorship Bias."

Understanding "Survivorship Bias": A Historical Case

During World War II, the Allied forces wanted to improve the durability of their bombers to reduce the chances of being shot down. To do this, they analyzed all the planes that successfully returned to base and found that the wings and tail sections had the most bullet holes, while the cockpit and engine areas had very few.The military's initial conclusion was: they should add more armor to the areas with the most bullet holes, the wings and tail.

However, a statistician named Abraham Wald proposed the exact opposite view. He argued that the areas that truly needed reinforcement were those with almost no bullet holes.

His logical insight was this: the entire sample of planes in the statistics were "survivors" that had successfully returned. The fact that the planes could still fly back even with numerous bullet holes in the wings and tail proved that damage to these parts was not fatal. Conversely, the planes that were hit in critical areas like the cockpit and engine had already crashed and never had the chance to return to base to be included in the statistics.

In the investment market, we mostly hear "lucky success" stories like my friend's. The experiences of those investors who used the same methods but ultimately suffered significant losses are often overlooked. This is the danger of "survivorship bias": it leads us to mistakenly view the characteristics of a few survivors as a universally applicable formula for success.

What Does This Mean for Your Investment Trading?

This behavior of "buying more as the price drops" is logically very similar to a well-known high-risk money management method in investment trading—the Martingale strategy.The so-called Martingale strategy is when, after a trade results in a loss, one re-enters with a doubled amount of funds, attempting to recoup all previous losses with just one win.

Whether it's stocks, cryptocurrencies, or forex, this strategy faces the same fundamental risk: if an extreme negative event occurs (an asset price continues to fall and never recovers, or the market experiences an extreme one-way trend), the account may be wiped out. My friend's success was only because he did not encounter such an extreme situation this time.

Redefining "Conservative Investing" and "Strong Mindset"

My friend believed his investment method was "conservative." This is a common misconception of the concept.- True "Conservative Investing": In professional terms, conservative investing is built on asset diversification and strict risk control. Its primary goal is the preservation of capital, not the pursuit of high returns. Investing all funds into a single high-volatility asset belongs to the highest risk category of "aggressive" investing.

- A True "Strong Mindset": A strong trading mindset is not about stubbornly holding a position as losses grow, but about having the discipline and courage to admit a decision may be wrong and execute a stop-loss according to a pre-determined plan. The latter requires overcoming more human weaknesses and is therefore more precious.

Conclusion: Distinguishing Between a "Good Outcome" and a "Good Decision"

Finally, it needs to be emphasized that I am not negating my friend's success; I am genuinely happy for the returns he received. However, we must clearly distinguish: a good outcome is not equivalent to a good decision-making process.His decision-making process involved extremely high risks, and the market just happened to provide him with a positive result. We cannot take such a low-probability lucky event as a replicable success story.

In the long journey of investing, we should learn from and emulate successful decision-making processes that are long-term, stable, and repeatable, rather than those survivor cases that came through extreme risks. Because in the next similar situation, luck may not be on our side.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.