What is Forex Margin? A Simple Guide for Beginners

Welcome to the world of Forex trading! If you're a newcomer, you might hear many unfamiliar terms, and "margin" is one of them.This word might sound a bit technical, but don't worry, it's simpler than you think.

This article will explain in the clearest and most direct way what Forex margin is and what role it plays in Forex trading.

After reading, you'll clear up your confusion about margin and take your first step in learning with more confidence.

1. The Essence of Margin: It's More Like a "Security Deposit"

Many people initially misunderstand margin as a transaction fee or an extra cost. That's not the case.You can think of Forex margin as a "security deposit" or "good faith deposit" that you're required to pay when renting something.

This money is a "good faith guarantee" that you need to deposit into your trading account to be able to open a trade.

Your broker temporarily holds this money mainly to ensure that you have sufficient funds in your account to cover potential trading losses.

The key point is: This money is still yours; it is not a fee that gets deducted.

When your trade is closed (assuming no losses have dipped into this fund), this occupied margin is released back into your account's usable balance.

2. How Margin Lets You "Use a Little to Win a Lot": Understanding Leverage

You might wonder, why is this "deposit" necessary?It's because transaction amounts in the Forex market are typically very large, and margin allows you to use a tool called "leverage".

Leverage is like a magnifier.

For example, if your broker offers 100:1 leverage, it means that to open a trade worth $10,000, you only need to put up 1/100 of that as margin, which is $100.

This $100 is your "Used Margin".

This is the most important role of margin: it allows you to control a much larger trading position with a relatively small amount of your own capital, giving ordinary people the opportunity to participate in the Forex market, which might otherwise require substantial funds.

3. Understanding Your Account Status: Key Margin Terms

When you start using a trading platform, you will see some data related to margin. It's important to understand them:- Used Margin: As mentioned earlier, this is the total amount of "deposit" required to maintain all your currently open positions (trades still in progress).

- Usable Margin (or Free Margin): This refers to the funds left in your account that are available for use after deducting the Used Margin. You can use this money to open new trades or to absorb floating losses from your current positions. The calculation is simple: Usable Margin = Equity - Used Margin.

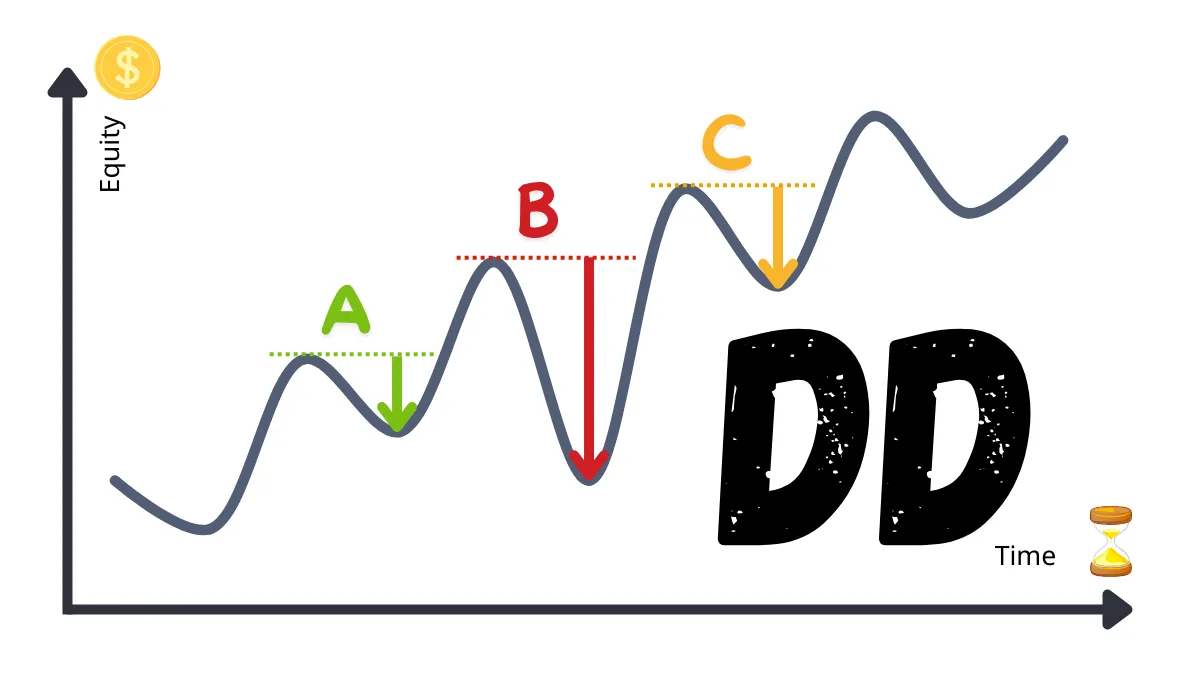

- Margin Level: This is a very critical percentage indicator, which you can think of as your account's "health index". It shows how many times your current equity (the total funds in your account, including unrealized profits and losses) covers your Used Margin. The formula is: Margin Level (%) = (Equity / Used Margin) x 100%. The higher this number, the safer your account is considered, and the stronger its ability to withstand market fluctuations.

4. Understanding the Risks: About Margin Calls

Many beginners are afraid of hearing the term "Margin Call".So, what happens if the market moves against you, causing your trades to lose money and your account equity to continuously drop?

When your "Margin Level" falls below a specific percentage set by your broker (e.g., 100% or 80%), you may receive a "Margin Call".

This is actually an important "alert", telling you: your account risk is too high, and the remaining Usable Margin is no longer sufficient to support your current losses and Used Margin.

If you receive this notice, it usually means you need to take immediate action:

- Deposit more funds into your account to increase your equity and Margin Level.

- Close some or all of your losing trades to reduce the Used Margin and free up funds.

This is called a "Stop Out".

Understanding margin calls is not meant to scare you, but to make you realize where the risks lie and why you need to manage them.

5. Practical Advice for Forex Beginners

Margin and leverage are features of Forex trading, but they are a double-edged sword.For beginners, the most important thing to understand is: while leverage magnifies potential profits, it equally magnifies potential losses.

Therefore, we strongly recommend:

- Use Leverage Cautiously: When starting out, be sure to use a lower leverage ratio. This means you will need to commit more margin, which, while limiting the size of the positions you can open, also reduces your risk exposure.

- Start with a Demo Account: Before trading with your real money, be sure to practice thoroughly with a "demo account". Familiarize yourself with the trading platform, observe how the Margin Level changes with market fluctuations, and learn to set "Stop-Loss orders" to proactively control the maximum loss on a single trade.

- Money Management: Only trade with money you can afford to lose.

- Understand Your Broker's Rules: The rules regarding margin calculation, margin call levels, and stop out levels may differ among brokers. Be sure to read and understand these rules carefully before opening an account and trading.

Conclusion

In summary, Forex margin is not a transaction fee but a "security deposit" required to use leverage and open a trading position.It is one of the fundamental mechanisms of how Forex trading works.

Understanding how margin works, learning to monitor your Margin Level, knowing the significance of a margin call, and always prioritizing risk management are essential steps for every Forex beginner on the path to sound trading.

We hope this simple explanation helps clarify the concept and gives you more confidence to continue learning about Forex.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.