Why You Need to Be a "Scanner" for the Martingale Strategy

In the world of automated trading, it's estimated that over 80% of Expert Advisors (EAs) incorporate the Martingale strategy in some form. It's like a ghost lurking behind all sorts of seemingly perfect performance reports. Therefore, learning how to identify it is not an advanced option, but a necessary survival skill. The purpose of this article is to provide you with all the tools you need, giving you a pair of "X-ray eyes" to see through the high-risk temptations of the market.The "Original Sin" of the Martingale Strategy — Its Mathematics vs. Reality

1. What is the "Classic Martingale"?

The name might sound academic, but its core logic comes from a very old and simple gambling strategy. We can understand it through a common "casino big or small" analogy:Imagine you are at a roulette table where you can only bet on "black" or "red," and the payout is 1:1.

- First Bet: You bet $10 on "red," but the result is "black." You lose $10.

- Second Bet: You double your bet to $20 and continue to bet on "red." The result is "black" again. You have now lost a total of $30.

- Third Bet: You double your bet again to $40 and continue to bet on "red." This time, luckily, it's "red"! You win $40.

Final Tally: You won $40 and lost $30, for a net profit of exactly $10—the amount of your first bet. This "theoretically foolproof" illusion is directly applied to trading: after a losing trade, the next trade is entered with double the position size, and this continues until a profit is made.

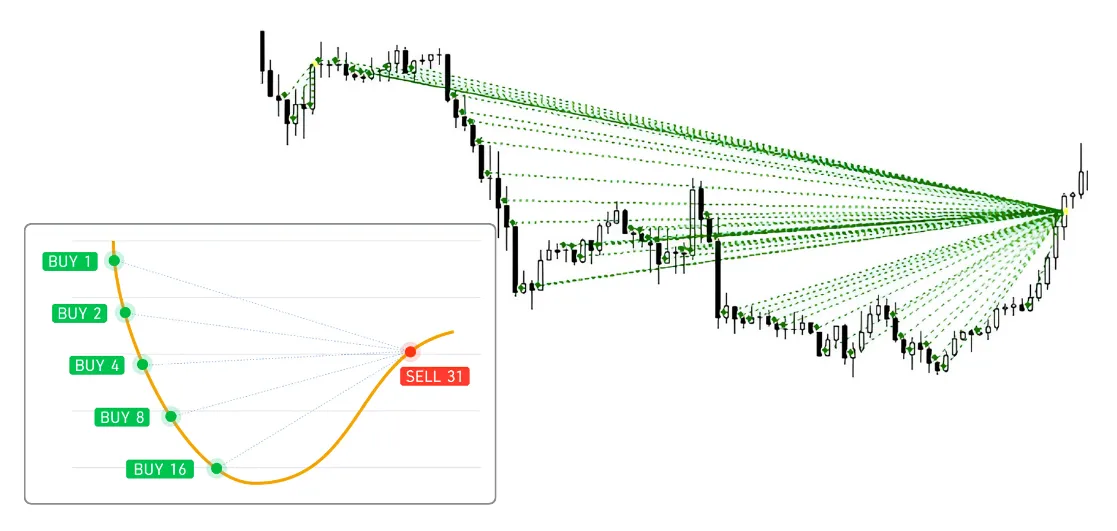

2. A Visual Guide to How Martingale Works

To help you understand this process more intuitively, the diagram below shows a typical Martingale process of continuously adding to a long position against a downtrend.

As the diagram shows, the strategy continuously opens new long positions with larger sizes after losses, attempting to lower the overall average entry price. As long as the market experiences a small rebound, all orders can be closed for a profit.

3. Ideal vs. Reality: Why is a Theoretical Holy Grail a Real-World Poison?

The classic Martingale theory is built on two fatal assumptions: unlimited capital and unlimited trading. But in real foreign exchange trading, several harsh "realities" completely shatter this theory:- The Mental Wall: When traders watch their position sizes double again and again, and their floating losses grow from tens of dollars to thousands or even tens of thousands, the immense fear and pressure will cause their mindset to collapse before their account does.

- The Opening Gambit Trap: Many users, in pursuit of high returns, set their initial position size too large. This means their account doesn't have enough room from the start to "survive" multiple consecutive losses.

- Trade Execution Friction: When positions become extremely large, severe slippage can cause the actual execution price to be far worse than expected, adding insult to injury.

- Broker's Hard Limits: Margin and leverage restrictions are the rules that end the game. When there is insufficient margin, the system will force a liquidation (margin call), and the game is over.

Many users tend to blame the broker after a margin call, without realizing that the problem was created by the strategy itself.

A Picture's Worth a Thousand Words — The Five Life Stages of a Martingale Curve

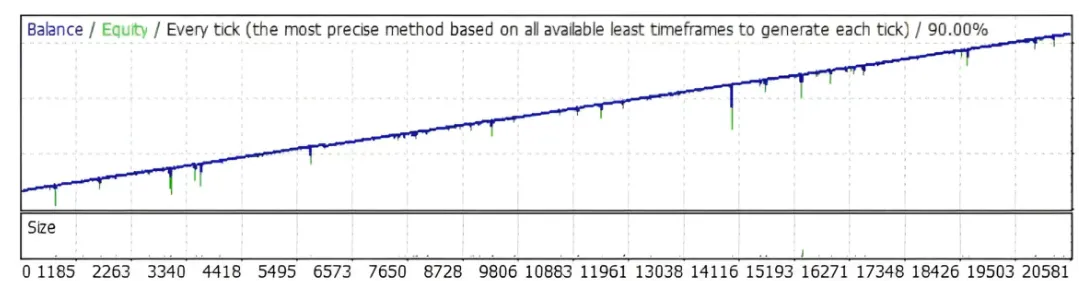

The most honest part of a performance report is the equity curve chart. By learning to read its story, you can avoid 90% of the traps. Let's use two real performance charts to break down the five life stages of a Martingale strategy, from "sweet temptation" to "final destruction."

Stage One: The Sweet Honeymoon Period

Chart Feature: In the early part of the chart above (approximately 0 to 5000 trades), the green equity line, which represents the real total assets, almost perfectly hugs the blue balance line, which represents realized profits, as it climbs steadily. This is the part that strategy sellers love to showcase.Stage Two: The First Divergence, a Warning Sign Appears

Chart Feature: The chart begins to show significant downward green spikes (e.g., around trade #6573). Every separation of the green equity line from the blue balance line represents the beginning of "holding onto a losing position against the trend." The larger the "scissor gap" between them, the more unrealized loss has accumulated.Stage Three: The Near-Death Experience and False Confidence

Chart Feature: In this chart, every green spike "luckily" bounces back to the blue line.Psychological Trap: This "close call" experience is the most dangerous poison for users. It doesn't make them wary of the risk; instead, it greatly reinforces the false belief that "it will always come back and make a profit."

Stage Four: The Deepening Canyon of Fear

Chart Feature: Pay special attention to the deepest, longest green canyon around trade #14116. Its depth far exceeds all previous drawdowns.Data Correspondence: This is where the "maximum drawdown" of 70%-90% reported in backtests occurs. At this moment, the account is just one step away from a margin call.

Stage Five: The Irreversible Final Collapse

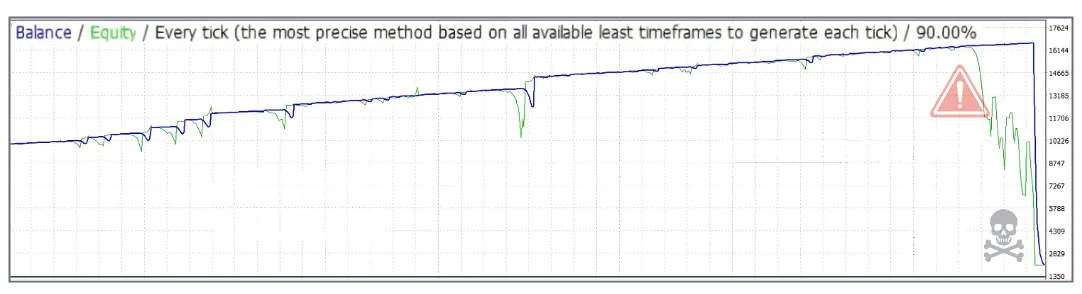

The first chart is a "survivor"; it luckily completed the backtest. However, when luck runs out, the fifth stage arrives. Look at the chart below, which documents the final outcome of a Martingale strategy account that "didn't make it."

Chart Feature: On the right side of the chart, the market enters a persistent one-sided trend. An unprecedentedly large "scissor gap" appears between the green equity line and the blue balance line (floating loss expands). Finally, the margin is depleted, and at the "Final Margin Call," the green equity line plummets vertically, dragging the perfect blue balance line down into the abyss with it, until it reaches zero.

The Final Outcome: This is the inevitable fate of the Martingale strategy. All the previous profits were merely a prelude to this final, devastating loss.

The More Hidden Killers — Common "Martingale Variations" in the Market

Most modern EAs use more complex variations to try to conceal the risks. Common ones include:- Anti-Martingale: Increase position size after a win, decrease after a loss. It's essentially a trend-following strategy but is vulnerable to ranging markets.

- Grid-Martingale: Combines grid trading by increasing the position size of grid orders in a Martingale fashion when moving against the trend, doubling the risk.

- Increased-Pip-Step Martingale: Gradually increases the distance between subsequent entries to try to "delay" a margin call, but it doesn't change the fundamental nature.

- Hedge-Martingale: Uses an opposing order to "lock" a loss, which seems safe. However, the subsequent "unlocking" process is extremely complex and often leads to even more chaotic losses.

No matter how clever the disguise, the performance reports of these variations will still reveal the common "Martingale DNA": a massive equity drawdown and an extremely unhealthy risk-to-reward ratio.

Conclusion: Goodbye to Fantasy, Embrace Real Trading

From the mathematical trap of the "Classic Martingale" to the devil in the details of performance reports, and the various disguised variations, we have completed an in-depth dissection of the Martingale strategy.The ultimate goal of this article is to empower you with the ability to think critically and make your own judgments. Real trading is not a gamble in pursuit of an undefeated myth, but an art of probability, discipline, and risk management. Say goodbye to the holy grail fantasy and start building your own real and robust trading career.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

One Response

Very useful, thank you.