What are you actually trading in Forex?

The Foreign Exchange market (Forex) is the most liquid financial market in the world. Here, you are not trading physical goods, but the value ratio between currencies of different countries. Below is a detailed breakdown of the core principles and operational logic of Forex trading.1. Core Concept: Currency Pairs

In the Forex market, currencies are always traded in pairs. For example: Euro vs. US Dollar (EUR/USD) or British Pound vs. Japanese Yen (GBP/JPY).- Simultaneous Operation: When you trade a currency pair, you are actually buying one currency while simultaneously selling another.

- Relative Value: You are not buying the currency itself, but investing in the relative strength relationship between two currencies.

2. Trading Structure: Base and Quote Currencies

Understanding the order of a currency pair is the first step. A pair consists of two parts:Base Currency:

The first currency in the pair (e.g., EUR/USD). This is the "object" of the trade—the unit you are buying or selling.

Quote Currency:

The second currency in the pair (e.g., EUR/USD). This is the "accounting unit" used to measure how much the base currency is worth.

Example: If EUR/USD = 1.1000, it means 1 Euro is worth 1.10 US Dollars. If you expect the Euro to strengthen, you would "Buy" this pair.

3. Speculative Mechanism: Going Long and Short

Forex traders earn profits by predicting exchange rate fluctuations:- Go Long (Buy): Expecting the "Base Currency" to appreciate relative to the Quote Currency.

- Go Short (Sell): Expecting the "Base Currency" to depreciate relative to the Quote Currency.

4. Market Drivers: Logic and Application

Exchange rates are influenced by economic data and central bank policies. When the US Federal Reserve (Fed) raises interest rates, the USD usually appreciates. In this case, the correct trading logic is:- Sell EUR/USD: Because the USD (Quote Currency) is getting stronger, the exchange rate figure will drop.

- Buy USD/JPY: Because the USD (Base Currency) is getting stronger, the exchange rate figure will rise.

Key Tip: The direction of your trade depends entirely on whether the currency you want to trade is in the "front" or the "back" of the pair.

5. Leverage and Margin

Forex trading allows the use of Leverage, meaning traders only need to put up a small Margin to control a large position.- Amplify Benefits: You can use a small amount of capital to achieve higher potential returns.

- Risk Management: Leverage is a double-edged sword; it amplifies losses at the same rate it amplifies gains.

6. Profit/Loss Calculation: Pips

Movements in the Forex market are usually measured in "Pips":- For most pairs, 1 Pip is the fourth decimal place (0.0001).

- If you buy EUR/USD at 1.0800 and sell at 1.0850, you have earned 50 Pips.

Summary

In the market, you are trading the comparison of economic strength between nations. Successful traders must accurately judge the impact of economic events on currency strength and combine this with strict risk management and correct operational directions.What are you actually trading in foreign exchange trading?

Foreign exchange trading is the largest financial market in the world, where traders are actually trading currency pairs. Unlike other markets such as stocks or instruments, the trading instruments in the foreign exchange market are currencies between countries. The following will explain in detail what you are actually trading in the foreign exchange market and the operational principles.1. Currency Pairs

In the foreign exchange market, all trades are conducted in the form of currency pairs. A currency pair consists of two different currencies, such as Euro to US Dollar (EUR/USD) or British Pound to Japanese Yen (GBP/JPY). This means you are simultaneously buying one currency and selling another. In other words, when you trade foreign exchange, you are actually investing in the value of one currency relative to the changes in another currency.For example:

- If you buy EUR/USD, it means you are buying Euros while selling US Dollars.

- If you sell GBP/JPY, it means you are selling British Pounds while buying Japanese Yen.

2. Base Currency and Quote Currency

The two currencies in a currency pair are referred to as the base currency and the quote currency. In a currency pair, the former is the base currency, and the latter is the quote currency. The trader's goal is to predict the value change of the base currency relative to the quote currency based on market exchange rate fluctuations.- Base Currency: The currency you buy or sell.

- Quote Currency: The currency you use to calculate the value of the base currency.

For example, EUR/USD = 1.2000 means 1 Euro (base currency) equals 1.20 US Dollars (quote currency). If you believe the Euro will appreciate, you would buy EUR/USD, and when the value of the Euro rises relative to the US Dollar, you can sell at a higher price, thus making a profit.

3. Speculation in Foreign Exchange Trading

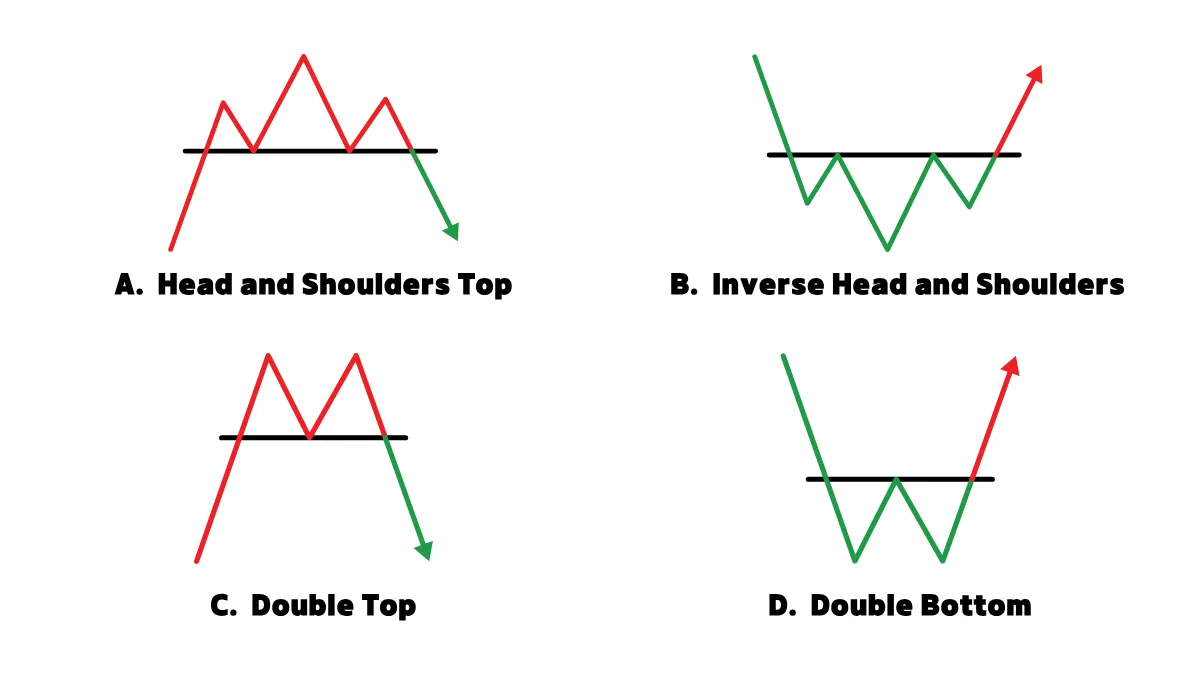

Most trading in the foreign exchange market is speculative trading. This means that traders do not actually need to use these currencies for international trade or travel, but rather earn the price difference by predicting exchange rate changes. When traders predict that a currency will appreciate or depreciate, they will perform corresponding trading operations:- Going Long (Buy): If traders predict that the base currency will appreciate, they will buy the currency pair and wait to sell after the price rises.

- Going Short (Sell): If traders predict that the base currency will depreciate, they will sell the currency pair, hoping to buy back at a lower price after the price drops.

4. Leverage and Margin

A unique feature of foreign exchange trading is the ability to use leverage. Leverage allows traders to control larger trading amounts with less capital. While leverage can amplify potential profits, it also magnifies losses. The use of leverage is based on margin, which is a collateral amount that allows traders to initiate larger trades with only a small portion of capital.For example, if a broker offers 1: 100 leverage, it means you only need to invest 1 dollar to control a position worth 100 dollars. While this provides greater profit potential, it also increases risk.

5. Volatility in the Foreign Exchange Market

Currency prices are influenced by various factors, including economic data (such as GDP, employment data), central bank policies, geopolitical events, and market sentiment. Traders use these factors to analyze and predict market trends, thus engaging in speculative trading.For example, if the Federal Reserve raises interest rates, it may lead to an appreciation of the US Dollar, as investors will shift funds to higher-yielding US Dollar assets. Therefore, traders may buy US Dollar pairs against other currencies (such as EUR/USD), hoping for the US Dollar to appreciate.

6. Calculating Profit and Loss in Trading

Profit and loss in foreign exchange trading are usually calculated in pips. A pip is the smallest unit of price movement for a currency pair, and for most currency pairs, 1 pip typically represents a change in the fourth decimal place (0.0001). For example, when EUR/USD moves from 1.2000 to 1.2001, it is said that the price has risen by 1 pip.A trader's profit and loss are calculated based on the movement of pips. If you buy EUR/USD and the price rises from 1.2000 to 1.2050, it indicates a price increase of 50 pips, and your profit is calculated based on the value of those 50 pips.

Conclusion

In the foreign exchange market, you are actually trading the relative value of currencies from different countries, known as currency pairs. By buying or selling currency pairs, traders can earn profits based on changes in currency exchange rates. The success of currency trading depends on accurate predictions of market volatility, risk management, and the proper use of leverage. Understanding the operation of base and quote currencies, trading strategies, and market driving factors can help traders succeed in this dynamic market.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.