The Martingale Strategy is a trading strategy that elicits polarized reactions in the foreign exchange market. On one hand, its seemingly perfect equity curve attracts many traders; on the other hand, its inherent high-risk nature has caused many trading accounts to lose all their funds.

A noteworthy phenomenon is: since the risks of this strategy are widely known, why is it still so prevalent in the market? Why do retail traders, Introducing Brokers (IBs), and even brokers seem to tacitly accept its existence?

This article will analyze the financial motives of the various parties involved in the Martingale strategy from a business analysis perspective. We will delve into the roles of retail traders, IBs, and brokers in this system and identify who the ultimate beneficiary is.

In standard industry practice, a broker's risk management system automatically classifies clients' trading behavior. The system identifies Martingale strategy users based on the following characteristics:

For traders, understanding this business model is crucial. When evaluating any trading strategy that claims to provide stable, high returns, one should carefully analyze the mechanism behind its operation and consider the role they play in the overall interest structure.

A noteworthy phenomenon is: since the risks of this strategy are widely known, why is it still so prevalent in the market? Why do retail traders, Introducing Brokers (IBs), and even brokers seem to tacitly accept its existence?

This article will analyze the financial motives of the various parties involved in the Martingale strategy from a business analysis perspective. We will delve into the roles of retail traders, IBs, and brokers in this system and identify who the ultimate beneficiary is.

Retail Traders: Participants Heavily Influenced by Psychological Biases

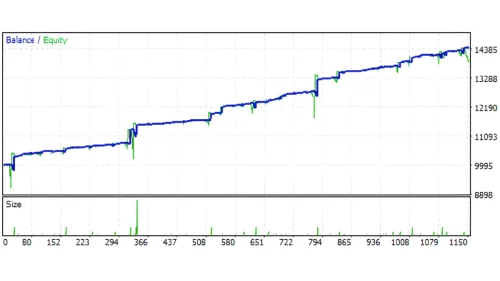

Retail traders are the direct users and ultimate risk-takers of the Martingale strategy. Their choice of this strategy is primarily driven by several strong psychological biases.- Visual Trust in the Equity Curve: The balance chart of the Martingale strategy, before the account loses all funds, is usually a steadily upward-sloping line. This visual "stability" creates a strong sense of psychological security, leading traders to mistakenly believe it is a perfect trading strategy.

- Loss Aversion: Psychological studies indicate that the negative feeling people have towards losses is much stronger than the positive feeling of gaining an equal amount of profit. The core mechanism of the Martingale strategy is to "not realize a loss" but to increase the position size and wait for a market reversal. This perfectly aligns with the human tendency to avoid confirming a loss.

- Psychological Need for Immediate Gratification: Based on long-term market observations, many traders feel anxious if their account has no trades or no profit for the day. They will frequently ask, "Why are there no new trades?" This psychological need for "daily returns" makes the high-frequency trading nature of the Martingale strategy particularly attractive.

Introducing Brokers (IBs): The Main Drivers of Trading Volume

Introducing Brokers (IBs) are intermediaries between retail traders and brokers. Their primary income comes from commissions generated when clients trade. Therefore, the total trading volume of clients is the key factor determining an IB's income. The Martingale strategy is a tool that can generate a huge amount of trading volume.- Exponentially Growing Trading Volume: Traditional trading strategies may maintain a fixed position size for a long time. However, in the Martingale strategy, positions grow exponentially after consecutive losses (e.g., 0.1, 0.2, 0.4, 0.8...). For IBs, this means a rapid increase in commission income.

- Effective Marketing Narrative: IBs often show potential clients the historical equity curve of the Martingale strategy and use phrases like "stable monthly profits," "weekly profits," and "daily trades." This marketing approach directly satisfies the psychological needs of retail traders mentioned in the first chapter. For IBs, maximizing client trading volume is their main business goal.

Brokers: System Managers and Ultimate Beneficiaries

Brokers are the rule-makers of the market and can earn stable profits from trading activities. The hybrid business model, with both "A-Book" and "B-Book" operations, is key to understanding the broker's role in this structure.A-Book Model

This is an Agency Model. In this model, the broker sends client orders directly to upstream liquidity providers. The broker's profit comes from spreads or commissions. Therefore, in the A-Book model, the broker benefits from the high trading volume generated by the Martingale strategy.B-Book Model

This is a Counterparty Model. In this model, the broker does not send the orders out but instead acts as the direct counterparty to the client. This means the client's loss is the broker's profit.In standard industry practice, a broker's risk management system automatically classifies clients' trading behavior. The system identifies Martingale strategy users based on the following characteristics:

- High-frequency trading.

- Extremely short holding times for profitable orders and extremely long holding times for losing orders.

- Infrequent or no use of stop-loss orders.

- Position size grows exponentially with consecutive losses.

Conclusion: Analysis of the Roles of the Various Parties Involved

In summary, we can clearly define the roles and interests of each party in this system:- Retail Traders: As providers of capital, they bear almost all the market risk. Their behavior is primarily driven by profit expectations and psychological biases.

- Introducing Brokers (IBs): As promoters of trading activity, they encourage high-frequency trading by satisfying the psychological needs of retail traders, earning volume-based commissions.

- Brokers: As the system managers and ultimate beneficiaries. In the A-Book model, they earn stable commissions; in the B-Book model, they profit directly from the retail traders' losses, including their principal.

For traders, understanding this business model is crucial. When evaluating any trading strategy that claims to provide stable, high returns, one should carefully analyze the mechanism behind its operation and consider the role they play in the overall interest structure.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

One Response

讚