Why Choose Forex Trading: Advantages of Forex Trading

1. Market Size and Liquidity

The Forex market is the largest financial market in the world, with an average daily trading volume of 7.5 trillion USD, far exceeding other financial markets. Such a massive scale means the market has extremely high liquidity, allowing traders to quickly execute buy and sell operations without worrying about excessive price fluctuations. High liquidity also reduces the risk of slippage, ensuring that traders can complete transactions at prices close to the quotes.2. Flexible Trading Hours

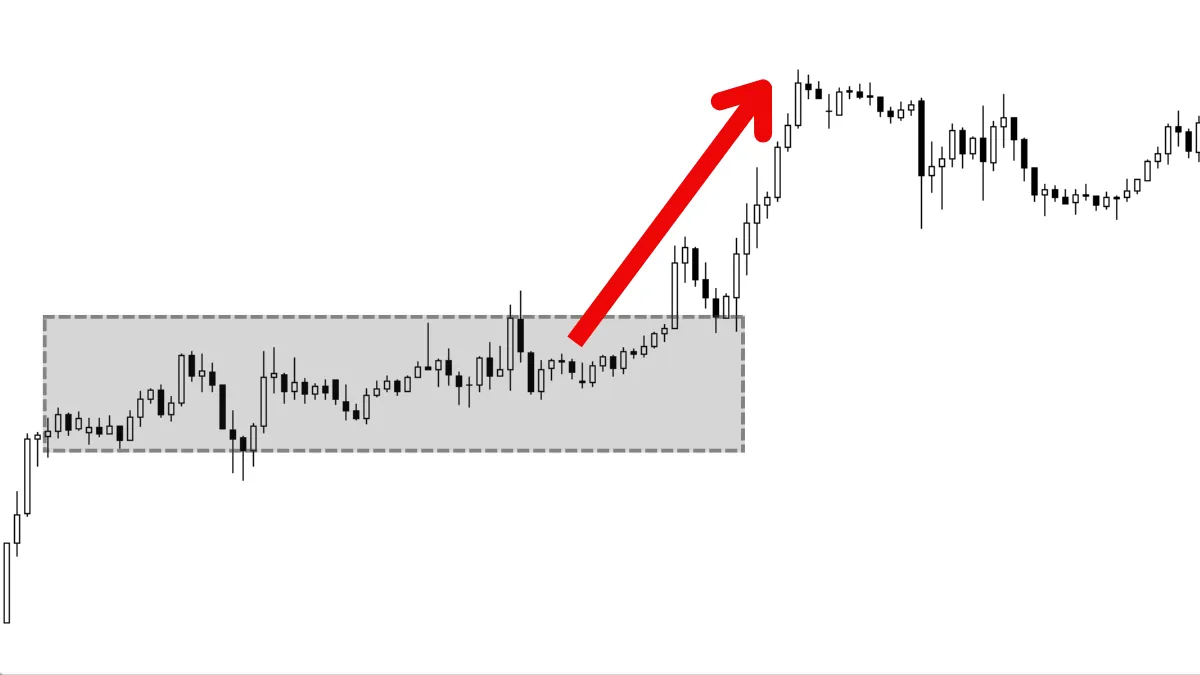

Unlike the stock market, the Forex market is open 24 hours a day, running continuously from Monday to Friday. This round-the-clock trading environment is suitable for traders around the world, allowing participation in trading regardless of time or location, providing great flexibility for investors with busy work or study schedules.3. Two-Way Trading Opportunities

Another significant advantage of Forex trading is the ability to operate in both directions. Traders can profit by buying when a currency appreciates and can also earn returns by selling when a currency depreciates. This allows the Forex market to provide more trading opportunities, regardless of whether market conditions are rising or falling.4. Leverage Trading

Leverage in the Forex market is a major highlight that attracts many investors. Leverage allows traders to control larger trading positions with less capital, thereby increasing potential profits. However, leverage also magnifies potential losses, so it needs to be used with caution.5. Diversified Trading Tools and Hedging Opportunities

The Forex market allows the use of various trading strategies and tools, such as Contracts for Difference (CFD) and futures contracts, providing flexibility for traders. Additionally, many businesses and investors use the Forex market for hedging to reduce the impact of currency fluctuations on their operations or investment portfolios.Conclusion

The Forex market is not only the largest market globally but also offers extremely high liquidity, flexible trading hours, and a variety of strategy options. These advantages make the Forex market an ideal platform for many investors seeking profits. Whether professional traders or novice investors, everyone can find suitable trading opportunities in this market.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.