The foreign exchange market is a 24-hour operating market that allows traders to choose suitable trading periods based on their schedules.

However, not all time periods are equally suitable for trading, as market volatility and liquidity can vary throughout the day. Choosing the right trading time is key to successful trading, as it helps you seize the best trading opportunities, reduce risks, and optimize your trading strategy.

These overlap periods are the times of highest liquidity and greatest volatility, providing more trading opportunities.

When the market is in a low liquidity state, spreads may widen, and price movements may be minimal, increasing trading costs.

However, not all time periods are equally suitable for trading, as market volatility and liquidity can vary throughout the day. Choosing the right trading time is key to successful trading, as it helps you seize the best trading opportunities, reduce risks, and optimize your trading strategy.

1. The 24-hour Cycle of the Market

The operation of the foreign exchange market is divided into four main time periods, covering the major financial centers around the world:- Sydney Session: 22: 00 GMT – 07: 00 GMT

- Tokyo Session: 00: 00 GMT – 09: 00 GMT

- London Session: 08: 00 GMT – 17: 00 GMT

- New York Session: 13: 00 GMT – 22: 00 GMT

2. Best Trading Times: Market Overlap Periods

Volatility in the foreign exchange market is particularly high during certain periods of the day, especially when two major markets are open simultaneously.These overlap periods are the times of highest liquidity and greatest volatility, providing more trading opportunities.

- Tokyo and London Market Overlap: 08: 00 GMT – 09: 00 GMT

During this time, the Asian market is about to close while the European market has just opened. Although liquidity is relatively low, there are still certain trading opportunities for traders dealing in Asian currency pairs like the yen and the Australian dollar. - London and New York Market Overlap: 13: 00 GMT – 17: 00 GMT

This is the period of the highest trading volume and greatest volatility of the day. Both the European and American markets are open, with a large number of traders participating, resulting in extremely strong liquidity, narrower spreads, suitable for short-term traders and trend followers.

3. Best Trading Times for Major Sessions

Each market session has its best trading times, and understanding these time periods can help you choose the most suitable trading opportunities:- London Session: 08: 00 GMT – 17: 00 GMT

Best Trading Times: 08: 00 – 11: 00 and 13: 00 – 17: 00.

In the early hours of the London session, significant economic data or policy changes often occur, triggering price volatility. Additionally, during the overlapping hours of the London and New York markets, market volatility peaks, making it the most active period for short-term traders. - New York Session: 13: 00 GMT – 22: 00 GMT

Best Trading Time: 13: 00 – 17: 00.

The first few hours after the New York market opens are usually the most active, especially during the overlap with the London session. This period has the highest trading volume and market volatility, particularly suitable for trading currency pairs related to the US dollar. - Tokyo Session: 00: 00 GMT – 09: 00 GMT

Best Trading Time: 00: 00 – 03: 00.

In the early hours of the Tokyo market, especially for currency pairs related to the yen and the Australian dollar, volatility is significant. Although the volatility in the Tokyo session is relatively lower compared to other markets, this period still offers good opportunities for trading Asian currency pairs.

4. Best Trading Times for Different Strategies

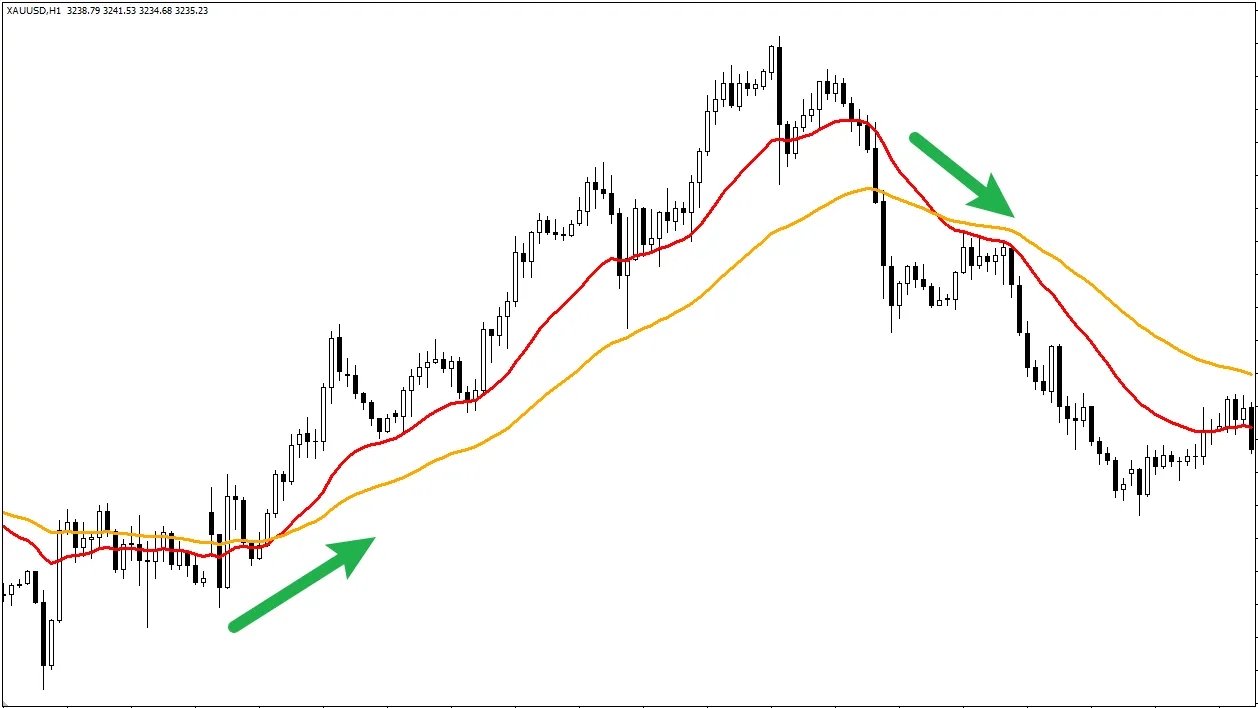

Depending on your trading strategy, different periods may be more suitable for specific trading methods:- Trend Trading:

Trend trading strategies are suitable for use during periods of high market volatility, especially during the overlap of the London and New York markets. During this time, the market often shows clear price trends, making it suitable for trading in the direction of the market. - Range Trading:

When market volatility is low, prices tend to fluctuate within a certain range. Range trading strategies are suitable for use during the Tokyo session, especially when the market is in a consolidation phase, allowing traders to buy and sell based on support and resistance levels. - Breakout Strategy:

Breakout strategies are suitable for use when market volatility increases, particularly before and after the release of significant economic data or news. Price breakouts often occur when the London market opens, allowing traders to capitalize on this time period for breakout trades.

5. Avoid Low Liquidity Periods

Although the foreign exchange market operates 24 hours, not all time periods are suitable for trading.When the market is in a low liquidity state, spreads may widen, and price movements may be minimal, increasing trading costs.

- Sydney Market Opening Alone (22: 00 GMT – 00: 00 GMT):

During this time, market liquidity is low, spreads widen, and volatility is limited, making it suitable for long-term investors but not for short-term trading. - Gaps Between Markets:

During the transition time between different markets, market liquidity may significantly decrease, increasing the risk of trading, especially for short-term traders who require high liquidity support.

Conclusion

Choosing the best trading time is key to successful foreign exchange trading. Understanding the operating hours of the global foreign exchange market, especially the high liquidity and volatility during market overlaps, can help you seize more trading opportunities. Whether it is the overlapping time of the London and New York markets or the early hours of the Tokyo market, selecting the appropriate strategy based on market characteristics will help you optimize trading results and achieve better profits.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.