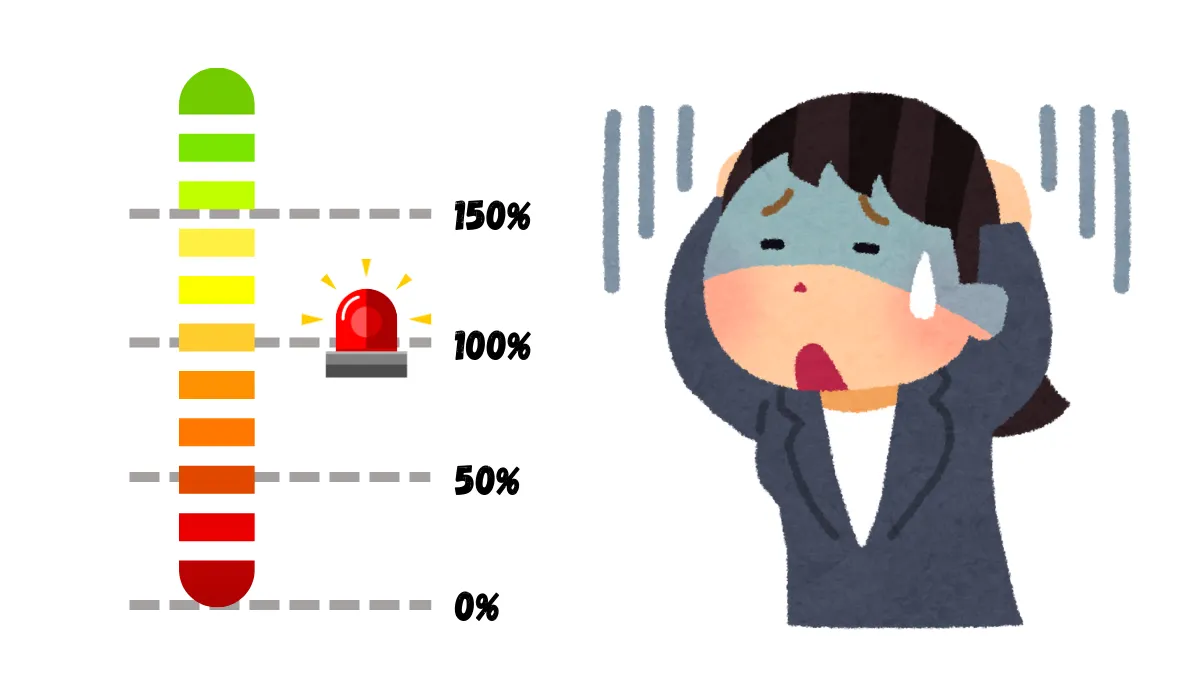

In this trading scenario, your account is set with a margin call level of 100%, but there is no separate stop out level.

This means that when your margin level drops to 100%, you will immediately receive a margin call notification, and the broker may instantly close part or all of your open positions without further warning or other notifications.

When the margin level falls below 100%, the broker will immediately notify you to add funds. If you fail to add funds in time, the broker may instantly liquidate your positions.

This means that when your margin level drops to 100%, you will immediately receive a margin call notification, and the broker may instantly close part or all of your open positions without further warning or other notifications.

What happens when the margin call level is 100%?

When your margin level equals 100%, it means your equity is exactly equal to the used margin. At this point, there is no available margin in your account to maintain other positions, nor can you open new positions.Impact of no stop out level:

- Immediate liquidation risk:

Due to the absence of a separate stop out level, once the margin level drops to 100%, you may immediately face the risk of your positions being automatically liquidated. - No buffer space:

If the market experiences severe volatility, you will have no buffer time to add funds or adjust positions.

Explanation:

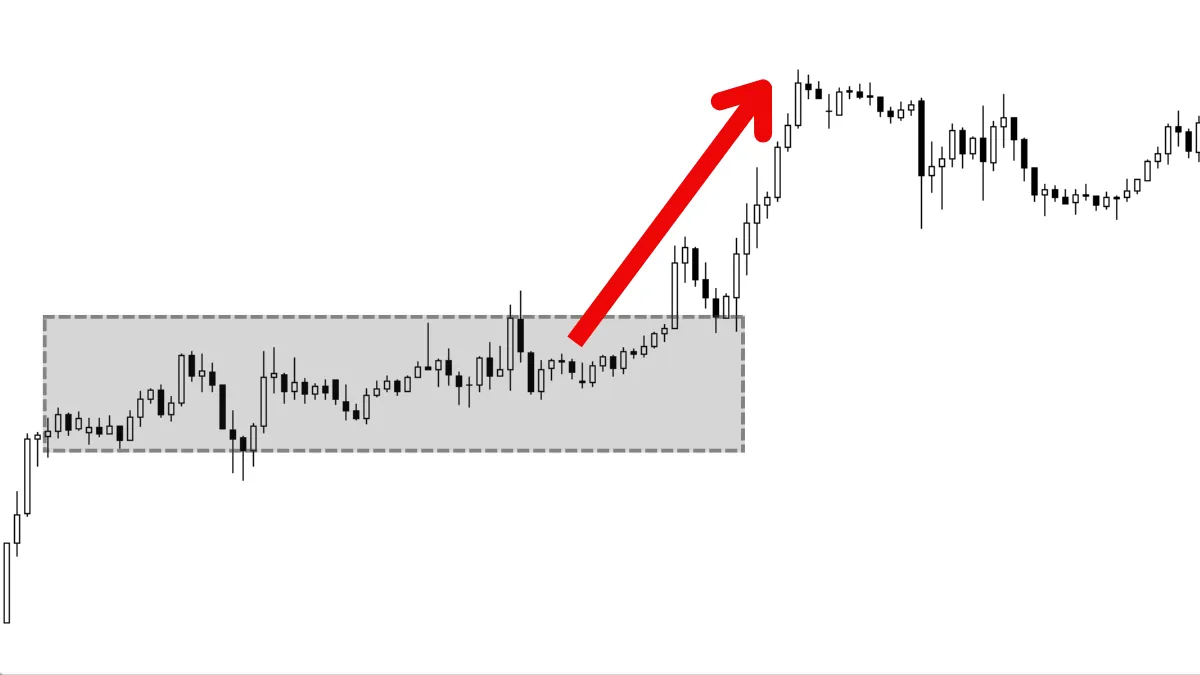

Assuming you have $1,000 in your account and have opened a position worth $10,000, the broker requires a margin of 10%, which is $1,000. Here are the specific details:- Account parameters:

- Account balance: $1,000

- Used margin: $1,000

- Floating loss: $50

- Equity calculation:

Equity = Account balance - Floating loss

Equity = 1,000 - 50 = $950 - Margin level calculation formula:

Margin level = (Equity / Used margin) x 100%

Margin level = (950 / 1,000) x 100% = 95%

When the margin level falls below 100%, the broker will immediately notify you to add funds. If you fail to add funds in time, the broker may instantly liquidate your positions.

Risks of lacking a stop out level:

- Immediate liquidation risk:

When the margin level reaches 100%, the broker may take immediate action, leading to your positions being quickly liquidated. - No buffer space:

You will not have additional time to adjust positions or add funds.

How to cope with this situation:

- Monitor margin levels:

Regularly check your margin levels to ensure they remain above 100% to avoid margin call notifications and liquidations. - Set stop-loss points:

Setting stop-loss points during market volatility can help you reduce losses and avoid significant capital loss. - Fund management:

Ensure that your account has sufficient free margin, so even in adverse market conditions, you still have time to add funds or close positions.

Summary:

In the absence of a separate stop out level, when the margin level reaches 100%, you will immediately face a margin call notification and potential automatic liquidation risk. Investors should strictly manage their funds, continuously monitor margin levels, and set effective stop-loss strategies to protect their capital.Hi, We are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights.Here, we focus on Global Broker Reviews, Trading System Setup (MT4 / MT5, EA, VPS), and Forex Trading Basics.

We personally teach you to master the "Operating Manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

- Help share this article to let more traders see the truth.

- Read more articles on Broker Tests and Forex Education.