How to Choose a Forex Broker

Choosing the right broker in the forex market is crucial for traders. A good broker not only provides quality service but also reduces trading costs and ensures the safety of funds. Here are several key factors to consider when selecting a forex broker:1. Regulatory Oversight:

Choosing a legitimate, regulated broker is the primary consideration. Although the forex market is the largest financial market globally, it also comes with high risks and fraud risks. Regulated brokers are subject to strict legal supervision, ensuring they comply with regulations and protect investors' funds. Be sure to confirm whether the broker is regulated by authoritative bodies such as the Financial Conduct Authority (FCA) in the UK, or the Australian Securities and Investments Commission (ASIC).

2. Trading Costs:

The costs of forex trading are typically reflected in the spread and commissions. The spread is the difference between the buying and selling price, which is one of the main sources of income for brokers. Brokers may offer fixed or variable spreads, and different spread models will affect your trading costs. For frequent traders, choosing a broker with lower spreads can significantly reduce costs.

3. Trading Platform and Tools:

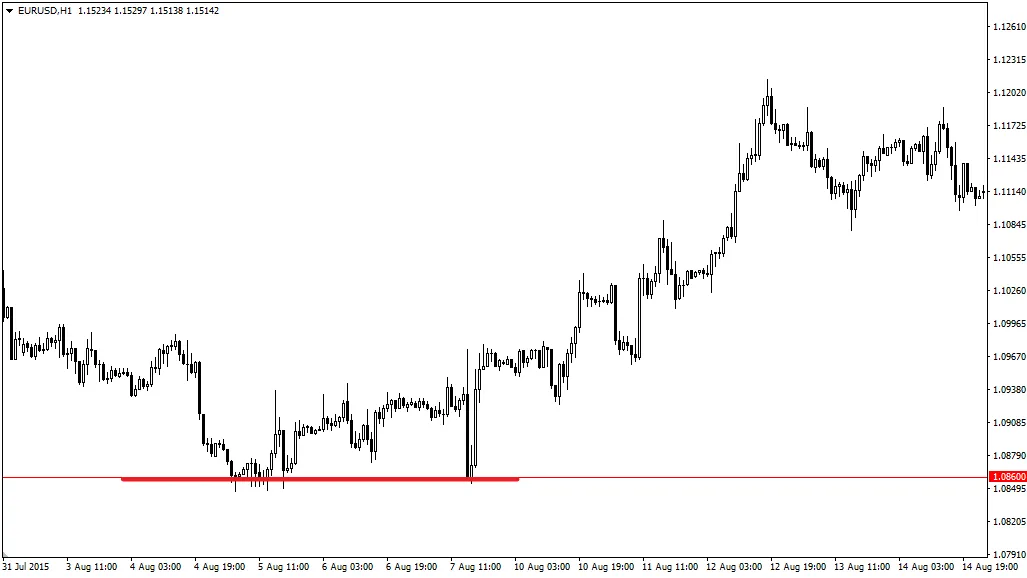

The trading platform provided by the forex broker is also an important consideration. The platform should be stable and easy to operate, and it should provide tools such as chart analysis and technical indicators to help investors analyze the market. Common forex trading platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Some brokers also offer proprietary platforms, allowing you to choose the one that best suits your needs.

4. Customer Service:

The forex market operates 24 hours a day globally, so good customer service is essential. You should choose a broker that offers round-the-clock support and ensure you can contact the customer service team through various means (such as phone, email, live chat). Additionally, confirm whether the broker provides multilingual support, which is especially important for investors whose native language is not English.

5. Funding and Withdrawal Methods:

Brokers should offer various convenient funding and withdrawal methods, including bank transfers, credit cards, or electronic payment platforms (such as PayPal, Skrill, etc.). It is also necessary to understand the processing times and related fees for deposits and withdrawals, as this will affect your fund liquidity.

6. Leverage and Margin Requirements:

Leverage is an important concept in forex trading, allowing investors to control larger trades with a smaller capital. However, high leverage also comes with high risks, so when choosing a broker, you should understand the range of leverage offered and the margin requirements. Different brokers may offer significantly different leverage, so choose an appropriate leverage ratio based on your risk tolerance.

7. Educational Resources:

For beginners, choosing a broker that provides educational resources can help you grasp the basics of forex trading more quickly. Many brokers offer free online courses, webinars, articles, and market analysis, which can help you improve your trading skills and better understand market trends.

Conclusion:

Choosing the right forex broker requires a comprehensive consideration of various factors, including regulatory status, trading costs, trading platforms, customer service, and funding methods. Selecting a broker that suits you can not only improve trading efficiency but also reduce unnecessary risks, helping you succeed in the forex market.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.