What is Triangular Arbitrage?

Triangular Arbitrage is a trading strategy focused on exploiting inconsistencies in exchange rates between three currency pairs, widely used in foreign exchange margin trading. Its characteristic is to lock in profits by quickly executing three trades before market prices correct, achieving stable and low-risk returns. This article will comprehensively introduce the core principles of triangular arbitrage, operational steps, and practical applications, and share how to effectively manage risks to maximize trading performance.Core Principles of Triangular Arbitrage

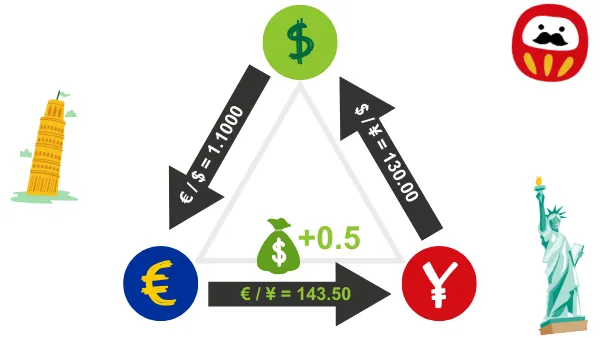

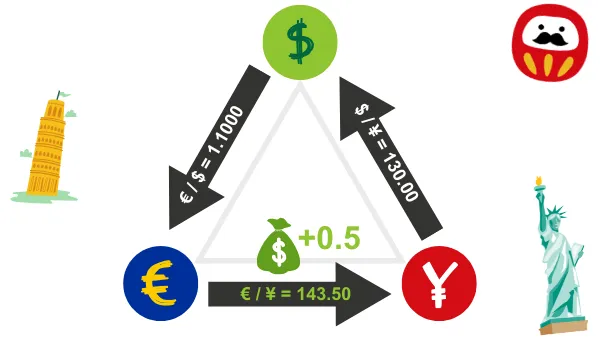

The basic idea of triangular arbitrage is to trade based on the inconsistencies in exchange rates among three currency pairs in the market.For example, suppose you find discrepancies in the exchange rates of EUR/USD, USD/JPY, and EUR/JPY, you can achieve arbitrage through the following three steps:

- Use currency A (such as USD) to buy currency B (such as EUR).

- Use currency B to buy currency C (such as JPY).

- Exchange currency C back to currency A.

If there is mispricing in the market quotes, the total profit from these three trades will be positive and will not depend on the overall direction of market fluctuations.

Operational Process of Triangular Arbitrage

Step 1: Choose Currency Combinations

Select three major currency pairs, such as EUR/USD, USD/JPY, and EUR/JPY, as these currency pairs have high liquidity, stable exchange rate quotes, and are more likely to present arbitrage opportunities.Step 2: Calculate the Difference Between Theoretical and Actual Exchange Rates

Use the real-time market quotes of the three currency pairs to calculate the theoretical exchange rate. For example:- Assuming EUR/USD = 1.1000, USD/JPY = 130.00, the theoretical EUR/JPY exchange rate should be 1.1000 × 130.00 = 143.00.

- If the actual market quote for EUR/JPY = 143.50, there is a 0.50 exchange rate inconsistency, allowing for arbitrage operations.

Step 3: Execute Three Trades

- Buy EUR with USD:

Use 1000 USD to buy EUR (1,000 ÷ 1.1000 = 909.09 EUR). - Buy JPY with EUR:

Use 909.09 EUR to buy JPY (909.09 × 143.50 = 130,454.42 JPY). - Exchange back to USD with JPY:

Exchange 130,454.42 JPY back to USD (130,454.42 ÷ 130.00 = 1,003.50 USD).

In this operation, the exchange rate deviation resulted in an arbitrage profit of 3.50 USD.

Practical Applications of Triangular Arbitrage

Case 1: Cross-Market Arbitrage

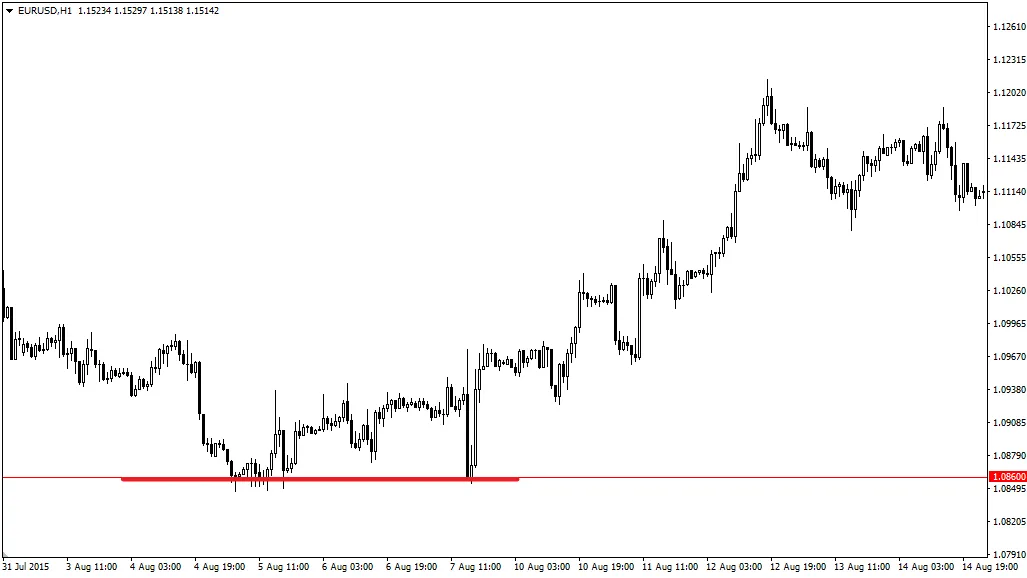

Assuming that the quotes for EUR/USD and USD/JPY are the same between the Tokyo and London markets, but there is a deviation in the quote for EUR/JPY, this situation is usually caused by quote delays or insufficient liquidity. Traders can exploit this deviation to execute triangular arbitrage.Case 2: Triangular Arbitrage in Algorithmic Trading

Use algorithmic trading systems to quickly detect exchange rate deviations and automatically execute trades, reducing the risk of delays in manual operations.Case 3: Major Event Arbitrage

After central bank interest rate decisions or the release of economic data, market quotes may become temporarily unbalanced, allowing traders to seize this opportunity to achieve triangular arbitrage.Advantages of Triangular Arbitrage

- Low Risk:

It does not rely on the overall fluctuations of market prices, only utilizing exchange rate inconsistencies for arbitrage, resulting in relatively low risk. - Efficiency:

By quickly executing trades, profits can be locked in before the market corrects prices. - Wide Application:

Suitable for high liquidity currency pairs in the foreign exchange margin market, with frequent arbitrage opportunities.

Risks and Challenges of Triangular Arbitrage

- Slippage Risk:

Executing three trades requires extremely high speed, and any delay may lead to slippage, reducing arbitrage profits. - Transaction Costs:

Spread and fees are important considerations for arbitrage profits, requiring the selection of low-cost trading platforms. - Increased Market Efficiency:

With the popularity of algorithmic trading, inconsistencies in exchange rates in the market are corrected more quickly, reducing arbitrage opportunities. - Execution Errors:

Triangular arbitrage requires accurate calculations and execution; any operational errors may lead to losses.

Tools and Strategies: Enhancing Triangular Arbitrage Efficiency

- Automated Trading Systems:

Use efficient algorithmic trading tools (such as MetaTrader) for exchange rate detection and trade execution. - Exchange Rate Calculation Tools:

Use professional calculators or tools to quickly assess arbitrage opportunities, shortening decision-making time. - Low Latency Trading Servers:

Ensure a low-latency trading execution environment to reduce slippage risk caused by delays. - Risk Management:

Set stop-loss points and trading limits to prevent losses due to price fluctuations or execution delays.

Conclusion

Triangular arbitrage is a professional arbitrage strategy that combines analytical ability, trading speed, and technical support, particularly suitable for major currency pairs in foreign exchange margin trading. Through accurate calculations, rapid execution, and strict risk management, traders can consistently capture profits from exchange rate inconsistencies in the market.I hope this article helps you gain a deeper understanding of the core techniques of triangular arbitrage, improve trading performance, and achieve stable profits in the foreign exchange market!

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.