Introduction to Forex Trading Strategies: More Than Just Entry and Exit Points, You Need a Complete Plan

We already know that forex traders have different styles (such as short-term, long-term) and use technical analysis or fundamental analysis to judge the market.However, analysis alone is not enough; you need a clear action guide to tell you what to do under specific circumstances.

This action guide is your "trading strategy".

Many beginners may think a strategy is just finding a magical "buy/sell signal".

But a truly effective trading strategy is much more than that; it is a complete, pre-defined plan covering every step from entry to exit.

Trading without a strategy is more like gambling, full of randomness and emotional decisions.

This article will explain what a trading strategy is, what elements it should include, and why having a strategy is crucial for trading success.

1. What is a Trading Strategy? Your Trading "Manual"

You can think of a trading strategy as a customized trading "manual" or "action rulebook" for yourself.It is a set of pre-determined, objective rules that guide all your decisions during the trading process, including:

- Under what conditions to enter the market (buy or sell) ?

- After entry, where to set the risk control point (stop-loss) ?

- What is the expected profit target (take-profit) ?

- How much capital to allocate per trade (position size) ?

The core purpose of formulating a trading strategy is to eliminate subjective guessing and emotional interference in trading (such as fear, greed, hesitation), allowing you to consistently execute trades according to the same logic.

2. What Elements Should a Basic Trading Strategy Include?

Although strategies can vary widely, a relatively complete and executable basic strategy should clearly answer the following questions:- Which market/currency pairs to trade? Which specific currency pairs do you intend to focus on? (This may be based on your familiarity with the pairs, volatility, spread costs, etc.)

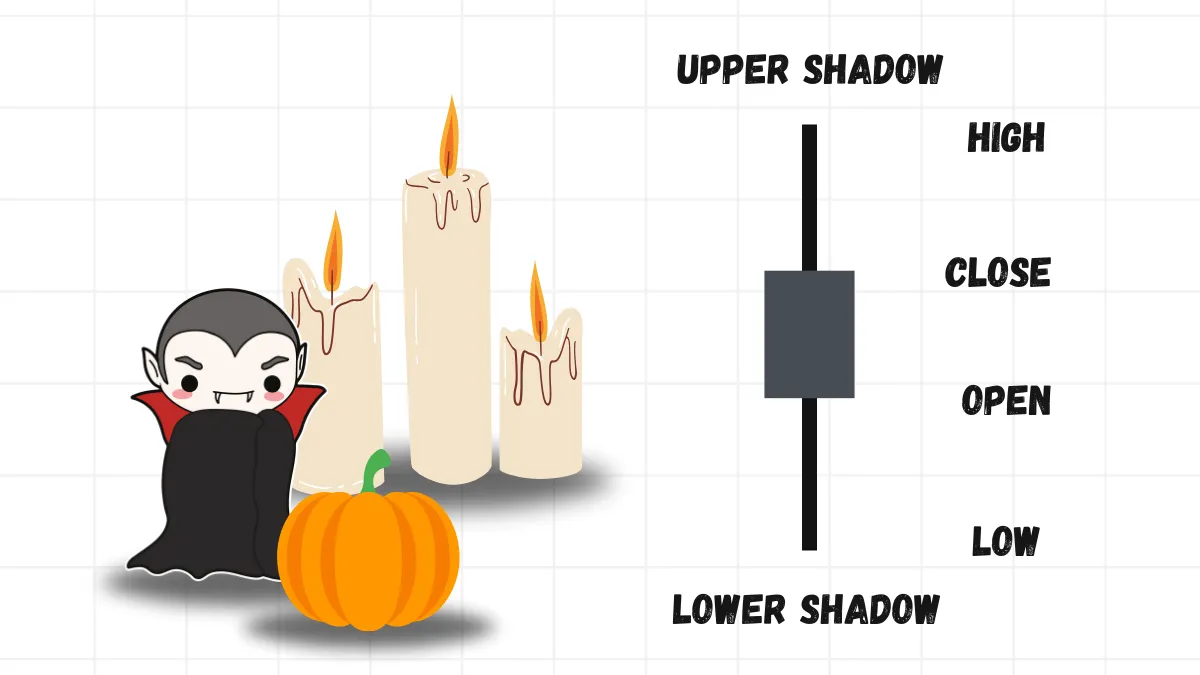

- What analysis methods to use? Is your decision-making mainly based on technical analysis, fundamental analysis, or a combination of both? Which specific chart patterns, technical indicators, economic data, or news events will you pay attention to?

- Clear entry rules (Entry Rules): Must be very specific! For example: "Only consider buying when the price breaks above the X moving average and indicator Y is below level Z." The rules need to be clear with no ambiguity.

- Clear exit rules (Exit Rules): This includes two aspects:

- Stop-loss rules (Stop-Loss): This is an absolutely indispensable part of the strategy! If the market moves against you, at what price point must you admit the mistake and exit the trade to limit losses?

- Take-profit rules/targets (Take-Profit/Target): If the market moves in your favor, under what conditions (e.g., reaching a certain price target, achieving a specific risk-reward ratio, or when a reversal signal appears) do you plan to exit the trade to lock in profits?

- Position sizing / risk management rules (Position Sizing / Risk Management): This is as important as stop-loss! How much risk are you willing to take per trade (usually recommended as a small percentage of total account capital, such as 1% or 2%) ? Based on your stop-loss distance and acceptable risk amount, calculate the lot size to use for this trade.

A good strategy plans all the above aspects in advance.

3. Why Do You Need a Trading Strategy?

Trading without a strategy is like sailing without a map and compass; it’s easy to lose direction.Having a clear trading strategy brings many benefits:

- Overcome emotional traps: Market volatility easily triggers fear and greed. With a set of objective rules, you can reduce impulsive trades and make more rational decisions.

- Maintain trading consistency: A strategy ensures you respond the same way to similar market conditions. Only consistent actions allow you to objectively evaluate your trading performance.

- Facilitate evaluation and improvement: With clear rules, you can record every trade and analyze the strategy’s performance. Which rules work? Which need adjustment? This allows your trading skills to improve based on data and experience rather than feelings.

- Build trading confidence: Acting according to a well-thought-out and tested plan makes you feel more in control and reduces anxiety caused by blind order placement.

4. Key Advice for Beginners

- Start simple and improve gradually: As a beginner, don’t pursue overly complex strategies. Choose one or two indicators or price patterns you can easily understand, and build simple rules around them that include all the basic elements mentioned above. Simple strategies are easier to stick to.

- Rules must be clear and executable: Ensure every rule is very clear with no ambiguity. It’s best to write them down in black and white.

- Accept that there is no "perfect strategy": Have realistic expectations. Every strategy will have losing trades; the market is dynamic. The goal is to find a strategy with a positive expectancy over the long term (i.e., overall profits exceed overall losses), not to chase a 100% win rate.

- Understand rather than blindly follow: You can learn others’ strategy ideas, but you must understand the logic and applicable conditions behind them. Directly copying a strategy you don’t understand is very risky because you won’t know when it might fail or how to adjust it.

- Strict testing is crucial: Before risking real money, you must thoroughly test your strategy! This includes:

- Backtesting: Test your strategy rules on historical chart data to see how it performed in the past.

- Forward testing / Demo trading: Trade in a Demo Account according to your strategy rules in real-time to verify its actual effectiveness in the current market environment and practice your execution skills.

- Risk management is core: Again, the effectiveness of any strategy is built on good risk management. Without strict stop-loss and reasonable position control, even the best entry signals can lead to disastrous losses.

Conclusion

A forex trading strategy is not a single buy or sell signal but a complete action plan guiding you through every step from entry, holding, risk control to exit.Having a clear, objective, tested, and personally suitable trading strategy is the key step that distinguishes professional traders from gamblers.

For beginners, there is no need to rush; start with simple, clear rules, spend time learning analysis methods, patiently test and refine your strategy in a Demo Account, and always prioritize risk management.

Building and executing a strategy requires time and discipline, but it is the necessary path to consistent and stable trading.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.