What is your daily trading preparation?

Successful forex traders often establish a fixed preparation process before starting trading each day. This daily trading preparation not only helps you clarify your thoughts, reduce errors, but also allows you to be fully mentally and technically prepared before the market opens. Whether you are a beginner or an experienced trader, establishing an effective daily trading routine is crucial for improving your trading performance.1. Check market news and updates

Before starting trading, the first step is to check the market news and updates for the day. Economic data, news events, and political changes can significantly impact the forex market, so understanding the latest market dynamics is a necessary preparatory step.a. Observe Economic Calendar

Browse the Economic Calendar to see if there are any major economic data releases for the day, such as non-farm payroll data, GDP reports, or central bank interest rate decisions. These data releases can trigger market volatility, so it is important to know their release times in advance to avoid trading recklessly during these high-risk periods.b. Pay attention to news events

In addition to economic data, international political news and major events (such as trade negotiations, geopolitical conflicts) can also affect market trends. Observing these news events helps you understand the possible direction of the market for the day and make necessary adjustments to your trading strategy.

2. Analyze market trends and technical charts

After checking the fundamental news, the next step is to conduct "technical analysis." This is an important part for traders to understand market trends and confirm entry and exit points.a. Analyze technical indicators and trend lines

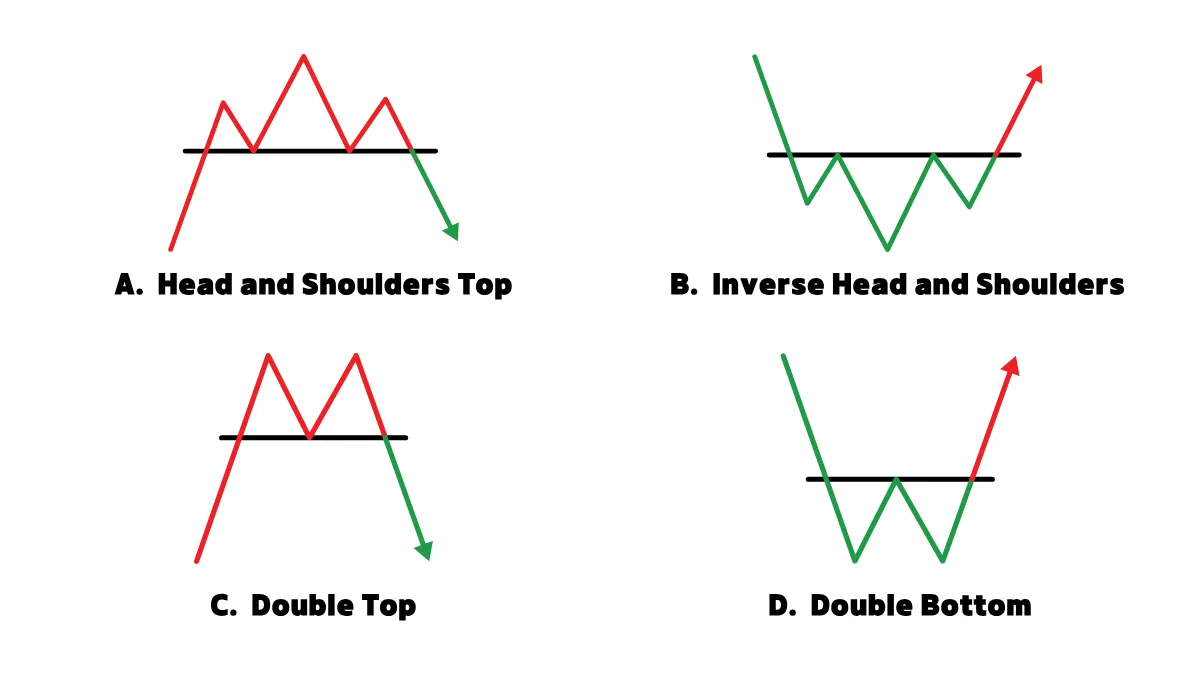

Open your preferred trading platform and check the trends and movements of current Major currency pairs. Use technical indicators (such as moving averages, Relative Strength Index, MACD, etc.) to analyze market trends and determine whether the market is in an uptrend, downtrend, or consolidation phase.b. Mark support and resistance levels

Mark key support and resistance levels on the chart; these levels are often important turning points in the market. When prices approach these levels, reversals or breakouts may occur, so marking them in advance can help you better formulate your trading strategy.c. Check market volatility

Observe the market's volatility to understand whether the current market sentiment is high-risk or stable. If volatility is high, consider reducing your position size or choosing a more conservative strategy; if the market is stable, you can proceed with your planned actions.3. Set trading plans and strategies

After thoroughly analyzing the market, formulate your "trading plan and strategy" for the day. The trading plan should detail every possible scenario, including entry, exit, stop-loss, and take-profit settings.a. Determine entry and exit conditions

Based on the market analysis results, determine your entry and exit points. For example, you can set specific technical indicators or price levels as entry signals and set stop-loss and take-profit levels. These conditions should be established in advance to avoid making arbitrary decisions during trading.b. Set risk management and position control

Risk management is an important part of the trading plan. Set the risk tolerance for each trade (for example, the maximum loss for each trade should not exceed 2% of your capital) and adjust your position size based on market conditions. This helps keep your capital safe during market fluctuations.

4. Adjust mental state and stay calm

Forex trading is not only about market analysis but also a challenge to your psychology. Mental preparation before trading is crucial for maintaining discipline and making rational decisions.a. Meditate or practice deep breathing

Spend a few minutes before trading to engage in simple meditation or deep breathing exercises, which can help reduce tension and keep your mindset stable. This helps you remain calm in the face of market fluctuations and prevents you from making erroneous decisions due to temporary emotions.b. Confirm goals and avoid greed

Before trading, remind yourself to follow the established trading plan and not to pursue high returns out of greed. Maintain discipline and focus on executing the plan rather than trying to guess market directions.5. Technical preparation: Check trading tools and platforms

Technical preparation before trading is also an essential step. Ensure that your trading platform and tools are functioning properly to avoid technical issues affecting your trades.a. Check trading platform and network connection

Ensure that your trading platform is updated to the latest version and check the stability of your network connection. This can prevent missing trading opportunities due to technical issues at critical moments.b. Set alerts and reminders

Use the alert features on your trading platform to set price alerts or technical indicator signal alerts. This way, you can be notified of market changes when specific conditions are met, reducing the likelihood of missing trading opportunities due to negligence.6. Daily review and record

Preparation before trading is not only about analyzing the market but also includes "reviewing and summarizing" past trades. This helps you understand your trading behavior and the effectiveness of your strategies.Before starting a new trading day, take a few minutes to review yesterday's trading records. Check whether your decisions align with the established strategy and analyze the reasons for success or failure. This helps you avoid repeating mistakes in the new day.

Conclusion

Establishing a stable and effective daily trading preparation can help you remain calm in the forex market, improve discipline, and reduce losses caused by arbitrary actions.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.