In foreign exchange margin trading, drawdown is an unavoidable phenomenon. Whether you are an experienced trader or a beginner, drawdown management plays an important role in your trading success. This article will gradually guide you through the definition of drawdown, common causes, and solutions, helping you to handle drawdown issues in trading and move forward more steadily in the foreign exchange market.

Why is drawdown management important?

Drawdown represents risk. If not managed effectively, the loss of funds may exceed the bearable range, leading to the forced termination of trading plans. Therefore, properly managing drawdown can not only protect your principal but also give you enough time to participate in the next market wave.

Remember, successful traders do not avoid failure; they know how to learn from failure and turn drawdown into a stepping stone to success.

I hope this article inspires you to be more steady and confident in the foreign exchange market.

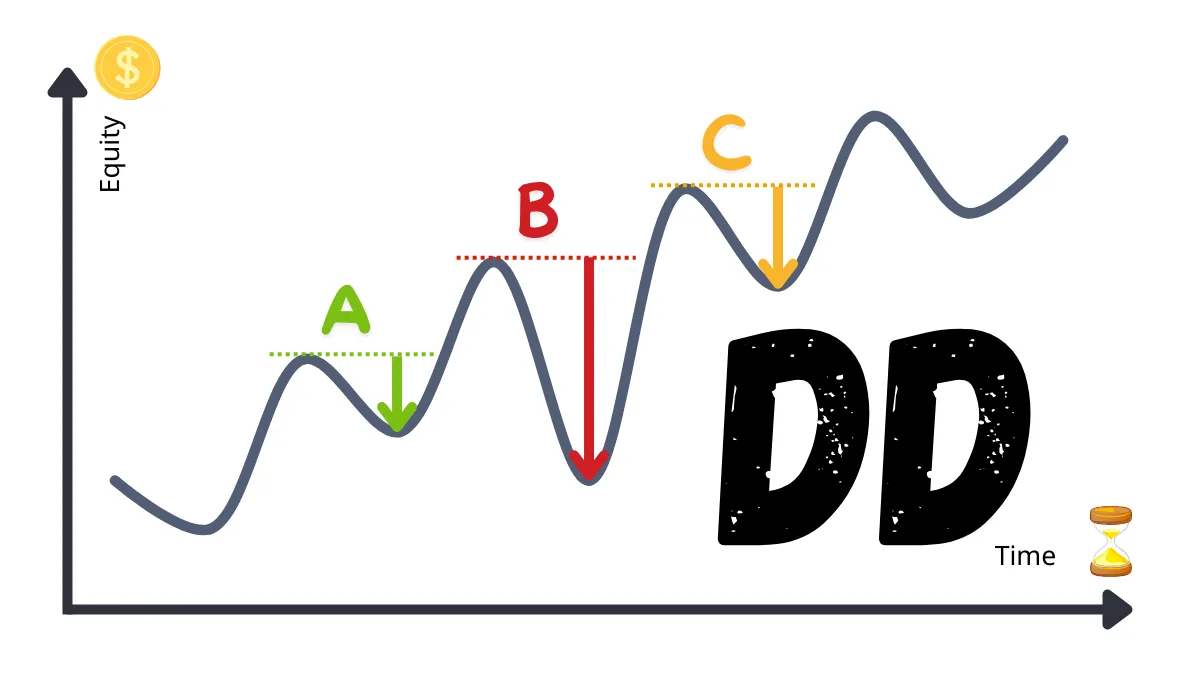

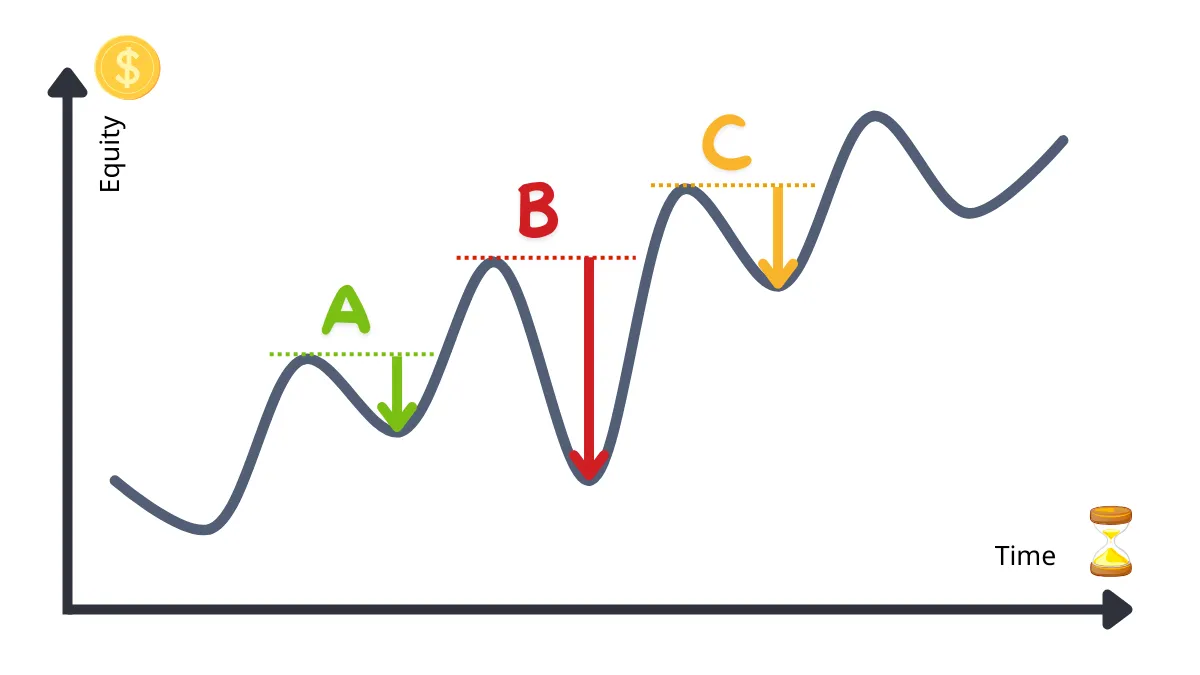

Drawdown refers to the reduction in trading capital from a peak to a trough over a certain period, usually expressed as a percentage. It is one of the important indicators for measuring trading risk and capital management.

2. How to determine if drawdown is too large?

Whether drawdown is too large usually depends on your capital size and risk tolerance. Generally, it is ideal to keep drawdown within 10% to 20%. If drawdown exceeds 50%, it may be necessary to reassess your trading strategy and risk management plan.

3. Does high leverage increase drawdown risk?

Yes. High leverage can amplify profits, but it also magnifies losses. When using high leverage, drawdown may expand rapidly, leading to capital loss. Therefore, it is recommended to reasonably control leverage ratios to avoid exceeding your own tolerance.

4. Can the divergence technique completely avoid drawdown?

The divergence technique is a tool for judging market reversals, but it cannot completely avoid drawdown, especially in strong market trends where it may fail. It is recommended to combine the divergence technique with other technical indicators or risk management strategies.

5. How should beginners control drawdown?

Beginners should adopt the following methods to control drawdown:

6. What should I do when drawdown is too large?

If drawdown exceeds your psychological expectations, it is recommended to stop trading immediately, analyze the problem, and adjust your strategy. Appropriately reduce positions, reassess the market and plan, and avoid continuing operations in an emotional state.

7. Is it possible to completely avoid drawdown?

Completely avoiding drawdown is unrealistic. Even the most successful traders experience drawdown, but they can effectively manage losses to ensure capital sustainability. The goal of drawdown management is to reduce losses and improve capital efficiency.

8. How to enhance psychological resilience when facing drawdown?

Enhancing psychological resilience can be achieved through the following ways:

What is drawdown? Why is it important?

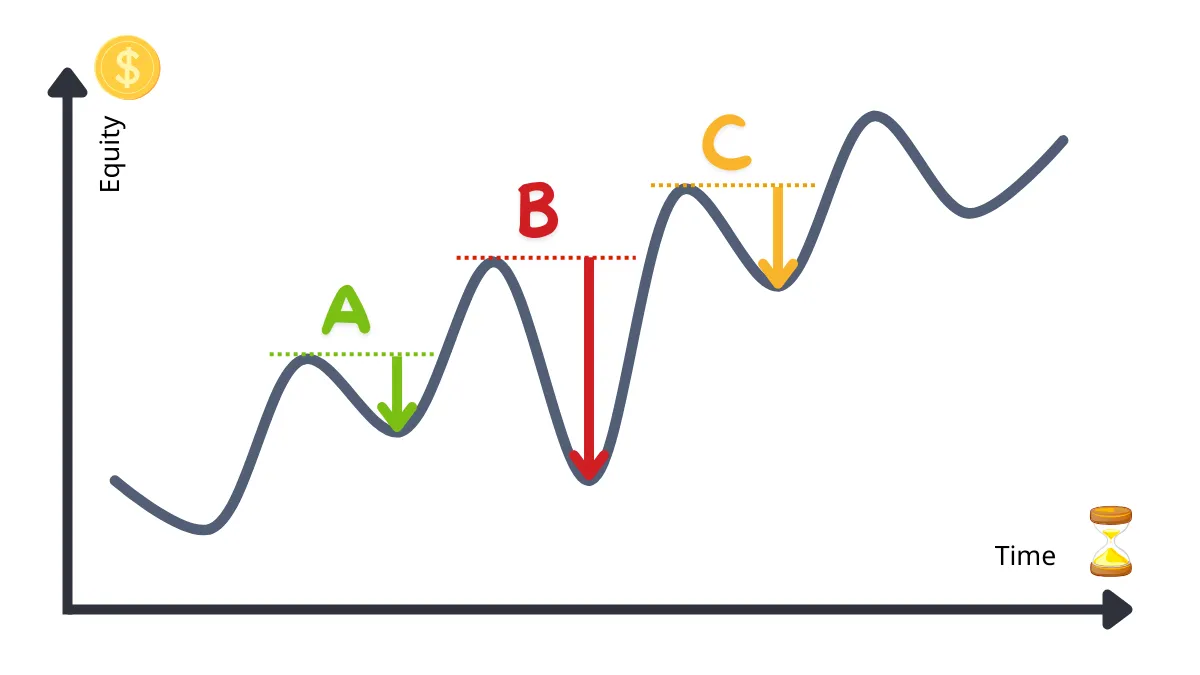

Drawdown, simply put, is the reduction in your account funds from a peak to a trough. To use a more intuitive metaphor, it is like the downhill process in a mountain biking race; although it can be thrilling, if managed properly, you can regain speed and continue racing.

In the image, A, B, and C are all "drawdown."

Among them, B has the largest magnitude, referred to as "max drawdown (Max Drawdown) "

Why is drawdown management important?

Drawdown represents risk. If not managed effectively, the loss of funds may exceed the bearable range, leading to the forced termination of trading plans. Therefore, properly managing drawdown can not only protect your principal but also give you enough time to participate in the next market wave.

Three common causes of drawdown

- Excessive market volatility

The foreign exchange market is influenced by multiple factors, and price fluctuations are often difficult to predict. Without appropriate risk management, sudden market changes can lead to significant drawdown. - Improper use of leverage

The leverage characteristic of foreign exchange margin trading is a double-edged sword. While high leverage can amplify profits, it can also magnify losses, and a slight misstep may lead to deep drawdown. - Trader psychological factors

Fear and greed are two major psychological barriers in trading. When market trends do not meet expectations, overtrading or delaying stop-loss can exacerbate drawdown.

How to effectively handle drawdown issues?

Here are two main drawdown handling strategies, each with its advantages and application scenarios:- Accept drawdown, focus on long-term gains

This strategy is suitable for traders with strong psychological resilience. They choose to accept short-term fluctuations and focus on the long-term gains that may be obtained in the larger trend.

Key points:- Set reasonable stop-loss ranges to avoid exiting too early.

- Strengthen psychological resilience to avoid letting short-term fluctuations affect trading judgment.

- Flexible operations to reduce drawdown magnitude

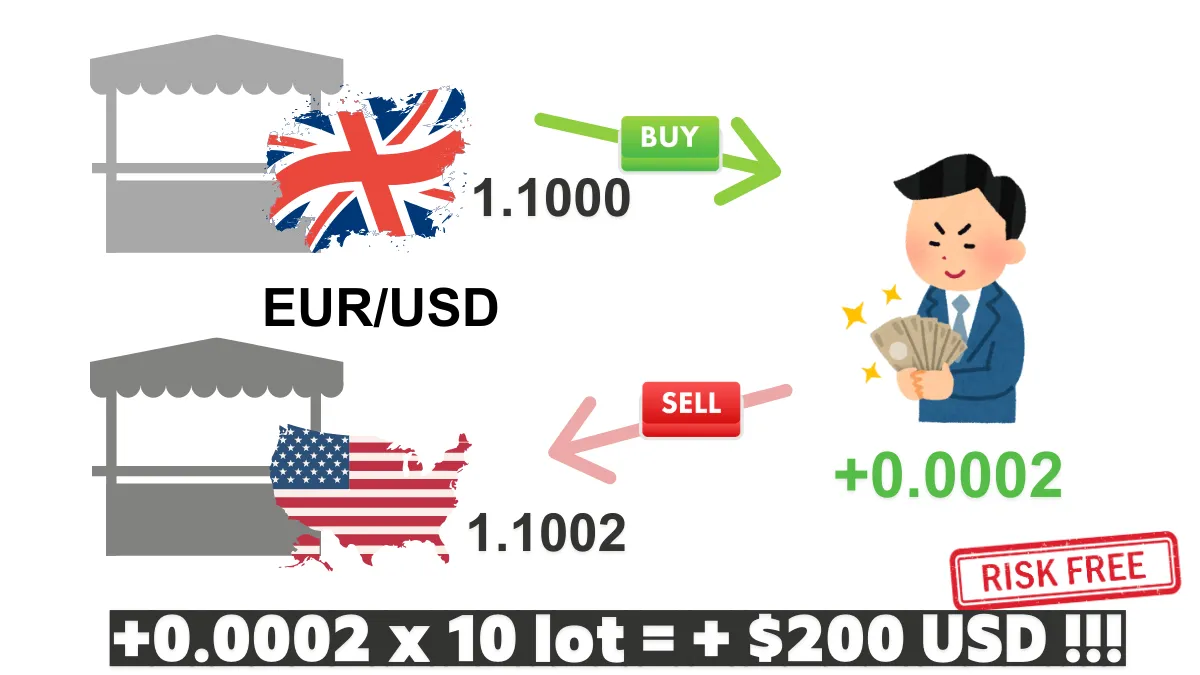

If you prefer short-term flexible operations, you can adopt the "rolling operation method." By buying low and selling high, you can reduce holding costs without changing the overall position.

Notes:- You must have proficient technical analysis skills to judge the short-term highs and lows of the market.

- Avoid frequent operations that may cause you to miss major market movements.

Divergence technique: A practical drawdown management tool

Technical analysis is crucial in drawdown management, and the "divergence technique" is one of its powerful tools. This is a method used to predict market reversals in advance by comparing price movements with technical indicators. Here are its core application principles:- Confirm divergence signals

When prices continuously reach new highs or lows, while technical indicators (such as MACD, RSI) fail to follow, a divergence signal has emerged. - Adopt divergence exit strategies

- If a top divergence occurs, it is recommended to reduce positions or close all positions when going long;

- If a bottom divergence occurs, you should immediately reduce positions or close positions when going short.

- Avoid the risk of indicator lagging

In strong market trends, the divergence technique may fail. Therefore, it should be supplemented with other risk management strategies.

Psychology and risk management: Core competencies for traders

When dealing with drawdown, psychological management and risk control are equally important. Here are some practical tips:- Develop a trading plan

Before each trade, set clear entry and exit points and risk tolerance ranges. - Strengthen psychological resilience

Cultivate stable emotional responses. You can try keeping a trading journal or practicing meditation to reduce the impact of emotional fluctuations on trading. - Follow the principle of "if in doubt, wait or withdraw"

If you are uncertain about the current market direction, choose to pause trading and reassess your strategy.

Conclusion: Drawdown management helps you go further

In foreign exchange trading, the core of drawdown management is not to completely avoid losses, but to preserve capital and maintain trading sustainability in an uncertain market. Whether you choose to endure drawdown or operate flexibly, the most important thing is to develop a trading plan that suits you and stick to it.Remember, successful traders do not avoid failure; they know how to learn from failure and turn drawdown into a stepping stone to success.

I hope this article inspires you to be more steady and confident in the foreign exchange market.

Frequently Asked Questions (FAQ)

1. What is drawdown?Drawdown refers to the reduction in trading capital from a peak to a trough over a certain period, usually expressed as a percentage. It is one of the important indicators for measuring trading risk and capital management.

2. How to determine if drawdown is too large?

Whether drawdown is too large usually depends on your capital size and risk tolerance. Generally, it is ideal to keep drawdown within 10% to 20%. If drawdown exceeds 50%, it may be necessary to reassess your trading strategy and risk management plan.

3. Does high leverage increase drawdown risk?

Yes. High leverage can amplify profits, but it also magnifies losses. When using high leverage, drawdown may expand rapidly, leading to capital loss. Therefore, it is recommended to reasonably control leverage ratios to avoid exceeding your own tolerance.

4. Can the divergence technique completely avoid drawdown?

The divergence technique is a tool for judging market reversals, but it cannot completely avoid drawdown, especially in strong market trends where it may fail. It is recommended to combine the divergence technique with other technical indicators or risk management strategies.

5. How should beginners control drawdown?

Beginners should adopt the following methods to control drawdown:

- Strictly set stop-loss points to avoid excessive greed.

- Start with small positions to reduce trading risk.

- Avoid frequent trading and adhere to the trading plan.

6. What should I do when drawdown is too large?

If drawdown exceeds your psychological expectations, it is recommended to stop trading immediately, analyze the problem, and adjust your strategy. Appropriately reduce positions, reassess the market and plan, and avoid continuing operations in an emotional state.

7. Is it possible to completely avoid drawdown?

Completely avoiding drawdown is unrealistic. Even the most successful traders experience drawdown, but they can effectively manage losses to ensure capital sustainability. The goal of drawdown management is to reduce losses and improve capital efficiency.

8. How to enhance psychological resilience when facing drawdown?

Enhancing psychological resilience can be achieved through the following ways:

- Practice meditation or mindfulness to stabilize emotions.

- Maintain a trading journal to review the decision-making process of each trade.

- Accept that drawdown is part of trading, focus on the long term, and concentrate on long-term gains.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.