What is EA Backtesting? Why is it Important?

'EA Backtesting' simulates the performance of an EA in the real market using historical data, thereby verifying the stability and profitability of the trading strategy. Its importance lies in:- Strategy Validation: Helps traders understand whether the EA can achieve stable profits over the long term.

- Parameter Optimization: Adjusts the risk control settings and strategy indicators of the EA to improve performance.

- Risk Identification: Understands max drawdown and potential loss range to avoid unexpected losses.

Steps for Backtesting Operation

Below is a complete EA backtesting tutorial, applicable to most traders using the MetaTrader 4/5 (MT4/MT5) platform:1. Install Expert Advisor (EA):

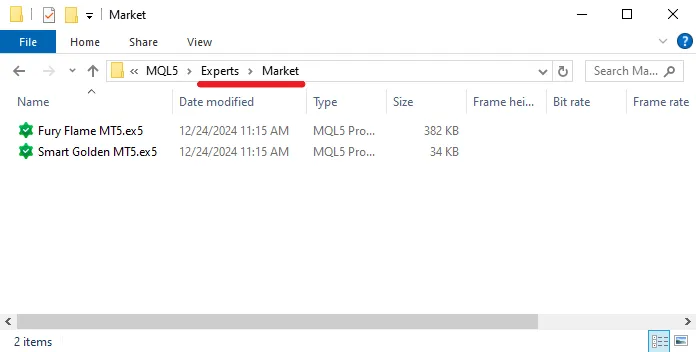

- Download the EA file (usually in .mq4, .ex4, .mq5, or .ex5 format).

- Place the file in the Market subfolder within the Experts folder of MetaTrader.

- Restart the platform to ensure the EA appears in the 'Expert Advisors' list in the Navigator.

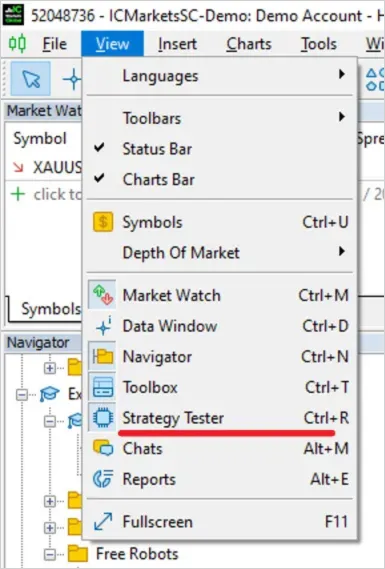

2. Open Strategy Tester:

- Find the Strategy Tester in the platform toolbar to enter the backtesting interface.

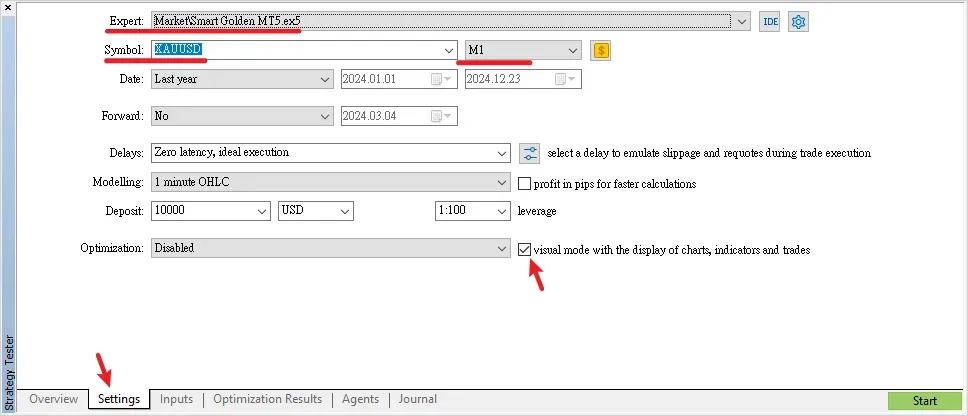

- Select the EA to be tested and make the following settings:

- Instrument: Choose a trading product type that matches the EA strategy (e.g., XAU/USD).

- Timeframe: Set the K-line period for backtesting (e.g., M15, H1).

- Historical Data: Download complete high-quality historical data to ensure testing accuracy.

3. Configure Backtesting Parameters:

- Enter the 'Settings' option of the tester to adjust the trading parameters of the EA:

- Capital Settings: Simulate initial capital and leverage ratio.

- Risk Control Settings: Adjust stop loss, take profit ratio, and maximum position size.

- Backtesting Mode: Choose point-by-point testing or open price only mode.

4. Execute Backtest:

Click the 'Start' button, and the strategy tester will execute the backtest based on historical data. Upon completion, the platform will generate a detailed backtest report containing the following key indicators:- Total Profit and Net Profit: The profitability of the EA.

- Max Drawdown: Reflects the risk of the strategy.

- Number of Trades and Success Rate: Evaluates the stability of the strategy.

5. Analyze Results:

A successful backtest should have the following characteristics:- Stable Upward Profit and Loss Curve: Indicates a robust and reliable strategy.

- High Profit Factor: Generally recommended to be greater than 1.5, indicating profit potential.

- Controllable Drawdown: It is recommended to keep max drawdown within 20%-30% of the initial capital.

6. Optimize Parameters:

Based on the backtest results, use the optimization feature of the strategy tester to adjust the key parameters of the EA (such as the period of moving averages, RSI overbought and oversold levels, etc.) to further enhance performance.Tips to Improve Backtesting Accuracy

- Use High-Quality Historical Data: Ensure data completeness to avoid false signals.

- Simulate Real Market Conditions: Include trading costs (such as spread, slippage) in the tests.

- Multi-Timeframe, Multi-Currency Pair Testing: Check the strategy's adaptability under different market conditions.

- Step-by-Step Optimization: Adjust parameters one by one to avoid overfitting.

Common Issues and Solutions in Backtesting

Backtest results are too ideal?Issue: May have overlooked slippage or trading costs.

Solution: Simulate real market conditions in the backtest.

Max drawdown too high?

Issue: Insufficient risk control in the strategy.

Solution: Adjust stop loss ratio to reduce risk per trade.

Real trading results do not match backtest?

Issue: Changes in market volatility or different server execution speeds.

Solution: Ensure the EA can adapt to dynamic markets.

Conclusion

Through the above tutorial, you have mastered the core techniques of EA backtesting. By continuously testing and optimizing, you will be able to create more stable and efficient trading strategies, helping you stand out in the foreign exchange market.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.