Introduction to Forex Breakout Strategy: Catching the Trend Start Point? Beware of False Breakouts!

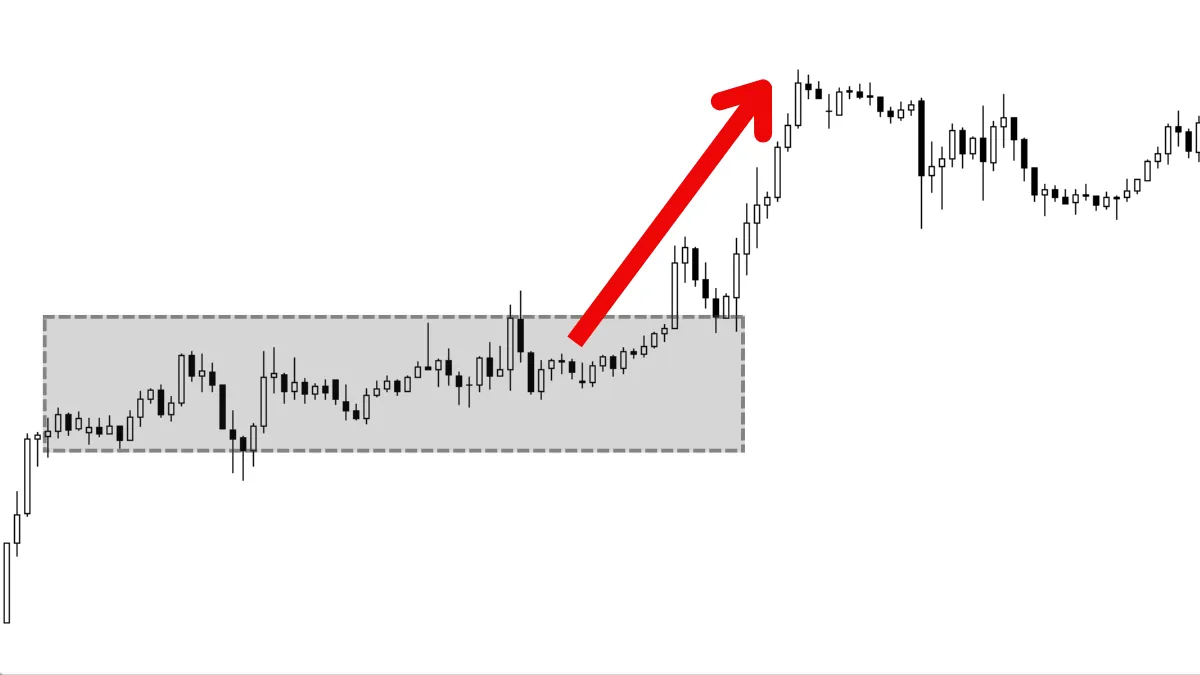

When you start learning technical analysis and observing price charts, you may notice that prices sometimes oscillate within a certain range for a period, then suddenly break free and move sharply in one direction.This behavior of price breaking through a key barrier is called a "breakout".

The trading method that attempts to enter the market during such breakouts to capture subsequent large price movements is called a "breakout strategy".

Breakout strategies attract traders because they can potentially catch the start or acceleration point of a trend.

However, they are also full of traps, the most famous being the "false breakout".

This article will briefly introduce the basic concepts of breakout strategies, how they work, their biggest risks, and what beginners should pay attention to when considering using this strategy.

1. What is a "Breakout"? Price Breaking Through Key Levels

On forex charts, a "breakout" refers to the decisive movement of a currency pair’s price beyond a previously tested and widely recognized key level or zone.These key levels usually include:

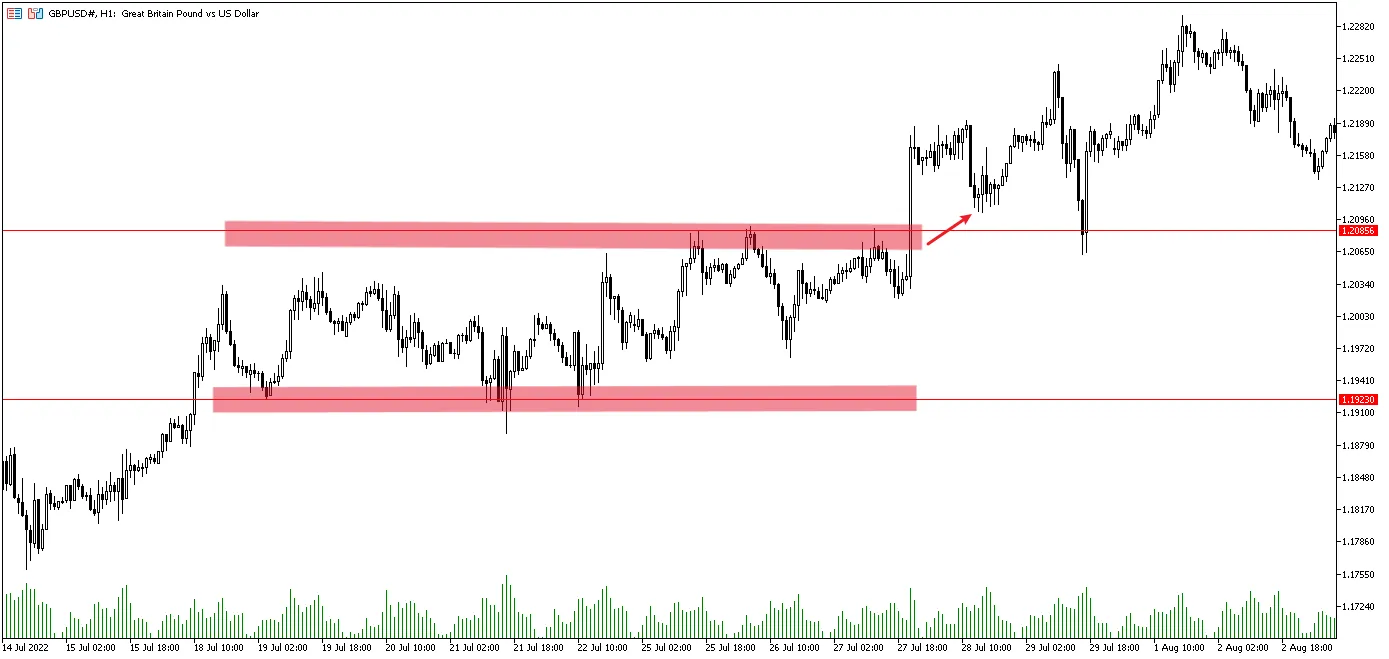

- Resistance: An upward breakout occurs when the price breaks through a resistance level that has previously prevented it from rising.

- Support: A downward breakout occurs when the price breaks below a support level that has previously prevented it from falling.

- Consolidation Pattern Boundary: For example, price breaking out of a triangle, rectangle (box), or flag consolidation pattern boundary.

You can imagine the price being "trapped" within a range, and a breakout means the price "escapes," possibly starting a new journey.

Accurately identifying these meaningful support, resistance, or pattern boundaries is the foundation of using breakout strategies (this requires knowledge of technical analysis and price action).

2. Basic Logic of Breakout Strategy: Following the Trend

The basic assumption behind the breakout strategy is that when the price powerfully breaks through an important barrier, it usually indicates a significant shift in the market’s supply and demand balance. The price is likely to continue moving in the breakout direction for some distance, potentially starting a new trend or continuing the existing one.Therefore, the core operational idea of breakout strategy is "following the trend":

- When the price breaks above resistance: breakout traders may choose to buy, expecting the price to continue rising.

- When the price breaks below support: breakout traders may choose to sell, expecting the price to continue falling.

3. The Biggest Challenge: Ubiquitous "False Breakouts" (False Breakout / Fakeout)

This is definitely the biggest difficulty and risk faced by breakout traders.

What is a false breakout? It refers to when the price appears to break through a key level, luring traders to enter, but fails to sustain the move and quickly reverses back into the original range or level.

Traders who enter at the breakout moment immediately face losses.

Why do false breakouts happen? There are many reasons, including: major market players testing levels, lack of sufficient follow-through momentum at breakout, brief "spike" moves around important news releases, and even "stop hunting" targeting retail traders’ stop-loss points.

Important recognition: False breakouts are extremely common in the forex market!

This is why the seemingly simple "enter on breakout" strategy is often difficult to apply successfully and has a low success rate.

Beginners are especially prone to being misled by false breakouts and suffering losses.

4. How to Deal with False Breakouts? (Advanced Considerations, Overview)

Experienced traders usually do not enter immediately when the price just touches a level. They use methods to filter signals or seek confirmation to improve breakout reliability (but note, no method can 100% avoid false breakouts):- Wait for candle close confirmation: Do not enter as soon as the price touches or crosses the level, but wait for the current candle (e.g., 1-hour or 4-hour candle) to close. If the close price remains beyond the breakout level, the breakout is considered more likely.

- (If applicable) Observe volume: In some markets (volume data in forex is relatively opaque and this method is less used), a breakout accompanied by significantly increased volume may indicate high market participation and stronger breakout intent.

- Wait for price retest: This is a commonly used method. After the breakout, do not chase immediately but wait for the price to pull back and retest the broken level (e.g., a resistance turned support after an upward breakout). If the level holds during the retest and shows signs of bouncing again, consider entering. This method is more robust but may miss strong moves without retests.

- Combine with other technical indicators: For example, require that at breakout, a momentum indicator (like RSI) also shows strength, or the price breaks an important moving average, as additional confirmation.

Key point: Dealing with false breakouts is about managing probabilities and risks, not chasing a perfect signal.

5. Risk Management in Breakout Strategy

Due to the existence of false breakouts, strict risk management is crucial for breakout strategies:- Must set stop-loss orders: This is a strict rule! Once entering a trade, immediately set a stop-loss to limit losses if the breakout fails (turns into a false breakout).

- Common stop-loss placement: Usually set on the opposite side of the broken level. For example, for a buy on an upward breakout of resistance, place stop-loss a certain distance below that resistance; for a sell on a downward breakout of support, place stop-loss a certain distance above that support.

- Reasonable position sizing: Calculate appropriate trading lot size based on your stop-loss distance and the risk amount you are willing to take on the trade (e.g., 1% of your total account capital). Ensure that even if stop-loss is triggered, the loss is within your plan.

6. Is Breakout Strategy Suitable for Beginners?

Attraction: The concept of breakout is relatively intuitive (breaking through barriers) and depicts the possibility of catching early large trend moves, which is attractive to beginners.Challenges for beginners:

- Accurately identifying meaningful support/resistance levels or chart patterns requires extensive practice and experience.

- Effectively dealing with frequent false breakouts is a huge test of psychology and capital.

- Depending on different confirmation methods, quick decision-making or patient waiting is required, demanding execution discipline.

Recommendations:

- Beginners should learn to identify potential breakout points on charts, as this is an important market behavior pattern.

- However, it is not recommended for beginners to rely mainly on simple breakout signals at the start, especially "naked breakouts" without any filtering or confirmation. The traps of false breakouts are numerous.

- Beginners may find it easier to start by learning to follow established trends (e.g., looking for opportunities during trend pullbacks) or trading within clear ranges.

- If you really want to try breakout strategies, be sure to: practice extensively on a Demo Account; focus on breakouts aligned with the main trend direction (e.g., only upward breakouts in a strong uptrend) ; use some confirmation methods (like waiting for candle close or retest) ; and most importantly, implement very strict risk management.

Conclusion

The breakout strategy is a trading method that attempts to enter when the price decisively breaks through key technical levels (support, resistance, or pattern boundaries) to capture potential new or continuing trends.It has the potential to catch big moves, but its biggest challenge is dealing with the widespread "false breakouts".

For beginners, understanding the concept of breakouts is important, but trading breakouts directly (especially unconfirmed breakouts) can be very challenging.

It is recommended that beginners approach with caution, prioritize learning more basic trend-following or range trading methods, and if attempting breakout trading, strengthen confirmation steps and place risk management as the absolute priority.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.