Forex Day Trading Unveiled: Same-Day Buying and Selling, Opportunities and Challenges Coexist

In the world of forex trading, "day trading" is a well-known term.As the name suggests, the core feature of this trading style is that all trades are completed within the same trading day, from opening to closing positions, never holding positions overnight.

For traders who want to avoid overnight market uncertainty risks, this seems like an attractive option.

But is day trading really as simple as it sounds? What skills and commitments does it require? Is it suitable for forex beginners just starting out?

This article will take you deep into the definition of day trading, typical practices, advantages and disadvantages, and what beginners need to pay attention to when considering this fast-paced style.

1. What is Day Trading?

Day trading is a trading strategy whose core principle is to close all open positions before the market trading hours end on the same day.Whether the trades are profitable or at a loss, positions are never held overnight to face the next day’s market opening.

Differences from other styles:

It holds positions slightly longer than scalping (Scalping), with trades lasting from a few minutes to several hours.

It holds positions much shorter than swing trading (Swing Trading), which can last several days or even weeks.

Goal: The goal of day traders is to profit from market price fluctuations within a single day, capturing intraday ups and downs.

2. Typical Practices of Day Traders

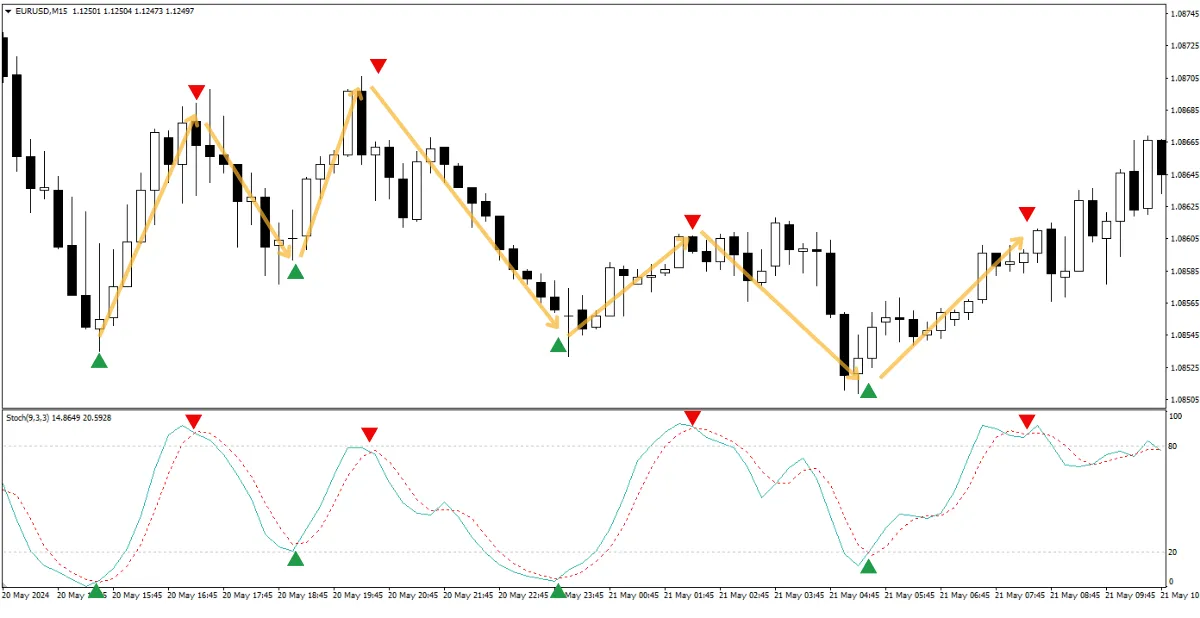

To complete trades and profit within a single day, day traders usually have the following characteristics:- Focus on Timeframes: They mainly analyze shorter timeframe charts, such as 1-hour chart (H1), 30-minute chart (M30), 15-minute chart (M15), and even shorter 5-minute chart (M5), to more precisely identify intraday entry and exit signals. Sometimes they also refer to slightly longer timeframes (such as 4-hour chart H4 or daily chart D1) to judge the possible main direction or important support/resistance levels of the day’s market.

- Main Analysis Methods:

- Heavily reliant on technical analysis: Day trading focuses heavily on technical analysis applied to short-term charts. Traders look for intraday trends, key price breakouts, chart patterns within short timeframes, and use more responsive technical indicators (such as moving average combinations, stochastic oscillator, Bollinger Bands, etc.).

- Attention to intraday economic data/news: Although not as deeply involved in macroeconomics as long-term traders, day traders must closely monitor the Economic Calendar to understand which important economic data or news events will be released during their active trading hours, as these events can trigger sudden and intense market volatility.

- Trade Execution and Management: Day trading requires making relatively frequent trading decisions throughout the day, demanding quick reactions. Usually, tighter stop-loss orders (closer stops) are set to control risk. The most important discipline is: no matter what, close all positions before market close.

3. Advantages of Day Trading

- Avoidance of overnight risk: This is the most significant advantage of day trading. Not holding positions overnight means traders can completely avoid the huge "gap" risk caused by major unexpected news or events during the night that may affect prices at the next day’s open, and also avoid paying or considering "swap/overnight interest".

- Faster feedback and learning cycle: Trades conclude within the same day, whether profit or loss, allowing traders to quickly test whether their strategies are effective, with a relatively short learning and adjustment cycle.

- Utilizing intraday volatility opportunities: Even on days without a clear major trend, the market often presents tradable volatility intraday. Day traders can focus on capturing these short-term price fluctuations.

4. Challenges and Risks of Day Trading

- Requires significant time and effort: This may be the biggest challenge for beginners. Successful day trading usually requires traders to stay focused on the market during the most active trading sessions (such as London and New York sessions) for extended periods, performing analysis, decision-making, and management. This is difficult to reconcile with a 9-to-5 full-time job or other time-consuming commitments.

- High psychological pressure and decision frequency: The market changes rapidly intraday, requiring traders to constantly make buy, sell, or hold decisions and manage ongoing trades, which can bring considerable psychological stress.

- Trading costs can accumulate quickly: Although the spread or commission per trade may not be high, the typically high frequency of day trading (multiple trades per day) can cause these costs to accumulate significantly, impacting profitability.

- Prone to "overtrading": Long hours of watching the market can cause boredom or anxiety, leading to impulsive trades outside of planned strategies or weak signals. This is called "overtrading" and is a common cause of losses.

5. Is Day Trading Suitable for Beginners?

Main barriers: For most beginners, the main obstacles to day trading are its demanding time commitment and the high level of self-discipline and emotional control required.Potential risks: The fast-paced trading environment combined with the cumulative effect of trading costs means that without proper risk management or discipline, beginners can easily suffer significant losses in a short time.

Recommendations: Although day trading’s "same-day completion" and avoidance of overnight risk are attractive features, overall it is usually more challenging and riskier for unprepared beginners compared to swing trading.

If a beginner truly has ample free time during active market hours, is passionate about learning, and confident in maintaining high self-discipline, then after thorough theoretical study, extensive simulated trading practice (especially practicing risk control and money management), and establishing realistic profit expectations, they can cautiously try day trading.

However, it must never be regarded as an easy shortcut to making money.

Conclusion

Day trading is a trading style that requires closing all positions within the same day, aiming to capture intraday price fluctuations and avoid overnight risk.Its advantages are no overnight risk and fast feedback, but its disadvantages include requiring significant time and effort, high psychological pressure, and easily accumulating trading costs.

Although day trading is very popular, its high demands make it a relatively difficult starting point for beginners with limited time, insufficient experience, or self-discipline that needs improvement.

In contrast, if patience is present, swing trading may be a relatively easier and more manageable entry choice.

Regardless of the style chosen, solid learning, sufficient simulated practice, and strict risk management are indispensable success factors.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.