Forex Fundamentals: Understanding Central Bank "Monetary Policy" Tightening and Easing

We know that central banks are the "helmsmen" of the forex market, using tools like interest rate adjustments to try to steer the economic ship smoothly forward.The series of actions and overall strategic direction taken by central banks at different times constitute what is called "monetary policy."

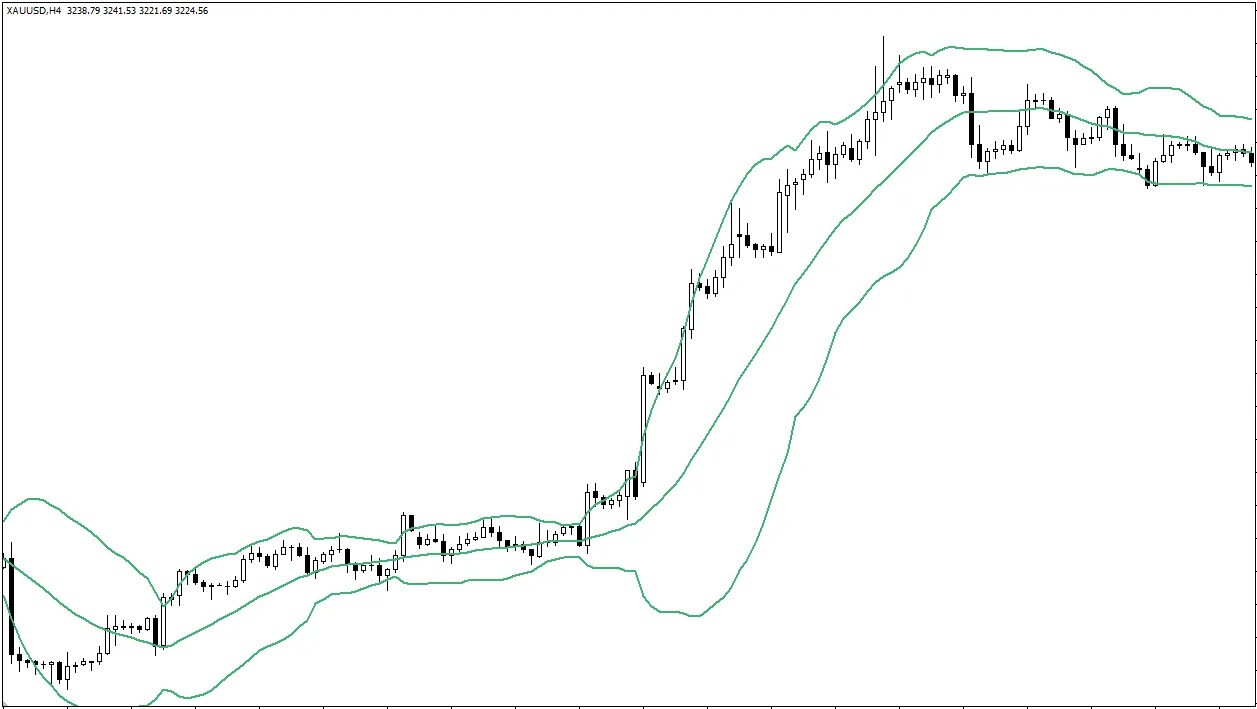

The tone of this policy—whether it tends to "apply the brakes" or "step on the gas" for the economy—directly affects interest rate levels, which in turn have a profound impact on exchange rates.

Monetary policy may sound somewhat academic, but it is actually one of the key keys to understanding the big picture of the forex market.

Figuring out whether the central banks of major countries are currently inclined to "tighten" or "ease" liquidity will help you better understand market dynamics and potential trends.

This article will simply explain what monetary policy is, the two main stances it takes (tightening and easing), what they mean respectively, and how they affect the forex market.

1. What is Monetary Policy? The Central Bank's "Overall Regulatory Guideline"

Monetary policy can be understood as a series of measures and strategies adopted by a country's central bank to achieve its macroeconomic goals (mainly price stability and promoting employment/economic growth) by managing the domestic money supply (the amount of money circulating in the market) and credit conditions (the ease and cost of borrowing).Simply put, it is the method the central bank uses to regulate the overall "gate" and flow of money nationwide.

2. Main Tools of Monetary Policy (Quick Review)

Central banks have different toolkits to implement monetary policy, which we have previously highlighted:- Benchmark Interest Rate: This is the most commonly used and directly impactful tool. By adjusting this rate, the central bank can influence the borrowing costs across the entire economy.

- Other Tools:

- Reserve Requirements: Regulations requiring commercial banks to keep a certain proportion of deposits as reserves, which cannot be lent out. Adjusting this ratio affects banks' lending capacity.

- Open Market Operations: The central bank buys or sells government bonds and other securities in the market to inject or withdraw funds. Recently, terms like "Quantitative Easing (QE) " refer to large-scale asset purchases, while "Quantitative Tightening (QT) " refers to the opposite operation.

The common purpose of these tools is to make funds and credit in the market more expensive and harder to obtain (tightening), or cheaper and easier to obtain (easing).

3. Two Main Stances of Monetary Policy: Tightening vs. Easing

Depending on the central bank's goals (whether to curb inflation or stimulate growth), monetary policy usually falls into two main tones or stances:- Contractionary / Tightening Monetary Policy:

- Goal: Typically adopted when economic growth is too fast and inflationary pressures are high. The aim is to cool down the economy and control price increases. Central banks holding this stance are called "hawkish."

- Common Measures: Raising the benchmark interest rate is the primary tool. It may also be combined with asset sales (QT) or raising reserve requirements.

- Expected Economic Impact: Increases borrowing costs, suppresses investment and consumption, may slow economic growth, and helps reduce inflation.

- Expected Exchange Rate Impact: Generally positive (bullish) for the domestic currency. Higher interest rates attract foreign capital seeking higher returns, increasing demand for the domestic currency.

- Expansionary / Easing Monetary Policy:

- Goal: Usually adopted when economic growth is weak, facing recession risks, or inflation is too low or there is deflation risk. The aim is to stimulate economic activity, encourage borrowing and spending. Central banks holding this stance are called "dovish."

- Common Measures: Lowering the benchmark interest rate is the primary tool. It may also be combined with asset purchases (QE) or lowering reserve requirements.

- Expected Economic Impact: Reduces borrowing costs, stimulates investment and consumption, may boost economic growth and employment, but can also push inflation higher.

- Expected Exchange Rate Impact: Generally negative (bearish) for the domestic currency. Lower interest rates reduce the attractiveness of domestic currency assets, potentially leading to capital outflows.

4. How to Judge Whether Current Monetary Policy is Tight or Loose?

To understand the current monetary policy tone of a central bank, you need to pay attention to:- Official Central Bank Statements: Monetary policy statements released after each interest rate decision directly explain the central bank's view on the economy and policy stance. Carefully reading the wording reveals whether they are more concerned about inflation (likely tightening) or economic growth (likely easing).

- Public Speeches by Central Bank Officials: Speeches and interviews by the central bank governor, chairperson, and other key decision-makers often reveal their views on future policy direction (i.e., "forward guidance"). The market carefully analyzes whether the tone is "hawkish" or "dovish."

- Actual Interest Rate Trends and Market Expectations: Observe recent interest rate adjustment history and market expectations for future rate paths (via interest rate futures and other tools).

- Performance of Key Economic Data: Persistent strong inflation and employment data may increase pressure on the central bank to tighten policy; conversely, weak data may increase the likelihood of easing. Monetary policy is usually "data-dependent."

5. The Significance of Monetary Policy for Beginners: Grasping the Big Picture

As a forex beginner, you may not need to study every detail of monetary policy as professional analysts do, but understanding its basic direction is very important:- Provides Macro Background: Knowing whether the central banks of major economies (such as the US and Eurozone) are currently in a "tightening cycle" or "easing cycle" helps you judge whether the fundamental outlook of related currencies is strong or weak in the medium to long term, providing a directional reference for your trading.

- Explains Market Volatility Causes: Often, large forex market fluctuations stem from changes in market expectations of monetary policy. Understanding this helps you better grasp why certain news or data trigger such significant moves.

- Assists in Filtering Trading Signals: Although monetary policy itself is not a direct buy or sell signal, it can help you filter technical analysis signals. For example, in a clearly tightening (hawkish) central bank environment, you might have more confidence in technical buy signals and be more cautious with sell signals.

- Enhances Risk Awareness: Knowing the central bank's meeting schedule and potential policy shift risks helps you better manage trading risks and avoid overexposure at critical moments.

Conclusion

Monetary policy is the overall strategy and actions used by central banks to regulate the economy and achieve their goals (such as price stability and promoting employment).It mainly influences market liquidity and borrowing costs by adjusting benchmark interest rates and other tools, and can generally be divided into two major types: "tightening" (hawkish) policies aimed at curbing inflation, and "easing" (dovish) policies aimed at stimulating the economy.

Understanding the monetary policy tone of major central banks and its possible changes is crucial for grasping medium- to long-term forex market trends and understanding market volatility.

For beginners, the focus should be on monitoring central bank statements and key economic data to understand the current policy direction (tightening or easing), using this as a basis to judge the macro background of the market, combined with risk management awareness, rather than attempting short-term forecasts or trades based solely on monetary policy.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.