Types of Forex Orders

In forex trading, different types of orders allow traders to flexibly manage trades and execute buy and sell operations based on market conditions. Each type of order has its specific function, helping you trade in different ways to achieve your trading goals.

Here are the most common types of orders in forex trading and their uses:

1. Market Order

Market Order is the most basic and commonly used type of order, indicating that the trader is willing to buy or sell a currency pair immediately at the current market price. This type of order is executed instantly, as it is filled at the current market's ask or bid price.

- Buy Market Order: When you want to buy a currency pair immediately at the market's ask price.

- Sell Market Order: When you want to sell a currency pair immediately at the market's bid price.

Market orders are suitable for traders who want to quickly enter or exit the market, especially during high volatility or when important economic data is released, as these orders ensure you transact at market prices.

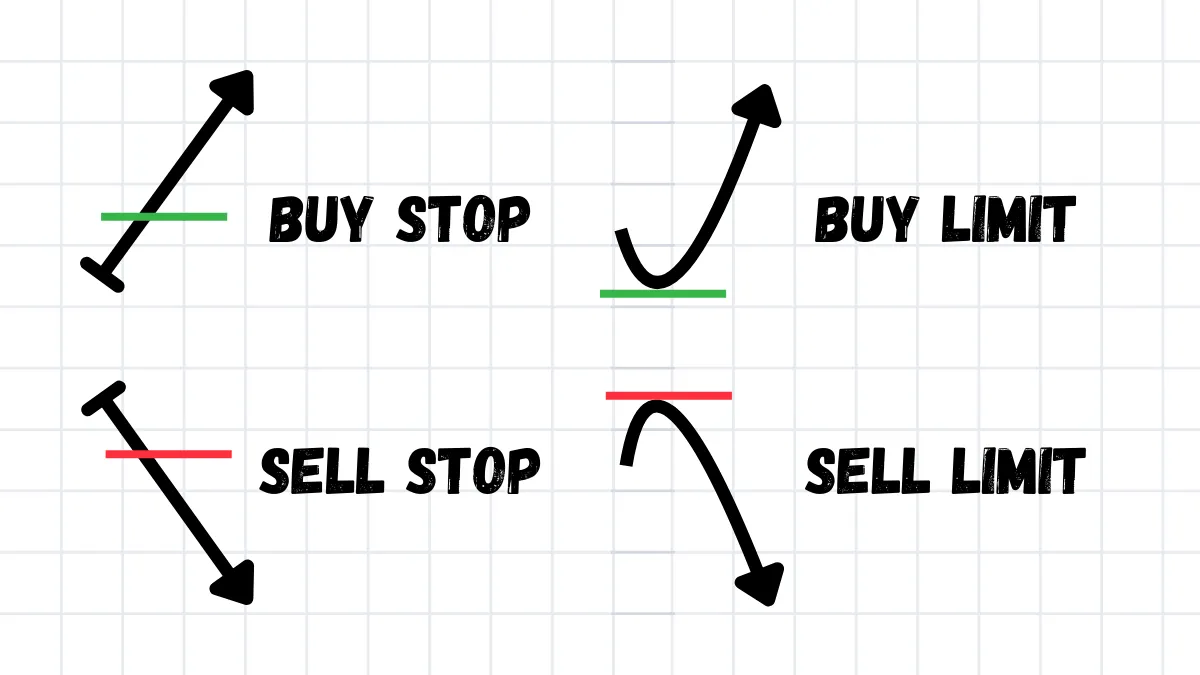

2. Limit Order

Limit Order is a conditional order that allows you to set a specified price to buy or sell a currency pair. This type of order will not be executed immediately but will trigger when the market price reaches your target price. (In the following examples, the blue dot represents the current market price)

- A. Buy Limit: You set a price below the current market price to buy. For example, if the current price of EUR/USD is 1.1050, you can set a buy limit order at 1.1020, waiting for the price to drop to this level to buy automatically.

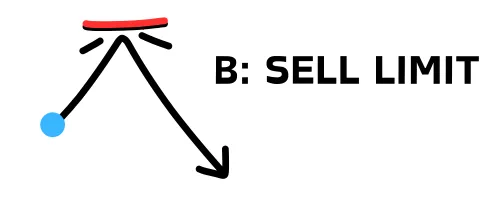

- B. Sell Limit: You set a price above the current market price to sell. For example, when the current price of EUR/USD is 1.1050, you can set a sell limit order at 1.1080, waiting for the price to rise to that level to sell automatically.

3. Stop Loss Order

Stop Loss Order is used to limit losses. When the price reaches your set stop loss price, the stop loss order will be executed automatically, helping you avoid further losses. (In the following examples, the blue dot represents the current market price)

- C. Buy Stop: You can set a price above the current market price, and when the price rises to that level, a buy operation will be executed automatically, which is usually used to capture market breakout opportunities.

- D. Sell Stop: You set a price below the current market price, and when the market falls to that level, a sell operation will be executed automatically, which can limit losses.

Stop loss orders are suitable for all traders, especially those who wish to manage risk and avoid unlimited losses.

4. Take Profit Order

Take Profit Order is used to lock in profits. When the market price reaches your target price, the take profit order will automatically execute a close, helping you realize the established profit.

For example, if you bought EUR/USD at 1.1050, you can set a take profit order at 1.1100, and when the price rises to 1.1100, the trade will automatically close, ensuring your profit.

Take profit orders are suitable for those who wish to automatically lock in profits after reaching target prices, thus avoiding missing profit opportunities due to market reversals.

5. Stop Limit Order

Stop Limit Order is a combination of stop loss and limit orders. It allows you to set a stop loss price and a limit price, and when the price reaches the stop loss price, it triggers a limit order, which will only execute when the market price reaches your set limit range.

- Buy Stop Limit: When the market price rises to the stop loss price, it triggers a buy limit order, but it will only execute when the market price is below the set limit.

- Sell Stop Limit: When the market price falls to the stop loss price, it triggers a sell limit order, but it will only execute when the market price is above the set limit.

Stop limit orders are suitable for those who wish to have more precise control over trade execution prices, especially in high volatility markets to avoid price slippage.

6. Trailing Stop Order

Trailing Stop Order is a dynamic stop loss order that automatically adjusts with market price changes. It can help you lock in profits while protecting you from market reversals.

- Trailing Sell Stop: When the market price rises, the trailing stop order will automatically move up, following market changes. When the price reverses and reaches the set distance, the trade will automatically close.

- Trailing Buy Stop: When the market price falls, the trailing stop order will automatically move down, following market changes. When the price reverses and reaches the set distance, the trade will automatically close.

For example, if you buy EUR/USD and set a trailing stop order of 50 pips, when the price rises by 50 pips, the stop loss price will automatically adjust up by 50 pips. If the price falls back by 50 pips, your trade will automatically close, protecting profits.

- Trailing Sell Stop is suitable for those who wish to lock in more profits during market uptrends.

- Trailing Buy Stop is suitable for those who wish to control trading risks during market downtrends.

Summary

There are various types of orders in forex trading, each with specific uses, helping traders operate flexibly under different market conditions. Understanding these order types and their applications can not only help you better manage risk but also enhance your trading efficiency.

Whether you are a beginner trader or an experienced expert, choosing the right type of order can help you achieve your trading goals.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.