Introduction to Forex Trading Styles: Understanding Different Types of Trading and Basic Strategies

Once you have a basic understanding of forex market concepts such as currency pairs, pips, lot size, margin, leverage, spread, and quotes, you might wonder: "So, how should I start trading? How do traders decide when to buy or sell?"In reality, forex traders develop different trading styles and strategies based on their time availability, risk tolerance, personality traits, and market understanding.

There is no one-size-fits-all method.

The purpose of this article is to introduce several common trading types (mainly classified by holding time) and the two main analytical approaches used to build trading strategies, helping you gain a preliminary understanding of how to make decisions in the forex market.

1. Trading Styles: Types Determined by Holding Time

The most common way to distinguish different trading styles is by how long traders usually hold their positions (i.e., maintain a buy or sell status):- Scalping:

- Definition: This is a very short-term trading method with extremely short holding times, usually only a few seconds to a few minutes.

- Goal: Not aiming for large price movements but hoping to conduct many trades within a day, earning very small profits each time (possibly just a few pips or less), accumulating over time.

- Characteristics: Requires high concentration, quick decision-making, and execution skills. Very sensitive to trading costs (especially spread). Traders usually need to monitor the market for long periods.

- Suitability for Beginners: Generally not recommended for beginners due to high stress, demanding technical and psychological skills, and significant impact from trading costs.

- Day Trading:

- Definition: Opening and closing positions within the same trading day, without holding positions overnight.

- Goal: Capture price fluctuation opportunities within the day.

- Characteristics: Requires investing considerable time during the trading day to analyze the market and monitor positions. Can avoid risks associated with overnight holding (such as market gaps or paying swap fees).

- Suitability for Beginners: Less stressful than scalping but still requires significant time and effort to learn intraday chart analysis and quick reactions.

- Swing Trading:

- Definition: Holding positions usually from several days to several weeks.

- Goal: Capture more obvious "swings" or trending movements formed over a period.

- Characteristics: Compared to day trading, does not require constant monitoring; checking a few times a day may suffice. Mainly relies on daily or weekly chart analysis. Needs to consider risks and costs of overnight holding and swap fees.

- Suitability for Beginners: A relatively feasible option for those who cannot monitor the market full-time. Requires patience to hold positions and the ability to withstand some floating profit and loss.

- Position Trading:

- Definition: Very long holding times, possibly lasting weeks, months, or even years.

- Goal: Profit from very long-term macro trends.

- Characteristics: Highly dependent on in-depth analysis of economic fundamentals, monetary policy, and long-term supply and demand relationships. Short-term market noise is basically ignored. Requires great patience, strong conviction, and sufficient capital to withstand significant price drawdowns.

- Suitability for Beginners: Requires solid macroeconomic analysis skills and excellent patience; may not be suitable for beginners seeking quick feedback and learning.

2. Strategy Basics: The Two Major Analytical Schools

Regardless of which trading style you choose, you need a method or strategy to help you decide "when to buy?", "when to sell?", and "when to exit?"The establishment of these strategies usually relies on the following two main market analysis methods (which we will introduce in more detail in future articles):

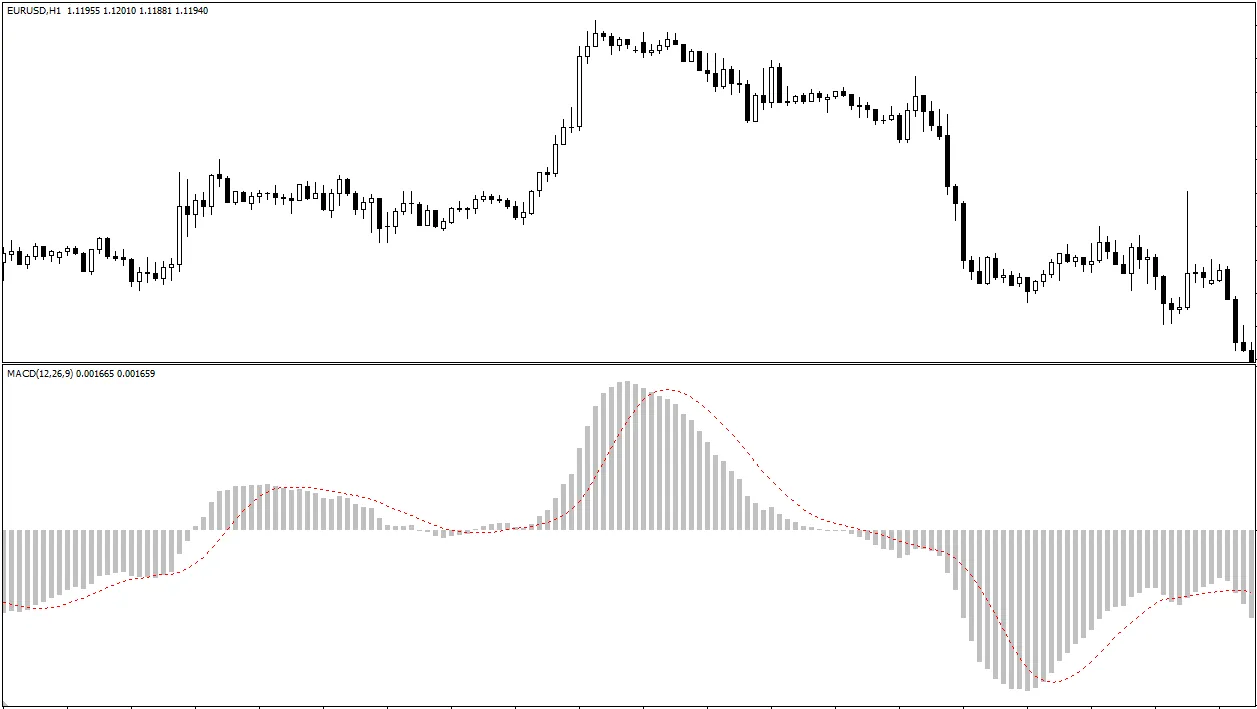

- Technical Analysis:

- Core Idea: Believes that all market-influencing information is contained in historical price movements and trading volume data, and future price trends can be predicted by analyzing past chart patterns.

- Common Tools: Trend lines, support and resistance levels, candlestick patterns, moving averages, Relative Strength Index (RSI), and various technical indicators.

- Focus: What is the price "doing"?

- Fundamental Analysis:

- Core Idea: Evaluates the "intrinsic value" of a currency by analyzing macroeconomic factors, political conditions, social events, etc., that affect a country's currency value, and predicts its long-term trend.

- Focus Factors: Interest rates, inflation, employment data, GDP growth, trade balance, government policies, election results, etc.

- Focus: Why is the price "moving"?

In practice, many traders combine technical and fundamental analysis to complement each other.

3. Key Advice for Beginners

With so many trading styles and analytical methods, how should beginners start?- There is no "best," only "suitable": There is no universally best trading style or strategy. The most important thing is to find a method that fits your personal situation (available time, risk preference, personality).

- Start by knowing yourself: Honestly assess how much time you can spend daily on market watching and learning. How much potential loss can you tolerate? Do you prefer quick decisions or careful deliberation?

- Build a solid analytical foundation: Regardless of your future preferred style, learning the basics of technical and fundamental analysis is essential. They are the cornerstone of any trading plan you develop.

- Demo Account is a testing ground: Don’t rush to determine your style. In a Demo Account, try observing charts of different timeframes (e.g., daily vs. 15-minute charts), feel the psychological changes brought by different holding times, and find a rhythm that feels relatively comfortable for you.

- Simplicity is key: As a beginner, don’t chase complex strategies that sound flashy but you cannot fully understand. Starting with simple, clear, and explainable rules often works better.

- Risk management is fundamental: No matter what style or strategy you adopt, risk management must be prioritized. Setting stop-losses and reasonably planning position sizes (lot sizes) are the foundation for your long-term survival in the market.

Conclusion

Forex trading offers diverse ways to participate.Different trading styles (scalping, day trading, swing trading, position trading) suit different time commitments and risk preferences, and trading decisions are usually based on technical analysis, fundamental analysis, or a combination of both.

As a beginner, the important thing is not to immediately find a "magical" strategy but to first understand the possibilities, know yourself, and build a solid analytical foundation.

Start with simple methods, explore through simulated trading, and most importantly, always put risk management first.

This way, you can find your own sustainable trading path in this market full of opportunities and challenges.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.