How to Interpret the US Dollar Index

Basic Concepts of the US Dollar Index

The US Dollar Index (USD Index, USDX) is an indicator used to measure the value of the US dollar relative to a basket of major currencies. It shows the strength or weakness of the dollar in the global market by tracking changes in the dollar against other currencies, providing an overall trend of the dollar. To correctly interpret the US Dollar Index, it is necessary to understand its calculation method, composition, and influencing factors.Reading the US Dollar Index

The benchmark value of the US Dollar Index is set at 100, which means that when the US Dollar Index is 100, it indicates that the value of the dollar is equal to the benchmark value at the time the index was established (1973). If the index is above 100, it indicates that the dollar's value has strengthened relative to other currencies; if below 100, it indicates that the dollar has weakened.For example:

- US Dollar Index = 110: The dollar has strengthened by 10% compared to the benchmark value.

- US Dollar Index = 90: The dollar has weakened by 10% compared to the benchmark value.

Reasons for Changes in the US Dollar Index

The changes in the US Dollar Index are influenced by various economic and market factors. Here are some major influencing factors:- Interest Rates: The Federal Reserve's interest rate policy has a direct impact on the US Dollar Index. When the Federal Reserve raises interest rates, the dollar typically strengthens, leading to an increase in the US Dollar Index; conversely, a rate cut weakens the dollar.

- Economic Data: Economic data from the US, such as GDP growth rate, unemployment rate, and inflation data, can affect market expectations for the dollar, thereby influencing the US Dollar Index. Strong economic data usually boosts the US Dollar Index, as it indicates a healthy US economy and increases foreign investors' demand for the dollar.

- Political and Geopolitical Events: The political stability of the US and global geopolitical events can also affect the US Dollar Index. For example, political instability or international crises may lead investors to seek the dollar as a safe-haven asset, causing the US Dollar Index to rise.

How to Interpret the Trends of the US Dollar Index

Reading the charts of the US Dollar Index can help traders understand the trends of the dollar and make corresponding investment decisions. Here are some important tips for reading the US Dollar Index charts:-

Trend Analysis:

- Uptrend: When the US Dollar Index shows a continuous increase, it indicates that the dollar is strengthening. This may be a positive signal for going long on dollar-related currency pairs (e.g., USD/JPY).

- Downtrend: When the US Dollar Index shows a continuous decrease, it indicates that the dollar is weakening. This may present an opportunity to short dollar-related currency pairs (e.g., EUR/USD).

-

Support and Resistance:

- Support Level: In the chart, if the US Dollar Index repeatedly stops falling at a certain level, this is the support level. When the price rebounds at this point, it may indicate that the dollar will strengthen.

- Resistance Level: When the US Dollar Index repeatedly fails to break through a certain level, this is the resistance level. When the price falls back at this point, it may indicate that the dollar will weaken.

-

Technical Indicators:

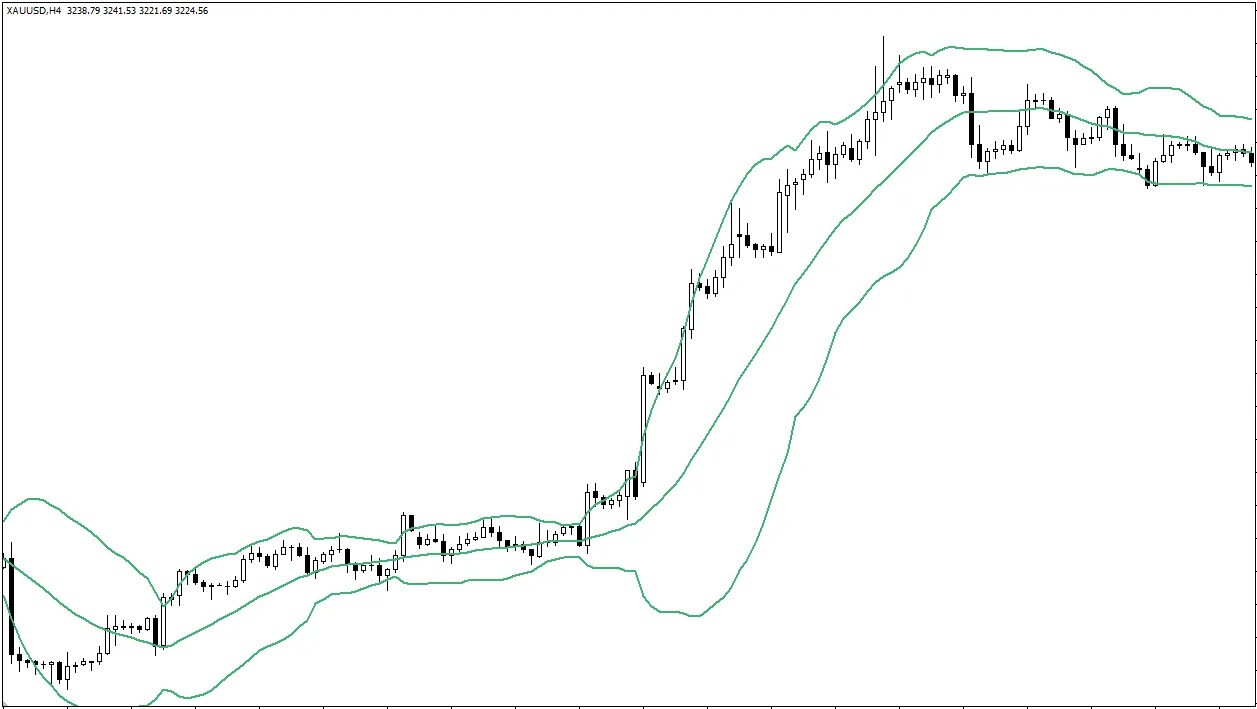

- Many technical analysis tools, such as the Relative Strength Index (RSI), Moving Averages (MA), and Bollinger Bands, can be applied to the US Dollar Index to help determine its trends and potential turning points.

Application of the US Dollar Index in Forex Trading

The US Dollar Index is an important reference tool for forex traders. It helps traders understand the overall market environment, especially when choosing trading strategies:- Guiding Currency Pair Trends: When the US Dollar Index shows strength, traders may choose to go long on the dollar, especially for major currency pairs such as EUR/USD and GBP/USD. Conversely, if the US Dollar Index is weak, traders may choose to short the dollar.

- Commodities Trading: Since many commodities (such as Gold and Oil) are priced in dollars, fluctuations in the US Dollar Index can also affect the prices of these instruments. An increase in the US Dollar Index typically leads to a decrease in the prices of these instruments, while a decrease in the US Dollar Index may push their prices higher.

- Hedging Strategies: During times of uncertainty in the global market, an increase in the US Dollar Index often indicates an increased demand for the dollar as a safe haven. This can help traders formulate hedging strategies in volatile markets.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.