In the foreign exchange market, traders often face two major challenges

How to effectively manage funds and how to control trading risks. The Kelly Criterion is a mathematically based fund management strategy that helps traders maximize long-term returns while minimizing risks. This article will detail the principles of the Kelly Criterion, explore its application techniques in foreign exchange fund management, and analyze how to manage foreign exchange risks using the Kelly Criterion.Core Principles of the Kelly Criterion

The Kelly Criterion is a fund management model used to calculate the optimal fund allocation ratio for each trade to achieve long-term capital maximization. The formula is as follows:Formula: f* = (bp - q) / b

- f*: Optimal fund allocation ratio (percentage of total funds).

- b: Win-loss ratio (average return per unit loss).

- p: Win rate (probability of successful trades).

- q: Loss rate (probability of failed trades, q = 1 - p).

Core Objective of the Formula: By considering the win-loss ratio and win rate, the Kelly Criterion helps traders achieve a balance between risk and return, thereby achieving stable long-term capital growth.

Application Example: Calculating Fund Ratio with the Kelly Criterion

Suppose your trading strategy is as follows:- Win-loss ratio (b): 1, meaning each profit is 1 times the loss.

- Win rate (p): 0.6, meaning the probability of successful trades is 0.6.

- Loss rate (q): 0.4, meaning the probability of failed trades is 0.4 (q = 1 - p).

Substituting these values into the formula:

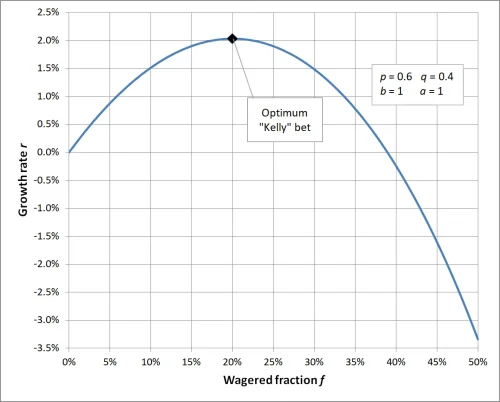

f* = [ (1 × 0.6) - 0.4] / 1Result: According to the Kelly Criterion, you should allocate 20% of your total funds to this trade. This ratio can achieve optimal growth of funds in the long term.

f* = (0.6 - 0.4) / 1

f* = 0.2

When the odds in the Kelly Criterion are set to 1, the calculated betting ratio is 20%, which means that for each trade, you should invest 20% of your total funds to maximize fund efficiency; if the invested fund ratio is higher or lower than this value, it will lead to suboptimal long-term returns, with a higher ratio increasing risk and a lower ratio not fully utilizing the potential for fund growth. This emphasizes the importance of scientific fund management and highlights the key role of the Kelly Criterion in risk control and return optimization.

Application of the Kelly Criterion in Foreign Exchange Fund Management

1. How to Manage Foreign Exchange Risks Using the Kelly Criterion

The foreign exchange market is highly volatile, and the Kelly Criterion can help traders adjust fund allocation ratios under different market conditions, effectively controlling trading risks.For example:

- When the win rate and win-loss ratio are high, the Kelly Criterion suggests investing more funds to pursue higher returns.

- In situations where the win rate or win-loss ratio is unstable, traders can reduce the fund ratio, for example, using 50% of the Kelly calculation result as the actual investment.

2. Application Techniques of the Kelly Criterion

- Accurate Data Collection: Calculating the Kelly Criterion requires accurate win rate and win-loss ratio data, so traders should regularly analyze trading records.

- Dynamic Adjustment of Ratios: Update win rates and win-loss ratios dynamically based on market changes to ensure the results of the Kelly Criterion align with current conditions.

- Reduce Excessive Risk: In practice, it is recommended to halve the fund ratio from the formula result to reduce the risks associated with excessive leverage.

3. Practical Applications in Foreign Exchange Trading Scenarios

- Trend Trading Strategy: Suitable for stable trend markets, the Kelly Criterion can help traders invest more funds in situations with higher win rates and win-loss ratios.

- Day Trading Strategy: For short-term high-frequency trading, the Kelly Criterion needs to be applied cautiously, as the volatility of short-term data may lead to deviations in calculation results.

The Role of the Kelly Criterion in Trading Risk Control

Advantages of the Kelly Criterion

- Mathematical Foundation for Foreign Exchange Fund Management: The Kelly Criterion provides a mathematical model that helps traders achieve precise fund management in the foreign exchange market.

- Optimal Balance of Risk and Return: The Kelly Criterion can maximize long-term returns while effectively controlling the risks of individual trades.

Challenges of the Kelly Criterion

- Data Dependency: The accuracy of the win rate and win-loss ratio directly affects the effectiveness of the Kelly Criterion, and traders need to carefully collect and analyze data.

- Emotional Interference: The foreign exchange market is ever-changing, and traders' emotions may affect the execution of fund allocation, leading to deviations from calculated results.

How to Optimize the Kelly Criterion for Foreign Exchange Fund Management

- Use Simulated Trading for Testing: Beginners can test the effectiveness of the Kelly Criterion in simulated trading to familiarize themselves with how to manage foreign exchange risks using the Kelly Criterion.

- Combine with Other Risk Management Strategies: Use tools such as trailing stops and asset diversification to further reduce trading risks.

- Adjust Investment Ratios: Adjust the ratios calculated by the Kelly Criterion based on market volatility to avoid excessive losses due to market uncertainty.

Conclusion

The Kelly Criterion is a powerful fund management tool, particularly suitable for risk control and return optimization in foreign exchange trading. However, market uncertainty requires traders to remain flexible when applying the Kelly Criterion. Through precise data analysis and dynamic adjustment of fund ratios, you will be able to manage risks in foreign exchange trading more effectively and achieve long-term stable capital growth.If you want to learn more about foreign exchange fund management and trading risk control, please continue to follow our content!

FAQ: About the Kelly Criterion and Foreign Exchange Fund Management

- Q1: Is the Kelly Criterion suitable for all foreign exchange traders?

A1: The Kelly Criterion is suitable for most traders, especially those with stable trading strategies who can accurately calculate win rates and win-loss ratios. However, short-term traders or those with highly variable win rates may find it unsuitable to rely entirely on the Kelly Criterion due to unstable data. - Q2: What should I do if the betting ratio calculated by the Kelly Criterion exceeds my risk tolerance?

A2: When the ratio calculated by the Kelly Criterion is too high, you can choose to take a portion of the formula result (such as 50% or 25%) as the actual investment ratio, which can reduce risk while maintaining the scientific nature of fund management. - Q3: Why use the Kelly Criterion to manage foreign exchange risks?

A3: The Kelly Criterion provides a mathematical model that helps traders balance risk and return, avoiding situations of over-betting or under-betting, ensuring that funds can continue to grow steadily in long-term trading. - Q4: What prerequisites are needed to use the Kelly Criterion?

A4: Using the Kelly Criterion requires accurate trading data, mainly including win rate (p) and win-loss ratio (b). If these data are inaccurate, the formula results may lose their reference value. - Q5: If the market environment suddenly changes, is the calculation result of the Kelly Criterion still applicable?

A5: When the market environment changes significantly, the win rate and win-loss ratio may also change, so it is necessary to recalculate the Kelly Criterion ratio to ensure that fund allocation matches the current market situation. - Q6: How to combine the Kelly Criterion with leverage trading?

A6: In foreign exchange leverage trading, the ratio calculated by the Kelly Criterion should be applied to actual funds (rather than leveraged funds), and the number of orders should be controlled based on leverage to avoid excessive risk. - Q7: Can the Kelly Criterion guarantee trading profits?

A7: The Kelly Criterion cannot guarantee profits, as the randomness and uncertainty of the market may lead to losses. However, it can effectively help traders maximize long-term capital growth rates under controllable risks. - Q8: I am a beginner, how should I start using the Kelly Criterion?

A8: Beginners should first focus on establishing a stable trading strategy and record sufficient historical trading data to calculate win rates and win-loss ratios. Test the effectiveness of the Kelly Criterion with small amounts of capital or in simulated trading to gradually familiarize yourself with its application.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.