Introduction to Forex Trading Platforms: Understanding the Most Popular MetaTrader 4 (MT4)

When you want to trade forex online, you need a software tool to connect to the market, view prices, analyze charts, and execute trades.This software is called a "trading platform."

There are many different trading platforms on the market, but one name you will almost certainly hear is MetaTrader 4 (MT4).

MT4 is one of the most popular and widely used trading platforms worldwide, especially among retail forex traders.

It acts like a trader's "cockpit," providing the core functions needed to observe the market, analyze trends, and place orders.

For beginners, understanding what MT4 is, its basic features, and why it is so popular is an important first step toward actual trading.

This article will give you a simple introduction to the MT4 platform.

1. What is MetaTrader 4 (MT4) ? The Bridge Connecting You to the Market

MetaTrader 4 (MT4) is an electronic trading platform software developed by MetaQuotes Software Corp.It is not a forex broker itself but serves as an intermediary interface that allows you (the trader) to connect to the server of your chosen forex broker to obtain real-time market quotes, perform chart analysis, and execute buy and sell orders.

Key point: You first need to select a forex broker that offers the MT4 trading platform and open a trading account (demo or live) with that broker.

Then, you need to download their dedicated version of MT4 from the broker’s official website and log in using your account information.

You cannot just download a generic version of MT4 and connect it to any broker.

Simple analogy: Think of MT4 as a very popular web browser (like Chrome).

The browser itself lets you access various websites, but you still need an Internet Service Provider (ISP) to provide the internet connection.

Similarly, MT4 lets you access the forex market, but you still need a forex broker to provide trading services and an account.

2. Why is MT4 So Popular?

Although MT4 was released a long time ago, it remains widely popular for several reasons:- Extensive Broker Support: Hundreds to thousands of forex brokers worldwide offer the MT4 platform to their clients. This means traders have great flexibility when choosing brokers.

- Relatively User-Friendly Interface: For a powerful platform, MT4’s basic layout and operational logic are relatively intuitive, making it easier for beginners to grasp core functions.

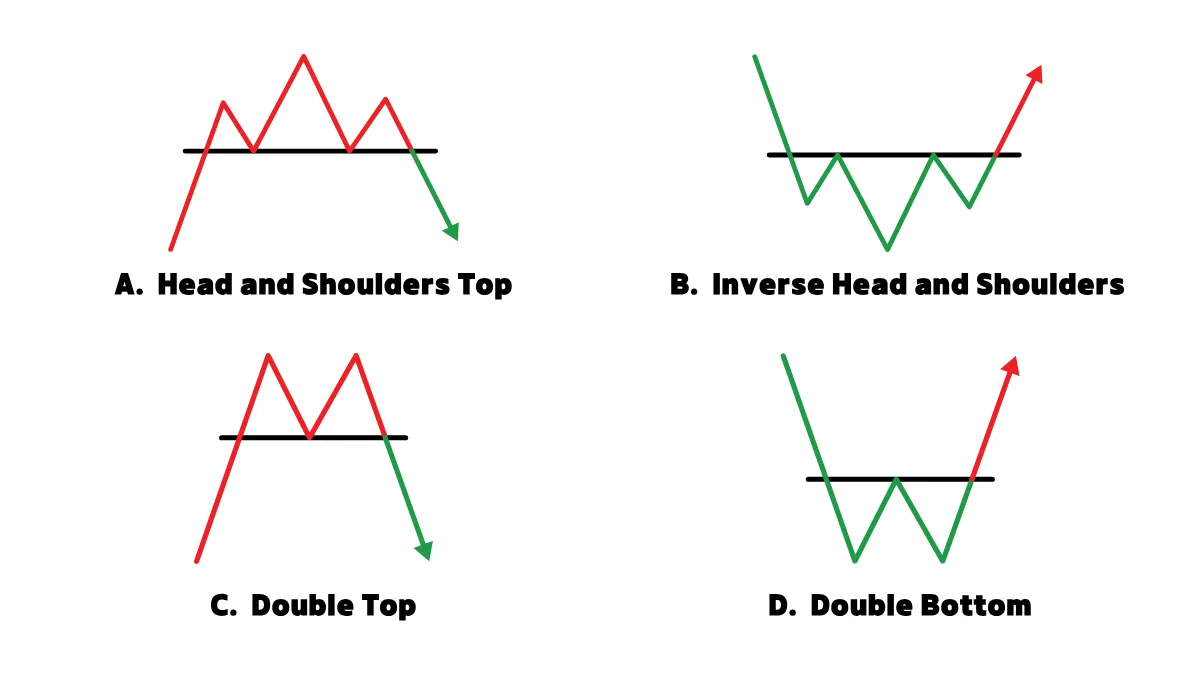

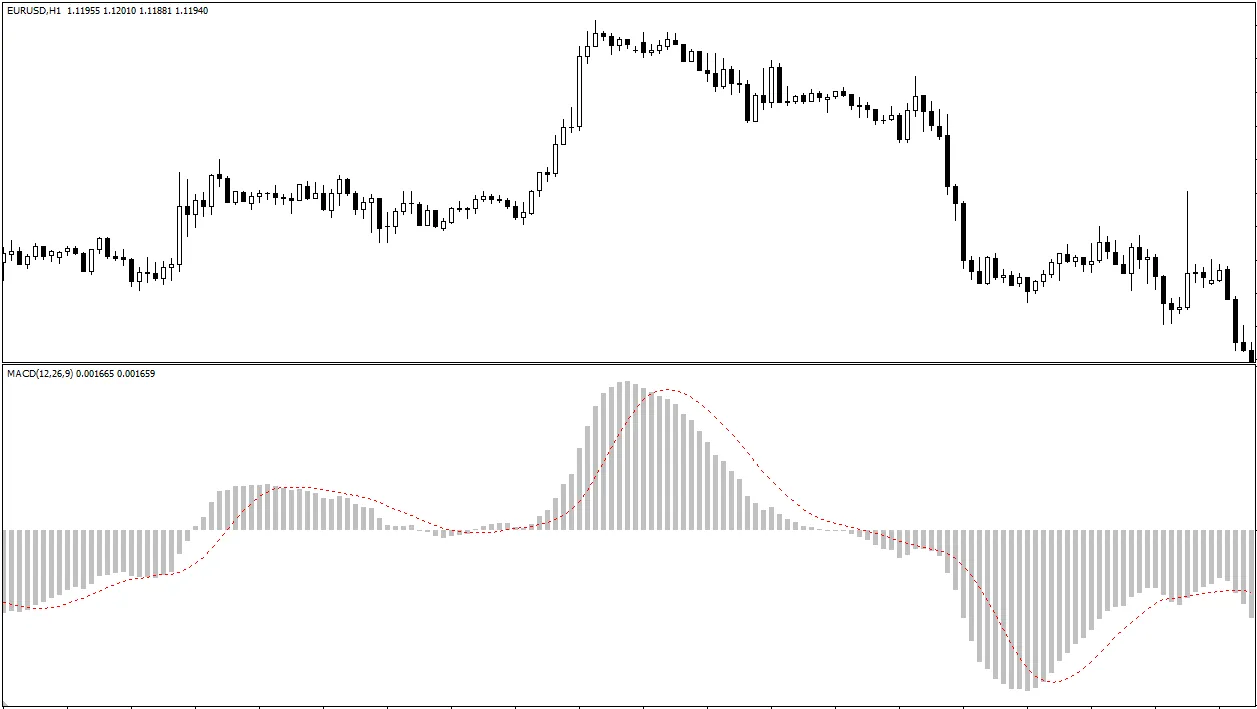

- Powerful Charting and Analysis Tools: MT4 provides very flexible and powerful charting tools, including multiple chart types (candlestick, bar, line), various timeframes, zoom functions, and a large number of built-in technical indicators (such as moving averages, RSI, MACD, Bollinger Bands, Fibonacci, etc.) and drawing tools (trend lines, support and resistance lines).

- Support for Automated Trading (EA): MT4 is famous for its powerful "Intelligent Trading System" (Expert Advisors, EAs) feature. EAs are programs that can automatically execute trades based on preset trading strategies. This is an advanced feature of MT4.

- Large Customization Resource Library: Due to its large user base, there is a vast amount of user- or third-party-developed custom technical indicators, scripts, and EAs available online that can be added to MT4.

- Recognized Stability and Reliability: After years of market testing, MT4 is widely regarded as a stable and highly reliable trading platform.

3. Main Features of MT4 (Beginner’s Perspective)

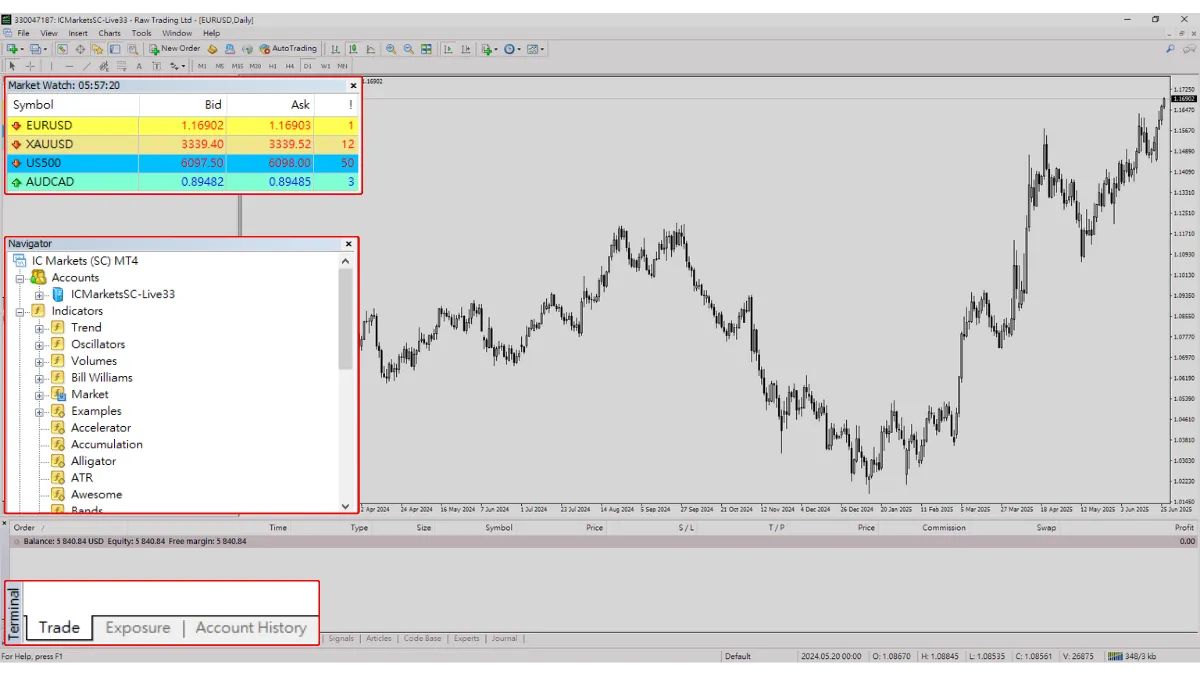

For beginners, the core MT4 functional areas you need to master mainly include:- Market Watch Window: Displays real-time bid (Bid) and ask (Ask) prices for various trading instruments provided by your broker (such as currency pairs, Gold, Indexes, etc.).

- Chart Window: This is the main area for technical analysis. You can open price charts for different instruments and timeframes, zoom in/out, add technical indicators, and drawing tools.

- Navigator Window: Here you can manage your trading accounts (login, switch), quickly access installed technical indicators, EAs, and scripts.

- Terminal Window: This window is very important and is usually located at the bottom of the platform. It contains multiple tabs:

- "Trade" Tab: Shows your current open positions (which orders are open), account balance, equity, used margin, free margin, and margin level. You can manage (modify or close) your open orders here.

- "Account History" Tab: Records all your closed trades, including profits and losses, commissions, and swap fees.

- Other tabs may include News, Alerts, Mailbox, Logs, etc.

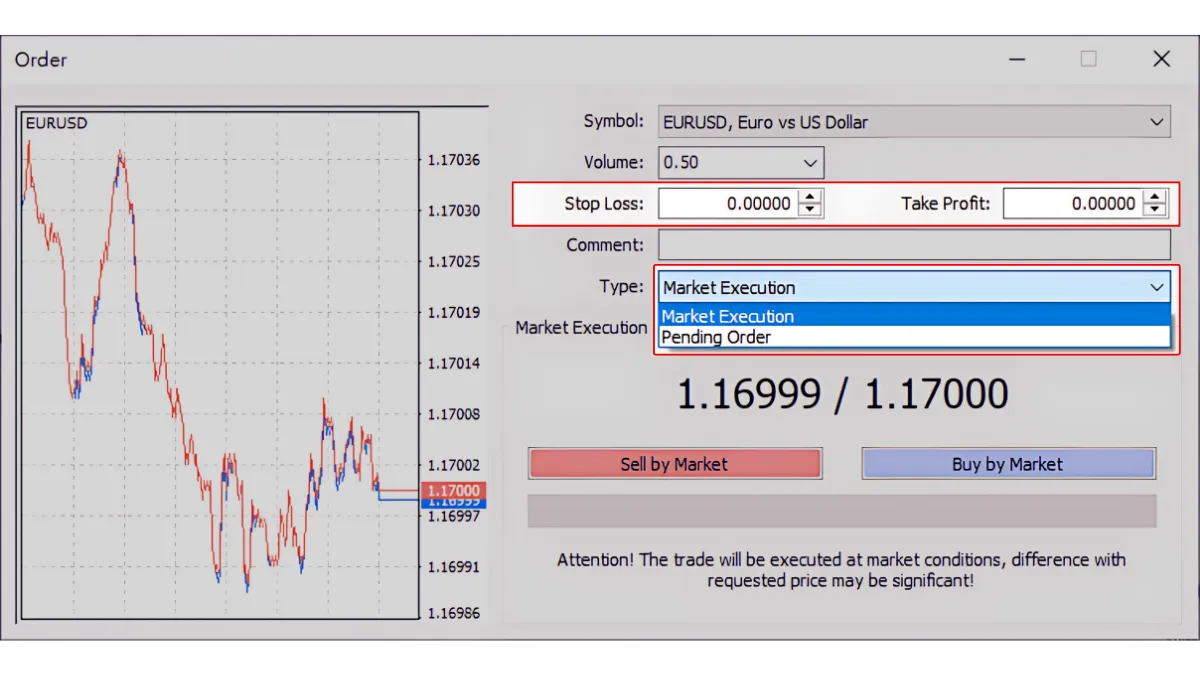

- Order Placement and Management Functions: MT4 provides a convenient order interface that allows you to execute:

- Market Execution: Buy or sell immediately at the best current market price.

- Pending Orders: Set buy or sell orders to be triggered at a specific future price (e.g., limit orders, stop orders).

- Setting Stop Loss and Take Profit: Set stop loss and take profit levels when placing or after placing orders. This is a key step in risk management.

4. Is MT4 Free? How to Obtain It?

- The platform software is usually free: For traders, the MT4 platform software is typically provided free of charge by forex brokers to their clients, whether for demo accounts or live accounts.

- Trading costs still exist: However, using a free platform does not mean trading itself is cost-free. You still need to pay the spread, possible commissions (fees), or swap fees charged by your broker during trading.

- How to obtain it: You need to first select a forex broker that offers MT4 and complete the account opening application on their official website (usually you can open a demo account first). Then, download the MT4 installation program provided by that broker from their website. After installation, log in with your account number and password.

5. MT4 vs. MT5 and Other Platforms

You may have also heard of MetaTrader 5 (MT5).It is the updated version of MT4 from the same company, offering more timeframe options, more built-in indicators, a more optimized programming language, and better support for trading other assets such as stocks and futures (depending on whether the broker offers them).

Additionally, some large brokers develop their own proprietary trading platforms, which may have unique interface designs and special features.

Why is MT4 still mainstream?

Although MT5 has been available for many years, MT4 remains the most mainstream retail forex trading platform globally due to its huge user base, rich third-party resources (EAs, indicators), and continued support from many brokers.

For beginners, learning the basic operations of MT4 is fully sufficient to meet entry-level needs, and its interface may be relatively simpler.

6. Advice for Beginners

- Be sure to start with a Demo Account!

This is the most important step. Before investing real money, you must open a demo account with your chosen broker and spend enough time (at least several weeks or even months) practicing in the MT4 simulated environment.

You need to become proficient in:- The functions and information of each window.

- How to view quotes and charts for different currency pairs.

- How to add and remove commonly used technical indicators.

- How to accurately place market and pending orders.

- How to set and modify stop loss and take profit for orders.

- How to monitor open positions and key account metrics (equity, margin level, etc.).

- How to view trading history records.

- Focus on basic operations: First learn core functions such as chart reading, order placement, order management, and setting stop loss/take profit. Do not get distracted by all the advanced MT4 features (like EA trading) at the beginning.

- Choose a reputable broker: MT4 itself is just a tool; your trading experience and fund safety depend more on whether the forex broker you choose is legitimate, reliable, and provides good service.

Conclusion

MetaTrader 4 (MT4) is a powerful, stable, and reliable forex trading platform widely used worldwide.It provides traders with the core tools needed to view market conditions, perform chart analysis, execute trade orders, and manage accounts.

For beginners, MT4 is an excellent entry-level platform because it is resource-rich, relatively intuitive to operate, and supported by many brokers.

But always remember, the best way to master platform operation is by opening a demo account with your chosen broker and practicing extensively until you can confidently use all the basic functions.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.