In foreign exchange margin trading, data analysis and model prediction are the core of building successful trading strategies. However, if the appropriate balance is not maintained during the process, you may encounter a common but easily overlooked problem: "Overfitting." This phenomenon not only makes your model appear flawless on test data but performs poorly in real trading, potentially costing you real money. This article will help you comprehensively understand overfitting, from simple metaphors to professional explanations, and provide practical countermeasures to help you stand firm in the foreign exchange market.

Overfitting refers to the phenomenon where a model performs exceptionally well on training data but loses accuracy on unseen new data. This occurs because the model focuses too much on the details and noise in the training data rather than learning the true patterns or rules that affect the market.

An overfitted model may appear very powerful on the surface, able to "remember" every feature of the training data perfectly, but in reality, it lacks the ability to cope with unknown market changes. This means you may rely on an overly confident strategy, ultimately leading to losses.

The model is too simple to accurately describe the features of the data, resulting in high training and testing errors.

The model appropriately describes the data, achieving good performance on both training and testing, balancing bias and variance.

The model is too complex, overfitting the training data, resulting in low training error but high testing error, with insufficient generalization ability.

Imagine you are preparing for a simulated test in the foreign exchange market, only to find that all the questions can be found in the textbook answers. So, you spend a lot of time memorizing the answers instead of truly understanding market dynamics. On the day of the exam, the questions are slightly altered, and you immediately cannot cope because your knowledge is based only on specific situations rather than being flexibly applied to real problems.

An overfitted model is like this "cheating student": its performance is limited to specific historical data and cannot adapt to real-time market fluctuations.

Fortunately, overfitting is not an unsolvable problem. Here are several practical methods that can help you reduce risks and improve the accuracy and stability of your model:

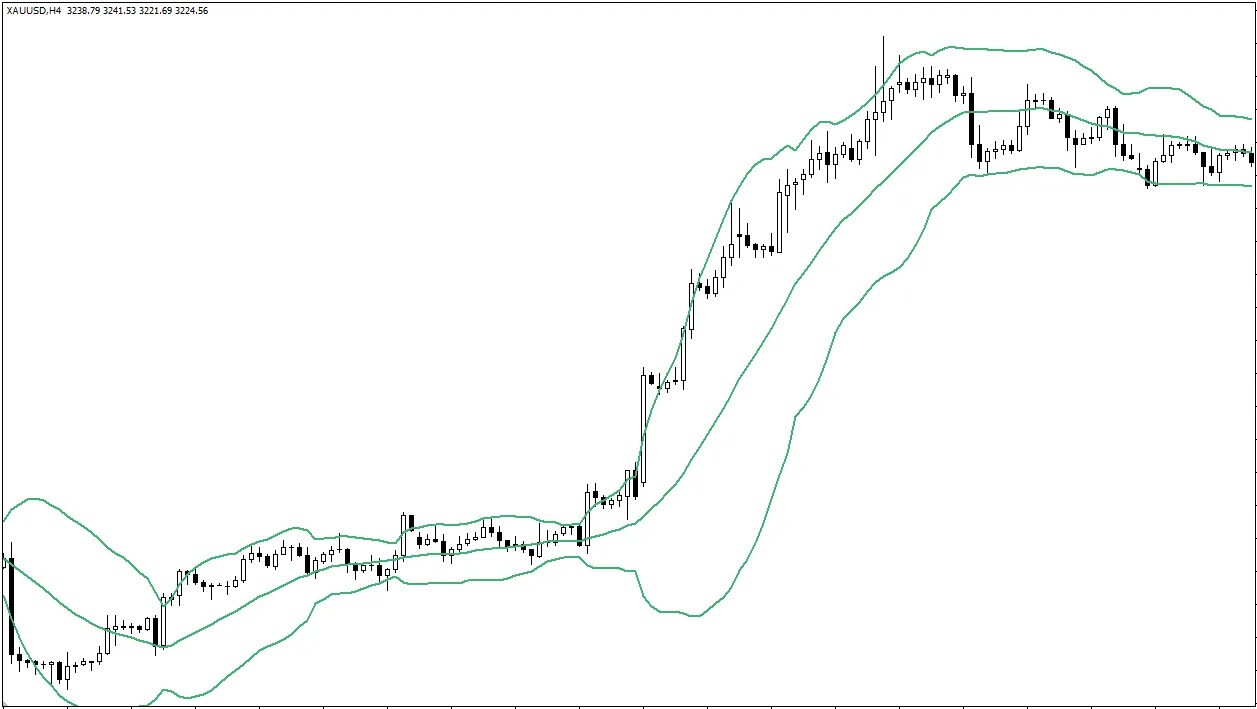

For example, a trader designed a foreign exchange strategy relying on multiple technical indicators and used historical data for backtesting, resulting in a monthly trading return rate of 20%. However, in actual trading, the strategy frequently missed the mark, even leading to significant drawdowns. Upon inspection, it was found that the model relied too heavily on specific past market conditions, such as the oscillation patterns of exchange rates, rather than learning more general market rules.

This is a typical manifestation of overfitting: relying too much on specific patterns in the training data and lacking the ability to cope with real market fluctuations.

In foreign exchange margin trading, overfitting is a challenge that every trader must pay attention to. While it may make the model appear flawless in historical data, what truly matters is whether the model can provide accurate and robust guidance in unknown market situations.

By using the right methods, such as cross-validation, regularization techniques, and data expansion, you can effectively reduce the risk of overfitting and make your trading strategies more reliable.

Remember, the market is always changing. Instead of pursuing perfect backtesting results, focus on building robust trading models that keep you in a winning position in the foreign exchange market!

What is Overfitting?

Overfitting refers to the phenomenon where a model performs exceptionally well on training data but loses accuracy on unseen new data. This occurs because the model focuses too much on the details and noise in the training data rather than learning the true patterns or rules that affect the market.

An overfitted model may appear very powerful on the surface, able to "remember" every feature of the training data perfectly, but in reality, it lacks the ability to cope with unknown market changes. This means you may rely on an overly confident strategy, ultimately leading to losses.

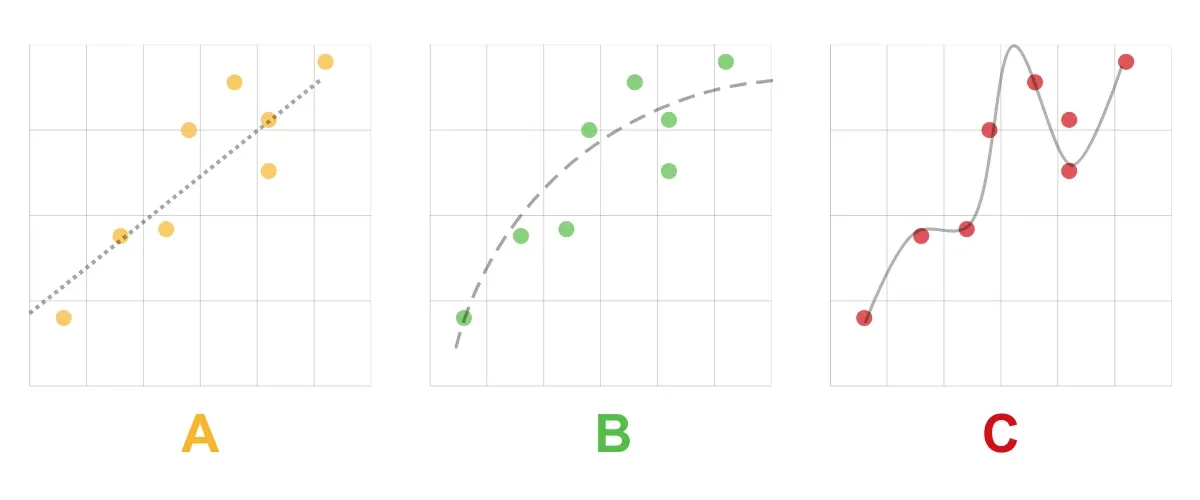

A. Underfitted

Underfitting (high bias error)The model is too simple to accurately describe the features of the data, resulting in high training and testing errors.

B. Good Fit / Robust

Good Fit / Robust (balance between bias and variance)The model appropriately describes the data, achieving good performance on both training and testing, balancing bias and variance.

C. Overfitted

Overfitted (high variance error)The model is too complex, overfitting the training data, resulting in low training error but high testing error, with insufficient generalization ability.

Metaphor: Overfitting is like cheating on an exam

Imagine you are preparing for a simulated test in the foreign exchange market, only to find that all the questions can be found in the textbook answers. So, you spend a lot of time memorizing the answers instead of truly understanding market dynamics. On the day of the exam, the questions are slightly altered, and you immediately cannot cope because your knowledge is based only on specific situations rather than being flexibly applied to real problems.

An overfitted model is like this "cheating student": its performance is limited to specific historical data and cannot adapt to real-time market fluctuations.

The Risks of Overfitting in Foreign Exchange Margin Trading

- Strategies Cannot Generalize

An overfitted model may focus too much on specific market environments, such as past trends or events, making it unable to respond to real-time market changes. - Distorted Backtesting Results

Backtesting results may lead you to mistakenly believe that the strategy is successful because the model "remembers" all the details in past data but cannot adapt to future markets. - Increased Trading Risks

Due to the model being overly sensitive to noise in the training data, it may lead to more unnecessary trading actions or even incorrect market direction judgments.

How to Avoid Overfitting?

Fortunately, overfitting is not an unsolvable problem. Here are several practical methods that can help you reduce risks and improve the accuracy and stability of your model:

- Cross-Validation

Divide the data into training, validation, and testing sets to ensure the model performs consistently on unseen data. Cross-validation is an important tool for assessing model generalization ability. - Reduce Model Complexity

Overly complex models are prone to overfitting. Choosing simpler models or limiting the number of parameters can effectively enhance the robustness of the model. - Regularization Techniques

Use L1 or L2 regularization to penalize excessively large model weights, helping the model focus on the most important features rather than noise in the training data. - Expand the Dataset

If possible, collect more historical data, especially data under different market conditions, to help the model learn broader market patterns. - Continuously Monitor Model Performance

In actual trading, regularly evaluate the model's performance and make appropriate adjustments based on market changes, which is a necessary step to prevent overfitting.

Case Study: How to Identify Overfitting?

For example, a trader designed a foreign exchange strategy relying on multiple technical indicators and used historical data for backtesting, resulting in a monthly trading return rate of 20%. However, in actual trading, the strategy frequently missed the mark, even leading to significant drawdowns. Upon inspection, it was found that the model relied too heavily on specific past market conditions, such as the oscillation patterns of exchange rates, rather than learning more general market rules.

This is a typical manifestation of overfitting: relying too much on specific patterns in the training data and lacking the ability to cope with real market fluctuations.

Conclusion: Avoid Overfitting and Build Robust Trading Strategies

In foreign exchange margin trading, overfitting is a challenge that every trader must pay attention to. While it may make the model appear flawless in historical data, what truly matters is whether the model can provide accurate and robust guidance in unknown market situations.

By using the right methods, such as cross-validation, regularization techniques, and data expansion, you can effectively reduce the risk of overfitting and make your trading strategies more reliable.

Remember, the market is always changing. Instead of pursuing perfect backtesting results, focus on building robust trading models that keep you in a winning position in the foreign exchange market!

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.