In foreign exchange trading, "pip" (Pip, full name Percentage in Point) is the smallest unit of measurement for price changes in currency pairs. It is an important concept in the forex market that helps traders calculate profits or losses. Understanding the definition of a pip and how to use it is crucial for calculating trading costs, managing risks, and assessing market volatility.

For example, for EUR/USD, if the exchange rate rises from 1.1050 to 1.1051, it has increased by 1 pip.

Conversely, when the exchange rate falls from 1.1050 to 1.1049, it indicates a decrease of 1 pip.

For example, if USD/JPY changes from 110.25 to 110.26, it represents an increase of 1 pip.

For example:

For EUR/USD, if you hold a standard lot (100,000 euros), each pip movement is worth 10 dollars.

If your position is a mini lot (10,000 units), then each pip is worth 1 dollar.

This calculation helps traders better assess their potential profits and losses in market volatility.

For example, the quote for EUR/USD may rise from 1.10500 to 1.10501, which represents an increase of 0.1 pips, also referred to as 1 Pipette.

Although the movement of a Pipette is relatively small, it still helps to measure slight price fluctuations more accurately.

Assuming you buy EUR/USD at 1.1050 for a standard lot (100,000 units), and then the price rises to 1.1070, this represents an increase of 20 pips.

Each pip is worth 10 dollars, so you will gain 20 pips x 10 dollars = 200 dollars in profit.

Conversely, if the price drops by 20 pips, you will lose 200 dollars.

For example, you can set a stop-loss order 50 pips away from the entry price, so when the market moves unfavorably, the trade will automatically close before exceeding a certain loss amount.

Pips can also help you calculate the risk-reward ratio. For example, if your potential profit target is 100 pips and the stop-loss is set at 50 pips, then your risk-reward ratio is 2: 1, which is a reasonable trading strategy.

Standard lot (100,000 units): Each pip is worth approximately 10 dollars.

Mini lot (10,000 units): Each pip is worth approximately 1 dollar.

Micro lot (1,000 units): Each pip is worth approximately 0.1 dollars.

Choosing the appropriate lot size helps control risk in trading.

Answer: A pip is the fourth decimal place of price movement, while a pipette is one-tenth of a pip, representing the change in the fifth decimal place.

2. How is pip calculated in yen pairs?

Answer: In yen (JPY) pairs, price quotes are usually only to two decimal places, so the pip change is the change in the second decimal place.

3. How to calculate the value of each pip?

Answer: The value of a pip depends on the lot size. In a standard lot (100,000 units), each pip is worth about 10 dollars; in a mini lot (10,000 units), about 1 dollar; and in a micro lot (1,000 units), about 0.1 dollars.

4. How to use pips for risk management?

Answer: By setting stop-loss orders to limit trading losses in pips. For example, setting a stop-loss at 50 pips, when the price movement reaches the set pips, it will automatically close to reduce losses.

1. Definition of pip:

Pip is the fourth decimal place in the price change of a currency pair. Most major currency pairs are quoted to four decimal places, so the smallest unit of price change is this "fourth decimal place."For example, for EUR/USD, if the exchange rate rises from 1.1050 to 1.1051, it has increased by 1 pip.

Conversely, when the exchange rate falls from 1.1050 to 1.1049, it indicates a decrease of 1 pip.

2. Exceptions for yen pairs:

Although most currency pairs are quoted to four decimal places, currency pairs related to Yen (JPY) are an exception. For example, USD/JPY is typically quoted to only two decimal places. For yen pairs, the pip change is the second decimal place.For example, if USD/JPY changes from 110.25 to 110.26, it represents an increase of 1 pip.

3. Definition of pip value:

The value of each pip depends on the currency pair, the size of the trade, and the currency of the account. Generally, for a standard lot (100,000 units), each pip is worth 10 units of the quoted currency.For example:

For EUR/USD, if you hold a standard lot (100,000 euros), each pip movement is worth 10 dollars.

If your position is a mini lot (10,000 units), then each pip is worth 1 dollar.

This calculation helps traders better assess their potential profits and losses in market volatility.

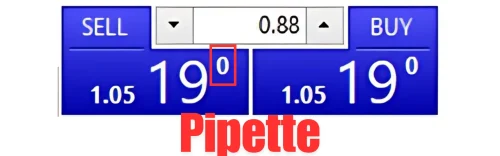

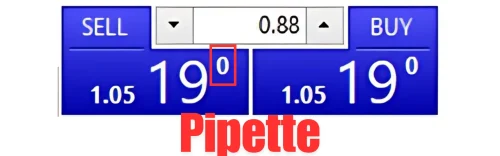

4. The fifth decimal place "pipette":

Now many brokers offer quotes accurate to five decimal places, and this extra decimal place is called Pipette. It represents one-tenth of a pip.For example, the quote for EUR/USD may rise from 1.10500 to 1.10501, which represents an increase of 0.1 pips, also referred to as 1 Pipette.

Although the movement of a Pipette is relatively small, it still helps to measure slight price fluctuations more accurately.

5. How to use pips to calculate profits and losses:

Pips play a key role in forex trading by helping traders calculate profits and losses. Here is a simple calculation process:Assuming you buy EUR/USD at 1.1050 for a standard lot (100,000 units), and then the price rises to 1.1070, this represents an increase of 20 pips.

Each pip is worth 10 dollars, so you will gain 20 pips x 10 dollars = 200 dollars in profit.

Conversely, if the price drops by 20 pips, you will lose 200 dollars.

6. Pips and risk management:

Understanding the value of pips helps in better risk management. Traders can limit risk by setting stop-loss orders, which are usually set in terms of pips.For example, you can set a stop-loss order 50 pips away from the entry price, so when the market moves unfavorably, the trade will automatically close before exceeding a certain loss amount.

Pips can also help you calculate the risk-reward ratio. For example, if your potential profit target is 100 pips and the stop-loss is set at 50 pips, then your risk-reward ratio is 2: 1, which is a reasonable trading strategy.

7. Pips and different lot sizes:

Different lot sizes affect the value of each pip, so traders should manage risk according to their lot size. Here are the effects of different lot sizes on pips:Standard lot (100,000 units): Each pip is worth approximately 10 dollars.

Mini lot (10,000 units): Each pip is worth approximately 1 dollar.

Micro lot (1,000 units): Each pip is worth approximately 0.1 dollars.

Choosing the appropriate lot size helps control risk in trading.

Summary

In forex trading, understanding the concept of "pips" is crucial for calculating profits, losses, and effective risk management. By understanding the pip movements of each currency pair, the value of pips, and how to apply them to calculate trading outcomes, you can better control market volatility and make more precise trading decisions.Frequently Asked Questions (FAQ)

1. What is the difference between pip and pipette?Answer: A pip is the fourth decimal place of price movement, while a pipette is one-tenth of a pip, representing the change in the fifth decimal place.

2. How is pip calculated in yen pairs?

Answer: In yen (JPY) pairs, price quotes are usually only to two decimal places, so the pip change is the change in the second decimal place.

3. How to calculate the value of each pip?

Answer: The value of a pip depends on the lot size. In a standard lot (100,000 units), each pip is worth about 10 dollars; in a mini lot (10,000 units), about 1 dollar; and in a micro lot (1,000 units), about 0.1 dollars.

4. How to use pips for risk management?

Answer: By setting stop-loss orders to limit trading losses in pips. For example, setting a stop-loss at 50 pips, when the price movement reaches the set pips, it will automatically close to reduce losses.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.