"Not Just Setting Return Targets, But Also Setting 'Risk Targets': Creating an Investment Plan That Lets You Sleep Well"

"I am investing and making money, so why am I still so anxious?"This was a question raised by a friend at a recent gathering.

Last year, he grew his account assets by 15% through investing, which is a very successful performance by any standard.

However, he said that for several months he was kept awake at night due to severe market volatility, and even once considered selling everything and never investing again.

His story highlights a common dilemma for many investors: Is a good investment plan only about the final return numbers?

If you have ever felt anxious on your investment journey or found the process of making money stressful, it is likely not because your returns are insufficient, but because you missed asking a crucial question at the start of your plan.

This article will guide you to build a complete investment plan that not only achieves financial growth but also allows you to "hold with peace of mind and sleep well."

Step 1: What Most People Do — Set a "Return Target"

Before discussing the forgotten question, let's do the right thing first: set a "return target."This is the foundation of investment planning.

If you have never set a target, no matter if the market gives you 5% or 50% returns, you may feel dissatisfied or confused.

Setting a target gives you a clear map to know where you are and where you should go.

You can ask yourself:

- "I want to accumulate 20 million in retirement funds in 20 years."

- "I currently have 3 million principal and can invest an additional 300,000 annually."

Using a simple financial calculator, you can easily calculate that to achieve this goal, you need a long-term "annualized return rate" of about 8%.

Congratulations! Now you have a clear number.

This "8%" is your compass, giving you an objective benchmark on your future investment path.

When your return rate reaches 10% this year, you will know you are ahead of schedule; when the market performs poorly with only 3%, you will know how much time you need to catch up.

This greatly alleviates anxiety from comparing yourself to others or short-term market fluctuations.

Step 2: The Forgotten Key Question — What Is Your "Risk Target"?

Now, let's answer the forgotten question from the beginning.You already know you need an "8% annualized return," but that only completes half the plan.

The other half, more important question is:

"To achieve this 8% return, how much asset drawdown are you willing to endure at most?"

This question is your "Risk Goal," also known as your "Drawdown Budget."

It refers to how much percentage decline you are willing to see your portfolio fall from its historical peak.

Are you willing to endure a -15% paper loss for an 8% return? -30%? Or -50%?

There is no standard answer to this number; it entirely depends on your age, financial situation, and psychological resilience.

But this question is the true key to determining the quality of your investment journey and whether you can successfully stick to it.

Step 3: Define a Complete Investment Goal — Your "Risk-Return Profile"

Now, we can combine these two parts to define a truly mature, personalized, and strictly executable investment goal.It should not be just a number but a complete "Risk-Return Profile."

For example, your goal should not just be:

"I want an 8% annualized return."

Instead, it should be:

"I want to pursue an 8% long-term annualized return with a max drawdown not exceeding 15%."

See, the difference between these two statements is huge.

The former is just a wish, while the latter is an actionable strategic blueprint.

It adds "guardrails" to your investment, ensuring that in pursuit of returns, you won't be shattered by a sudden crash.

When you have this "dual goal," you evolve from a simple "return chaser" into a thoughtful "risk manager."

Step 4: How to Find Tools That Meet Your "Dual Goals"?

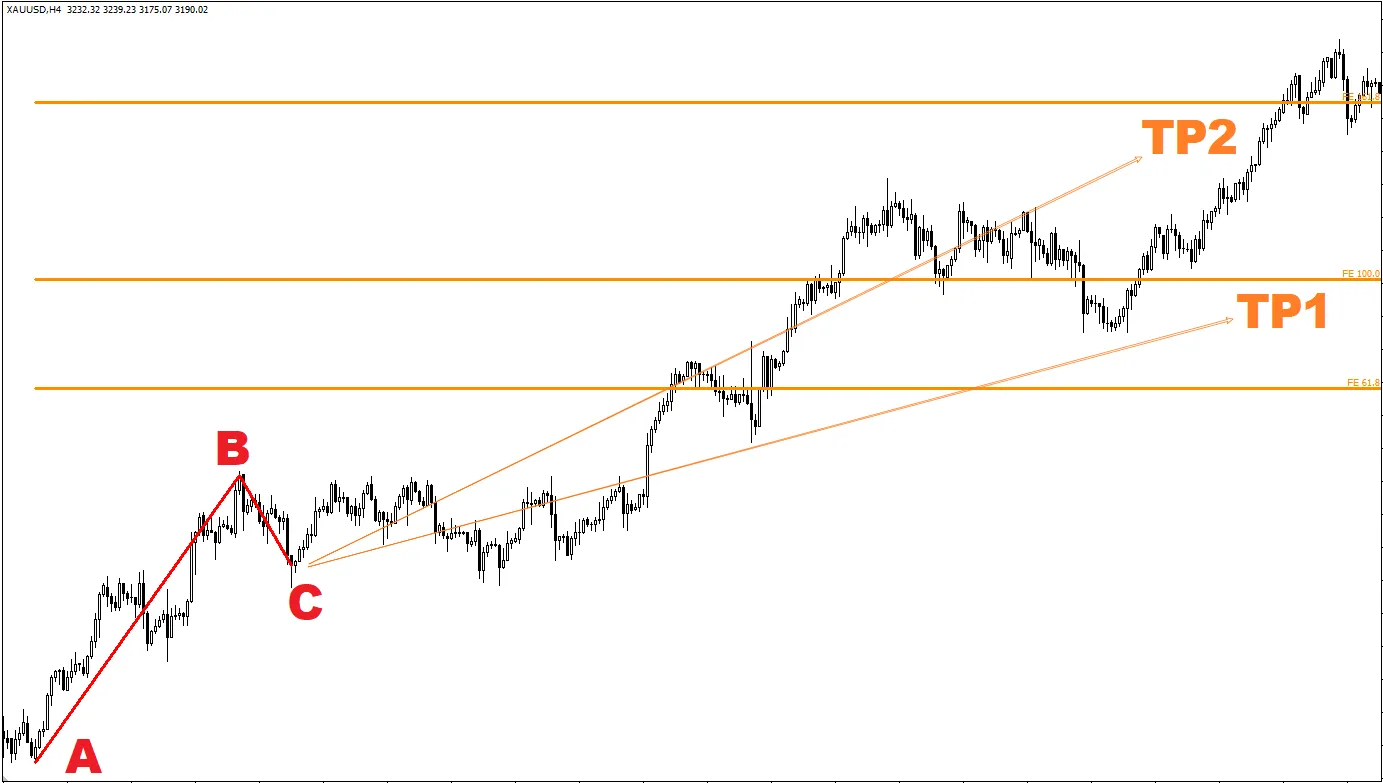

Once you define your complete "Risk-Return Profile," the next challenge is: where to find investment tools that satisfy both conditions?This is exactly the limitation of traditional investment methods.

For example, you decide to buy an ETF tracking the global market.

In the long run, it may meet your 8% "return target."

But what about its "risk target"?

Historical data shows that during major financial crises, these ETFs' max drawdowns easily reach -40% to -50%.

If your initial "drawdown budget" was -15%, then this tool obviously cannot let you "sleep well."

You need a platform that allows you to simultaneously review "returns" and "risks" to precisely find solutions that fit your complete profile.

Conclusion: Build an Investment Plan That Gives You Peace of Mind

Investing should not be a gamble full of gains and losses but a calm and confident journey.The starting point is setting a more complete goal.

Remember:

- Step 1: Set your "Return Target" to give yourself a clear direction.

- Step 2: Set your "Risk Target" to draw a safety baseline for your assets.

- Step 3: Combine both to form your unique "Risk-Return Profile."

- Step 4: Find tools and strategies that meet your dual goals.

At Mr.Forex, we firmly believe that a responsible platform has the obligation to reveal the full story to investors.

That is why every strategy you see here presents risk indicators like max drawdown (MDD) alongside historical return data.

Our purpose is to help prudent investors like you find high-quality strategies that truly fit your complete "Risk-Return Profile."

Stop blindly chasing returns in the market. Start building an investment plan that truly belongs to you and lets you invest with peace of mind.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.