In the foreign exchange market, investment performance depends not only on the size of returns but also on the risks undertaken. This makes the "Sharpe Ratio" a crucial indicator. It helps forex traders balance returns and risks with clear data, thereby evaluating the effectiveness of trading strategies.

Sharpe Ratio = (Average Return of the Portfolio - Risk-Free Rate) ÷ Standard Deviation of Investment Returns

In short, the Sharpe Ratio is used to compare the return per unit of risk. The higher the ratio, the more efficient the investment strategy, making the returns more attractive relative to the risk.

Calculation of the Sharpe Ratio:

The results show that although Strategy A has a higher return rate, Strategy B is more attractive after risk adjustment.

For example:

This result indicates that the strategy's risk-adjusted return is limited.

The solution is to use other indicators in conjunction, such as the Sortino Ratio, which focuses on downside risk.

Definition of Sharpe Ratio

The Sharpe Ratio is an indicator that measures risk-adjusted returns. Its basic formula is as follows:Sharpe Ratio = (Average Return of the Portfolio - Risk-Free Rate) ÷ Standard Deviation of Investment Returns

- Average Return: The average return on investment over a period.

- Risk-Free Rate: Usually represented by the return rate of government bonds or bank deposits.

- Standard Deviation: The volatility of returns, representing risk.

In short, the Sharpe Ratio is used to compare the return per unit of risk. The higher the ratio, the more efficient the investment strategy, making the returns more attractive relative to the risk.

How is the Sharpe Ratio applied in forex trading?

The forex market is characterized by high volatility and high leverage, and the Sharpe Ratio helps traders evaluate the performance of different strategies in this environment. Here are some common application scenarios:1. Comparing Trading Strategies

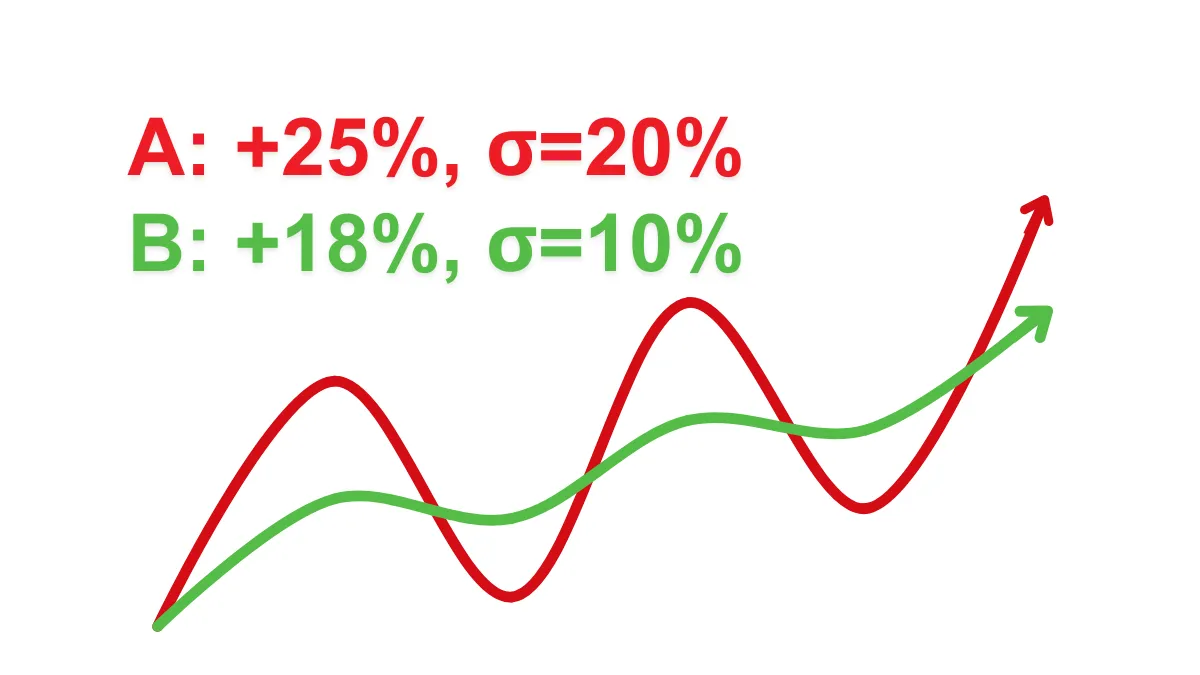

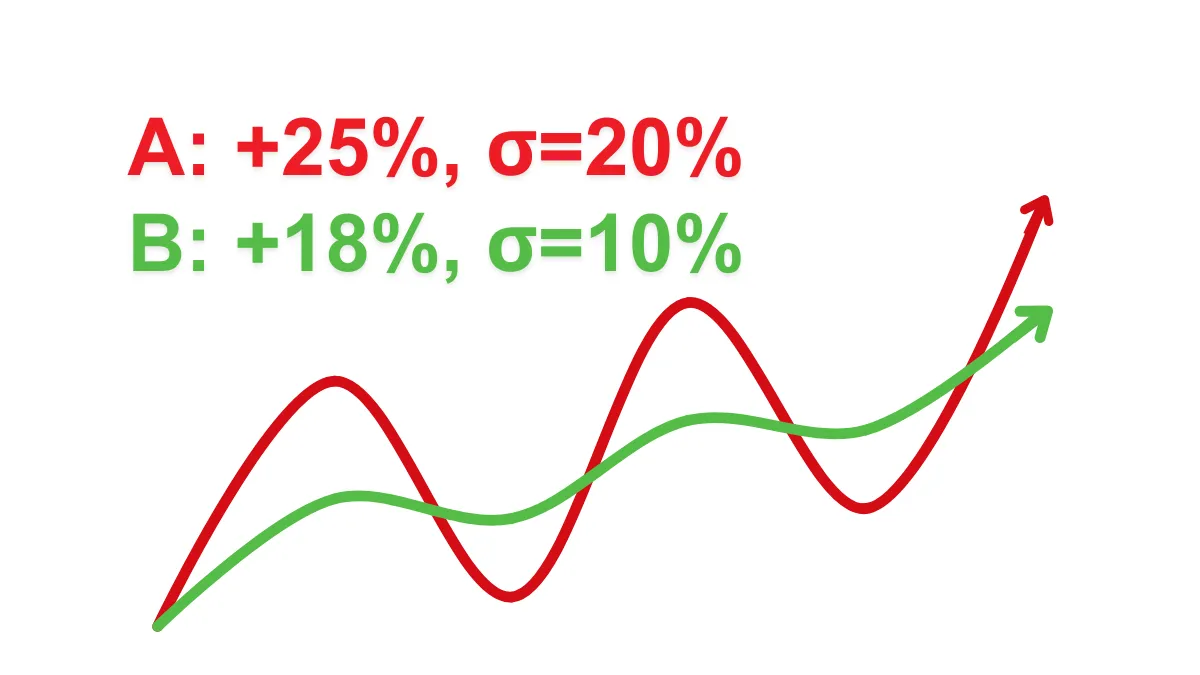

Traders can compare the performance of two or more strategies using the Sharpe Ratio. For example: (Assuming the risk-free rate is 3%)- Strategy A: Annual return rate 25%, volatility (standard deviation) 20%.

- Strategy B: Annual return rate 18%, volatility 10%.

Calculation of the Sharpe Ratio:

- Sharpe Ratio of Strategy A: (25% - 3%) ÷ 20% = 1.1

- Sharpe Ratio of Strategy B: (18% - 3%) ÷ 10% = 1.5

The results show that although Strategy A has a higher return rate, Strategy B is more attractive after risk adjustment.

2. Optimizing Leverage and Fund Management

High leverage in forex trading can quickly amplify returns but also increases risk. Through the Sharpe Ratio, traders can set leverage more rationally, avoiding unnecessary risks.3. Identifying High-Risk Strategies

Strategies with a low Sharpe Ratio (below 1) may indicate a mismatch between risk and return, prompting traders to reassess their trading plans.How to calculate the Sharpe Ratio?

Here are simplified calculation steps:- Calculate the average return of the trading strategy (e.g., monthly or annual return rate).

- Subtract the risk-free rate, usually choosing the return of national bonds as a reference.

- Divide the result by the volatility of returns (standard deviation).

For example:

- Monthly average return rate is 2%, risk-free rate is 0.5%, volatility is 3%.

- Sharpe Ratio calculation: (2% - 0.5%) ÷ 3% = 0.5

This result indicates that the strategy's risk-adjusted return is limited.

Advantages and Limitations of the Sharpe Ratio

Advantages

- Intuitive and Easy to Understand: Represents risk and return with a single value, facilitating the comparison of different strategies.

- Widely Applicable: Applicable to various financial markets, including forex, stocks, funds, etc.

- Quantifies Performance: Helps traders analyze rationally rather than relying solely on intuition.

Limitations

- Assumes Normal Distribution of Returns: In the forex market, returns often deviate from a normal distribution, which may lead to distorted results.

- Does Not Consider Downside Risk: The Sharpe Ratio treats all volatility equally, but actual downside volatility (losses) has a greater impact on investors.

The solution is to use other indicators in conjunction, such as the Sortino Ratio, which focuses on downside risk.

How to improve the Sharpe Ratio in forex trading?

- Improve Trading Strategies

- Reduce random trading and enhance the stability of strategies.

- Focus on integrating fundamental and technical analysis.

- Diversify Investment Portfolio

- Do not concentrate all funds on a single currency pair; diversify investments to reduce risk.

- Use Leverage Rationally

- Avoid excessive leverage, moderately amplify returns while controlling risk.

- Regularly Evaluate Performance

- Continuously monitor the Sharpe Ratio and adjust strategies in a timely manner to maintain a balance between risk and return.

Conclusion

The Sharpe Ratio is an indispensable performance indicator for forex traders, revealing the balance between risk and return. By understanding and applying the Sharpe Ratio, traders can formulate more rational strategies in the highly volatile forex market, reducing risk and increasing long-term returns. If you wish to stand out in the forex market, learning to calculate and use the Sharpe Ratio will be key to your success!

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.