Dollar Smile Theory

Concept of the Dollar Smile Theory

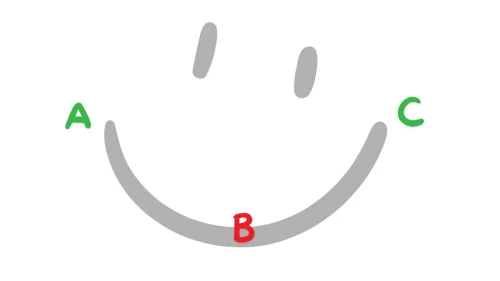

The Dollar Smile Theory is a theory that explains the movement of the dollar under different economic conditions. This theory was proposed by Morgan Stanley economist Stephen Jen in 2001, and the name of the theory comes from the "smile" shape formed by the dollar's movement in the global market. According to this theory, the dollar's movement can be divided into three stages, forming a shape similar to a smile curve.Three Stages of the Dollar Smile Theory

According to the Dollar Smile Theory, the dollar's movement can be divided into the following three stages:

According to the Dollar Smile Theory, the dollar's movement can be divided into the following three stages: When the global economy faces uncertainty or crisis, investors will shift their funds to safe assets, such as the dollar. Therefore, even though the U.S. economy may be in a weak state, the dollar will still strengthen due to safe-haven demand. The rise of the dollar in this stage is due to the increased demand from investors seeking safe assets.

Characteristics:

- Global economic instability or crisis.

- Increased safe-haven demand for the dollar from investors.

- Increased demand for the dollar in the global market, leading to dollar strength.

When the global economy gradually stabilizes and investors' preference for risk assets increases, the safe-haven demand for the dollar decreases. At this time, the U.S. economy may still be in a low-growth or weak state, and the attractiveness of the dollar declines. Therefore, in this stage, the dollar usually weakens, as funds flow to higher-yielding or riskier assets.

Characteristics:

- Global economic stability or growth.

- Decreased safe-haven demand for the dollar from investors.

- Funds flow to high-yield or risk assets, leading to dollar depreciation.

When the U.S. economy grows strongly and significantly outperforms other major economies, the dollar will strengthen again due to strong economic performance. In this stage, the strength of the dollar is no longer due to safe-haven demand, but rather supported by the fundamentals of the U.S. economy, such as higher interest rates and stable growth.

Characteristics:

- Strong U.S. economic growth.

- The Federal Reserve may raise interest rates, attracting foreign investors.

- Funds flow into the U.S. market, driving dollar strength.

Practical Applications of the Dollar Smile Theory

The Dollar Smile Theory is significant for analyzing the dollar's movement in the foreign exchange market. Traders can predict the dollar's movement based on global economic conditions and U.S. economic performance, and formulate corresponding trading strategies. Here are some practical application examples:- Safe-Haven Period During Economic Instability: When the global economy is unstable or facing a crisis, the dollar usually strengthens. At this time, traders may consider going long on dollar-related currency pairs, such as USD/JPY, as the yen, being a safe-haven currency, typically weakens.

- Period of Global Economic Stability: When the global economy stabilizes and investors' risk appetite increases, the dollar may weaken. At this time, traders may consider going long on other major currencies, such as EUR/USD or GBP/USD, as these currencies may rise due to investors' risk appetite.

- Period of U.S. Economic Growth: When the U.S. economy performs better than other regions globally, the dollar will strengthen again. At this time, traders may consider going long on dollar-related currency pairs, especially when the Federal Reserve adopts a rate hike policy to respond to economic growth and inflation.

Limitations of the Dollar Smile Theory

Although the Dollar Smile Theory provides a framework for understanding the dollar's movement under different economic conditions, it also has its limitations. Here are some aspects to note:- Overly Simplified: While the Dollar Smile Theory provides a clear framework for dollar movement, real market fluctuations are often influenced by various factors, such as geopolitical events, policy changes, and market sentiment.

- Inability to Precisely Predict Timing: This theory can help determine the long-term trend of the dollar, but it cannot precisely predict the specific timing of trend reversals. Therefore, traders still need to combine other technical analysis tools and economic indicators in actual operations.

- Impact of External Factors: The Dollar Smile Theory mainly considers the economic conditions of the U.S. and the global economy, but other factors such as geopolitical risks, international trade relations, and changes in global central bank policies can also have significant impacts on the dollar.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.