What is the US Dollar Index (USDX) ?

Basic Concept of the US Dollar Index

The US Dollar Index (USDX) is an indicator that measures the value of the US dollar relative to a basket of major international currencies. The Index was originally created by the Federal Reserve System in 1973, aiming to reflect the strength and weakness of the US dollar in the global market. The benchmark value of the US Dollar Index is 100; when the Index is above 100, it indicates that the value of the US dollar has risen relative to the currency basket; conversely, when it is below 100, it indicates a depreciation of the US dollar.Currencies Comprising the US Dollar Index

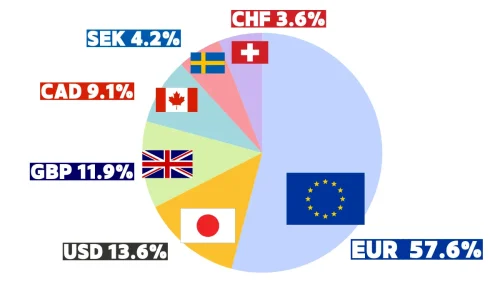

The US Dollar Index is composed of six major currencies that hold significant positions in international trade and financial markets. These currencies and their weights in the Index are as follows:

- Euro (EUR) - 57.61%

- Japanese Yen (JPY) - 13.61%

- Pound Sterling (GBP) - 11.91%

- Canadian Dollar (CAD) - 9.11%

- Swedish Krona (SEK) - 4.21%

- Swiss Franc (CHF) - 3.61%

The Euro has the largest weight in the US Dollar Index, meaning it has the most significant impact on the Index. Therefore, appreciation or depreciation of the Euro often significantly affects the trend of the US Dollar Index.

Calculation Method of the US Dollar Index

The US Dollar Index is calculated based on a weighted average method, which determines the total value change of the US dollar relative to these currencies according to their weights. The specific formula is relatively complex, but conceptually it is similar to deriving the overall trend of the US dollar in the international market based on the exchange rate changes of various currencies.Functions of the US Dollar Index

The US Dollar Index is an important indicator in the foreign exchange market, providing guidance for investors and economic analysts. It helps analyze trends in the global foreign exchange market and provides important signals regarding the strength and weakness of the US dollar. Here are several main uses of the US Dollar Index:- Measuring US Dollar Strength: The US Dollar Index can quickly reflect the performance of the US dollar in the global market. If the Index rises, it indicates that the US dollar has appreciated against other major currencies; if the Index falls, it indicates depreciation of the US dollar.

- Foreign Exchange Trading Strategies: Many forex traders refer to the US Dollar Index to formulate trading strategies. When the US Dollar Index shows strength, traders may choose to go long on US dollar-related currency pairs, such as USD/JPY; conversely, they may choose to go short.

- Impact on Commodities Prices: Since most commodities (such as oil, gold) are priced in US dollars, fluctuations in the US Dollar Index also affect the prices of these instruments. Generally, a stronger US dollar leads to lower commodities prices, and vice versa.

History and Importance of the US Dollar Index

Since its establishment, the US Dollar Index has undergone several significant changes. For example, in 1985, the US Dollar Index reached a historical high of 164.72, while during the global financial crisis in 2008, it briefly fell to a low of 71.58. These fluctuations reflect the performance of the US dollar during different economic periods and illustrate the impact of the global economic environment on the US dollar.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.