What is a "Pip" in Forex Trading? Essential Profit and Loss Calculation Basics for Beginners

When you start observing forex market quotes, you may notice that exchange rate numbers change very quickly, but each change seems very small.So, how do we accurately measure these tiny price movements?

This is where the most basic unit in forex trading comes in: "Pip".

You will definitely hear the term "Pip" frequently.

Understanding what it is and how it works is crucial for calculating whether your trades make a profit or a loss.

Don’t worry, this article will introduce you to this measuring "ruler" for exchange rate changes in the simplest way.

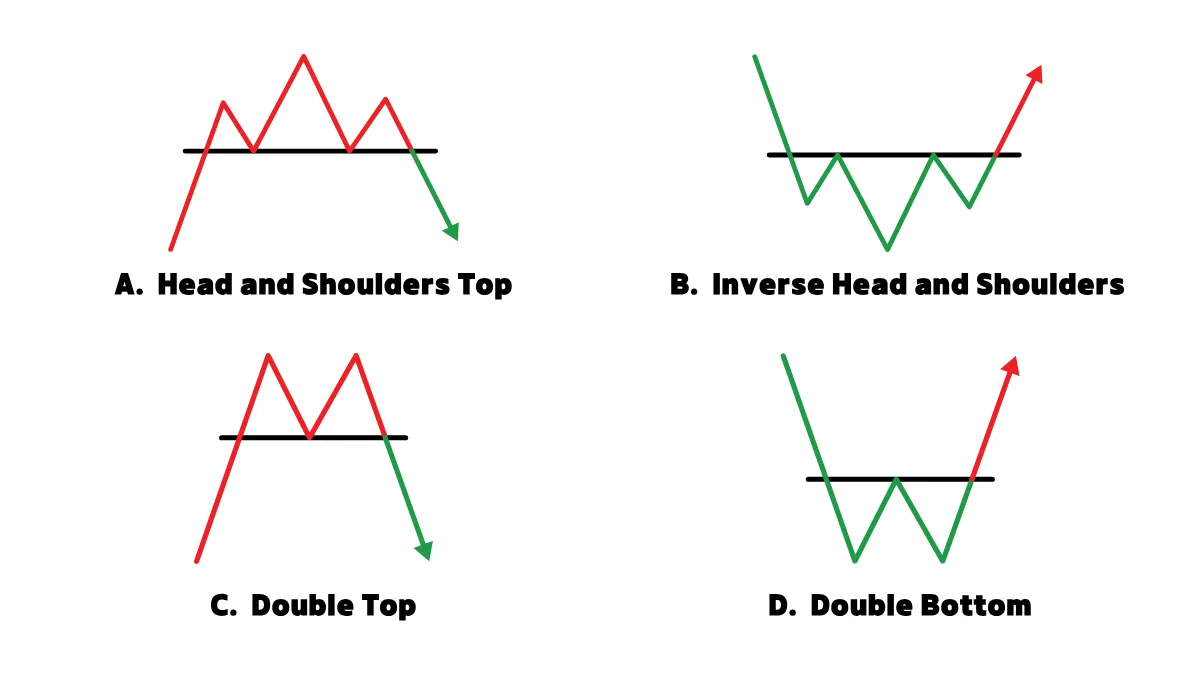

1. What Exactly is a "Pip"? The Smallest Unit of Measurement for Price Movement

Simply put, a "Pip" is the smallest standardized unit used to measure changes in currency pair exchange rates.You can think of it like the "millimeter" or "centimeter" on a ruler in daily life, which are basic units for measuring length; in forex, a "Pip" is the basic unit for measuring exchange rate changes.

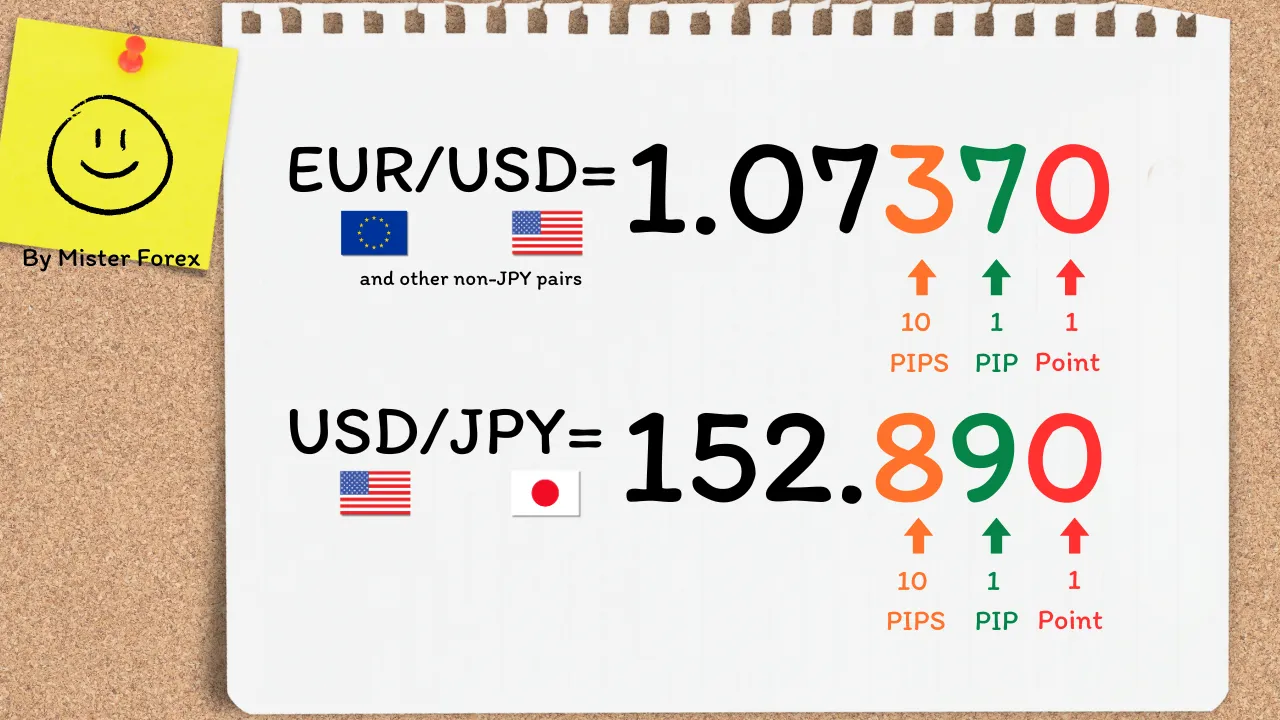

For most currency pairs (e.g., EUR/USD, GBP/USD), a "Pip" usually refers to a change in the fourth decimal place.

Example: If the EUR/USD exchange rate rises from 1.1050 to 1.1051, this means the rate has increased by 1 Pip.

If it falls from 1.1050 to 1.1048, this means the rate has decreased by 2 Pips.

2. Why is the "Pip" So Important? The Basis for Calculating Profit and Loss

Understanding "Pip" is critical because whether your forex trade makes a profit or loss, and how much you gain or lose, is calculated based on how many "Pips" the exchange rate moves after you open a position.When you buy a currency pair, each favorable movement of one Pip in the exchange rate represents a certain amount of potential profit; conversely, if the rate moves against you by one Pip, you incur a certain amount of potential loss.

The opposite applies when you sell.

Therefore, the movement of "Pips" directly affects your wallet.

It transforms abstract exchange rate fluctuations into calculable profit and loss figures.

3. Does the "Pip Value" Change? Factors Affecting the Value of Each Pip

Here is an important concept: although a "Pip" is a unit of measurement, the actual monetary value of each "Pip" (called "pip value") is not fixed.It is influenced mainly by two factors:

- The currency pair traded: Different currency pairs have different quote currencies, so the calculated pip value varies. However, you don’t need to dive into complex formulas at the start.

- Trade size (Lot Size): This is the most direct factor affecting pip value. The larger the trade size (e.g., trading 1 standard lot), the greater the monetary amount represented by each Pip movement; if you trade smaller sizes (e.g., 0.01 lots), each Pip movement represents a smaller amount.

Simply remember: The larger your trade size, the greater the impact of each Pip movement on your account balance.

This is why beginners should start practicing with smaller trade sizes.

4. Special Case: Currency Pairs Involving Japanese Yen (JPY)

There is a common exception to note: when a currency pair includes Japanese Yen (JPY), such as USD/JPY or EUR/JPY.For these JPY-related pairs, a "Pip" usually refers to a change in the second decimal place.

Example: If the USD/JPY rate rises from 110.45 to 110.46, this means the rate has increased by 1 Pip.

If it falls from 110.45 to 110.40, this means the rate has decreased by 5 Pips.

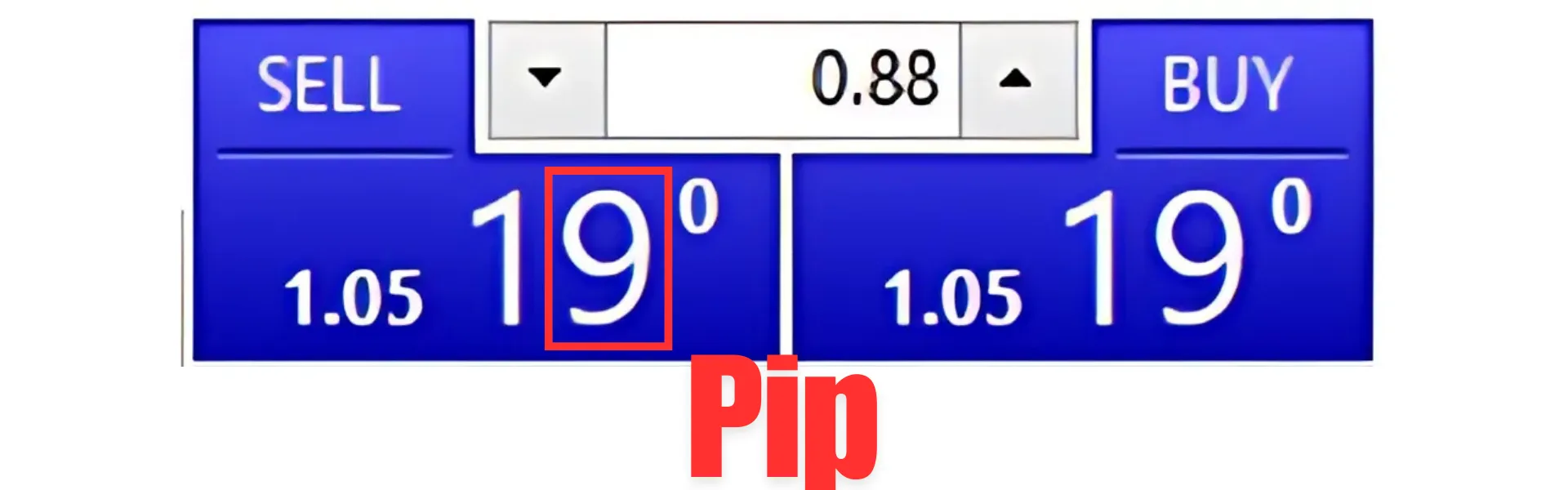

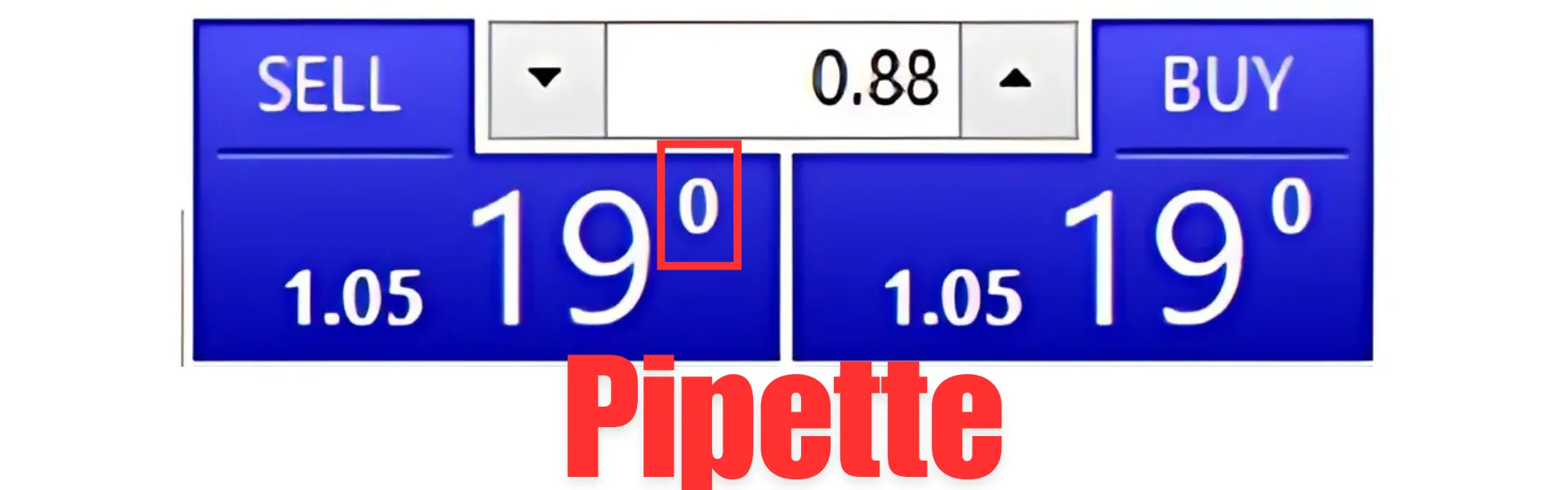

5. The Fifth Decimal Place? Understanding "Pipette / Fractional Pip"

You may also notice that many trading platforms now provide quotes with an extra digit beyond the standard "Pip" (i.e., the fifth decimal place for most currency pairs, or the third decimal place for JPY pairs).This smaller unit is called a "Pipette" or "Fractional Pip" (also known as Fractional Pip / Pipette / Point).

It represents one-tenth of a standard Pip (1/10 Pip).

Its introduction allows for more precise quotes, especially for displaying spreads (the difference between bid and ask prices) more finely.

For beginners, it’s enough to understand the existence of the "Pipette" and focus initially on the standard "Pip" without getting too caught up in it.

6. Key Reminders for Beginners

- Core Concept: Remember that a "Pip" is the basic unit for measuring exchange rate changes.

- Profit and Loss Relation: Your trading profit or loss depends on the number of "Pips" the rate moves and the "lot size" you trade.

- Main Focus: When practicing initially, focus more on judging the direction of exchange rate movement (will it rise or fall?) and the magnitude of the movement (approximately how many Pips?). The exact monetary value of each Pip is usually calculated and displayed automatically by trading platforms.

- Risk Awareness: Since each Pip represents real money fluctuations, understanding "Pips" and learning to use "stop-loss orders" to control potential loss in Pips is fundamental to risk management.

Conclusion

"Pip" is one of the most commonly used terms in the world of forex trading.It is your fundamental tool for measuring market volatility and calculating trade outcomes.

Although you may initially be confused by decimal places, differences in JPY pairs, or even Pipettes, once you grasp the core concept—that a "Pip" is the basic unit of measurement and its value is directly related to trade size—you lay an important foundation for understanding trading profit and loss and risk management.

Spend more time observing and feeling the changes in "Pips" in your Demo Account!

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.