What is the "spread" in foreign exchange trading?

In foreign exchange trading, the spread refers to the difference between the bid price and the ask price of a currency pair. This is a cost that traders must bear in each transaction and is one of the main sources of profit for forex brokers. Understanding the concept of spread and how it affects your trading is essential knowledge to master when engaging in foreign exchange trading.

1. The basic concept of spread

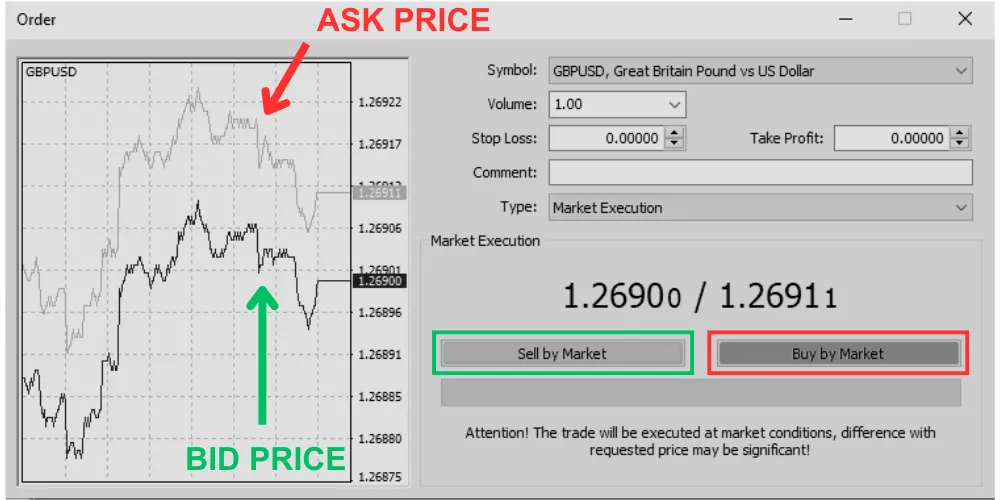

In the forex market, any currency pair will have two prices at the same time:- Bid price: This is the price at which the market is willing to buy the currency pair, i.e., the price at which you can sell.

- Ask price: This is the price at which the market is willing to sell the currency pair, i.e., the price at which you can buy.

Spread is the gap between the bid price and the ask price. For example:

If the ask price of EUR/USD is 1.1050 and the bid price is 1.1048, then the spread is 2 pips.

Each time you trade, you need to pay the spread as the cost of entry. When you buy a currency pair, your transaction will occur at the ask price, but to sell immediately, it will be completed at the lower bid price. Therefore, when you enter the market, it must first overcome this spread before you can start making a profit.

2. Types of spread

The width of the spread depends on various factors, such as market liquidity, the popularity of the traded currency pair, and the policies of forex brokers. Spreads are generally divided into the following two types:

- Fixed spread: Brokers offer a fixed spread that does not change with market conditions. This is a stable choice for traders who want to understand specific trading costs, especially when market volatility is high and trading costs do not suddenly increase.

- Floating spread: Floating spreads fluctuate with market liquidity and volatility. When the market is active and liquidity is high (such as during the overlap of the London and New York markets), the spread is usually smaller; whereas during inactive or highly volatile market conditions (such as during major economic data releases), the spread may widen.

3. The relationship between spread and market liquidity

The size of the spread usually reflects the market's liquidity:

- Major currency pairs: Such as EUR/USD, GBP/USD, etc., due to high trading volume and market liquidity, the spread is usually small, possibly only 1-2 pips.

- Cross currency pairs: Such as EUR/GBP, AUD/JPY, these currency pairs have relatively lower liquidity, and the spread is usually wider, possibly between 5-10 pips.

- Rare currency pairs: Such as USD/TRY (US Dollar/Turkish Lira) or USD/ZAR (US Dollar/South African Rand), these currency pairs have lower liquidity, and the spread may reach 20 pips or more.

4. How spread affects trading costs

The spread is a direct cost in trading, meaning that in each transaction, traders must first overcome the spread to start making a profit. For example:

If the spread of EUR/USD is 2 pips, then when you make a buy transaction, the price needs to rise at least 2 pips to reach the breakeven point and start making a profit.

The spread is particularly important for short-term traders (such as day traders) because they frequently enter and exit the market, often trading on small price fluctuations. If the spread is too large, the frequent trading costs may significantly reduce profits. Therefore:

- Short-term traders: Usually prefer currency pairs with smaller spreads.

- Long-term traders: Because they capture larger price fluctuations and trade less frequently, the impact of the spread on overall costs is smaller.

5. How to choose a low spread broker

Choosing a broker that offers low spreads can significantly reduce your trading costs. The following factors should be considered:

- Type of spread: Determine whether the broker offers fixed or floating spreads and understand whether these spreads will widen during periods of high market volatility.

- Currency pair selection: For the currency pairs you frequently trade, confirm their typical spread size.

- Hidden fees: Some brokers may offer seemingly lower spreads but charge additional commission fees. Ensure you understand all potential costs.

6. The combination of spread and leverage

The spread amplifies trading costs when using leverage. Since leverage allows you to control larger positions with less capital, the cost of the spread will also be proportionally amplified. Therefore:

- In high leverage situations, even a small spread can have a significant impact on trading costs.

- Especially for high-frequency traders, it is essential to pay more attention to the combined effects of leverage and spread.

7. Tips to reduce spread costs

The following tips can help reduce the impact of the spread on trading:

- Choose highly liquid markets: Trade during the periods of highest market liquidity (such as during the overlap of the London and New York markets).

- Select currency pairs with smaller spreads: For example, major currency pairs like EUR/USD.

- Consider the type of broker: Some brokers offer trading accounts with low spreads but may charge commissions. Compare based on overall trading costs.

Conclusion

The spread is one of the core costs in foreign exchange trading, reflecting the difference between the bid price and the ask price of a currency pair. Understanding the patterns of spread changes and how to choose a low spread broker can effectively reduce trading costs and increase potential profits. The spread has a significant impact on short-term traders, and choosing highly liquid currency pairs and trading during appropriate market times can help reduce the impact of the spread on trading.

Hi, we are the Mr.Forex Research Team

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.

Trading requires not just the right mindset, but also useful tools and insights. We focus on global broker reviews, trading system setups (MT4 / MT5, EA, VPS), and practical forex basics. We personally teach you to master the "operating manual" of financial markets, building a professional trading environment from scratch.

If you want to move from theory to practice:

1. Help share this article to let more traders see the truth.

2. Read more articles related to Forex Education.